AS Macroeconomics

1/231

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

232 Terms

What are the government macro economic objectives?

TIGERDS

Trade (Balanced, also related to healthy balance of payments which trade can be a large component),

Inflation (low and stable, concerns price stability),

economic Growth (sustained and sustainable),

Employment (full),

Redistribution of wealth (fair),

economic Development and inclusive growth. (holistic. SOL of the country should growth together)

SUSTAINABILITY!

Why is low and stable inflation important?

If you have high inflation or unstable prices:

- firms face uncertainty, reduce investments, lower AD

- rapid rising prices due to cost push inflation erode real wages, purchasing power drop, drop in SOL, ask for wage hike, further cost push inflation

- export competitiveness affected

- think of all knock-on effects with a proper chain of thought.

Benefits are:

- investments easier to make

- Bank can predict future value of money and adjust interest accordingly, so people can save more, which gives banks more loanable funds. Cost of borrowing decreases eventually because interest rate lowers and people invest more.

Why is price stability a key macroeconomic objective?

Price stability ensures overall macroeconomic stability and prevents excessive inflation, which can erode real income, reduce purchasing power, and negatively affect the standard of living.

Think links for the above!

What are the negative effects of rapid inflation?

Rapid inflation can cause:

Declines in real income and purchasing power.

Higher wage demands, leading to cost-push inflation.

INCREASED COST OF PRODUCTION, reducing profits and investment.

Higher export prices, reducing competitiveness and increasing the current account deficit (if M-L holds).

Think links for the above!

What are the benefits of low and stable inflation?

Low inflation fosters:

A conducive environment for savings and investments.

Greater certainty for banks, consumers, and investors.

Lower interest rates, which stimulate consumption and investment.

International competitiveness due to low production costs.

Avoidance of cyclical economic fluctuations like booms and busts.

Think reasons and link for the above!

What is the target unemployment rate, and why is it important?

The target unemployment rate, or the natural rate of unemployment, is approximately 5%.

Achieving this rate ensures that the macroeconomy operates at full capacity, with no output gaps or demand-deficient unemployment.

What are the societal and economic consequences of high unemployment? think 3 economic 3 social

Economic

- Unemployed people lose income, decline of SOL. Can be pushed to poverty.

- higher household debt. people borrow more to make ends meet.

- Human capital loss. cause unemployed skills erode over time. AS affected

- Loss of real output. Economy below potential. Wasted resources.

——-Can lead to a deflationary spiral that lasts very long.

- Loss of tax revenue. → increase govt borrowing.

- increased fiscal burden as govt spends more on benefits

Social

- makes it even more difficult to find work. Harms future prospects.

- homelessness

- mental anxiety, reduced self worth

- crime rates increase

- Leads to social unrest and can cause political instability

What are the benefits of low unemployment?

Low unemployment results in:

Higher average incomes and improved standards of living.

Increased real GDP and greater availability of goods and services.

Reduced fiscal burden on the government, allowing for investments in infrastructure, healthcare, and education.

Think links for the above!

Why is stable and sustainable economic growth preferred?

Stable growth prevents inflationary pressure and allows aggregate supply to expand and catch up with aggregate demand, enabling long-term improvements in income, employment, and poverty reduction.

Sustainable growth does the above without depleting resources or causing environmental harm.

What are the downsides of unsustainable growth?

Unsustainable growth can lead to:

Rapid depletion of scarce natural resources. Increased pollution and climate change.

Inflation if income levels exceed potential output.

What is economic development, and what does it aim to achieve?

Economic development involves improving the standard of living of the whole country, particularly for the poorest groups.

It aims to achieve:

Higher incomes and employment.

Better access to food, housing, healthcare, and education.

A more equitable distribution of resources.

What is the goal of sustainable growth?

Sustainable growth ensures that current economic improvements do not come at the expense of future generations and maintains a healthy, clean, and safe environment for all.

Why is inclusive growth important?

Inclusive growth ensures that economic prosperity benefits all sections of society, preventing inequality where only a few reap the rewards of economic booms.

What is the Balance of Payments (BOP), and why is equilibrium important?

The BOP is an accounting record of all economic transactions between a country and the rest of the world over a period of time.

A balanced BOP avoids falls in national output, employment, and standard of living due to trade deficits.

What happens during a persistent CAD deficit?

A persistent deficit due to a trade deficit can lead to: Reduced domestic output and rising unemployment. Government borrowing may increase as well.

How do governments redistribute income and wealth?

Redistribution is achieved through:

Taxes on higher-income groups, including capital gains and inheritance taxes.

Increased government spending on welfare and benefits for lower-income groups.

Why is redistribution particularly challenging in developing economies?

Many developing economies lack the resources and fiscal structures to effectively reduce inequality, making it harder to address income and wealth disparities.

What is inflation and how is it calculated?

Inflation is a SUSTAINED increase in the GENERAL price levels OVER A PERIOD OF TIME

- prices are rising.

- value of money decreases, purchasing power decreases

- cost of living increases

Calculated as the rate of increase of average price level.

What is deflation?

Negative inflation. A sustained decrease in the average price level over a period of time.

What is disinflation?

A decrease in the rate of inflation.

Inflation is rising but slower.

What is a target inflation?

Target inflation is low and stable. Typically around the rate of 2-3%, sometiems 4-5%

Signifies economic growth.

What are some special types of inflation?

Creeping inflation

- inflation that is reasonably low and stable

Hyperinflation

- a situation when inflation hits excessive rates

Stagflation

- inflation without economic growth. Unemployment increasing along with price level.

How do you measure changes in the price level?

Can use:

CPI (Consumer price index)

- is not inflation.

- a measure of the general price level

- percentage change of CPI can estimate inflation

PPI (Producer Price Index)

- a measure of the average prices of factors of production.

- useful to predict changes in future inflation because factor prices are measured in the early stages of production.

- percentage change of PPI can estimate inflation

Core (underlying rate of inflation)

- price index that excludes price volatile goods such as oil and food that would have been included in the CPI

- gives a more accurate picture of underlying inflation.

How do you construct a CPI?

1) Determine a base year

2) Determine a basket of goods and services

3) Approportion weight to each item based on proportion of expediture spent on the item

4) Get the average price of an item across different outlets

5) Calculate the average weighted price to get CPI.

REMEMBER: Indices need to x100.

What can CPI be used for?

As an economic indicator.

-measures cost of living, impacts of macro policies

-can use to estimate inflation

As a price deflator. (Cause it is a price index)

As a index to tie certain fixed payments (such as pensions and taxes

How can CPI be an inaccurate measure of inflation?

Weightage and basket of goods might not be representative, across income groups, ethnicities.

Regional variations are not taken into account. ofc ipoh is cheaper.

Quality of goods might increase without change in prices. CPI doesnt reflect that.

CPI doesnt take into account of discounts and sales.

How to make sure that the CPI is accurate?

Revise basket of goods and services periodically

Choose base year that is not unusual. One with minimal price fluctuation.

What is the GDP deflator? vs CPI. What is the difference?

Both are indices. Nominal / Real x 100.

The GDP deflator reflects the price of ALL domestically produced goods and services in an economy. Doesnt include imports

CPI specifically measures the price changes of a fixed basket of consumer goods and services. Can include imports. doesnt include stuff consumers dont buy, such as capital goods, exports etc.

What is demand pull inflation?

Inflation caused by the sustained increase in aggregate demand.

It happens when the AS cannot keep up with the AD, typically happens during full employment. If you analyse using AD/AD diagram it will show a one-off price increase.

EV: keynesian model says that during low levels of output (eg, recession) , increase in AD might not increase price leves at all.

What is cost-push inflation?

Cost push inflation is caused a sustained decrease in AS. It can be caused by increase of cop (increase in factor prices) on sth that affects all firms.

a subset of cost push inflation is imported inflation. Where cost of imported raw inputs increase.

How can you get persistent inflation?

Inflation that is persistent can only happen when money stock increases. (which causes people to spend more)

What are the consequences of inflation?

If low and stable, it will promote economic growth.

- stability helps reduce the uncertainty.

- banks can set an appropriate interest rate and it can also encourage savings, which increases loanable funds and decreases cost of borrowing.

Summary

- wealth redistribution

- uncertainty

- money as store of value and arsi

- menu and shoe leather costs

- exports.

Internal (consequences of things happening in country)

Wealth redistribution is impacted.

- Cash holders, fixed income (pensions, debt collectors) people lose purchasing power.

- Asset holders gain.

- lenders lose but borrowers gain because the real value of payments decrease.

- hence increased wealth inequality due to winners and losers.

- EV: Can be combated by interest rate increase and income increase

Uncertainty is promoted if inflation is too high.

- Producers cannot predict their revenue and expenditure due to changing market prices.

- Investments are discouraged and are risky.

People lack confidence in money as a store of value.

- savings are discouraged.

- might speculate on assets, which do not result in innovation.

Market inefficiency losses

- prices unable to function as a signal and incentive. Because it is very far from real values.

Menu costs and shoe-leather costs incurred.

- Menu cost is the cost of updating prices for firms.

- Shoe-leather cost is the costs to consumers to shift money to high interest accounts.

- EV: Not very applicable in digital age.

- EV: Only apparent in very high inflation.

External (consequences of things happening outside)

- Export competitiveness is impacted due to difference in relative inflation rate.

- EV: If Marshall-Lerner condition doesnt hold, deteriotation of tot might leade to current account balance improving.

What causes deflation?

bad deflation

Caused by sustained decrease of AD. (typically due to fall in incomes.)

- can happen when the central bank has no more levers to pull (interest rates already zero)

- can lead to a deflationary spiral as firms produce less as they predict lower demand, then lay off, then even lower demand, etc.

Or AD rising slower than expected.

- LRAS increase too quickly, maybe firms over invested. If AD then rise too slowly there can be deflation.

good deflation

Caused by increase in AS due to improvements in tech or productivity.

What are the consequences of deflation?

Firms and individual may delay purchases because they think prices will fall.

- this leads to a deflationary spiral. Bc it causes AD to shift. Real ouput decreases, then wages will fall. wage-price spiral.

Real value of debt increases

- firms and people indebted will be more reluctant to spend.

- more difficult to service loans. might lead to a banking crisis.

however:

exports are more competitive. And AD might increase due to net exports.

How to deal with deflation?

It is very difficult to deal with deflation. Because it is a vicious cycle.

EG: Japan dealing with it since the 1990s.

Monetary policy (interest rate tweaking) ineffective if interest rates already low.

Fiscal policy (demand stimulus) difficult because people will sit on money and the value will increase. They wont spend.

- KEY: Convince people to expect inflation and spend more now. Inspire consumer confidence.

- Govt can print vouchers with expiry dates to force people to spend.

- Deflation can be corrected due to increase in AD from cheaper exports.

What is the difference between a closed economy and an open economy?

A closed economy does not involve the foriegn sector. An open economy trades in the international market.

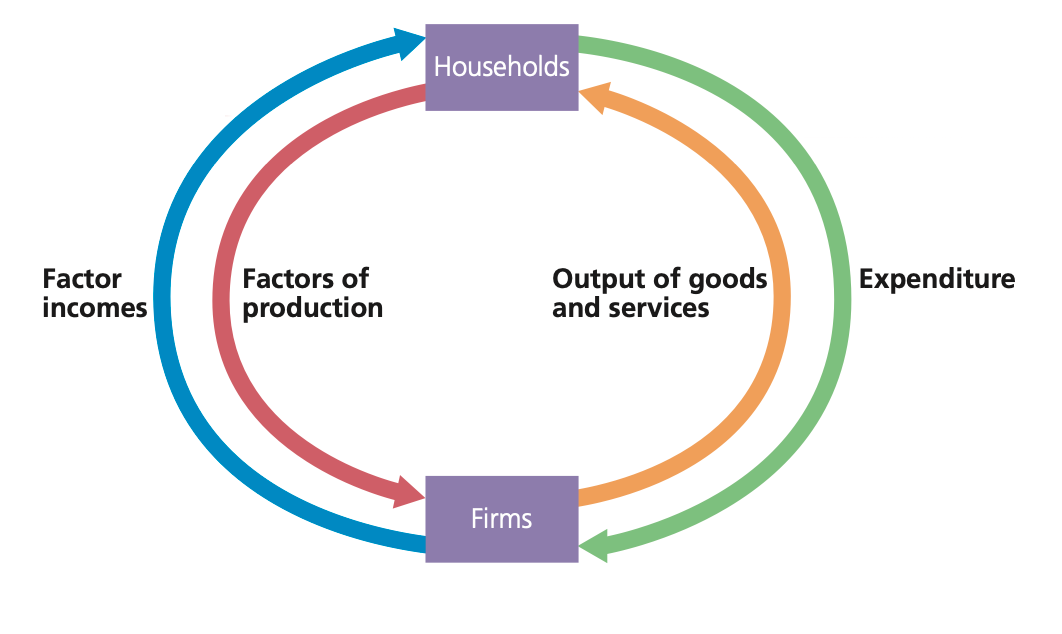

Describe a 2 sector economy and draw its flows.

Two sector economy only has the Households and Firms. (Note, all the money flows are on the outside. The asset flows are inside)

What is a 3 sector economy? Is it open or closed?

3 sector economy involves households, firms and the government. The extra flows are taxes from households to the government and gov expenditure from govt to firms.

No foreign sector, so closed economy.

What is a 4 sector economy?

4 sector economy involves households, firms, government and the foreign sector. Extra flows are money paid for imports and money from exports.

May include the bank.

What is the circular flow model?

Circular flow model illustrates the flow of income, factors of production, and goods and services in an economy between the consumers and producers, govt, and rest of the world.

What are factor incomes/payments? What are factor services?

factor incomes/payments = rewards to the factors of production

factor services = factors of production

What quantities must balance in a closed economy? What can we use these quantities for?

national expenditure = national output = national income

They can be used to measure economic activity.

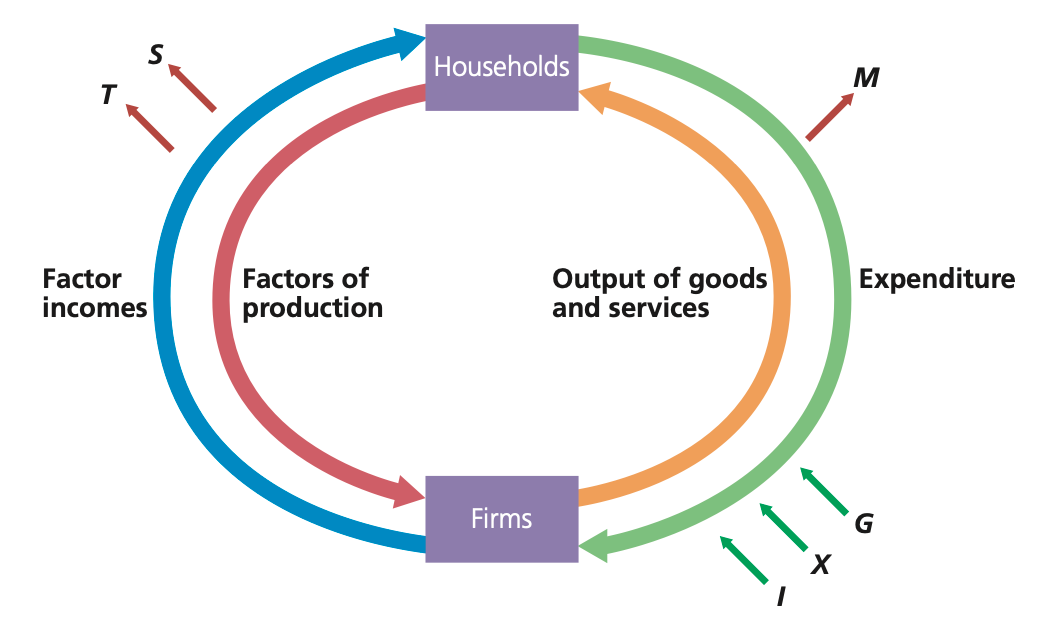

How can you illustrate an open economy?

Add the withdrawals / leakages (W) and injections (J) to the circular model.

W = Imports (M) + Taxes (T) + Savings (S)

J = Exports (X) + Govt Expenditure (G) + Investments (I)

Note: It probably doesnt matter where the in arrows and out arrows are, as long as they are pointing to the money flow.

When is it that an economy is in equilibrium?

When W = J

What are injections?

Money inflow to the circular flow of an economy in the form of exports, investments, govt expenditure.

What are withdrawals/leakages?

Money outflow from the circular flow of an economy in the form of imports, savings, and taxes.

What is the GDP?

The total amount of all the goods and services provided by an economy in a given period of time.

How can we calculate GDP (3 ways!)

Expenditure: Add all the things people spent on. Also known as Aggregate Demand. AD = Consumption (C) + Govt Expenditure (G) + Firm Investments (I) + Net Exports (X - I)

National Income: Add up all the wages, rents, profits, interest etc. (but minus stock appreciation and transfer payments because it is money from one person to another)

Output: Total value of the goods produced (Have to be calculated in terms of value added to the product. So using basic prices)

What is a nominal GDP?

GDP calculated based on current prices.

What is a real GDP?

GDP calculated taking in to account of changing prices, is based on a fixed price of a base year.

How do you calculate a GDP price index?

Price index = 100 x (nominal GDP / real GDP)

Hence, at the base year where nominal = real, the price index is 100.

What is the Gross National Income (GNI?)

GNI is GDP plus net foriegn income.

So net foreign income is taken into account, and this is significant for countries like Bangladesh and Pakistan. Income outflow is also considered.

National income vs gross national income

GNI → GDP + Net income

NI → GDP

What are basic prices (factor costs)?

Market price - taxes + subsidies.

The cost of the product if there were no government intervention.

Is also the total value added on the product

What form of GDP are market prices used to calculate?

Expenditure measure of GDP.

What are market prices?

Factor costs (Basic prices) + taxes - subsidy

Prices as traded on the market. Price paid by buyer.

Test knowledge, given the below, what is the GDP at market price and GNI?

Gross value added at basic prices: 1275

Taxes on products: 91

Net Income abroad: 86

Subsidies on products: 9

GDP at market price is 1275 + 91 - 9 =1,357

GNI = 1357 + 86 = 1,443

GDP at market price vs GDP at factor cost (basic price).

GDP at market price = GDP at factor cost + taxes - subsidy.

Tax increases the monetary value, subsidy reduces it.

GDP at factor cost(Basic price) = GDP at market price - tax + subsidy.

GDP if there was no govt

What is the Net National Income (NNI)

Gross national income - depreciation.

Depreciation is also known as capital consumption.

Basically the net income after depreciation of fixed assets

What is depreciation?

The loss in value of capital stock as a result of wear and tear.

What is the net domestic product?

GDP - depreciation

Basically the net GDP after depreciation of fixed assets

How to determine the standard of living? (Essay prompt!)

Can use GDP per capita.

EV: cannot assess qualitative aspects.

What is standard of living?

Looks into the social and economic welfare of people.

There are the qualitative (no monetary value) and quantitive (material) aspects of life of the populace.

How do base years and indices work?

Base year is the reference year, to make it an index the base year has an index 100. (100 so that percentages are more easily calculated)

The ratios between the indices of years will therefore be the ratios of the values themselves

What is investment?

expenditure by firms on capital goods

Gross investment vs net investment?

Gross investment is the total spent on investment.

Net investment = Total investment - depreciation. It is the amount spent to increase the amount of capital goods (not counting the amount spent to replace existing worn goods!)

How to improve quantity of CELL?

Land

-land reclamation

-new access to resources or discovery of a new resource.

Labour

-Increase immigration

-decrease natural rate of unemployment

-increase birth rate

-anything that increases labour work force.

Enterprise

-anything that encourages new local businesses.

Capital

-investment (just buy more Loh!)

How to improve quality of CELL?

Land

-reduce pollution

-fertilisers

-etc

Labour

-education, training

-healthcare

Enterprise:

-management training.

Capital

-tech advancements, R&D

What is the working age population?

Typically people between 16 years to 64 years.

Economically active vs economically inactive?

Within the working population:

Economically active are those who want to work (includes both employed and unemployed)

Economically inactive are those not looking to work (students, housewifes, sick people, discouraged workers)

What makes up the labour force?

The economically active portion of the working age population.

how do you calculate the unemployment rate?

The percentage of the labour force (the economically active people.) that are unemployed.

how do you calculate the labour force participation rate?

The percentage of working population that is in the labour force.

What is hidden (disguised) unemployment?

Hidden unemployment are

- people without a job but not counted as unemployed because they are not seeking a job.

- people who are underemployed yet counted fully employed.

What is underemployment?

People who are not working full time, or skills are underutilised, but could and would like to work more, yet are still counted as fully employed

How do you measure unemployment practically?

Few ways:

Claimant count of unemployment. See how many people are claiming unemployed benefits. Jobseeker’s allowance in UK is an example.

Surveys based on the ILO definition of unemployment.

EV:

-not everyone qualifies or would claim the unemployment benefits. Some claim fraudulently. Different countries have different criterion as well, so difficult to use the metric to compare.

-Surveys inherit difficulties from surveys

-Hidden unemployment (from underemployment) always muck up the reliability of the numbers.

Exact International Labour Organisation unemployment definition.

Want to work.

Have been looking for work. (for 4 weeks)

Can start work. (in 2 weeks)

Or already got work, but will be starting in 2 weeks.

General difficulties in measuring unemployment.

Underemployment conceals the extant of labour underutilisation

Discouraged workers who would otherwise have liked to work but gave up are not counted as unemployed.

Surveys are difficult to carry out

Countries with large informal sectors (eg in agriculture) may have higher number of people classified as economically inactive.

Unemployment is an average over the entire country. Doesnt say anything about differences according to ethnicity, gender, area.

Full employment is difficult to define. Because there is always a natural rate of unemployment when economy is at full capacity.

Size of labour force depends on?

Amount of people

-Population size

-birth/death rate

Age related

-school leaving age

-retirement age

Women in the workforce

-attitudes to women working

-availability and cost of childcare

Others

-availability and value of unemployment benefits.

what is the natural rate of unemployment?

Refers to the lowest rate of unemployment when economy is at full capacity.

What is labour productivity? How do you calculate it?

Labour productivity is amount of output per worker. (in a period of time)

What does labour productivity depend on?

-Education and training

-Experience

-Level of capital available

-Healthcare

-Work practices (management)

Causes of unemployment (ie, types of unemployment)

Frictional unemployment

- is due to jobseekers in the search for jobs.

Structural unemployment

- due to changes in demand for a labourer in a particular industry. Caused by mismatch of skills

- Technological unemployment is a type of the above. Caused due to workers being replaced by technology.

Cyclical unemployment

- due to the business cycle. Recession.

Seasonal unemployment

- due to changes in seasonal changes in demand in the industry causing changes in demand for the labour.

Other

- discrimination

- lack of training

- High unemployment benefits.

Frictional unemployment. What causes it and how can it be addressed?

Frictional unemployment is due to jobseeker looking for jobs.

- Can be difficult to find new job due to lack of information about vacancies and geographical/occupational mobillity

Govt can provide information to address this. Improved transport infra can also help.

Structual unemployment. What causes it and how can it be addressed?

Triggered by decline of certain sectors in the economy. Technological unemployment is also structural. Caused by mismatch of skills of workers leaving sunset industries and the demands of expanding industries.

Can be long term due to time needed to retrain.

Govt can provide training programmes

Seasonal unemployment. What causes it and how can it be addressed?

Unemployment due to low demand for certain sectors during certain times of the year, leading to decrease of demand in labour in those sectors.

Examples are tourism and agriculture.

Retraining in different skills to find interim jobs could help.

Occupational mobility vs geographical mobility?

Occupational mobility

- being able to switch from one purpose to another.

geographical mobility

- being able to move from one place to another.

What are the different parts of the business cycle?

Expansion, peak, contraction, trough.

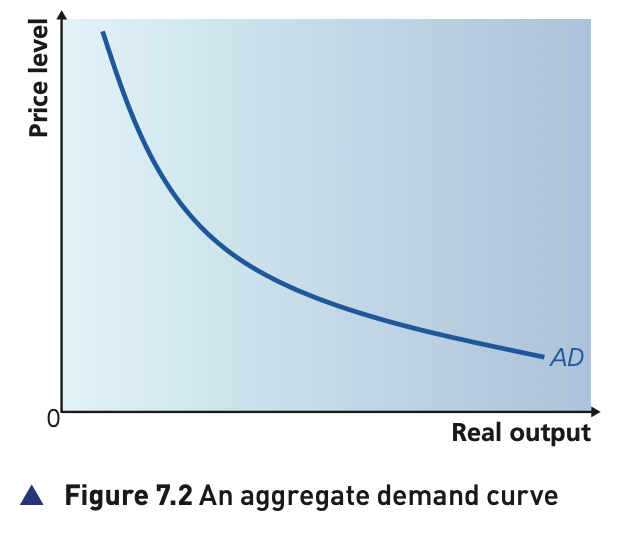

What is aggregate demand? How do you calculate it?

It is the total effective demand for all the goods and services produced in an economy in a period of time.

It can be calculated by

AD = C + I + G + X - M

How do you draw a aggregate demand curve and what does it illustrate?

Y-axis is Price Level, X-axis is Real GDP.

It shows the relationship between total demand and price level.

Why is the aggregate demand curve downward sloping?

3 reasons:

1) Wealth effect.

2) Interest Rate effect.

3) Trade effect.

NOTE THESE ARE ALL MOVEMENT ALONG THE CURVE!

What is the wealth effect.

Higher price levels while real incomes stay low will make people feel poorer, hence a reduction in overall demand.

What is the interest rate effect?

Higher price levels will induce increase the demand for money, which will increase interest rates, causing an increase in the costs of borrowing and hence a decrease in investment and purchases of big ticket items.

What is the trade effect?

Relatively lower price levels will make exports more competitive. Amount of imports will also decrease, so overall demand will increase.

What can affect consumption?

Anything that changes disposable income

- Income tax changes

- Income changes

Interest rates

- borrowings and savings are affected

Wealth

- changes in asset value will make people feel richer/poorer, hence spend more/less

Expectation of future prices/consumer confidence

- If people think prices will rise, they will buy more now.

Level of houshold debt

-More debt, less comfortable to spend

Availability of credit

- easier to borrow, will spend more

What can affect investment?

Interest rate.

- makes firms decided whether to borrow or not for investments

- BUT depends in interest rate elasticity of investment. During booms and recessions it can be inelastic because firms think it is going to get good.

Coporate taxes (through govt)

- Taxes reduce retained profits and hence money available to invest

Firm confidence

- Will invest if confident that consumer demand will increase

Level of coporate debt

- less debt, can invest

Tech change

-firms FOMO and want to invest to keep up with tech change.

What can affect government expenditure?

Changes in political, economical priorities.

Lets say fiscal policies, monetary policies, infrastructure projects.

What can affect net exports?

Foriegn incomes, domestic incomes

- Will affect the amount of exports/imports

Currency exchange

Relative inflation rates

Competitiveness of products

Any protectionist measures

What is the Marshall-Lerner condition?

Marshall-Lerner condition is when relative PED of X and M are elastic.

XPED + MPED > 1

When it DOES NOT HOLD, price increase of export does not lead to trade deficit.

short run vs long run

Short run

-FOP costs typically fixed

-firms cannot vary inputs

Long run

-more variables can vary.