Chapter 2 | Tax Compliance, the IRS, and Tax Authorities

1/62

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

63 Terms

Taxpayer Filing Requirements for Corporations

All must file regardless of taxable income

Taxpayer Filing Requirements for Estates and Trusts

Required to file if gross income exceeds $600

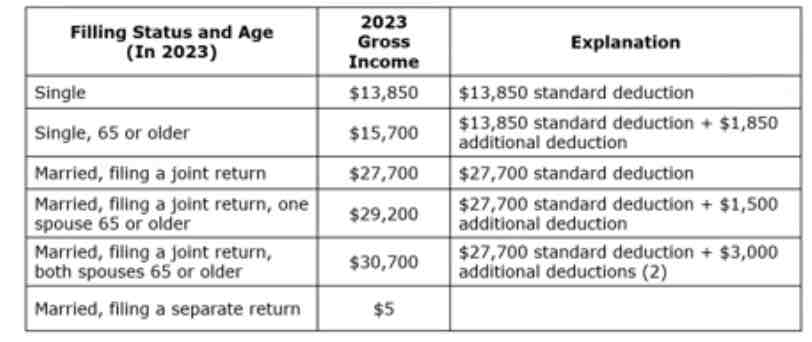

Taxpayer Filing Requirements for Individuals

Filing is determined by taxpayers filing status, age, and gross income

223 GrossIncome Thresholds by Filing Status

Tax Return Due Date for Individuals

Fifteenth day of fourth month following end of tax year

Tax Return Due Date for C corporations

Generally fifteenth day of the fourth month following end of tax year

Tax Return Due Date for Partnerships and S corporations

Fifteenth day of the third month following end of tax year

Tax Return Due Dates that land on a Saturday, Sunday or holiday are extended to

The next business day

When it comes to Tax Return Due Dates, Individuals, Corporations, and Partnerships are allowed to apply for

Automatic extensions

Statute of limitations

The time in which the taxpayer can file an amended return or the IRS can assess a tax deficiency

It usually is three years later of when the tax returns were actually filed, or when the tax’s due date was

In general a taxpayers return is selected for an audit because

The IRS believes the tax returns has a high probability of being incorrect

Type of Audit: Correspondence examinations

Most common audit

Conducted by mail and are generally limited to one or two items on the return

Type of Audit: Office examinations

second most common audit

Conducted in the local IRS office and tends to be broader in scope

Type of Audit: Field examinations

least common audit

Held at the taxpayer’s place of business an can last months to years

Trial Courts deal with

IRS Cases

Trial-Level Courts: U.S. Tax Court

National court; Tax experts; Do not pay tax first

Trial-Level Courts: U.S. district courts

local courts; possible jury trial; generalists; pay tax first

Trial-Level Courts: U.S. Court of Federal Claims

National court; generalists; pay tax first; Appeals to the U.S. Circuit Court of Appeals for the Federal Circuit

Tax Law Sources: Primary Authorities

Official sources of tax law

Statutory sources (e.g., Internal Revenue Code)

Judicial sources (the courts)

Administrative sources (IRS pronouncements)

Tax Law Sources: Secondary Authorities

Unofficial tax authorities

Tax services

Tax articles

Steps in Tax Research

Step 1: Understand facts.

Step 2: Identify issues.

Step 3: Locate relevant authorities.

Step 4: Analyze tax authorities.

Step 5: Document and communicate the results.

If the taxpayer misreports income (not exceeding 25 percent of gross income) or deductions

Three years

If the taxpayer omits items of gross income that exceed 25 percent of gross income

Six years

If the taxpayer commits fraud or doesn’t file a tax return

No statute of limitations

The _____ _____ system assigns a score to each tax return representing the probability the tax liabilities on the return have been underreported

DIF (Discriminant Function) System

Best Choice for a taxpayer in this situation:

The tax returns position is low on technical support, but high on emotional appeal

U.S. District Court

Best Choice for a taxpayer in this situation:

A taxpayer feels very confident in her position and lacks the funds to pay the assessment

U.S. Tax Court

Best Choice for a taxpayer in this situation:

The taxpayer knows that the Circuit Court of Appeals in the circuit in which she resides has ruled against a similar tax return position in the past.

U.S. Court of Federal Claims

What type of tax authority is the U.S. Constitution, the Internal Revenue Code, and tax treaties?

Legislative authority

The ______ authorizes are official sources of the tax law generated by one of the branches of government. The _____ authorities are unofficial tax authorities that help explain the law.

Primary

Secondary

The highest judicial authority is the U.S. ____ Court followed by the 13 U.S. Circuit Court of Appeal, the U.S. _____ Court, the U.S. Court of Federal Claims, and the District Court.

Supreme

Tax

What is the due date for calendar-year corporate income tax returns assuming the date does NOT fall on a Saturday, Sunday or holiday?

April 15

When does the statute of limitations generally end for tax noncompliance when fraud is not a factor?

3 years

The ____ ____ is charged with administering and interpreting the tax laws

Treasury Department

Which of the following is NOT a computer initiate that helps the IRS identify tax returns that may have an understated tax liability?

Statistical percentage program

Which of the following primary authorities is NOT a legislative source of authority

tax treaties

Treasury regulations

Internal revenue code

U.S. Constitution

Treasury regulations

While of the following choices is NOT one of the steps in the tax research process?

Request private letter ruling

Which of the following statements is correct

The Supreme Court and the Internal Revenue Code represent the highest tax-specific authorities in tax law

What is the due date for calendar-year partnership income tax returns, assuming the date does NOT fall on a Saturday, Sunday or holiday?

March 15

_____ facts have not yet occurred.

_____ facts have already occurred.

Open

Closed

The highest authoritative weight when interpreting the Internal Revenue Coe are _____ issued by the Treasury Department

Regulations

During the tax research process, the exercise of attaining and understanding the client’s facts and combining those facts with the tax preparer’s knowledge of the tax law is referred to as:

Identifying the issues

The ____ ____ system assigns a score to each tax return representing the probability the tax liabilities on the return have been underreported.

DIF (Discriminant Function) System

Tax services that are arranged by the Internal Revenue Code Sections are known as ____ tax services

Annotated

Which of the following is NOT one of the steps in the tax research process?

Identify issues

Located tax authorities

Contact IRS

Understand facts

Contact IRS

A question of _____ could involve the interpretation of a particular Code section, while a question of _____ hinges upon the circumstances of the taxpayer’s transaction

Law

Fact

In order to identify issues int he tax research process, the tax preparer should get a good understanding of ______ _____. then, the tax preparer can combine that information with his knowledge of the tax laws.

Clients

Facts

Tax services that are arranged by topic, such as types of taxable income, are known as _____ tax services.

Topical

Which type of issue will focus on understanding how the various components and circumstances of the transaction affect the research answer and look for authorities with fact patterns similar to the client’s?

Question of fact

In which of the following situations will a tax preparer’s likely incur a penalty?

The tax position is supported by one authority, contradicted by several other authorities, and is not disclosed on the tax return.

Which of the following lists contains the basic components of a client letter?

Research question and limitations, facts, analysis, and closing

The IRC imposes a penalty on a tax practitioner for any position that is not supported by _____ _____.

Substantial authority

Which of the is INCORRECT regarding the components of a client letter?

The facts should be detailed and lengthy in order to ensure to everything has been covered

The IRS information matching program checks each tax return for mathematical mistakes

False

Field examinations are conducted by the IRS at the local IRS field office

FALSE

The “30-day” letter gives the taxpayer the opportunity to pay the proposed tax adjustment or file a petition in the U.S. District Court to hear the case.

False

U.S. District Court appeals to U.S. Circuit Courts.

True

Private Letter Rulings have less authoritative weight than Revenue Rulings

True

Jackie’s return was selected for audit because she did not report her salary (from her Form W-2 from her employer) on her tax return. Which IRS program likely identified Jackie’s oversign?

Information matching

Which of the following is NOT considered a primary authority?

Supreme Court case

Tax Law Review article

Regulation

Internal Revenue Code

Tax Law Review article

Which of the following committees is not involved in enacting tax legislation?

House Ways and Means Committee

House Tax Committee

Senate Finance Committee

Joint Conference Committee

House Tax Committee

Which of the following items is most commonly used to check the status of a court case?

Private letter ruling

Citator

Revenue ruling

Tax digest

Determination letter

Citator

Which of the following is a type of common tax service used in tax research?

Annotated tax service

Antiquated tax service

Analytical tax service

Technical tax service

All of these choices are correct.

Annotated tax service