4.1.5.7 - price discrimination

1/15

Earn XP

Description and Tags

Price discrimination

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

Price discrimination definition

firm charges different prices to different customers or groups of customers for the same product, based on their willingness to pay, and not because of differences in production costs. E.g. student discounts vs adult price, off peak fares vs peak fares

1st degree (perfect) price discrimination

requires perfect information. In reality it is impossible to achieve. The perfect information includes the maximum price that a consumer is willing to pay

Auctions are very ___ to ___ degree price discrimination because it shows the willingness that a consumer is ___ to pay, through ___.

close, first, willing, bidding

Dynamic pricing definition

determination of market price by real time demand and supply, E.g. uber price fluctuates depending on peak times (demand)

Why dynamic pricing may not always be 1st degree price discrimination

Lack of individualised pricing, focus on market conditions, CS still exists

Why dynamic pricing resembles 1st degree price discrimination

personalised pricing, maximising willingness to pay, elimination of CS

2nd Degree of Price Discrimination

Offering different prices based on the quantity purchased or the consumer’s choice of package. It doesn’t require the firm to identify consumer groups directly. E.g. bulk discounts, off-peak pricing

Economic significance of 2nd degree price discrimination:

Encourages greater consumption by offering lower per-unit prices for larger quantities

Useful in markets where demand is heterogeneous, but segmentation is difficult. E.g. streaming platforms cannot directly observe individual willingness to pay, income, or viewing preferences without violating privacy.

Economic significance examples of 2nd degree price discrimination:

Wholesale markets: single t-shirt is £10, but a pack of 5 costs £40 (£8 per shirt)

Streaming subscription

Public transport

Third-degree price discrimination:

Relies on dividing consumers into distinct groups based on their demand elasticities and charging each group a different price

Third-degree price discrimination characteristics

Focuses on observable characteristics (e.g age, income, location) or situations to segment consumers.

Charge customers with more inelastic PED higher price

Ex: Student discounts, regional pricing, business vs. Economy airfare

Economic significance of 3rd degree price discrimination

Enables firms to maximise profits by charging higher prices to inelastic consumers

Requires the firm to prevent arbitrage (resale)

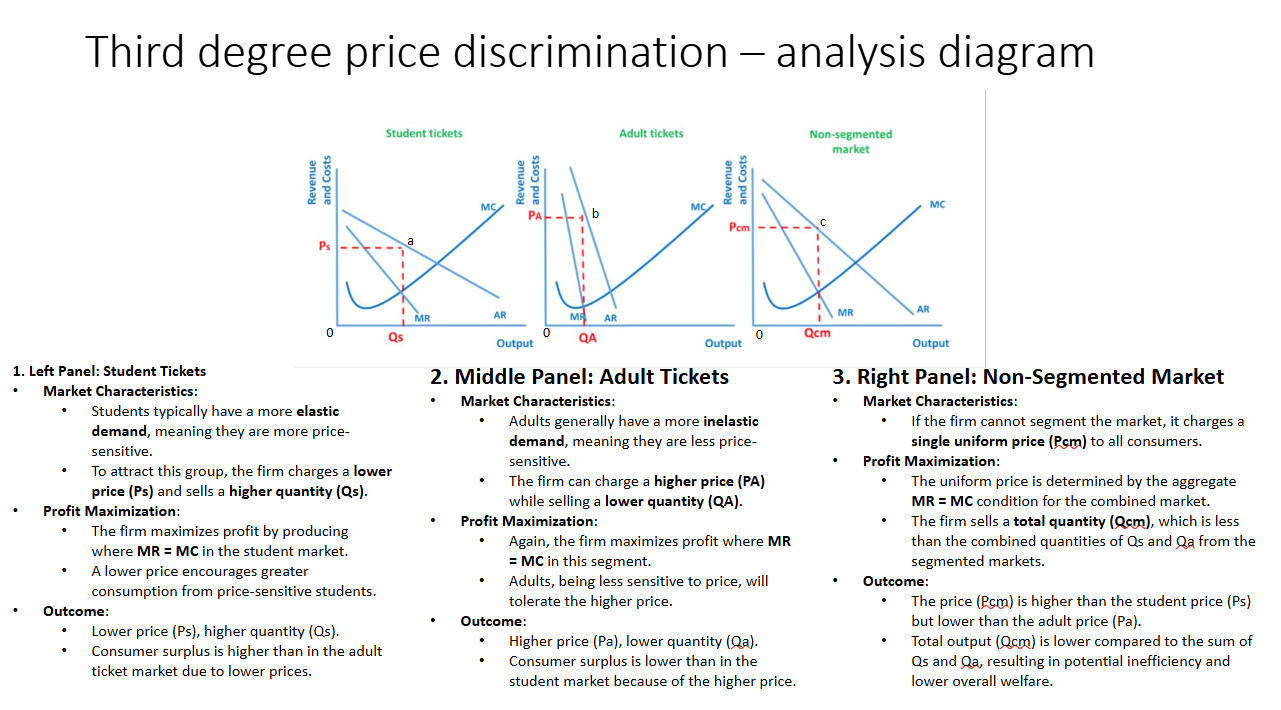

Third degree price discrimination - analysis diagram

Economic implications

Third-degree price discrimination:

Allows firm to capture more CS by tailoring prices to each group’s elasticity of demand, redistribution of consumer surplus

Increases firm TR compared to a single uniform price (non-segmented market)

Consumer impact:

Price-sensitive groups (e.g., students) benefit from lower prices, increasing accessibility

Price-insensitive groups (e.g., adults) pay higher prices, reducing their CS

Market efficiency:

Segmented pricing increases total output (Qs +Qa > Qcm), improving allocative efficiency compared to a non-segmented market

However, price discrimination redistributes welfare form consumers (CS) to producers (PS).

Pros of price discrimination (FILR)

Firms able to increase revenue, increased investment, lower P for some, manages demand, reducing waste

Cons of price discrimination (HADPP)

Higher P for some, administration costs, decline in CS, potentially unfair, predatory pricing