ECON 2020 Exam 2

1/87

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

88 Terms

Economic growth affects....

human welfare

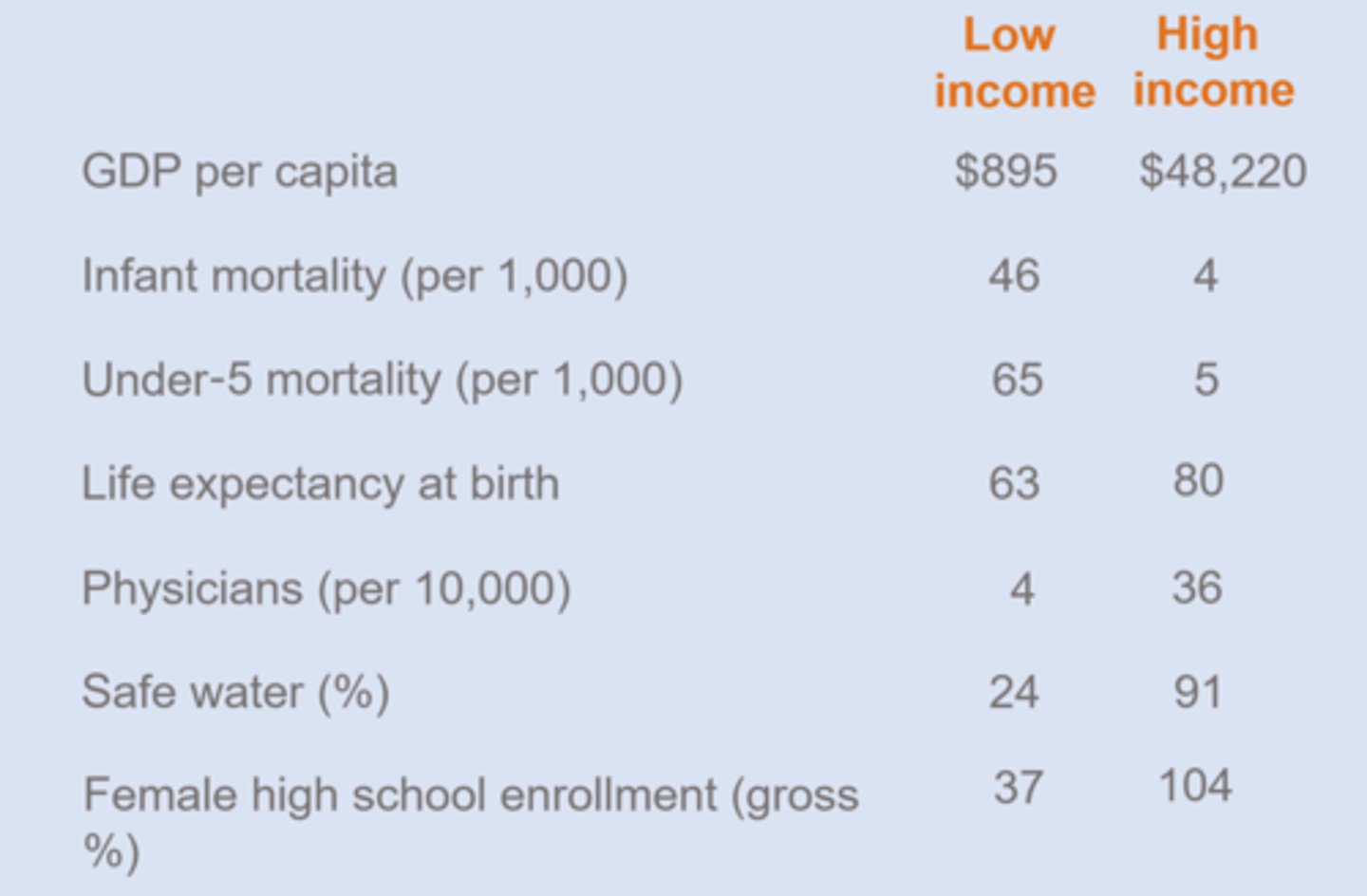

Why does economic growth matter?

living standards differences: GDP per capita, infant mortality, life expectancy, physicians, access to safe water, female high school enrollment

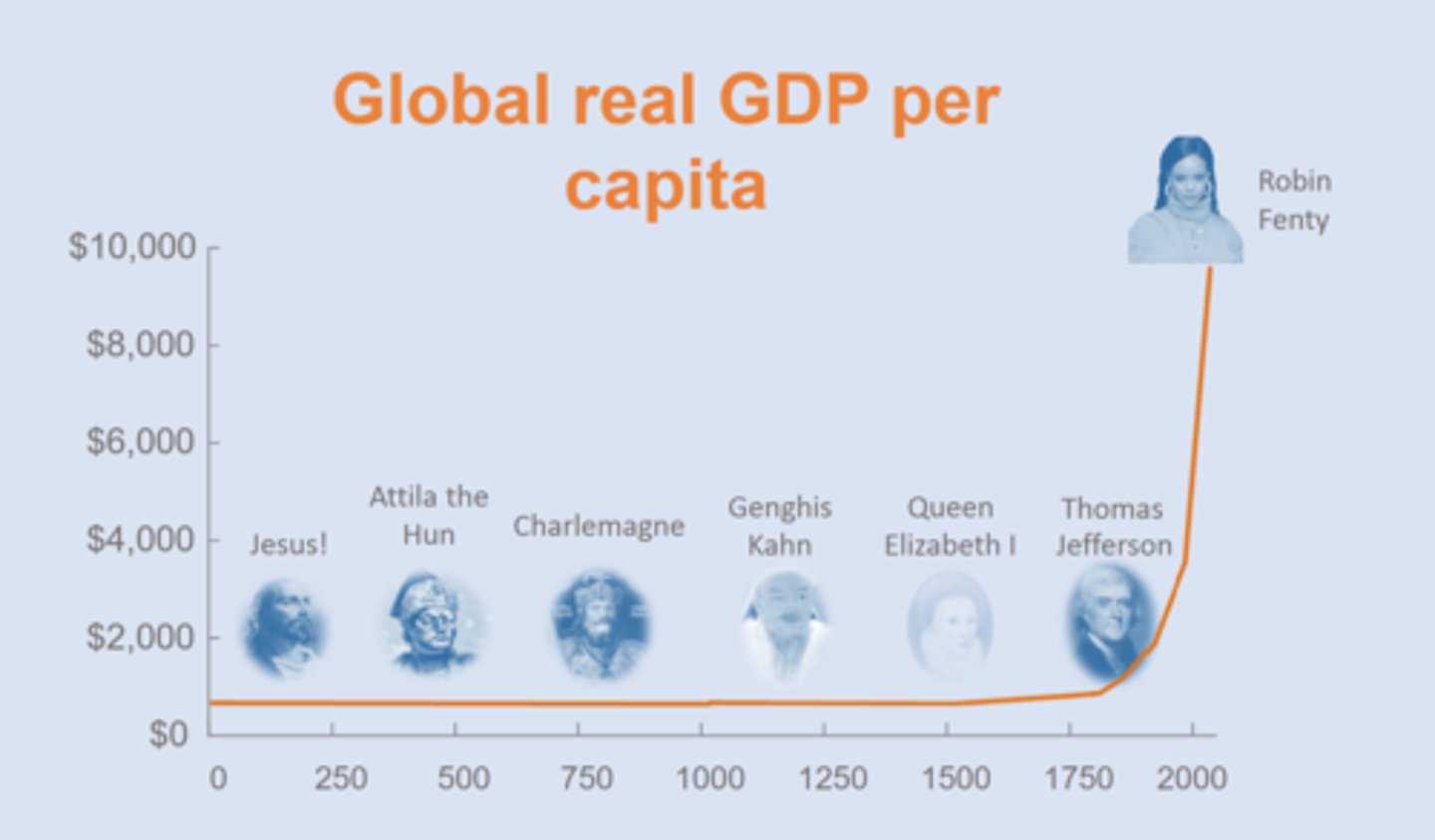

Global real GDP per capita trend historically

exponentially grew globally in 20th & 21st century ==> some countries did stay the same though

Growth Rate of real GDP per capital

nominal GDP growth - inflation - population growth = real PC GDP growth

(% changes)

Rule of 70

With annual growth of x percent, the level of a variable doubles every 70/x years.

With a growth rate of 3% it takes 23.33 years to double? What size is the new value in 70 years relative to the og value?

8x the og

Best Way to Grow an Economy?

consistent long term growth

What contributes to economic growth?

resources, institutions, and technology

resources

land (ex: mountains, oil, water, geography), labor (workers, skills, human capital), capital (tools, public goods, medical tools)

Resources __________, but by themselves _______________________.

aid in economic growth, but by themselves are not sufficient to produce sustained growth

technology

knowledge available for use in production

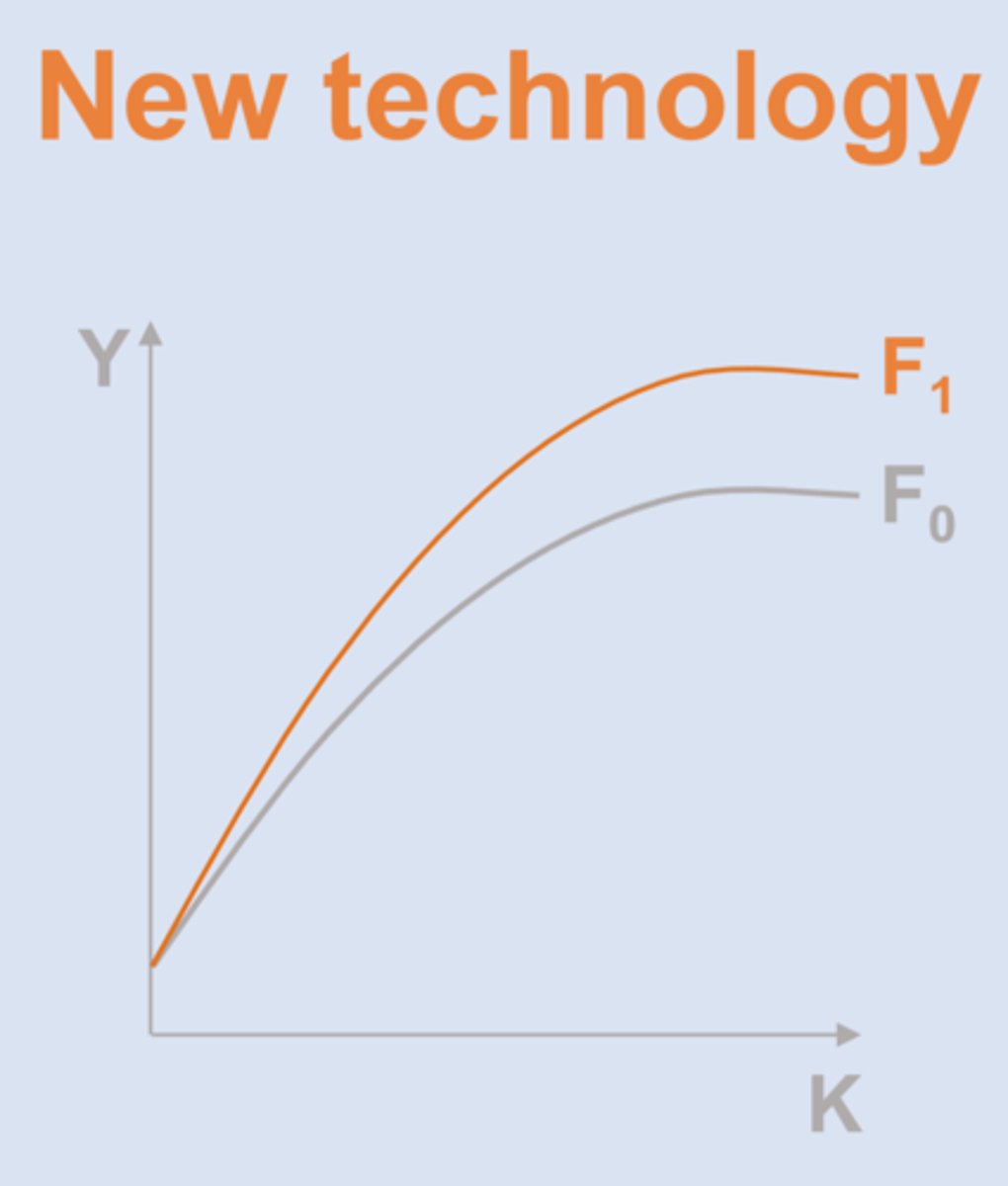

technological advancements

new techniques/methods to 1. produce more w/ same amount or 2. produce same w/ fewer amount

institution

significant practice/relationship/organizations that officially or unofficially shape society

ex: government, private property, political stability, international trade, taxes, etc.

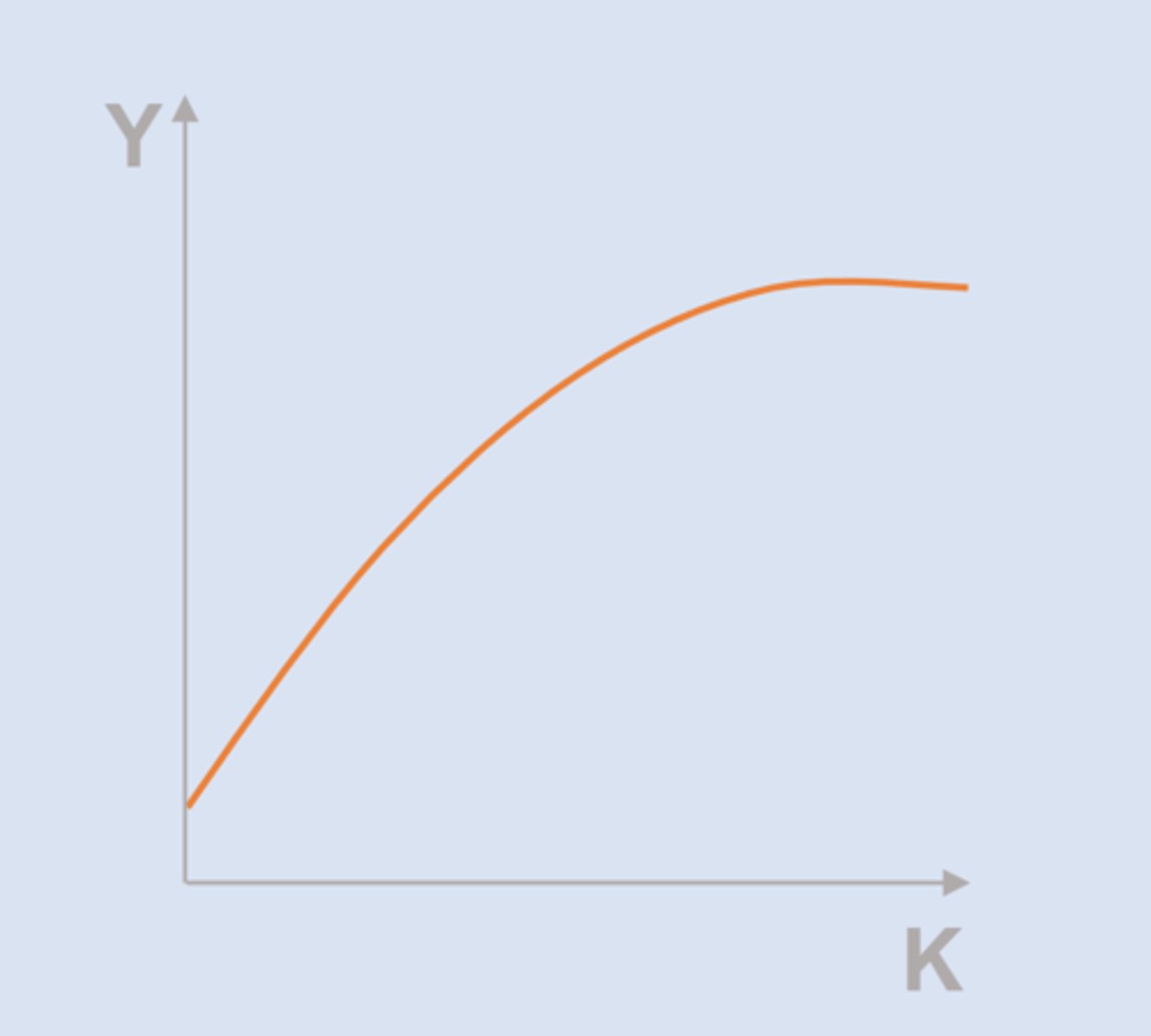

Solow Growth Model 1

Y = F(land, labor, CAPITAL)

==> focus on capital because

1. high income countries have more capital

2. investment and growth are correlated

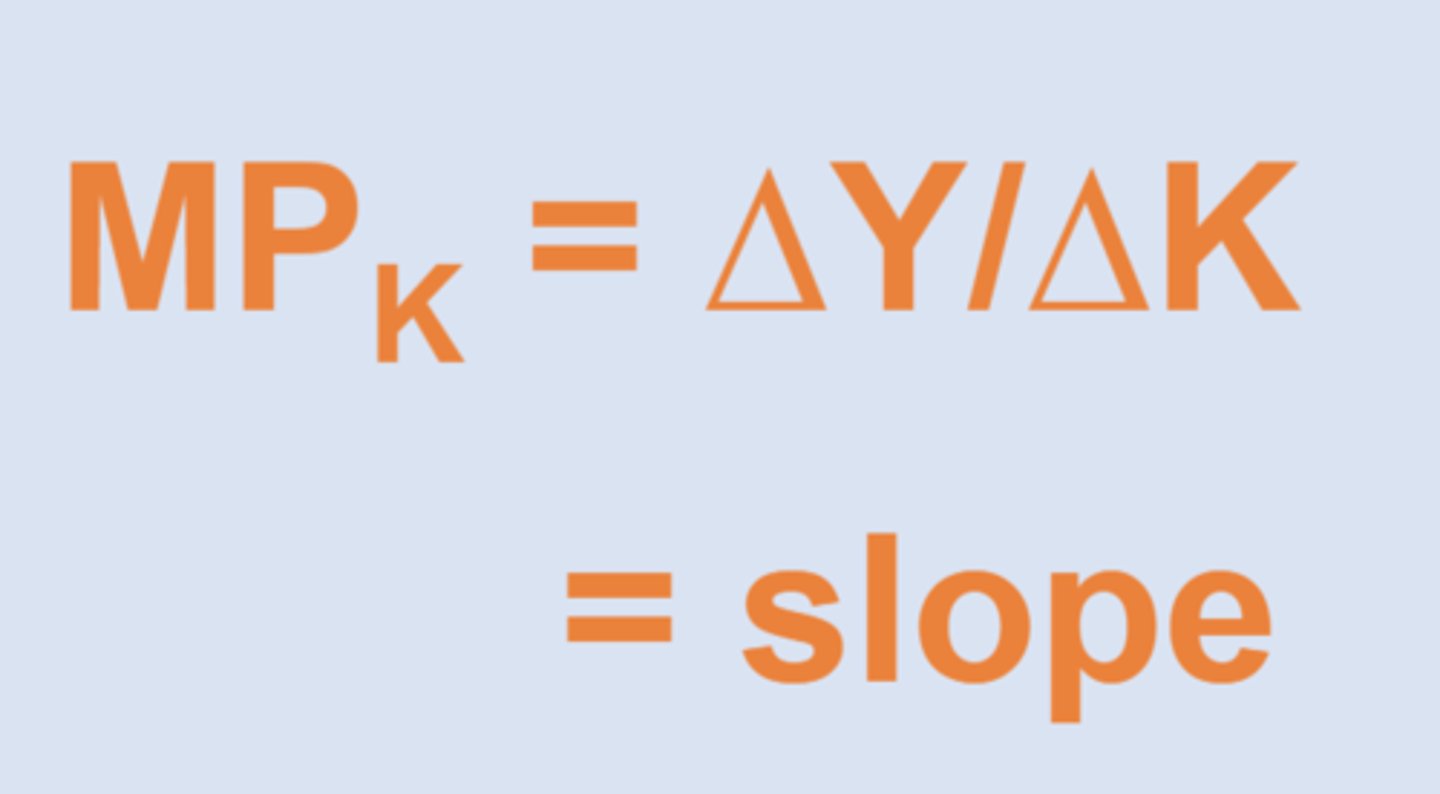

Marginal product

The change in output from a change in an input, everything else held constant

Diminishing Marginal Product

When the marginal product of an input falls as the quantity of the input rises ==> "diminishing returns"

Assumptions of Solow 1

diminishing marginal product

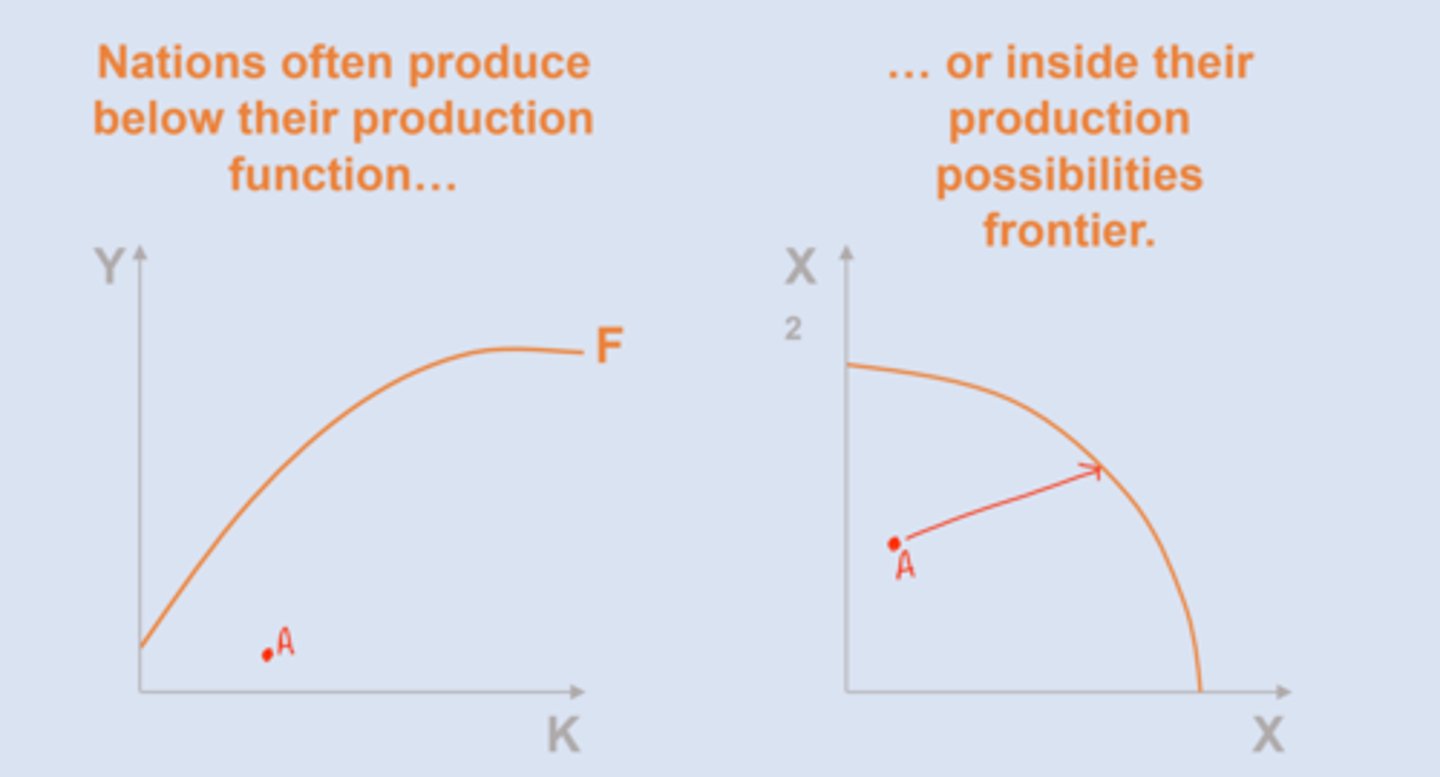

Implications of Solow Model 1

1. steady states ==> condition in econ where there is no net growth ==> "stagnant/sad"

- no net investment

- no changing K

- no growth

2. convergence ==> income levels across nations converge as the approach their SS

- growth in rich countries slows down

- poorer countries enjoy higher returns

Empiricle Problems w/ Solow 1

- wealthy nations keep growing

- many poor nations not growing

Solow Model II

Y = A x F(capital, land, labor)

another growth source is new technology (advancement)

2 Sources of Growth (Solow II)

- technology

- resources

Solow Model II Assumption

technology develops exogenously (randomly) due to external factors

Exogenous technology

When technological advancements are unrelated to conditions or actions inside the economy

Policy based on SGM

gov & organizations aid supply loans a direct air for infrastructure, healthcare, factories, education ==> FAIL

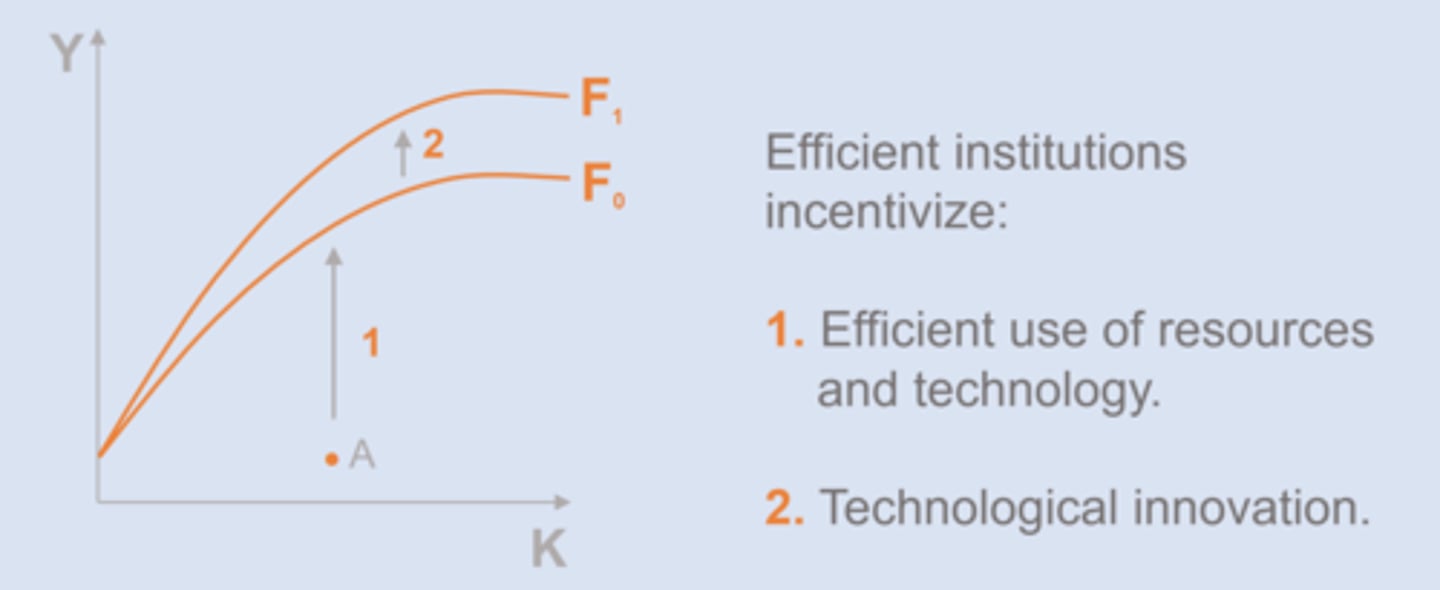

Modern Growth Theory

Y = A x F(resources & institutions)

begins w/ idea that growth in endogenous (factors inside an economy)

Harmful Institutions for Economic Growth

Harmful:

- corruption, inflation, high taxes

Growth Fostering Institutions

How do institutions affect the production function?

Certain institutions create incentives for __________________.

endogenous growth

Rotunda Principle 3

The three sources of economic growth are resources, technology, and institutions

Short to Long Run Economics

Recessions have _____________ over US history.

decreased substantially

AD-AS Model

The model we use to study short-run fluctuations in the economy.

Aggregate Demand

total demand for all final good & services in an economy (spending side)

Why does AD slope down?

wealth effect, interest rate effect, international trade effect

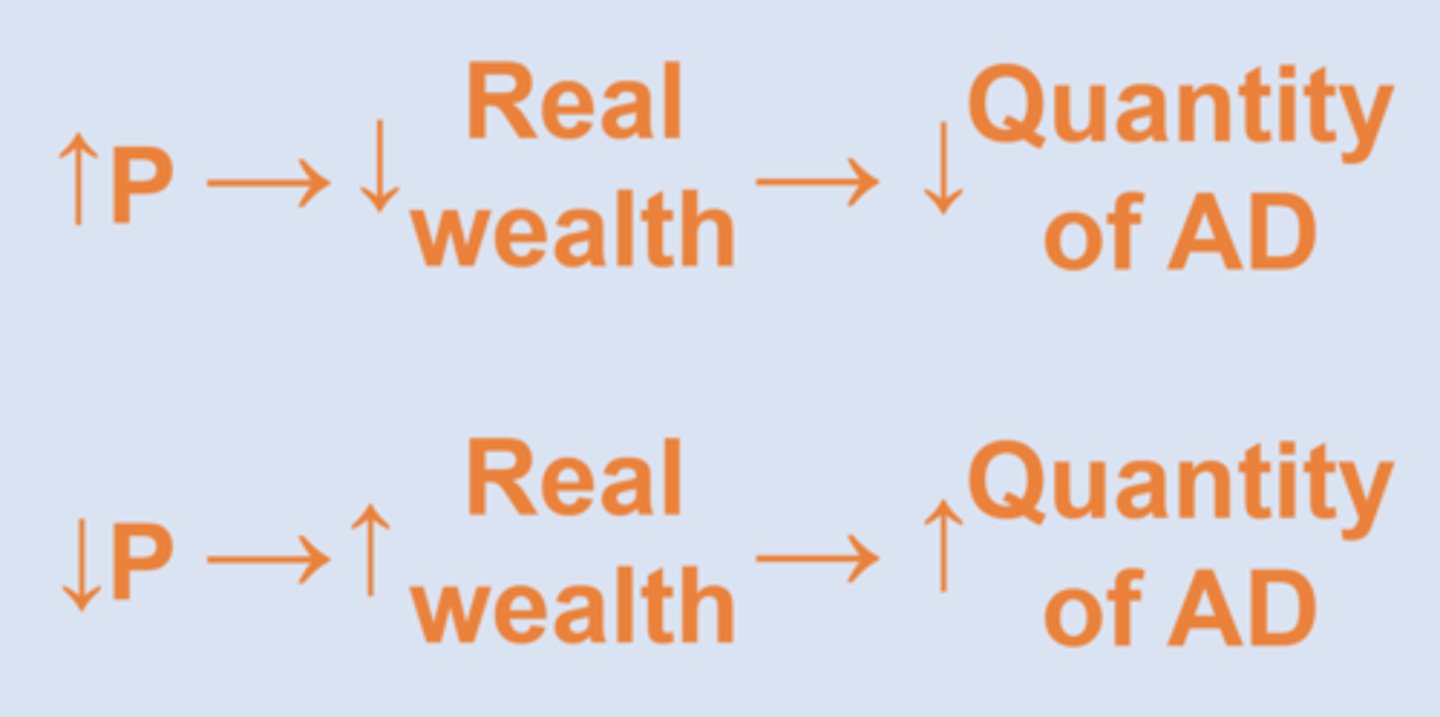

Changes in P (price level) lead to....

changes in QUANTITY of aggregate demand (movement along the curve)

wealth effect

changes in price level affect people's real wealth and this leads to changes in their quantity of aggregate demand.

real wealth

market value of all accumulated assets (ex: bank accounts, property, stocks)

interest rate effect

⬆️ P ==> ⬇️real wealth ==> ⬇️savings ==> ⬆️interest rates ==> ⬇️investment ==> ⬇️AD

international trade effect

⬆️ P ==> ⬆️relative price of US goods ==> ⬇️exports ==> ⬆️imports ==> ⬇️NX==> ⬇️AD

Shift Factors of AD (4)

= C + I + NX + G

Movement Along the Demand Curve

results from changes in P

when p ⬆️....

C⬇️ (wealth effect)

I ⬇️ (interest rate effect)

NX⬇️ (international trade effect)

Consumption Shifts

real weath note**: here it is unrelated to changes in P

consumer confidence

how optimistic consumers are about the economy and their finances ==> measures expected future income how

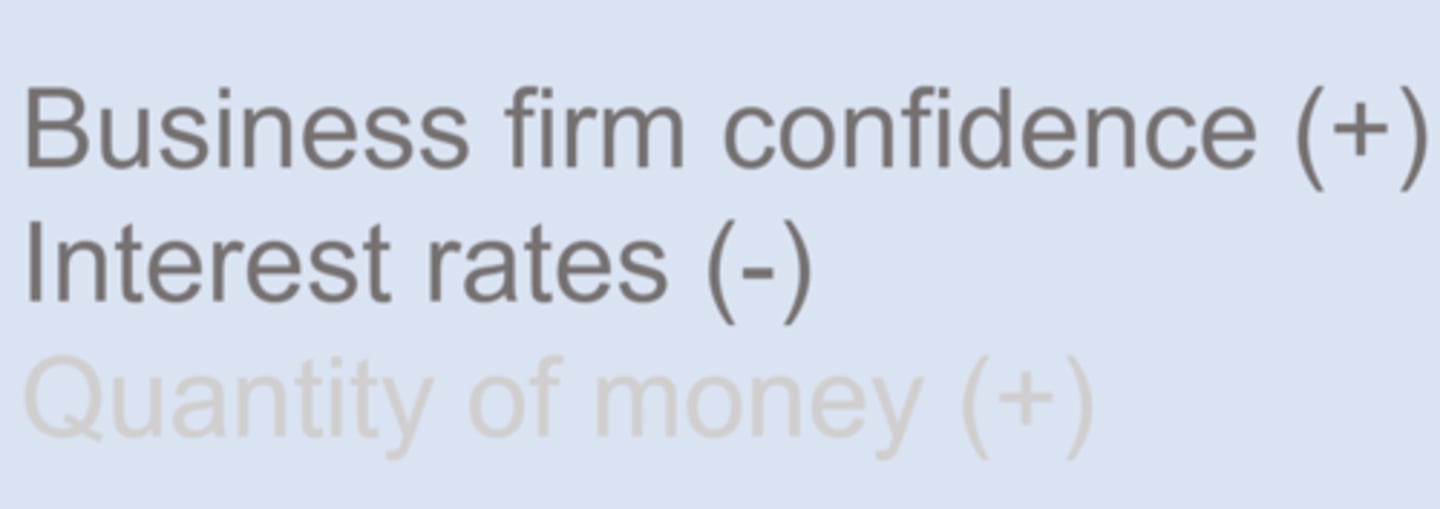

Investment Shifts

Net Export Shifts

- people wealthier ==> spend more money

- value of the dollar (relative to foreign currencies)

ex: value US dollar up, demand imports up & exports down = lower NX

Bad Vibes (of a recession)

- consumer confidence down

- business confidence down

Aggregate Supply

the total supply of all final goods/services

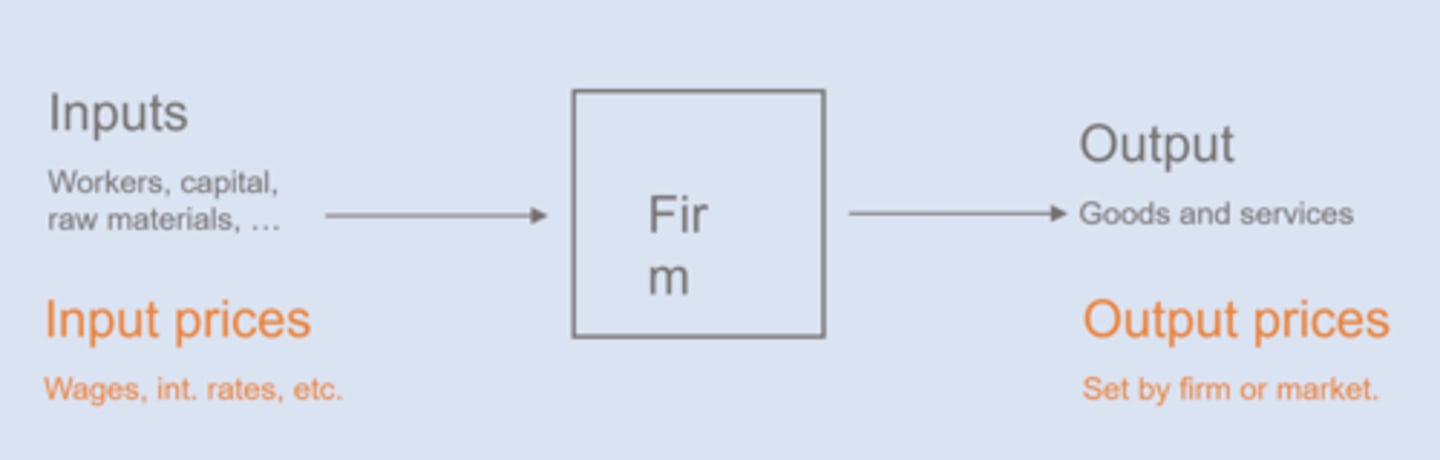

Firm Model

Input prices tend to be stickier than output prices

ex: wage contracts

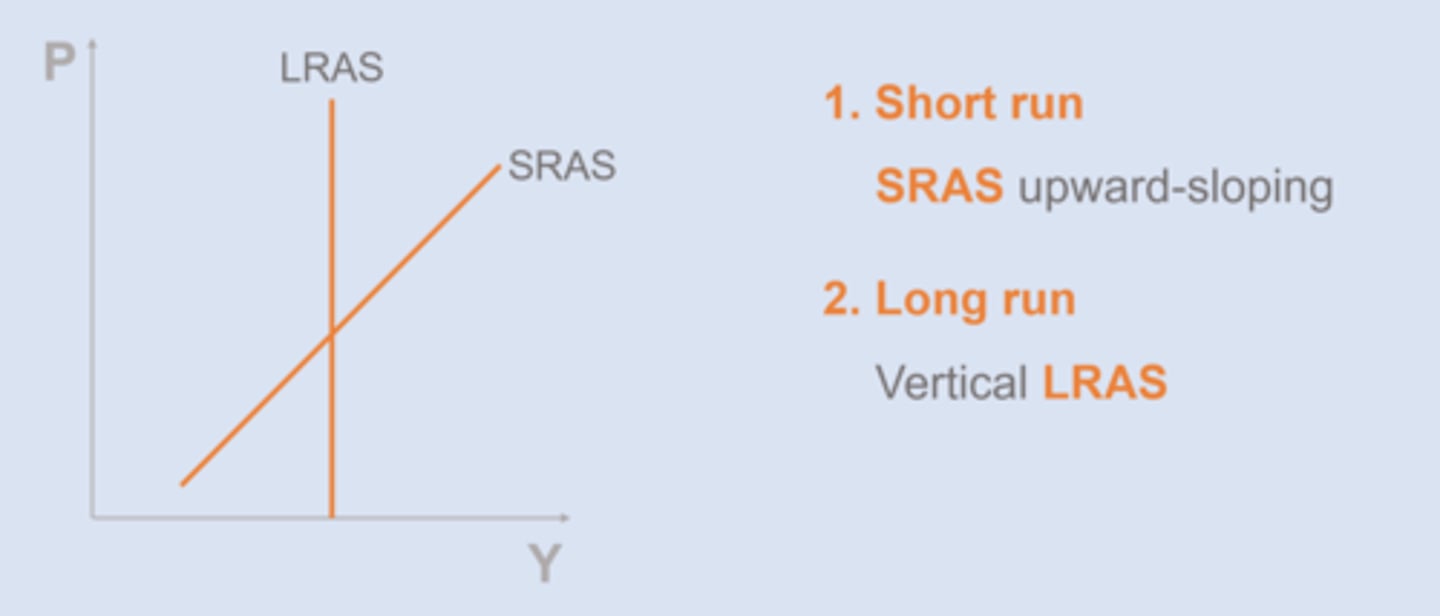

long run

A period of time sufficient for all prices to adjust

short run

A period of time in which some prices have not yet adjusted

Which prices are sticky?

SRAS curve

upward sloping (as p increases, Y increases)

why?

==> inflexible input prices (if P increases, yet input costs stay the same, revenue increases, you increase Y)

==> menu costs (if inflation occurs, yet output costs stay the same, they will seem cheaper & sell more)

==> money illusion

LRAS curve

vertical sloping (because P does not affect Y)

shifts in LRAS

related to technology, institutions, and resources (changes in Y) ==> u = u is maintained

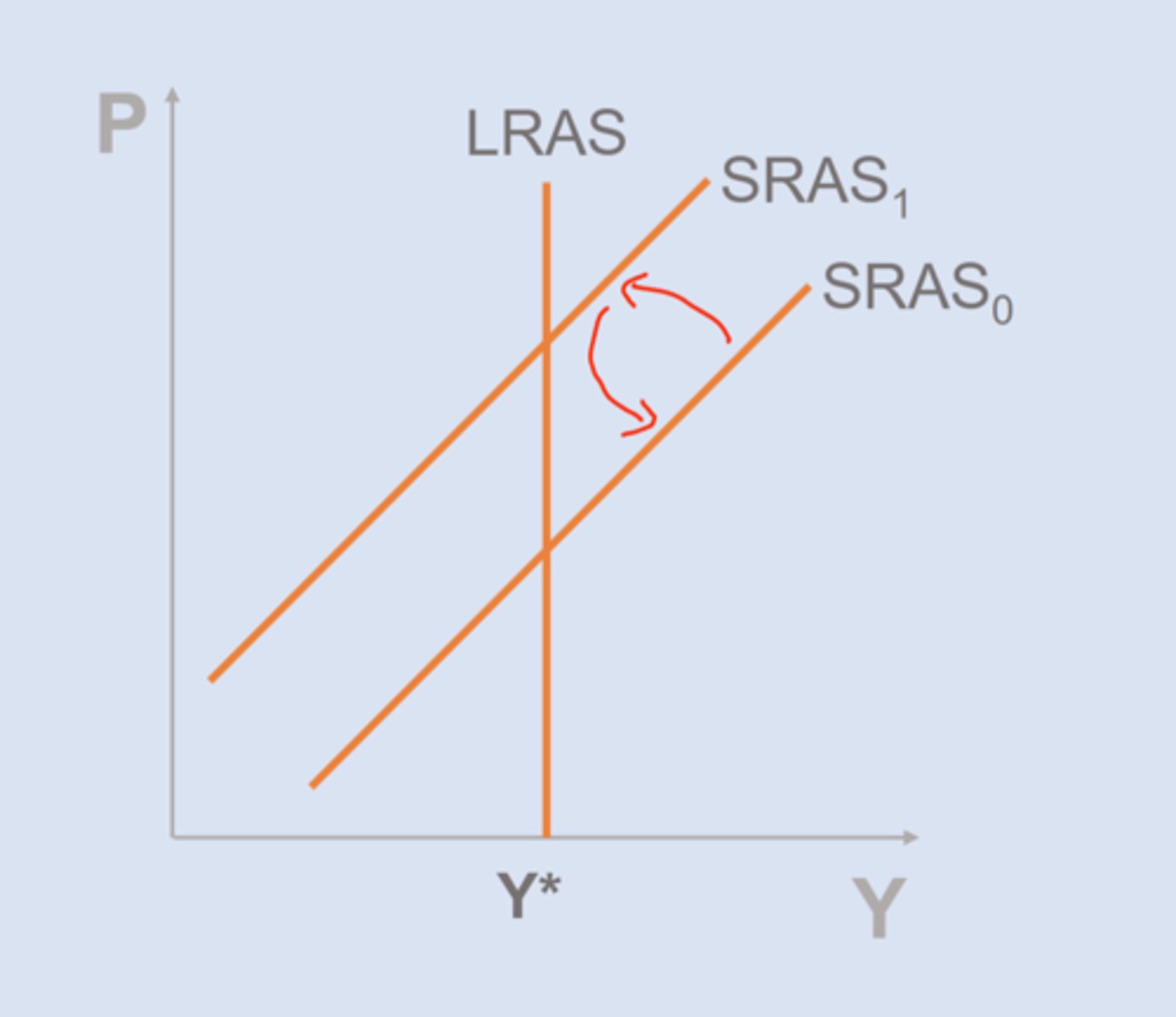

Shifts in the LR affect the SR too (lR shift ==> SR shift)

full employment output

output level sustainable for economy in the LR (Y) ==> GDP when u = u, unrelated to P

shifts in the SRAS

1. resource/input prices change (-)

2. SR supply shocks (+/-)

supply shocks

Temporary exogenous events that change production costs

ex: nat disasters, pandemics, droughts

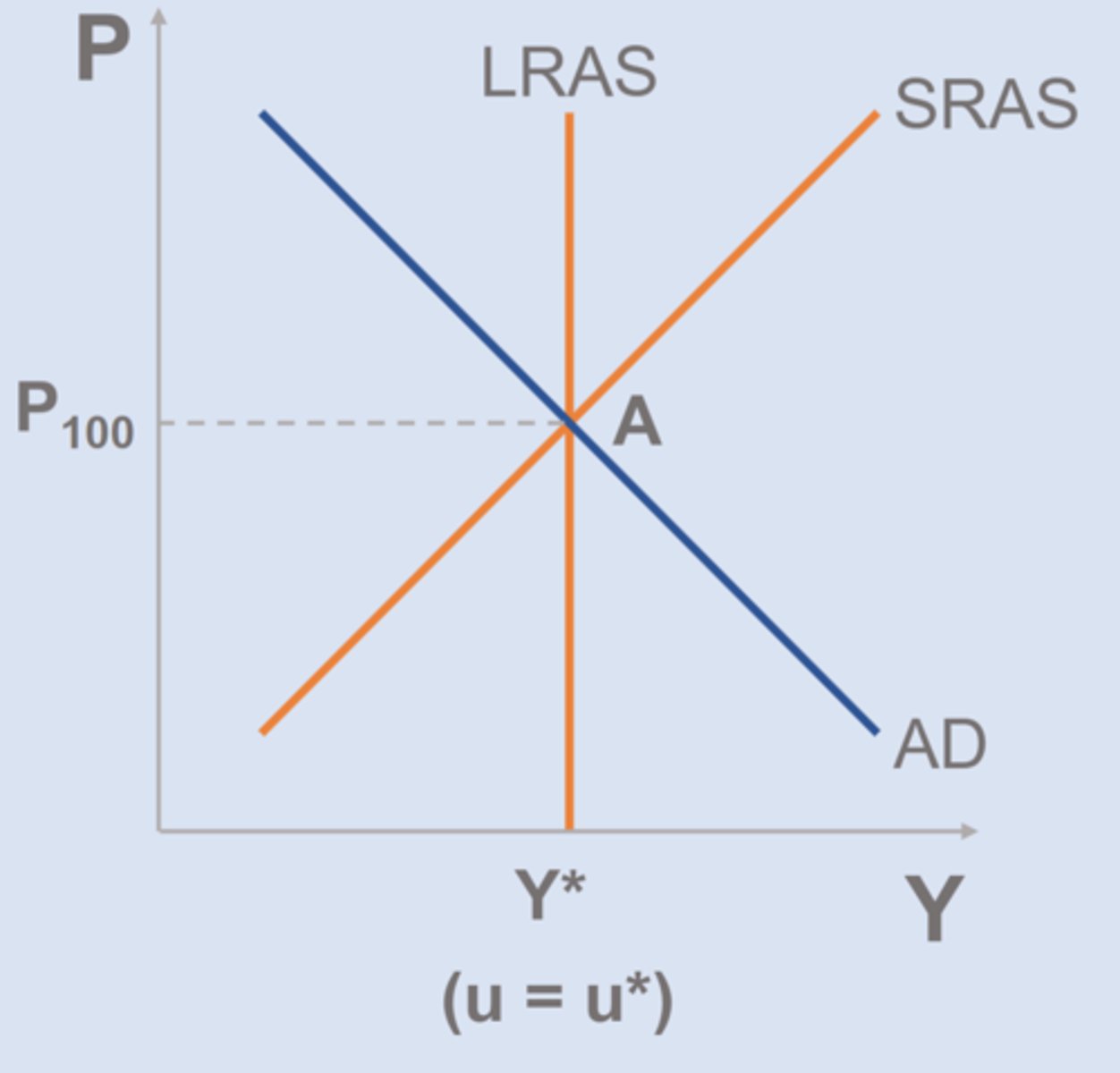

AD-AS Equilibrium

Characteristics of long run equilibrium(A):

LRAS = AD = SRAS

Y = Y*

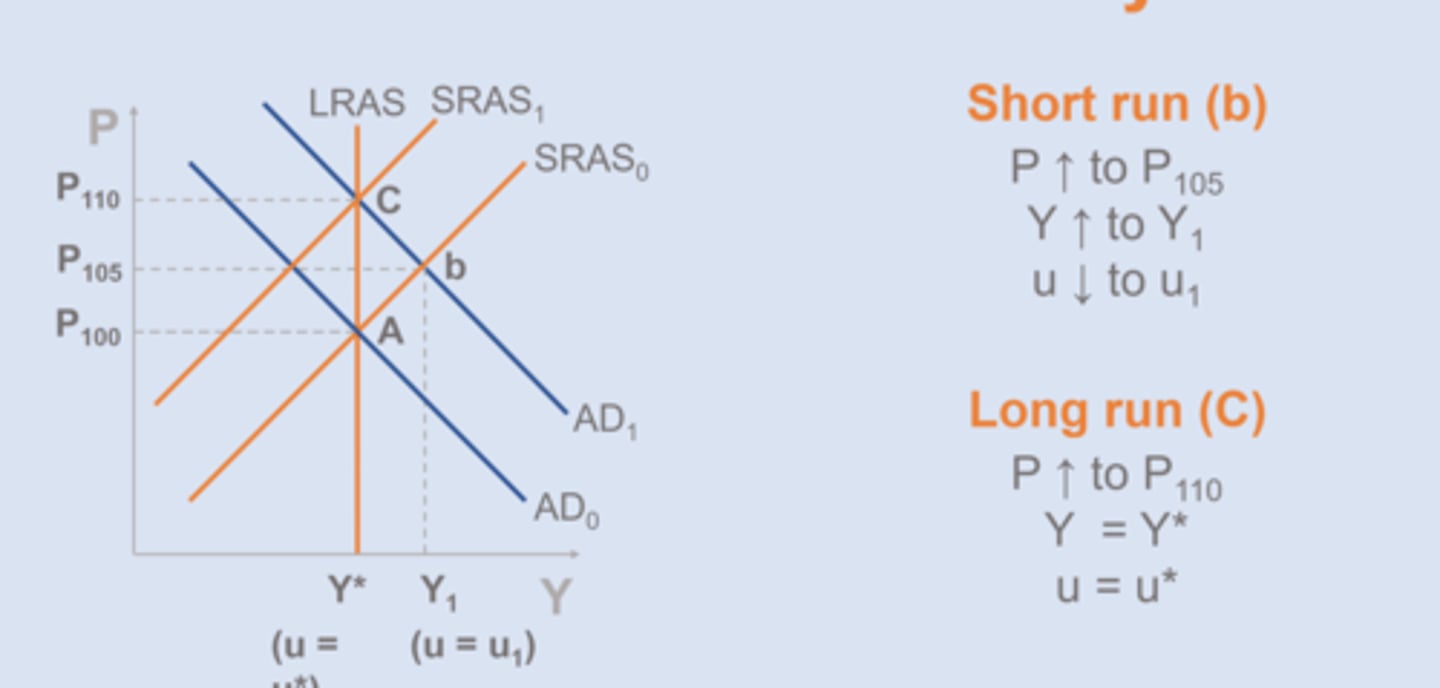

ex: Increase in AD

1. AD shifts out (SR equilibrium b)

2. SR shifts back (LR equilibrium C)

==> input prices rise to match raise in P

In LR all prices adjust

Does spending stimulate the economy?

Yes, in the SR.

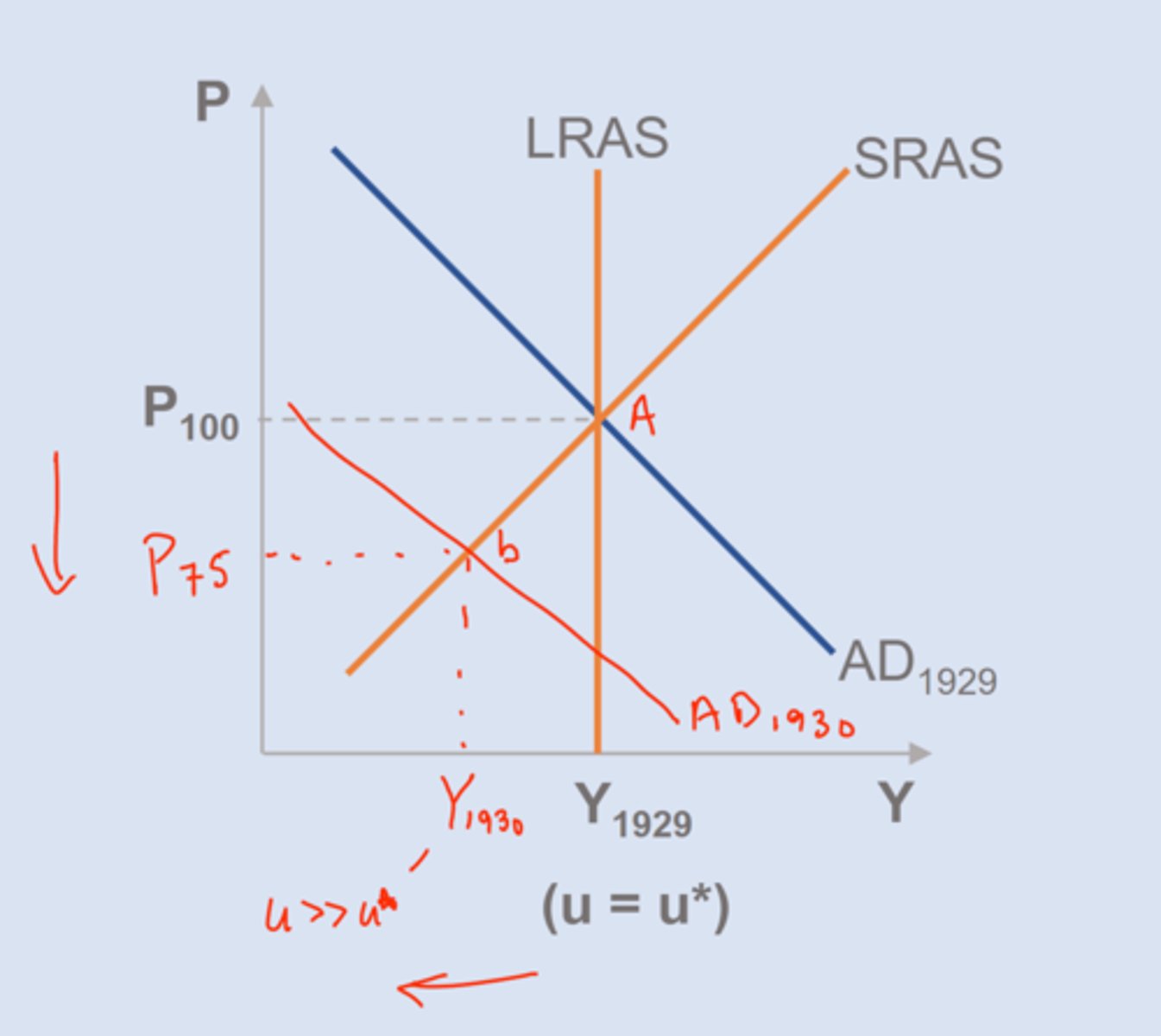

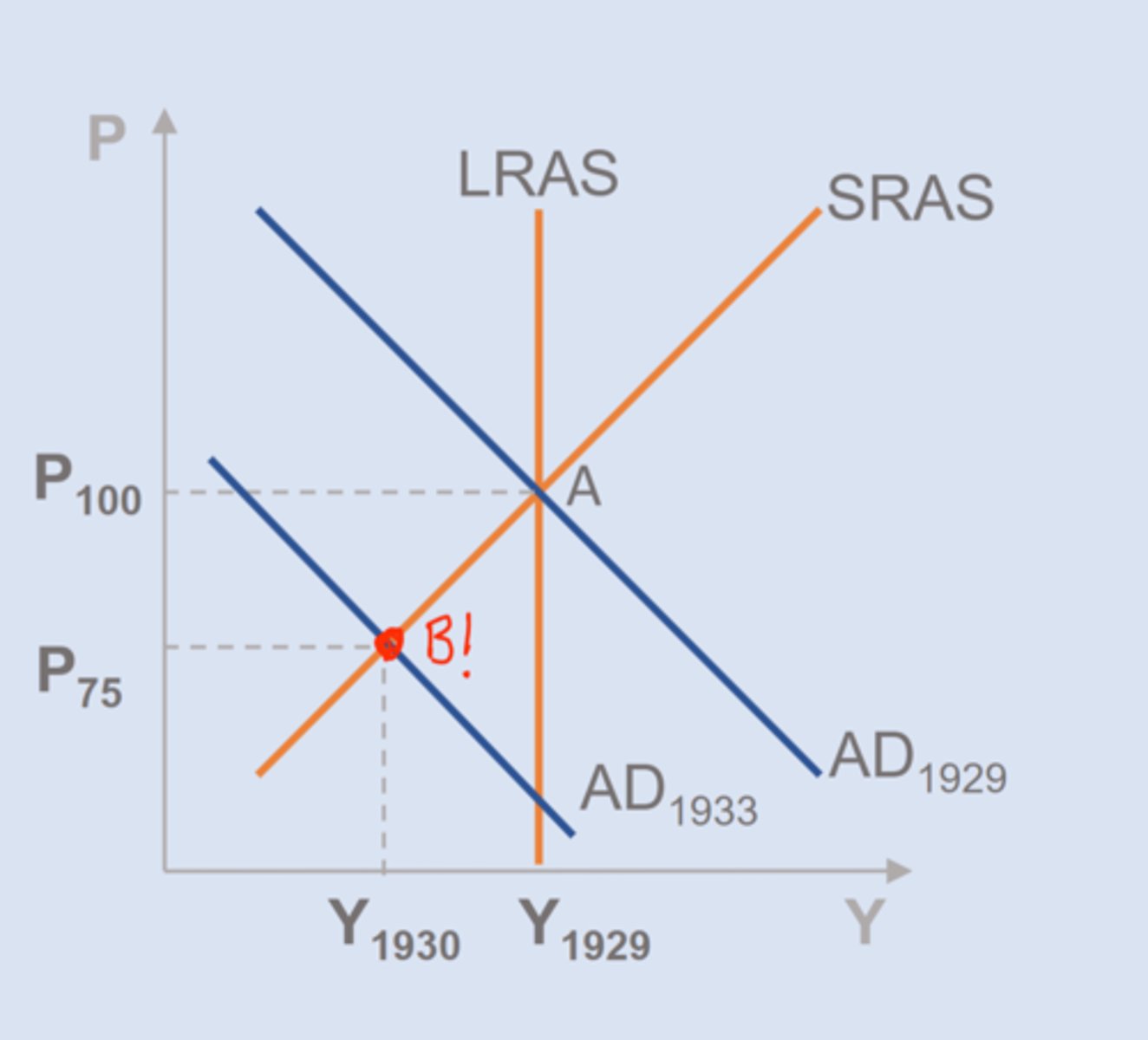

The Great Depression & Cause

AD decline (real GDP down 30%, unemployment > 15%, deflation 25%)

==> decline real wealth

==> decline in expected future income

==> gov. blunders (raise taxes, decrease money supply)

macroeconomic policy

gov acts that influence macroeconomy

fiscal policy

use of gov. budget tools (gov spending & taxes) to influence macroeconomy

monetary policy

change in money supply that influences macroeconomics

Policy during recessions

gov tries to increase AD through spending, tax cuts, expansionary policy

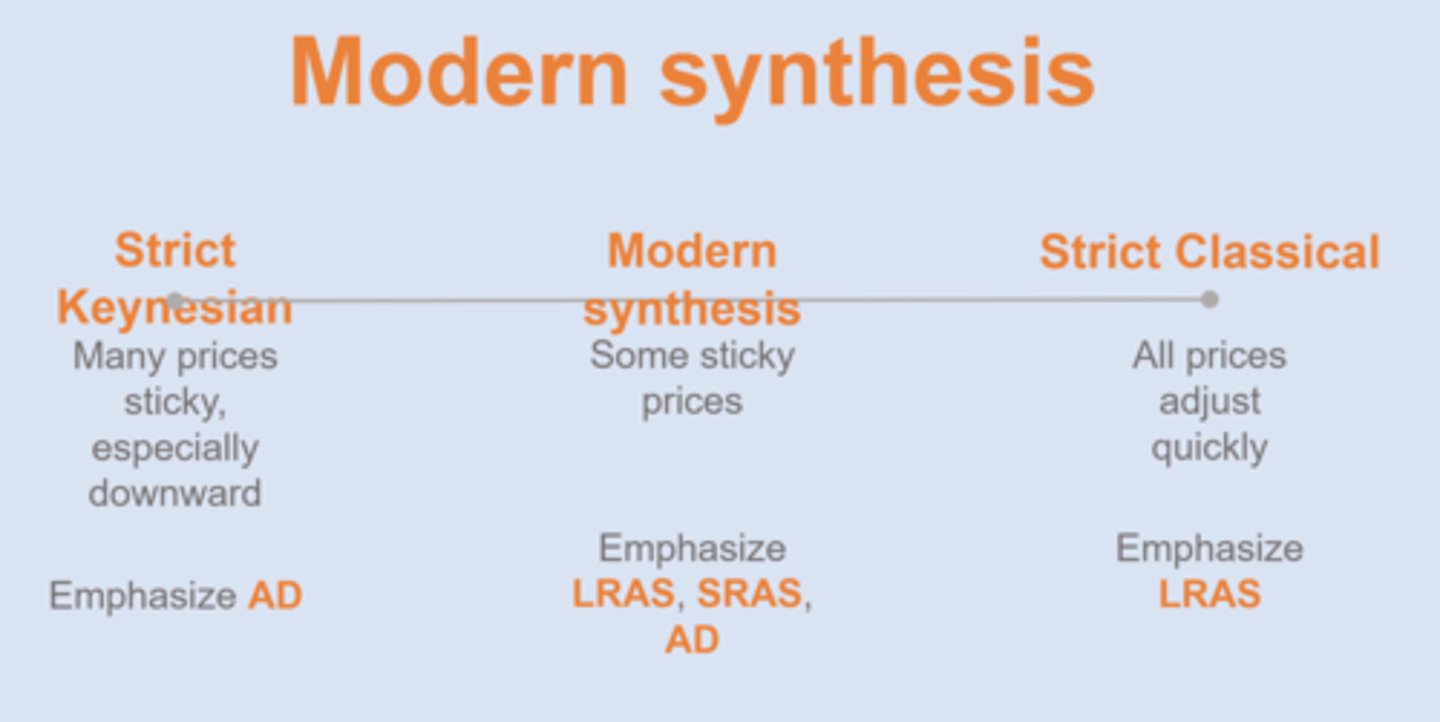

Classical Economics

- focus on spending side

- prices adjust to equilibrium

==> assumption: prices are flexible (no sticky prices)

==> implications:

- no long unemployment

- economy inherently stable

- AS = main focus (only LR)

Keynesian Economics

- focus on demand side

==> assumption: many prices take a while to adjust, especially downward ==> due to money illusion and wage contracts

==> implications:

- GDP adjusts instead ==> "if prices don't adjust, output must"

- focus shifts to AD

- economy in inherently unstable

- government must help!

Comparison of Classical, Modern, Keynesian

The Great Recession

Dec 2007 - Jun 2009

LOWER AD

- decline in real wealth (housing prices)

- decline in expected future income

SHIFT LEFT IN LRAS

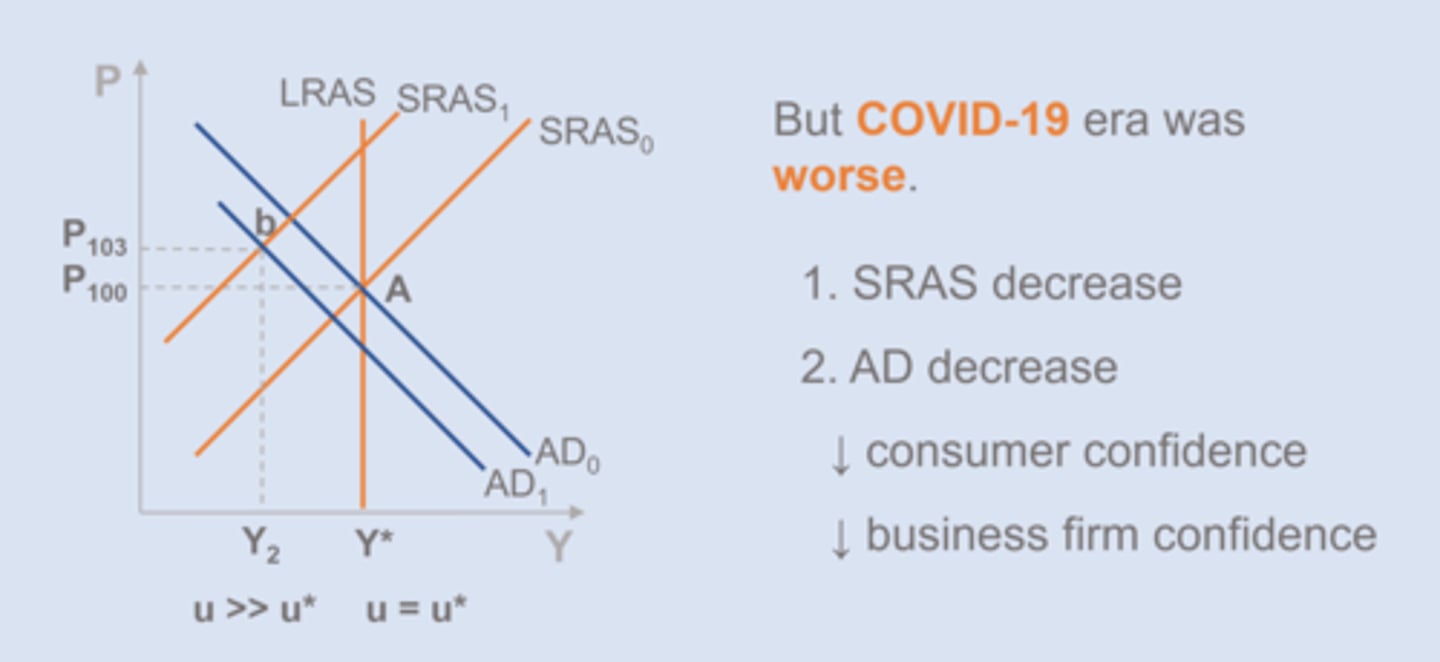

COVID-19 Recession

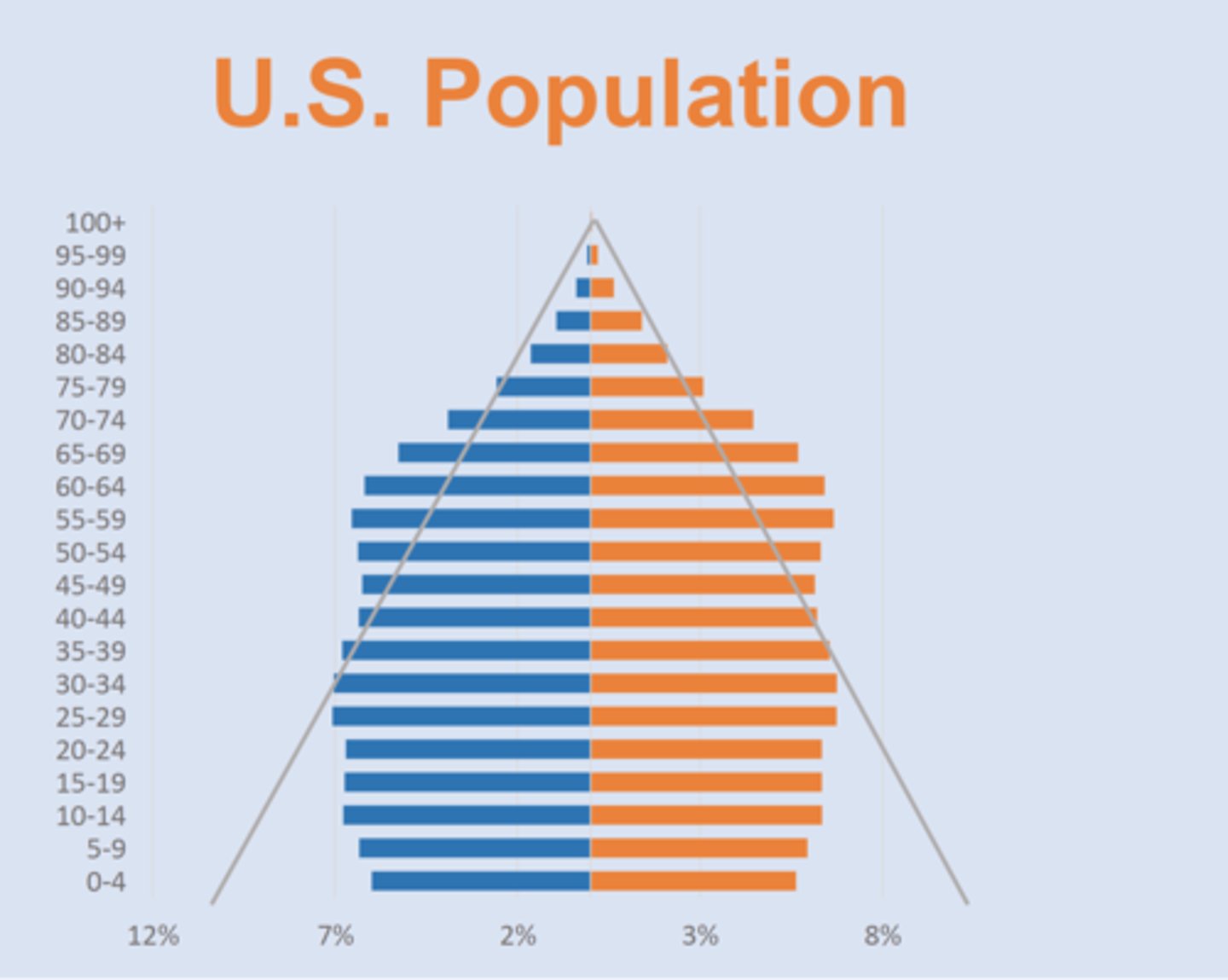

US Population Breakdown

NOT a pyramid

==> so many Boomers, longer lifespans, lower birthrate

==> concerns for fed. budget as population reaching retirement age is larger

Social Security

Retirement program run by the federal government

Medicare

Elderly health insurance program run by the federal government.

Federal Budget

The national government's plan for outlays and revenues

Outlays

The spending side of the budget ==> direct spending plus transfer payments

ex: national defense, education, highways, healthcare, retirement

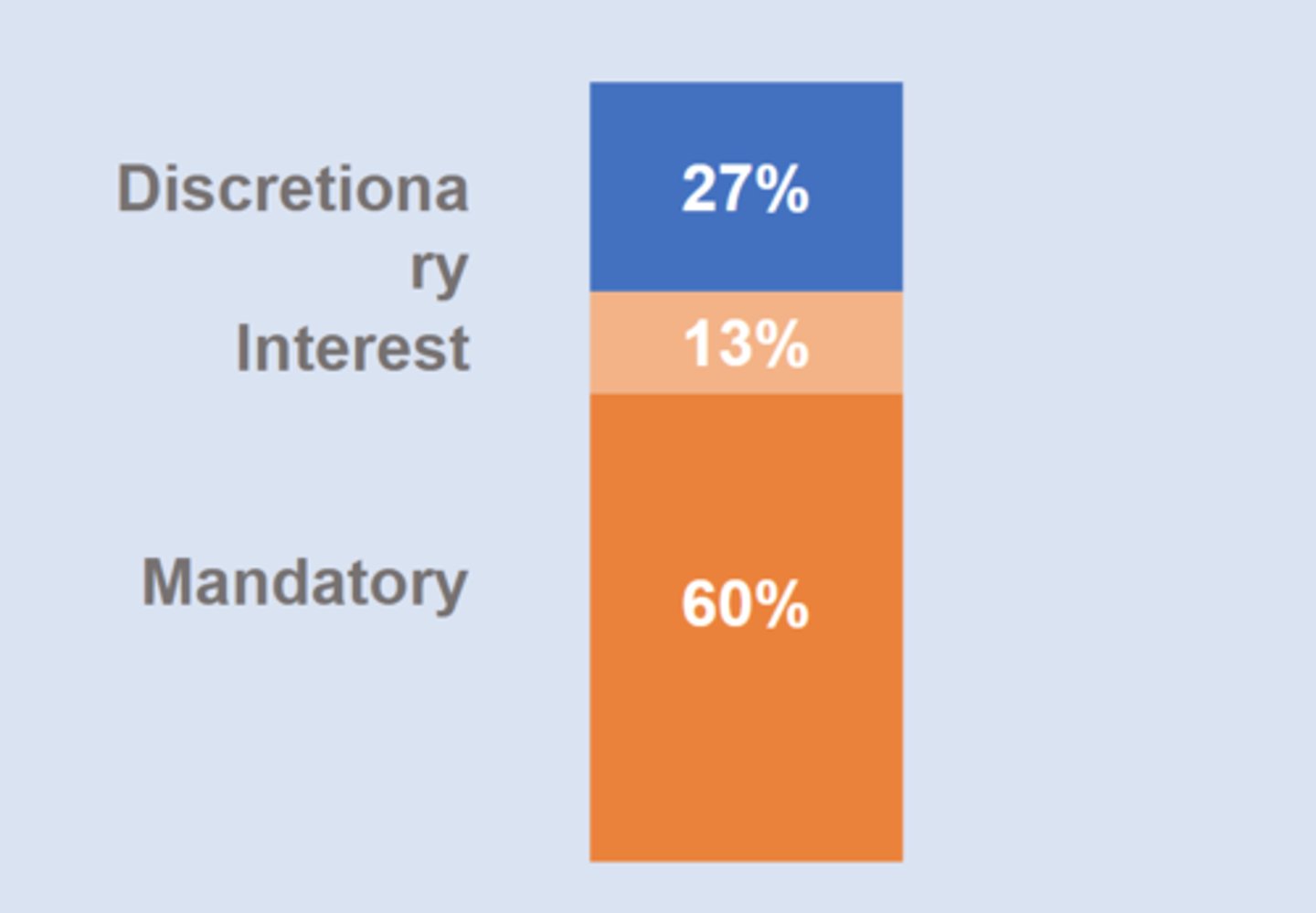

Discretionary Outlays

budget items that are adjustable on a year-to-year basis (flexible) ex: groceries/defense

Mandatory Outlays

budget items that are predetermined each year based on existing obligations

ex: rent

==> includes entitlement programs like SS and medicare

Breakdown of Outlays in Fed Budget

mandatory (SS, medicare, income assistance)

discretionary (defense and non-defense)

==> shift over time to more majority mandatory outlays

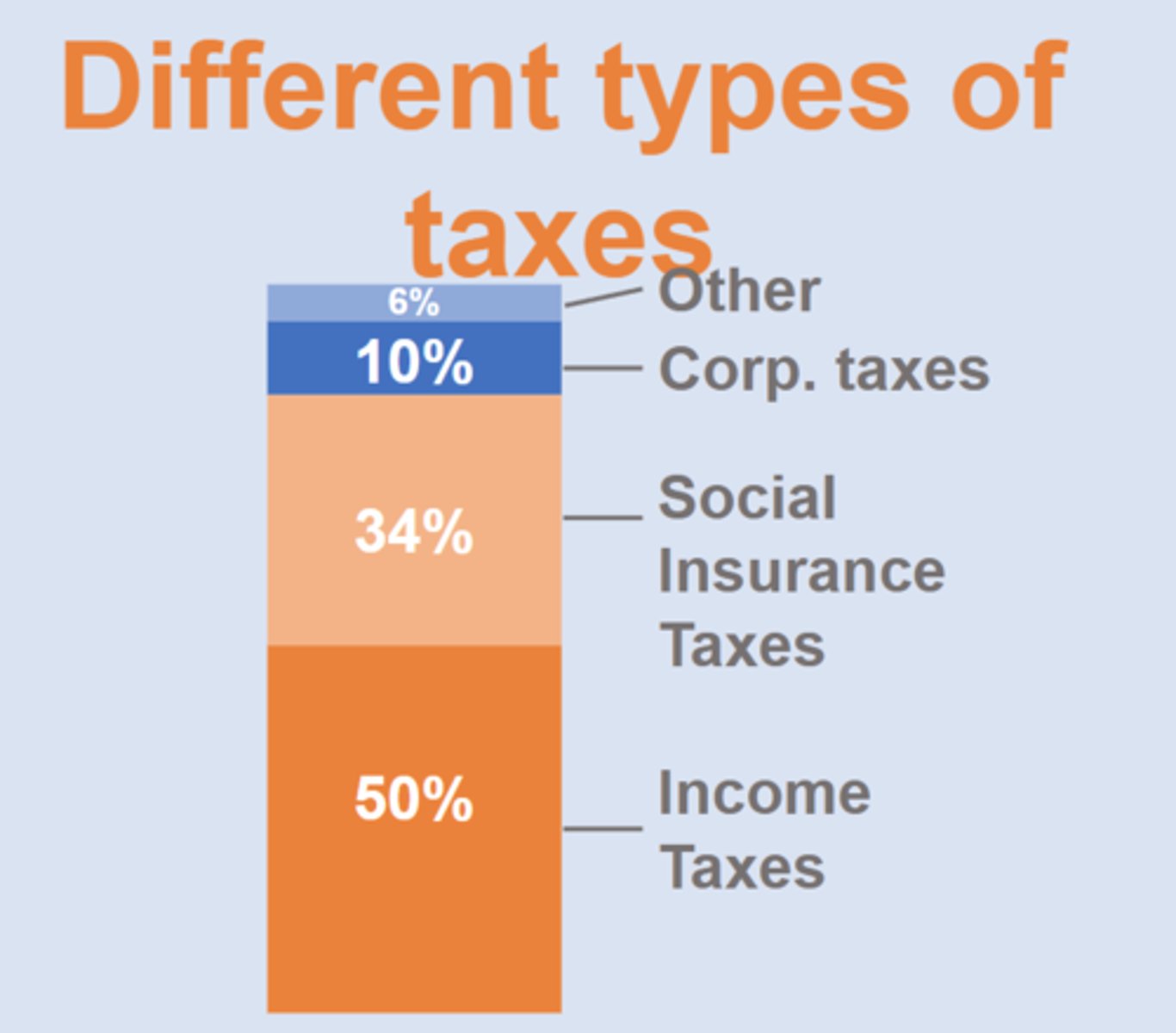

Revenues & Taxes (types of taxes)

approximately 5 trillion

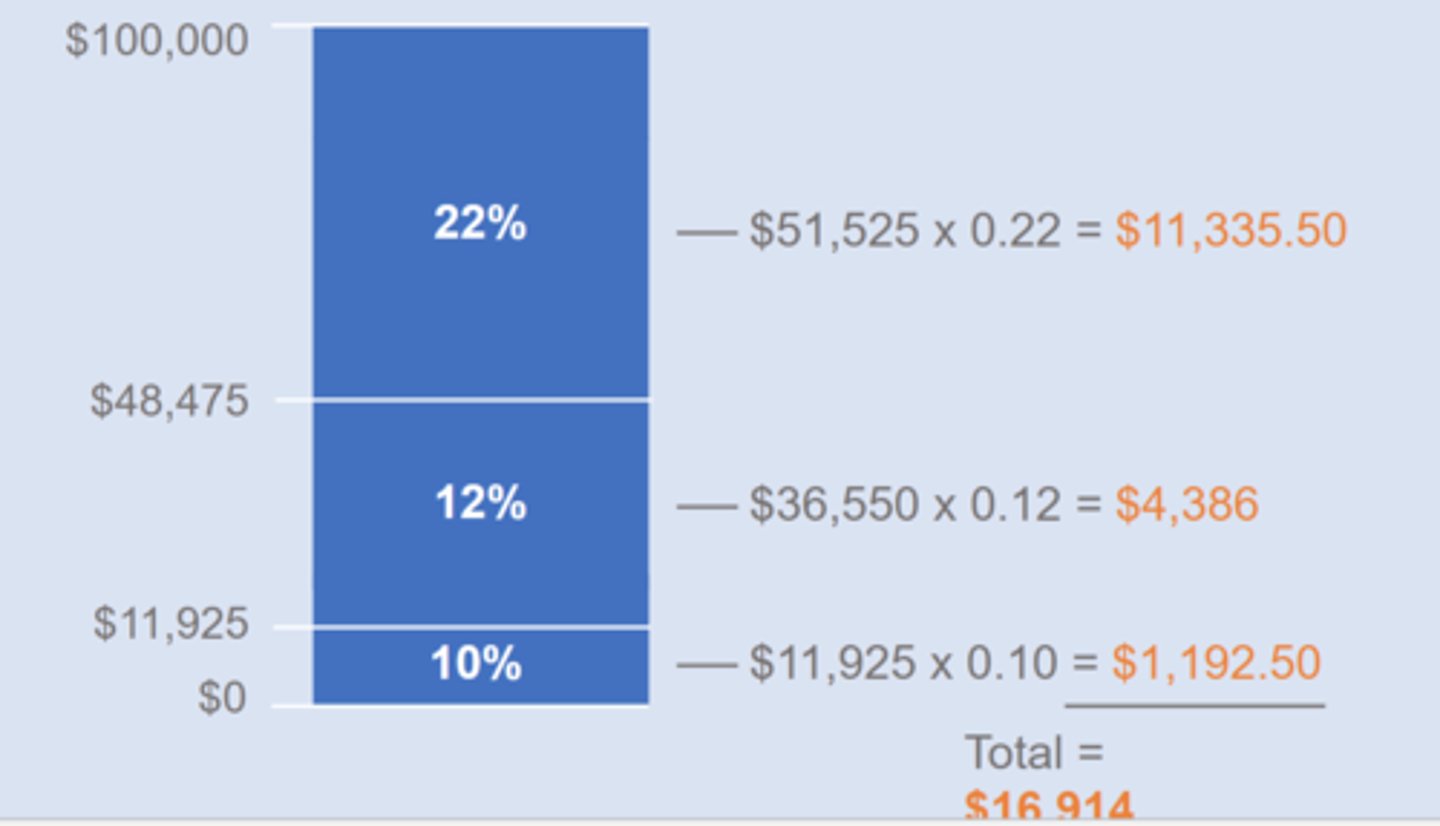

progressive income tax

tax rate increases as person's income rise

marginal tax rate

The tax rate that applies to a person's next dollar of income

Average tax rate

ATR = T/Y

Budget Deficit

Outlays > revenue

==> applies to a particular time period (a year)

==> must borrow to make up difference

Budget Surplus

tax revenue > total outlays

National Debt

accumulation of all unpaid deficits

==> 36 trillion for US

=> projection to increase as average deficit gap projection increases (4 ==> 6)

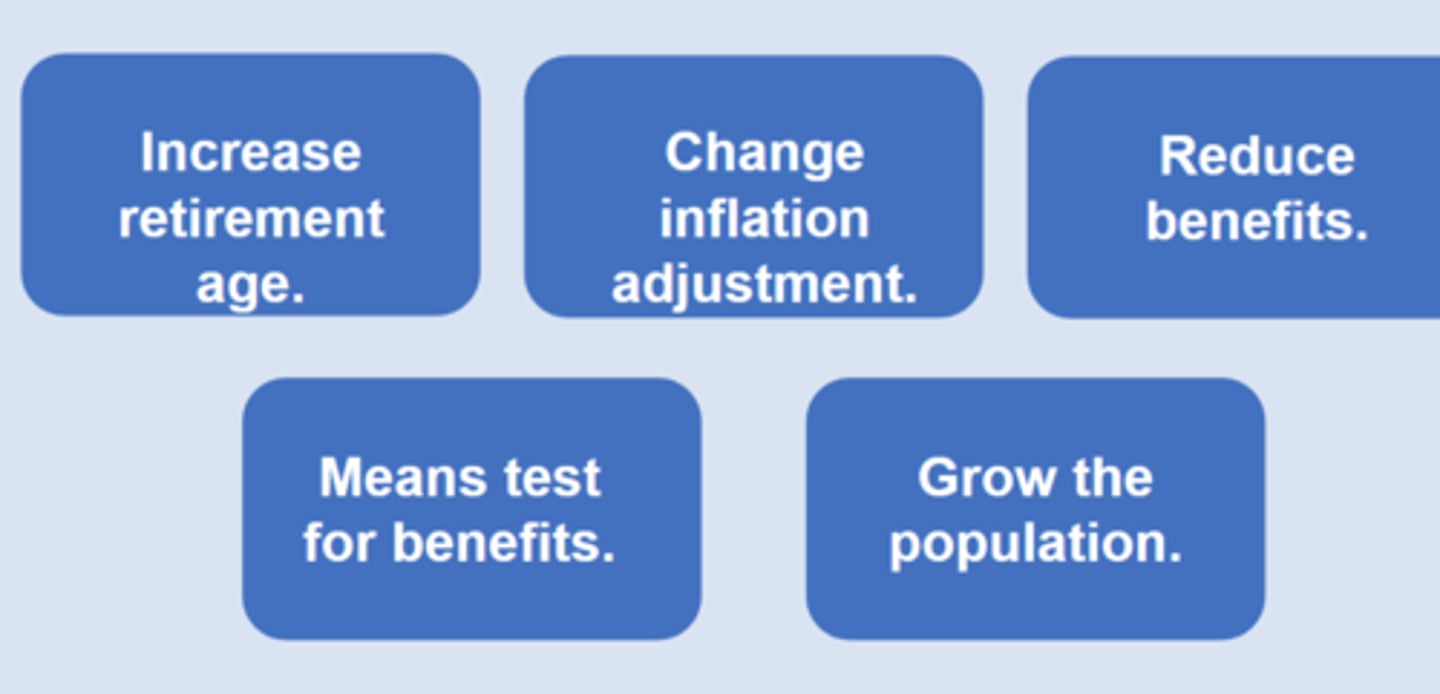

Entitlement Reform Ideas

What can DOGE do?

only can control the 27% of outlays (discretionary part)