Trade protection and exchange rates

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

Barriers to trade

Obstacles to international trade, imposed by a government to safeguard national interests by reducing the competitiveness of foreign firms.

Tariffs

A specific tax on imported goods and services

Aim of tariffs

Increase production costs for a foreign firm to increase the price of a good or service and make domestically produced goods more competitve.

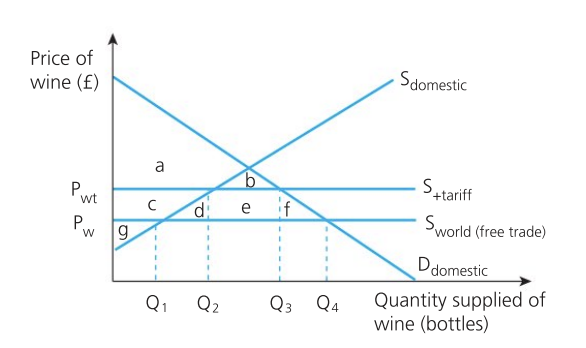

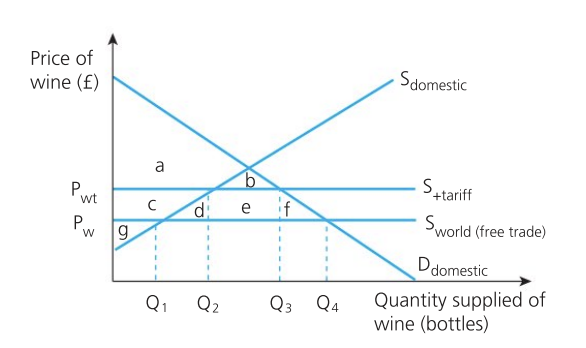

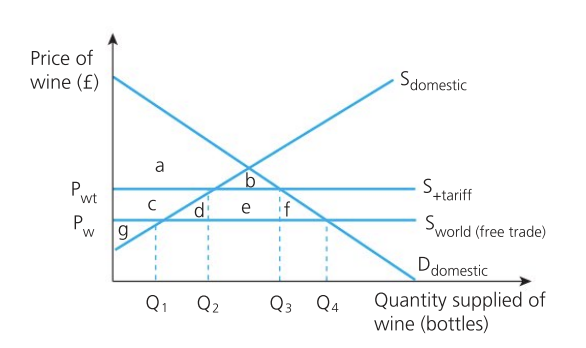

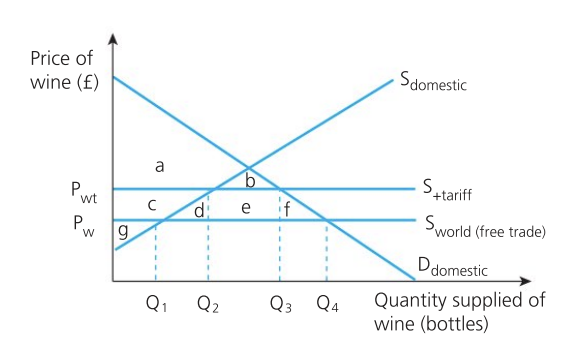

Effect of tariff on consumers

higher prices

reduced variety of good and service

consumer surplus decreases from a + b + c + d + e + f to a + b

Effect of tariff on producers

domestic producers:

benefit in the short run as they are able to compete more effectively despite their lack of comparative advantage

increase in producer surplus from g to c + g

increase in producer revenue as domestic demand increases from Q1 to Q2

in the long run they may experience a reduction in export revenues due to retaliation from foreign governments

foreign producers:

lose revenue

Effect of tariff on government

tax revenue e

protecting jobs in the domestic industry so they will have to pay less unemployment benefits so taxpayers are also benefited

burden of costs of enforcing the tariff

may also face action from the World Trade organization such as fines or sanctions

Effect of tariff on market efficiency and welfare

consumer surplus decreases from a + b + c + d + e + f to a + b

producer surplus increases to from g to c + g

thus, social surplus decreases from a + b + c + d + e + f + g to a + b + c + g

efficiency is lower and there is a welfare loss represented by d + f

f is loss of consumers and d represents inefficient production by firms

Non-tariff barriers

Restrictions to international trade that do not involve a tax or duty (tariff), such as quotas, export subsidies and administrative barriers.

Quotas

Quantitative limits on the importation of a good into a country

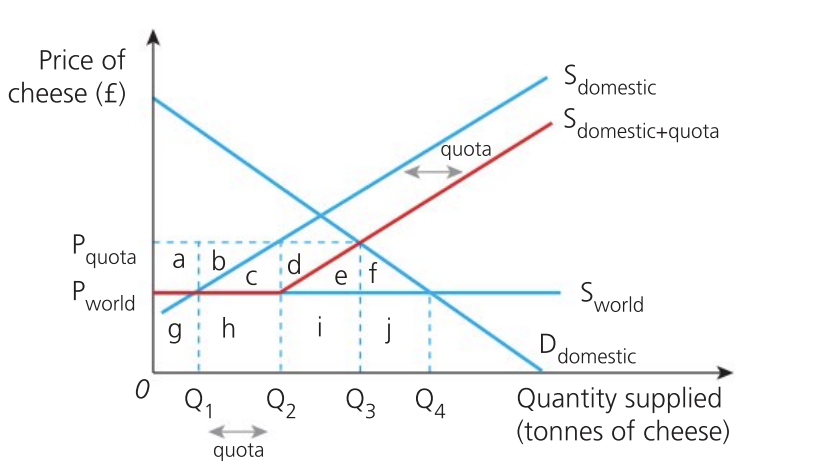

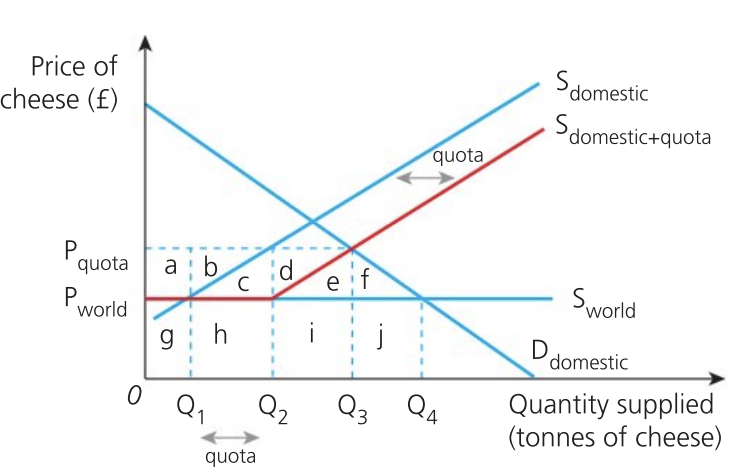

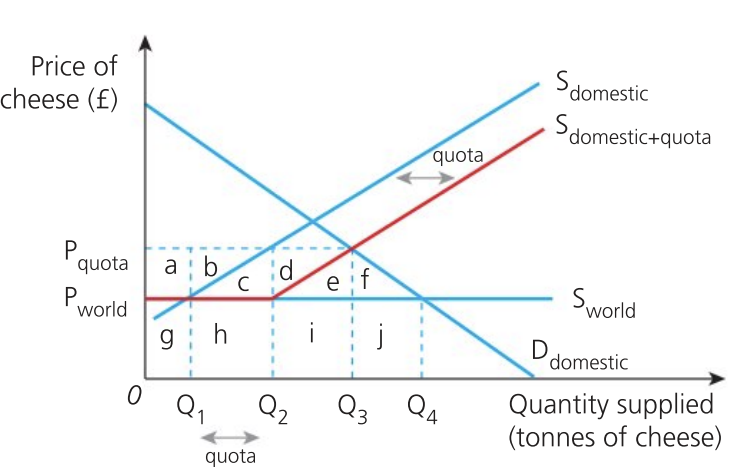

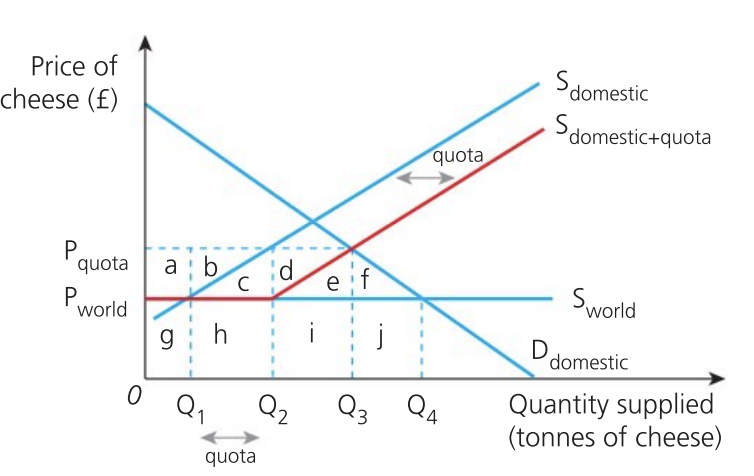

Effect of quota on consumers

introduction of quota from Q1 to Q2 creates greater scarcity causing an increase in price to Pquota

reduction in variety and choice

consumer expenditure increases from g + h + i + j to a + b + c + d + e + g + h + i

loss in consumer surplus is a + b + c + d + e + f

Effect of quota on producers

domestic producers:

revenue increases from g + h + i + j to a + g + d + e + i

could lead to economies of scale increase profits

foreign producers:

reduction in revenue from h + i + j to b + c + h

still receive a higher price per good but it is likely to lead to lower revenues due to limit on their supply

depends on the price elasticity of demand and supply

Effect of quota on the government

will receive some revenue from sale of import licences

enforcement costs from administering it, selling the license and deterring smuggling operations

Effect of quota on welfare (society)

loss of efficiency due to lower levels of competition and less choice for domestic consumers

welfare loss represented by e + f

base of triangle is loss in imports of cheese and the height is the higher price

thus, society is worse off

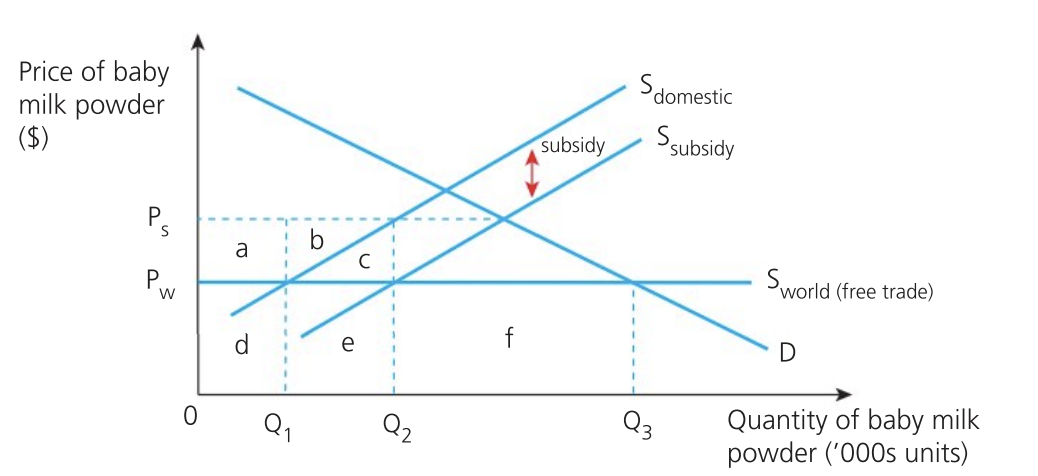

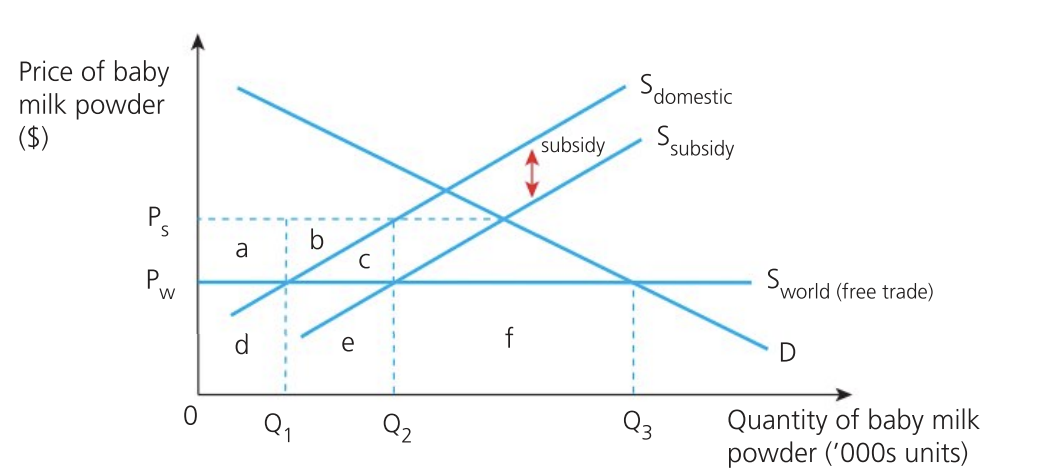

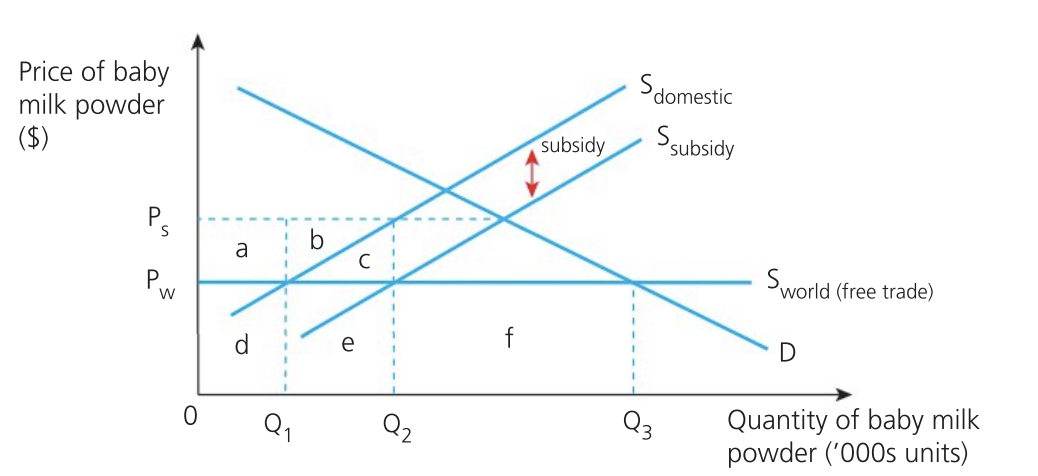

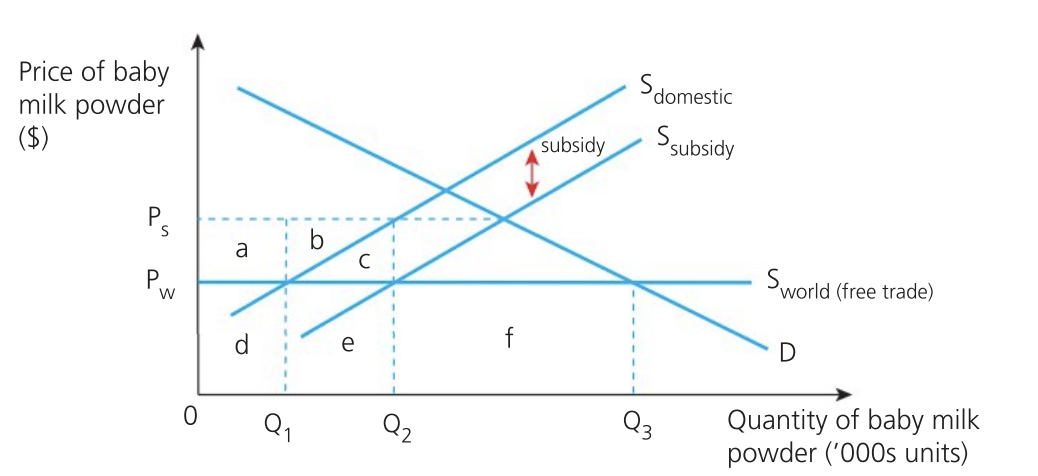

Subsidies

A form of financial assistance to domestic firms by lowering their costs of production in order to help them compete against foreign imports

Production subsidies

Most common, used to help reduce the production costs of domestic firms

Export subsidies

Less wide-ranging as they are targeted at protecting specific export orientated firms

Effect of subsidy on consumers

consumption and price are unaffected

buy more domestic goods so gain or lose depends on the quality difference

consumer expenditure (Pw x Q3): d + e + f

consumer surplus stays the same

Effect of subsidy on producers

domestic firms:

sell at world price but receive Ps

gain more as they supply at Q2 rather than Q 1

revenue increases from d to a + b + c + d + e

foreign producers:

decrease in exports from Q3-Q1 to Q3-Q2

revenue decreases from e + f to e

Effect of subsidy on the government

increased expenditure to a + b + c

tax payers are worse off due to opportunity cost

Effect of subsidy on welfare (society)

encourages inefficient output from domestic firms

welfare loss represented by C

Administrative barriers

The application of bureaucratic standards and regulations imposed on foreign firms in order to protect domestic firms and consumers.

For example, strict rules regarding food safety, environmental standards and product quality.

Effect of administrative trade barriers

increases costs for foreign firms thereby giving an advantage to domestic firms

slow the supply chain of foreign goods and services creating a shortage and the gap can be filled by domestic firms

Embargoes

A form of administrative barrier that involves the use of bans on trade with a certain country, often due to political and/or economic disputes

Exchange controls

A form of administrative barrier involving restrictions on the quantity of foreign exchange that can be bought or sold by domestic residents.

Exchange rates

The value of one currency expressed in terms of another currency

Floating exchange rate

The value of a currency is determined by the demand for and supply of the currency in the foreign exchange market

Appreciation

A sustained increase in the value of one currency in terms of another under a floating exchange rate system

Depreciation

A sustained decrease in the value of one currency in terms of another under a floating exchange rate system

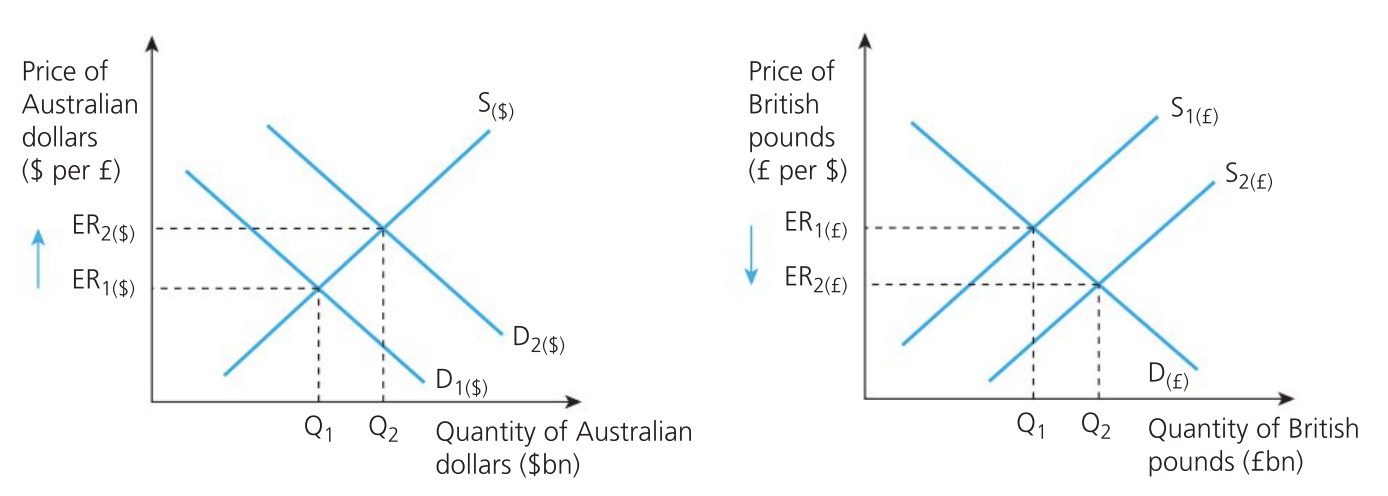

Appreciation of the Australian dollar

increased demand for AUD is caused by a higher demand in the UK for australian goods

this increases the supply of British pounds by British buyers who exchange their pounds for dollars

increase in the value of the Australian dollar against British pound from ER1 to ER2 is matched by a fall in the value of the British pound against the Australian dollar from ER1 to Er2

Creates incentive for holders of AUD to increase the quantity supplied of AUD in anticipation of a better price

leads to a new equilibrium exchange rate of ER2 and Q2 billions of AUD traded

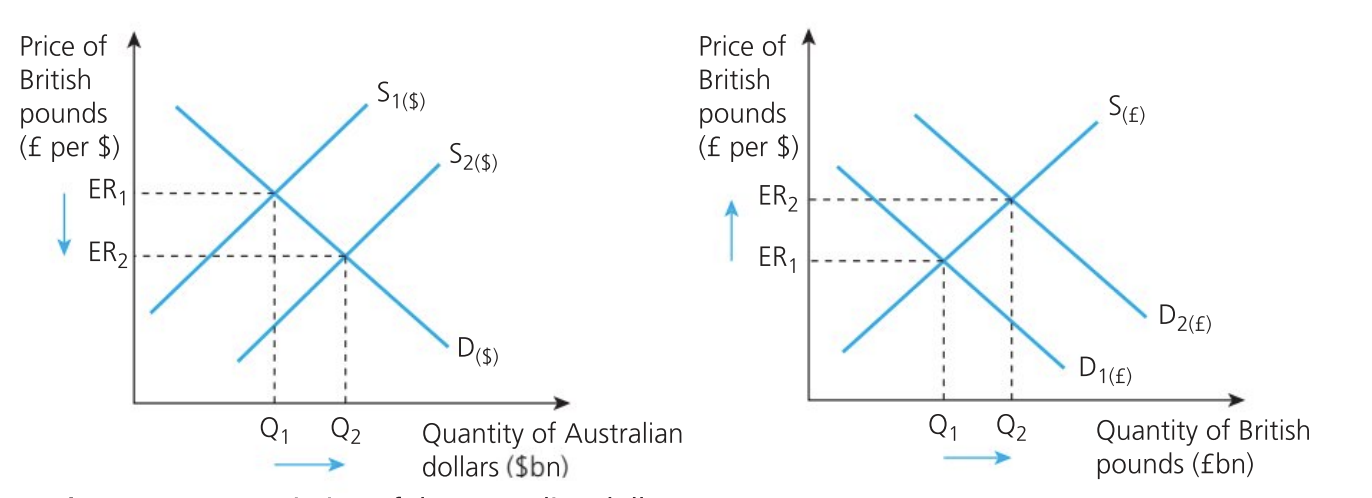

Depreciation of the Australian dollar

Australian dollars wish to purchase British pounds

They must first sell their dollars causing an increase in supply of dollars from S1 to S2

Causes a fall in the value of the dollar as the exchange rate drops from ER1 to ER2

AUD holders will accept lower bids for their dollars as they are less scarce (more supply)

signals to the amrket that price of AUD is likely to fall

increase in quantity demanded and a new equilibrium ER1 and Q2

Inward foreign direct investment

Refers to foreign multinational companies expanding their operations in the domestic economy

Outward foreign direct investment

Refers to multinational companies from the domestic economy expanding their operations in overseas markets.

Portfolio investment

The purchase of financial investments abroad, such as the purchase of stocks, shares and bonds of overseas firms and government.

Inward: spending in the domestic economy by foreign investors. Supply (sell) their own currencies and demand (buy the currency of the economy that they are investing in.

Outward: spending by an economy’s investors in overseas markets. Increases supply of domestic economy’s currency and demand for the currency of the other economy.

Reminttances

Refer to the movement of money when nationals working abroad send money back to their home country. Results in the depreciation of the currency of the economy that they are working in and appreciation of the currency of their home economy, ceteris paribus.

Speculation

Occurs when a financial asset, such as the domestic currency or a foreign currency, is purchased in the hope or anticipation that the resale value will be higher.

Relative inflation rates

Increase in the price of goods and services caused by inflation decreases the demand for exports. Leads to reduction in the demand for a currency and therefore depreciation of the currency. Speculators may choose to sell this currency and further depreciating it.

Relative interest rates

investors may wish to save in an economy that has higher interest rates than in their own country

to do this investors will need to purchase the currency of the foreign country where they will be saving their money. Increase in supply of the domestic currency and increase in demand for foreign currency.

Relative growth rates

higher levels of economic growth in a foreign economy leads to increase in AD

this causes demand-pull inflation and increases the likelihood of contractionary monetary policy

The higher interest rates will generate an increase in the demand for the currency of that economy, leading to the appreciation of it

Central bank intervention

A central bank may also restrict the supply or sale of its currency to control the money supply

These currencies are likely to face lower levels of demand as they become less desirable to speculators.

Fixed exchange rate system

Exists when the central bank buys and sells foreign currencies to ensure the value of its currency stays at a single, predetermined rate. Do this by buying (demanding) or selling (supplying) foreign currency reserves.

Foreign currency reserves

Stocks of foreign currencies held by a central bank, usually to influence the value of its currency.

Devaluation

Occurs when the price of a currency operating in a fixed exchange rate system is officially and deliberately lowered.

Can improve international competitiveness as exports become relatively cheaper and imports become more expensive.

Revaluation

Occurs when the price of a currency operating in a fixed exchange rate system is officially deliberately increased.

Governments may do this when they wish import more essential goods and services.

Managed exchange rate

A system where the government or central monetary authority intervenes periodically in the foreign exchange market to influence the exchange rate, when deemed necessary to maintain certainty and confidence in the economy

Crawling peg

A form of fixed exchange rate system in which a currency is permitted to fluctuate within predetermined bands of exchange rates.

Overvalued currency

Occurs when the value of a currency is above its equilibrium value in the long run.

Undervalued currency

Occurs when the value of a currency is below its equilibrium value in the long run.