Intermediate Accounting - Chapter 1

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

Financial Accounting

provides relevant financial information to various external users.

capital markets

mechanisms to help an economy allocate resources efficiently.

corporation

dominant form of business organization that acquires capital from investors in exchange for ownership interest and from creditors by borrowing.

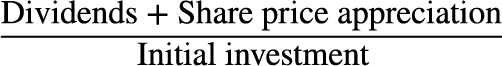

Rate of return

the gain or loss made on an investment relative to the amount invested, usually expressed as a percentage.

accural accounting

measures income according to the entity’s accomplishments and resource sacrifices during the period from transactions related to providing goods and services to customers, regardless of when cash is received or paid.

cash-basis accounting

measures income as the difference between cash receipts and cash disbursements during a reporting period from transactions related to providing goods and services to customers.

net operating cash flow

difference between cash receipts and cash disbursements fromtransactions related toproviding goods and servicesto customers during a reporting period.

Generally accepted accounting principles (GAAP)

set of both broad and specific guidelines that companies should follow when measuring and reporting the information in their financial statements and related notes.

Securities and Exchange Commission (SEC)

has the authority to set accounting standards for companies, but it relies on the private sector to do so

Committee on Accounting Procedure (CAP)

first private sector body that was delegated the task of setting accounting standards.

American Institute of Certified Public Accountants (AICPA)

national organization of professional public accountants.

Accounting principles board (APB)

the second private sector body delegated the task of setting accounting standards.

Financial Accounting Standards Board (FASB)

the private sector body responsible for establishing standards of financial accounting and reporting in the U.S.

Financial Accounting Foundation (FAF)

responsible for selecting the members of the FASB and its Advisory Council, ensuring adequate funding of FASB activities, and exercising general oversight of the FASB’s activities.

Emerging Issues Task Force (EITF)

responsible for providing timely responses to emerging financial reporting issueswithin the framework of existing GAAP.

conceptual framework

deals with theoretical and conceptual issues and provides an underlying structure for current and future accounting and reporting standards.

FASB Accounting Standards Codification

integrates and topically organizes all relevant accounting pronouncements comprising GAAP in a searchable, online database.

International Accounting Standards Committee (IASC)

umbrella organization formed to develop global accounting standards.

International Accounting Standards Board (IASB)

objectives are to develop a single set of high-quality, understandable global accounting standards, to promote the use of those standards, and to bring about the convergence of national accounting standards and International Accounting Standards.

International Financial Reporting Standards (IFRS)

developed by the IASB and used by more than 120 jurisdictions

auditors

independent professionals who render an opinion about whether the financial statements fairly present the company’s financial position, performance, and cash flows in compliance with GAAP.

Certified Public Accountant (CPA)

licensed individuals who can represent that the financial statements have been audited in accordance with generally accepted auditing standards.

Objectives-oriented/principles-based accounting standards

approach to standard setting stresses professional judgment, as opposed to following a list of rules.

Rules-based accounting standards

standards that specify appropriate accounting treatments using precise thresholds or definitions and requiring little professional judgment for interpretation.

Institute of Management Accountants (IMA)

primary national organization of accountants working in industry and government.

Institute of Internal Auditors

national organization of accountants providing internal auditing services for their own organizations.

Conceptual framework

deals with theoretical and conceptual issues and provides an underlying structure for current and future accounting and reporting standards.

predictive value

confirmation of investor expectations about future cash-generating ability.

material

has qualitative or quantitative characteristics that make it matter for decision making.

faithful representation

exists when there is agreement between a measure or description and the phenomenon it purports to represent.

convervatism

practice followed in an attempt to ensure that uncertainties and risks inherent in business situations are adequately considered.

qualitative characteristics

identifies four enhancing qualitative characteristics: comparability (including consistency), verifiability, timeliness, and understandability.

cost effective

the perceived benefit of increased decision usefulness exceeds the anticipated cost of providing that information.

The four assumptions underlying GAAP

the economic entity assumption,

the going concern assumption,

the periodicity assumption, and

The monetary unit assumption.

economic entity assumption

presumes that economic events can be identified specifically with an economic entity.

going concern assumption

in the absence of information to the contrary, it is anticipated that a business will operate indefinitely.

periodicity assumption

allows the life of a company to be divided into artificial time periods to provide timely information.

monetary unit assumption

states that financial statement elements should be measured in a particular monetary unit (in the United States, the U.S. dollar).

Recognition

process of admitting information into the basic financial statements.

measurement

process of associating numerical amounts with the elements.

disclosure

including pertinent information in the financial statements and accompanying notes.

historical cost

bases measurements on the amount given or received in the original exchange transaction

net receivable value (NRV)

estimated selling prices of inventory in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation.

Depreciated (or amortized) cost

reduces historical cost to reflect depreciation (or amortization) recognized to date.

current cost

are the costs that would be incurred to purchase or reproduce an asset

present value

bases measurement on future cash flows discounted for the time value of money

fair value

bases measurements on the price that would be received to sell assets or transfer liabilities in an orderly market transaction.

fair value option

allows companies to report specified financial assets and liabilities at fair value.

full-disclosure principle

financial reports should include any information that could affect the decisions made by external users.

revenue/expenses approach

recognition and measurement of revenues and expenses are emphasized; with balance sheet accounts adjusted as necessary to reflect revenues and expenses.

Asset/liability approach

recognition and measurement of assets and liabilities drives revenue and expense recognition.