Microeconomics OCR A Level

1/281

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

282 Terms

Economic goods

Goods which benefit society, have the problem of scarcity and have an opportunity cost. Since economic goods are scarce, they have some value, so consumers will pay for them, and they can be traded.

Factors which may enable/make easier collusion/cartels

There are only a small number of firms in the industry and there are significant barriers to prevent new firms entering the industry.

Market demand is not too variable (or cyclical) i.e. it is reasonably predictable and not subject to violent fluctuations which may lead to excess demand or excess supply.

Demand is fairly inelastic with respect to price so that a higher cartel price increases the total revenue to suppliers - this is easier when the product is viewed as a necessity.

Each firm's output can be easily monitored (this is important!) - This enables the cartel more easily to control total supply and identify firms who are cheating on output quotas.

Factors which may cause cartels/collusion to break down/limit the possibility of collusion/cartels

Enforcement problems: The cartel aims to restrict production to maximize total profits of members. But each individual seller finds it profitable to expand production. It may become difficult for the cartel to enforce its output quotas and there may be disputes about how to share out the profits. Other firms - not members of the cartel - may opt to take a free ride by selling just under the cartel price.

Falling market demand creates excess capacity in the industry and puts pressure on individual firms to discount prices to maintain their revenue

The successful entry of non-cartel firms into the industry undermines a cartel's control of the market. Rapid technological change can often undermine a cartel e.g. a new entrant with an innovative and success alternative business model.

The exposure of illegal price-fixing by market regulators such as the European Union Competition Commission and the UK's Competition and Markets Authority.

The exposure of price-fixing by whistle-blowing firms - these are firms previously engaged in a cartel that decides to withdraw from it and pass on information to the competition authorities.

Labour Market Failure

Occurs when there are:

Barriers to labour mobility (geographical/occupational immobility of labour).

Imperfect information among buyers and sellers of labour - such that labour may not be aware of job vacancies and so unemployment and vacancies coexist in the market.

A single seller or buyer (monopoly or monopsony power in the labour market) is able by their own actions to influence/distort the market price.

There is a poverty/unemployment trap.

There is discrimination.

A skills gap is present.

Free goods

Goods which have no opportunity cost, because there is no scarcity of the good. For example, air and water are free goods. These goods are not traded because they are freely available.

The basic economic problem is

Scarcity - unlimited wants and finite resources

Positive statements are

Objective statements. They can be tested with factual evidence, and can consequently be rejected or accepted.

Normative statements are

Statements which are based on value judgements. These are subjective and based on opinion rather than factual evidence.

Factors of production

Capital, Enterprise, Labour, Land (CELL)

Capital

Physical: goods which can be used in the production process

Fixed: Machines; buildings Working: finished or semi-finished consumer goods

Enterprise

Managerial ability. The entrepreneur is someone who takes risks, innovates, and uses the factors of production. Resources are drawn together into the production process.

Labour

Human capital, which is the workforce of the economy.

Land

Natural resources such as oil, coal, wheat, water. It can also be the physical space for fixed capital.

The environment is a

Scarce resource

Renewable resources

Resources which can be replenished

Renewable resources are

Sustainable

Non-renewable resources

Resources which cannot be replenished and are therefore not sustainable

Sustainable

Meets the needs of the present, without compromising the needs of the future - does not deplete the stock of capital over time (including environmental capital).

Economic agents

Government, Firms, Households

Market economies/Free economies

Economies where governments leave markets to their own devices (no government interventions/public sector). The market forces of supply and demand allocate all (scarce) resources.

Economic question

What to produce, who to produce for, how to produce

In a Market economy: What to produce is determined by?

Consumer preference

In a Market economy: Who to produce for is determined by?

Whoever has the greatest purchasing power in the

economy, and is therefore able to buy the good/service

In a Market economy: How to produce is determined by?

Producer's seeking profit

Advantages of a Market economy

Firms are likely to be efficient because they have to provide goods and services demanded by consumers.

Firms are also likely to lower their average costs and make better use of scarce resources so as to profit maximise (and meet other objectives).

Therefore, overall output of the economy increases (economic growth).

The bureaucracy from government intervention is avoided - increasing efficiency.

Some economists might argue the freedom gained from having a free economy leads to more personal freedom.

Disadvantages of a Market economy

The free market ignores inequality, and tends to benefit those who hold most of the wealth.

There are no social security payments for those on low incomes.

There could be monopolies, which could exploit the market by charging higher prices.

There could be the overconsumption of demerit goods, which have large negative externalities, such as tobacco.

Public goods are not provided in a free market, such as national defence.

Merit goods, such as education, are under provided.

Mixed economy

An economy in which there is some degree of government intervention and therefore the market is controlled by both the government and the forces of supply and demand (there is a public sector and private sector).

In a Mixed economy: What to produce is determined by?

both consumer and government preferences

In a Mixed economy: Who to produce for is determined by?

Both the purchasing power of private individuals (and firms), and the government

In a Mixed economy: How to produce is determined by?

Producers making profits and the government

Advantages of a Mixed economy

It might be easier to coordinate resources in times of crises, such as wars.

The government can compensate for market failure, by reallocating resources. This may ensure everyone can access basic necessities - and thus reduce poverty/absolute poverty.

Inequality in society could be reduced, and society might maximise welfare rather than profit.

The abuse of monopoly power could be prevented.

Disadvantages of a Mixed economy

Governments fail, as do markets, and they may not be fully informed for what to produce.

They may not necessarily meet consumer preferences.

It limits democracy and personal freedom.

Marginal utility

The additional utility gained from consuming an extra unit of a good or service.

Law of diminishing marginal utility

Is the reason for why the demand curve slopes downwards. It suggests that consumer surplus generally declines with extra units consumed. This is because the extra unit generates less utility than the one already consumed. Therefore, consumers are willing to pay less for extra units.

Economic agents respond to...

Incentives.

Where incentives are not given properly...

Resources may be misallocated.

Prices in market economies provide...

Signals to buyers and sellers, which is an incentive to purchase or sell the good or service.

Opportunity cost

The next best alternative foregone when making a choice.

The scarcity of resource gives rise to...

Opportunity cost.

Trade off

Where one thing is lost to gain something else.

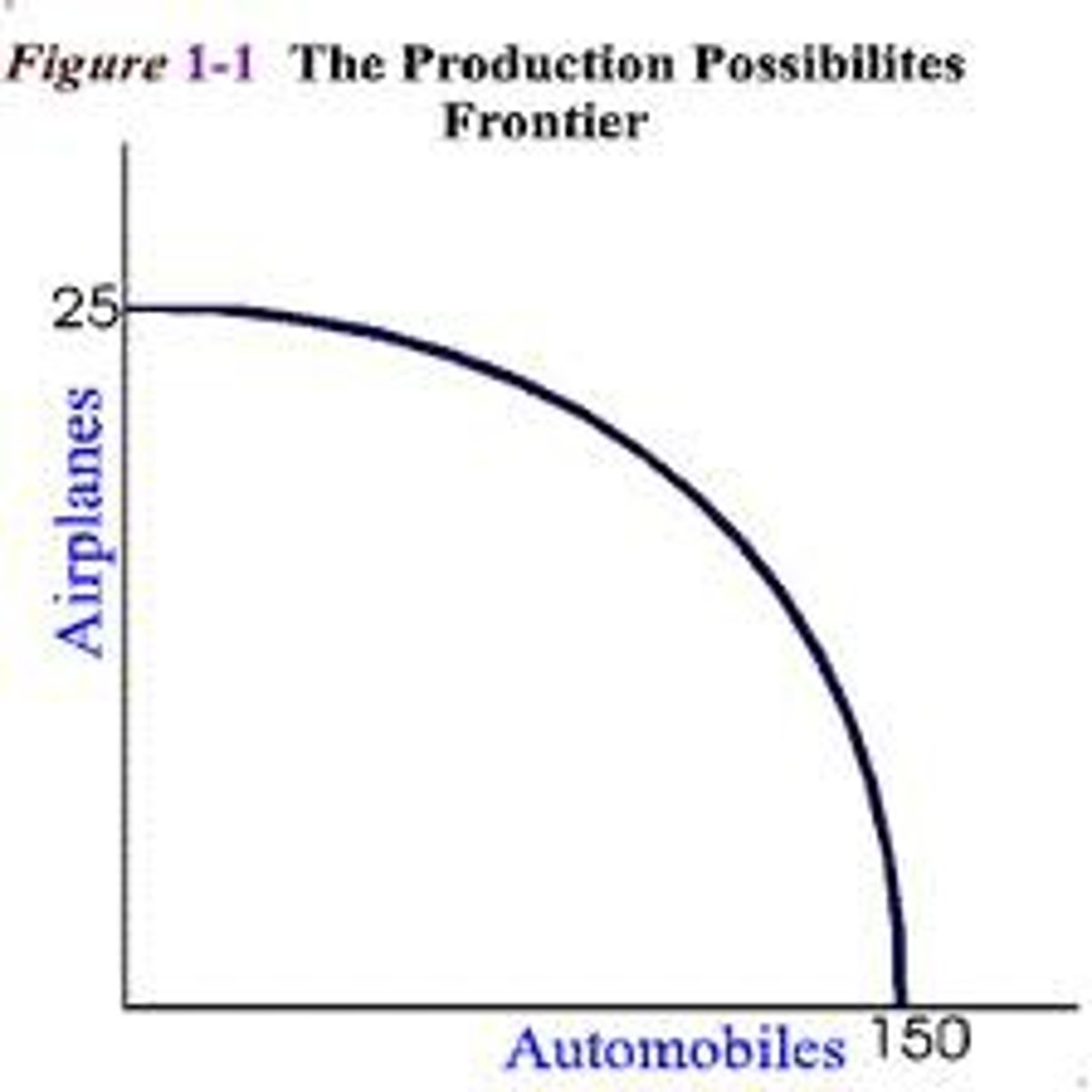

Production possibility frontier (PPF)

Depicts the maximum productive potential of an economy, using a combination of two goods or services, when resources are fully and efficiently employed.

(A graph that describes the maximum amount of one good that can be produced for every possible level of production of the other good).

The law of diminishing returns states that...(LODR for PPF)

The opportunity cost of producing more of good X increases, in terms of the lost units of good Y that could have been produced, as the production of X increases.

PPF assumes

A fixed amount of resources are used and there is a constant state of technology.

PPF shifts if

There is an increase in the quantity or quality of resources, so that the productive potential of the economy increases, and there is economic growth. This can be achieved with the use of supply side policies.

Capital goods

Goods which can be used to create other goods - such as machinery.

Consumer goods

Goods which cannot be used to produce other goods, and are themselves consumed - such as clothing.

Division of labour

A process whereby the production procedure is broken down into stages and workers are assigned to specific stages.

Specialisation

Where a business, area or economy focuses on the production of a limited scope of products or services to gain greater degrees of productive efficiency within an overall system.

Benefits of Specialisation (for all economic agents)

Increased quality / increased productivity / Variety / bigger market / increased competition /reduced unit costs / reduced labour costs / lower prices / increased speed of production / Workers receive higher pay / Worker's skills improve / Worker's feel more motivation from job satisfaction.

Negatives of Specialisation (for all economic agents)

Unrewarding repetitive work reduces worker's motivation and productivity / high employee turnover due to 'boring' nature of role, this may increase firms' costs of production / increase structural unemployment (occupational immobility) / mass produced, standardised goods and services can reduce consumer choice and variety / can deplete resources at a greater rate / lead to countries becoming increasingly dependent on other.

Comparative Advantage

a country's ability to produce a good or service relatively more efficiently (i.e at a lower opportunity cost) than another country.

Absolute Advantage

A country's ability to produce a good or service using less resources than another country.

Advantages of specialisation on a global scale (exploitation of absolute/comparative advantages)

Greater world output, so there is a gain in economic welfare.

Lower average costs, since the market becomes more competitive.There is an increased supply of goods to choose from.

There is an outward shift in the PPF curve.

Disadvantages of specialisation on a global scale (exploitation of absolute/comparative advantage)

Less developed countries might use up their non-renewable resources too quickly, so they might run out.

Countries could become over-dependent on the export of one commodity, such as wheat. If there are poor weather conditions, or the price falls, then the economy would suffer.

Functions of money

Medium of exchange

Unit of account

Means of deferred payment

Store of value

Medium of exchange

Money can be used in exchange for goods and services (eliminating the need for a double coincidence of wants/barter).

Unit of account

Money can be used to provide a measure of the value of a good or service.

Means of deferred payment

Money can allow for debts to be created. People can therefore pay for things without having money in the present, and can pay for it later. This relies on money storing its value.

Store of value

Money has to hold its value to be used for payment. It can be kept for a long time without expiring.

Double coincidence of wants

Where both parties in a transaction want the good or service that the other is providing.

Resource allocation

Refers to how resources are distributed among producers and how goods and services are distributed among consumers.

Planned economy

This is where the government allocates all of the scarce resources in an economy to where they think there is a greater need. It is also referred to as central planning.

In a Planned economy: What to produce/How to produce it/For whom to produce it for, is determined by?

The government

Advantages of a Planned economy

It might be easier to coordinate resources in times of crises, such as wars.

The government can compensate for market failure, by reallocating resources - this might ensure everyone can access basic necessities.

Inequality in society could be reduced, and society might maximise welfare rather than profit.

The abuse of monopoly power can be prevented.

Disadvantages of a Planned economy

Government failure, as they may not be fully informed for what to produce.

Consumer preferences and allocative efficiency may not be met.

Limits democracy and personal freedom.

Economic agents are assumed to be

Rational

Rational economic agents have what objective?

Maximisation - firms aim to maximise profits and consumers aim to maximise utility

Market

A set of arrangements that allows transactions to take place.

Demand

The quantity of a good or service that consumers are willing and able to buy at a given price in a given period of time.

Supply

The quantity of a good or service that producers are willing and able to produce at a given price in a given period of time.

Derived demand

Demand for a factor of production or good which derives not from the factor or good itself but from the goods it produces.

Composite demand

Demand for a good that has multiple uses.

Joint demand

Demand for goods that are interdependent, such that they are demanded together (complementary goods may be in joint demand).

Joint supply

Where a firm produces more than one good or service together.

Composite supply

Where a product produced by a firm serves more than one market.

Competitive demand

Demand for goods which are in competition with each other (substitutes)

Competitive supply

A situation in which a firm can use its factors of production to produce alternative products.

What two effects are witnessed when the price of a good rises?

Income effect and Substitution effect

Substitution effect

An increase in the price of a good will encourage consumers to buy alternative goods. The substitution effect measures how much the higher price encourages consumers to use other goods, assuming the same level of income.

Income effect

How the price change effects consumer income. If price rises, it effectively cuts disposable income and there will be lower demand.

Expansion

Movements along the demand/supply curve resulting in an increase in demand/supply.

Contraction

Movements along the demand/supply curve resulting in a decrease in demand/supply.

Factors that shift demand

Population

Advertising

Substitutes

Income

Fashion and trends

Interest rates

Complementary goods

Factors that shift supply

Productivity

Indirect tax

Number of firms

Technology

Subsidies

Weather

Costs of production

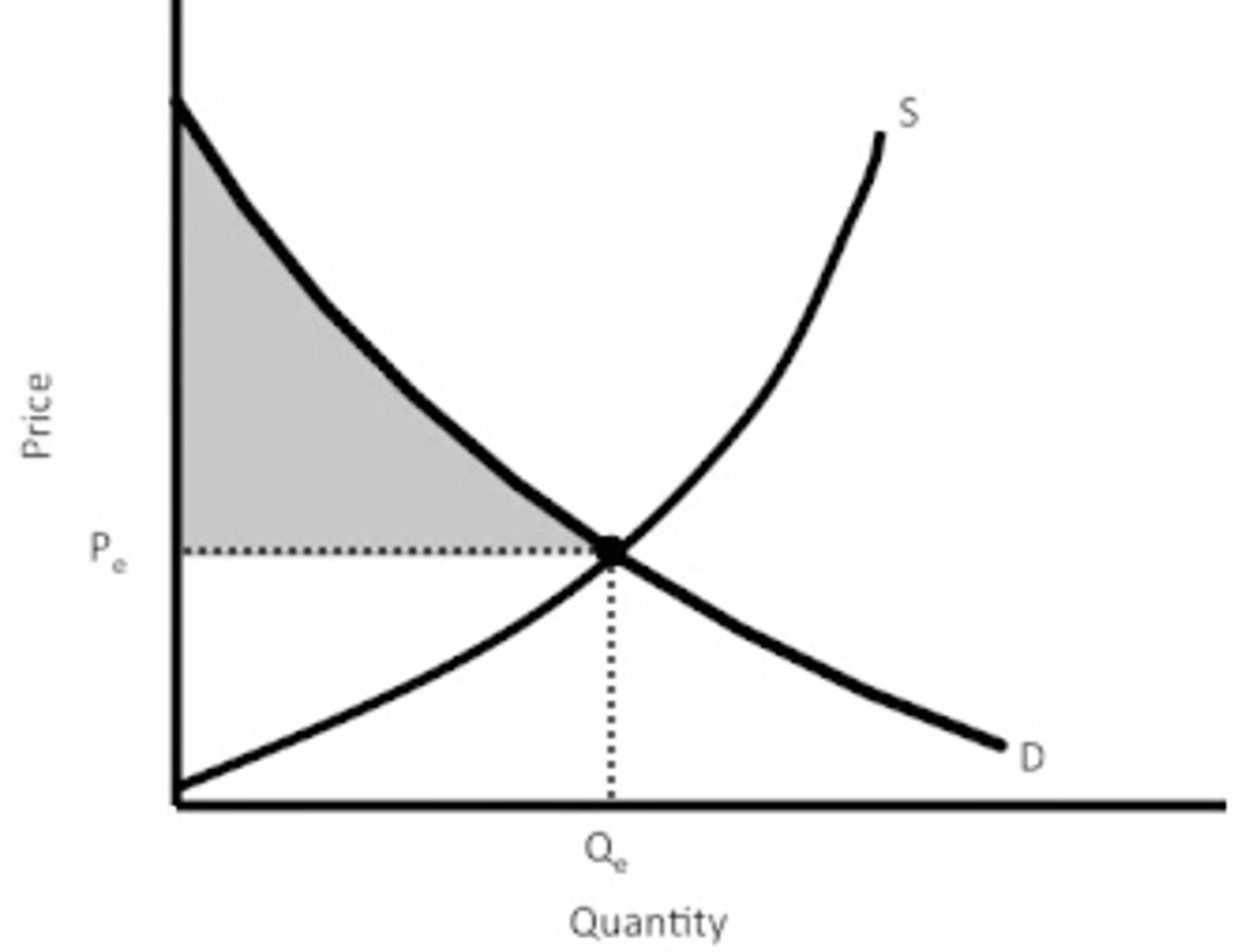

Consumer surplus

The value that consumers gain from consuming a good or service over and above the price paid.

The difference between the price paid for a good or service and the price at which they would have been prepared pay.

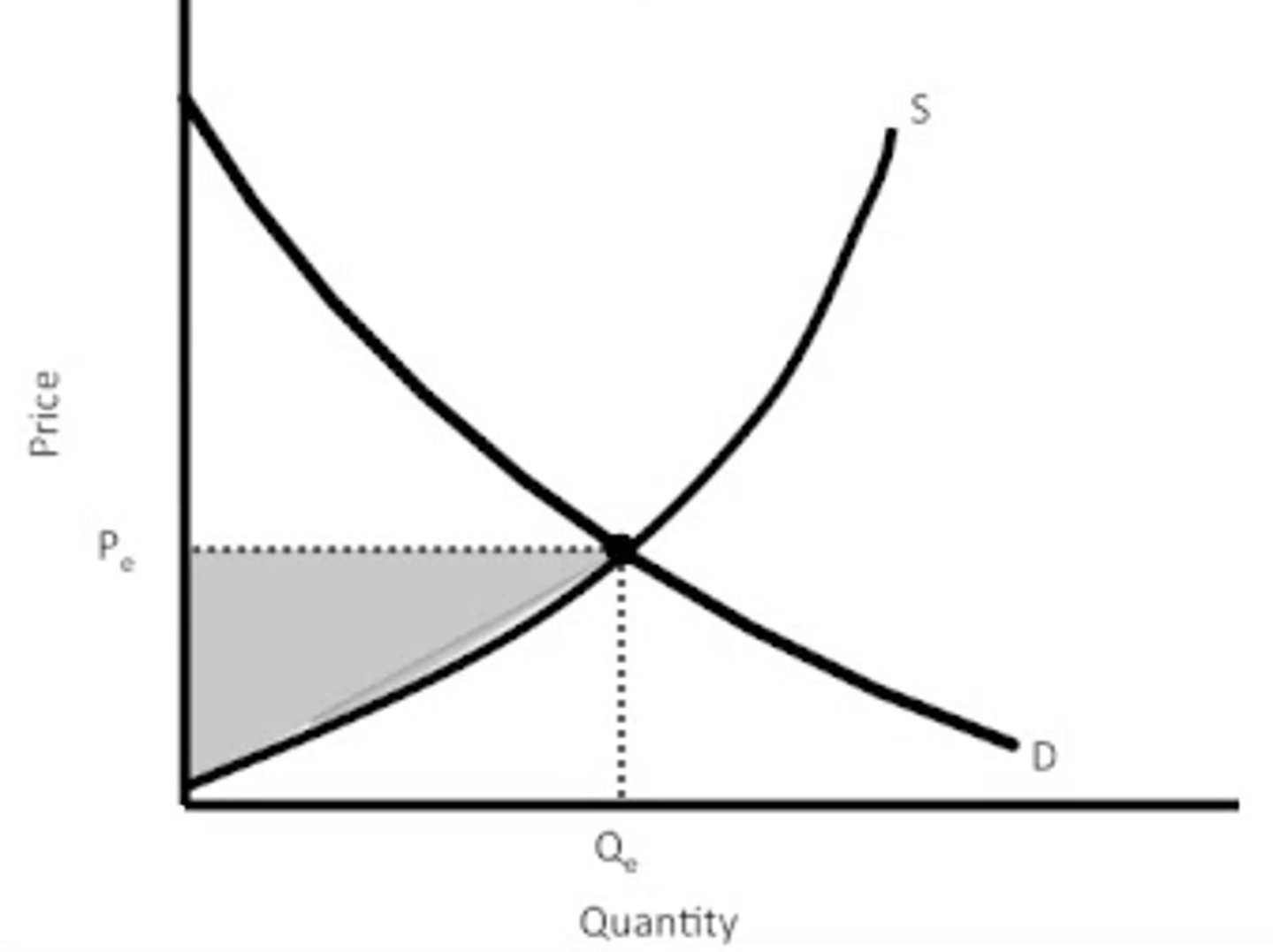

Producer surplus

The difference between the price received by firms for a good or service and the price at which they would have been prepared to supply at.

Equilibrium

Where supply meets demand - at market equilibrium, price has no tendency to change, this is the market clearing price.

Disequilibrium

Occurs when there is excess demand or supply.

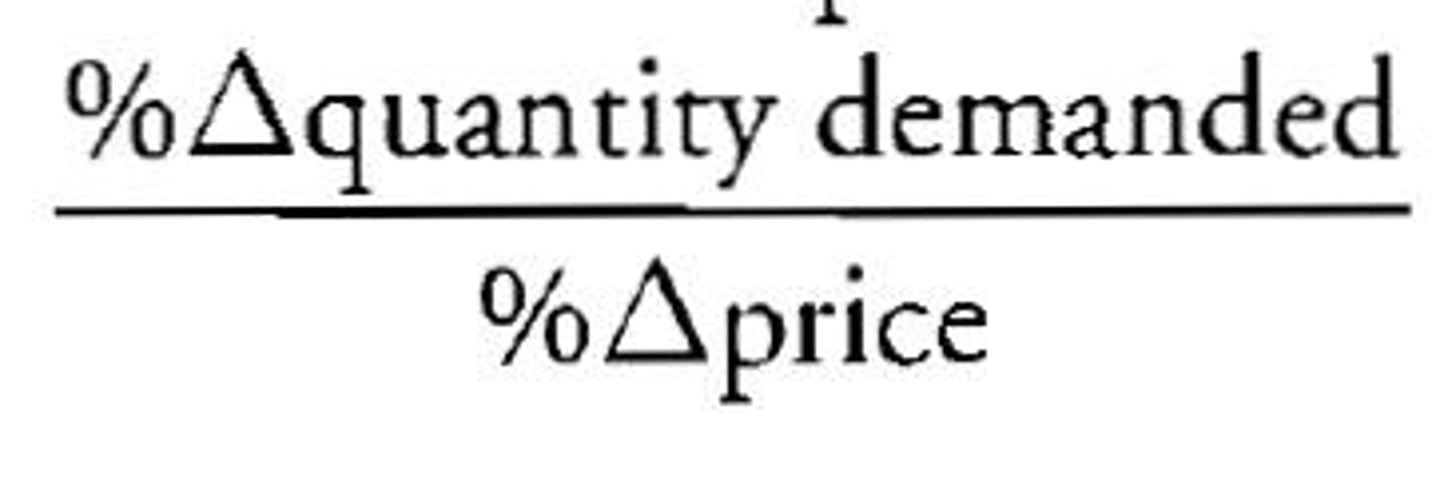

Price elasticity of demand

A measure of the responsiveness of the quantity demanded to a change in the price of a good or services.

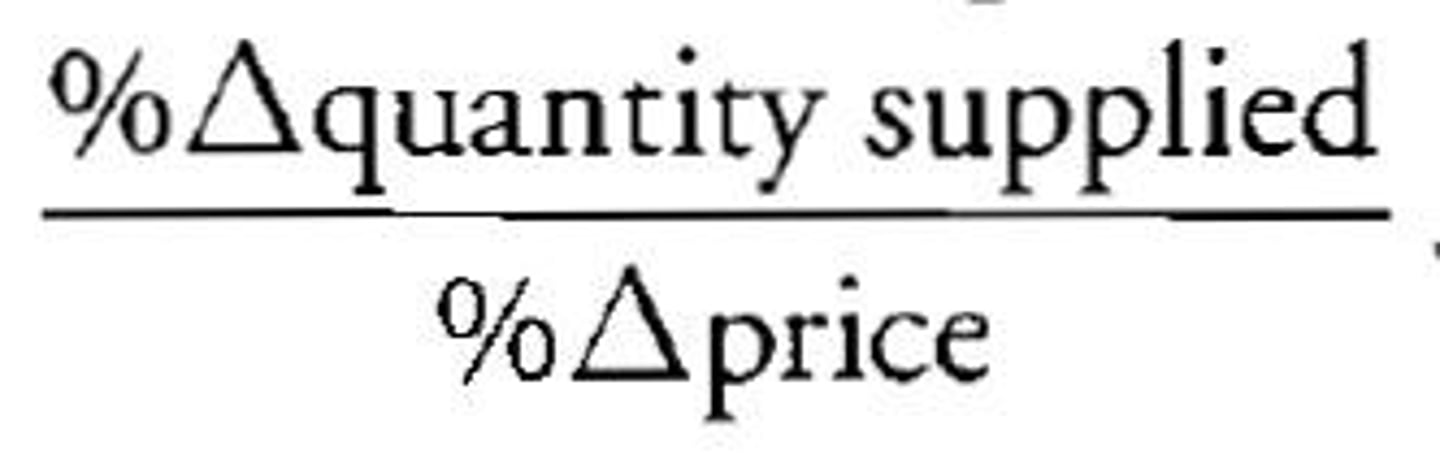

Price elasticity of supply

A measure of the responsiveness of the quantity supplied of a good or service to a change in its price.

A price elastic good is...

A good for which the quantity demanded/supplied is very responsive to a change in price. PED>1/PES>1

A price inelastic good is...

A good for which the quantity demand/supplied is very unresponsive to a change in price. PED<1/PES<1

Unitary elastic good

A good for which the change in quantity demanded is equal to the change in price, such that PED=1.

Factors influencing PED

Necessity

Substitutes

Habit forming goods

Proportion of income

Time period

Durability of a good

Peak and off Peak demand

Incidence of tax

The way in which the burden of paying an indirect tax is divided between buyers and sellers.

Burden of tax increases for consumers (and decreases for producers) if...

The good/service is relatively price inelastic.

Burden of tax decreases for consumers (and increases for producers)if...

The good or service is relatively price elastic.

Total Revenue

The quantity of goods/services sold x the price of each good/service

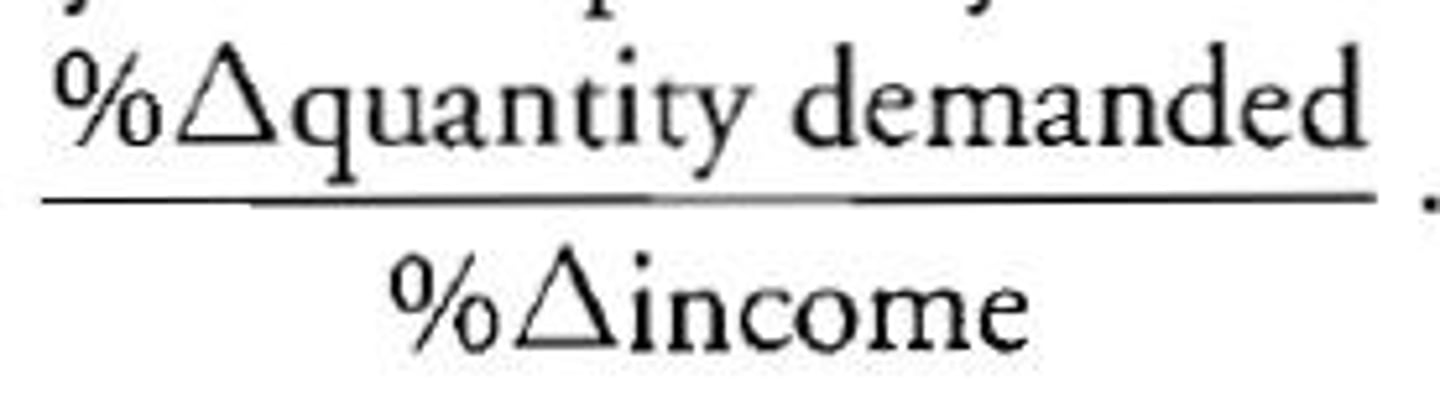

Income elasticity of demand

The responsiveness of a change in quantity demanded to a change in income.

Inferior good

A good for which the quantity demanded decreases with a rise in income. YED<0