Macroeconomics (Year 1)

1/377

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

378 Terms

How to structure your answers?

K (Knowledge - start with the point)

A (Application - give some real-world examples or data from the extracts)

A (Analysis - the bulk of your marks: answer the question using chains, how does X lead to Y?)

E (Evaluation - whether you evaluate, and the degree of your evaluation depends on the question asked but always break your analysis up and think 'what assumptions have I made / what could go wrong / why may X not actually lead to Y?)

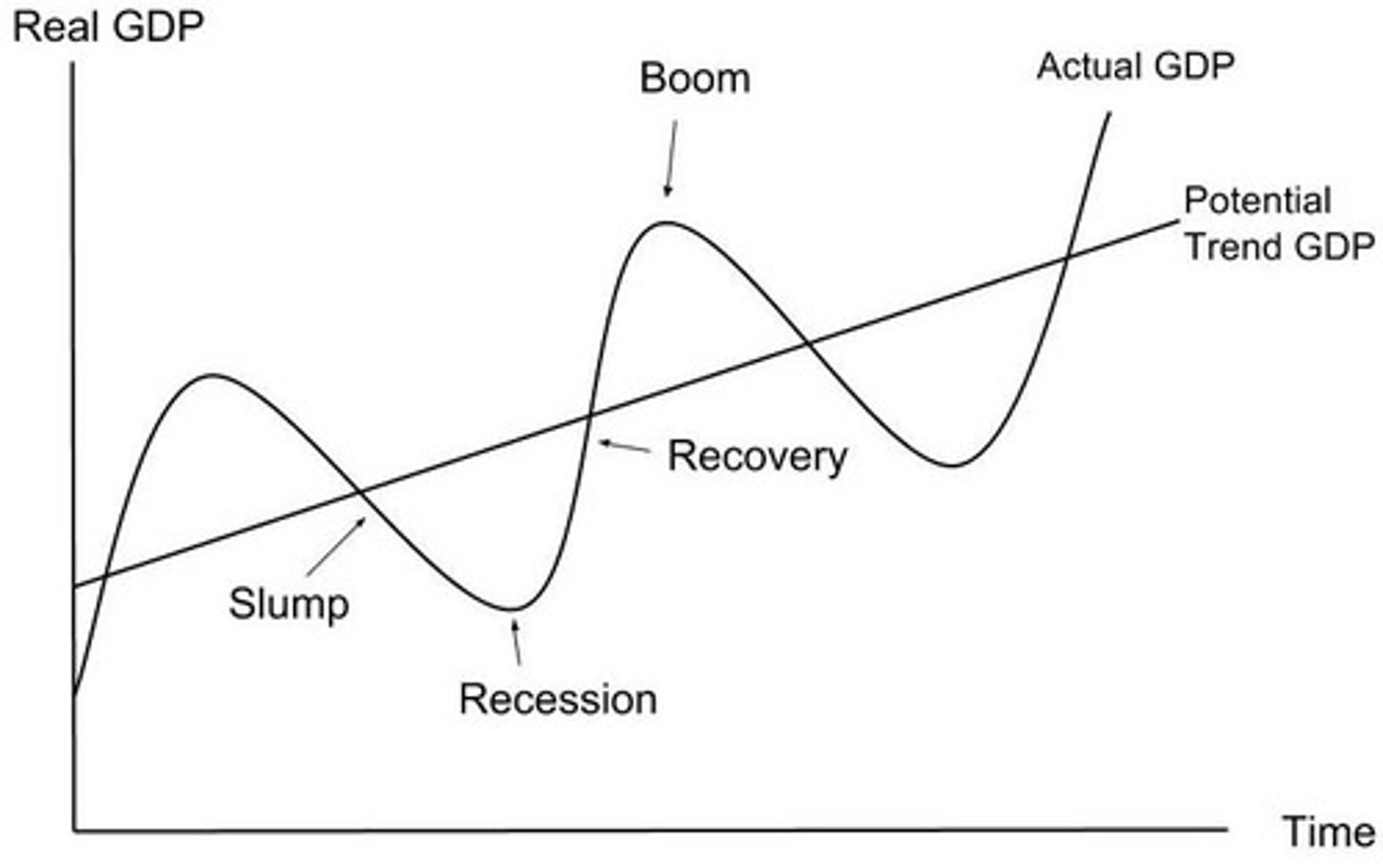

What are the axes on the trade cycle?

Y real GDP

X time

Why may the claimant count differ to ILO's measure of unemployment?

because the ILO measures 16-18year olds but claimant count doesn't

Who does the claimant count exclude? (5)

- People under 18

• People in full time education, who may still be classed as unemployed.

• People not eligible for contribution based JSA. To claim the contributions

based JSA they need to have paid at least two years of NI contributions.

• People with high savings

• People on a government training scheme

Effects of an outward shift in SRAS on the economy

1) lower prices - >more output -> increased derived demand for labour -> more employment

2) lower prices -> international competitiveness increases -> more exports -> AD shifts outwards -> Real GDP increases

How does spare capacity affect the multiplier?

- If there is a lack of spare capacity, firms will struggle to increase their production meaning that the multiplier effect may in fact be smaller than first proposed.

- Increases in AD may just be inflationary if the economy is producing at full output

What is the crowding out effect? Why does it happen?

- When increased government spending, often financed by borrowing, reduces private sector investment and spending.

- This happens because government borrowing can drive up interest rates, making it more expensive for businesses and individuals to borrow money, thus discouraging private investment.

Why do some consumers not want the most efficient form of production?

it may involve cruelty to animals or damage to environment

What is the crowding in effect? Give an example too.

When government spending increases private investment. This happens because public spending can stimulate economic growth, creating more profitable investment opportunities for businesses.

(e.g. The government builds a new high-speed rail line. This improves transport links between cities, making it faster and cheaper to move goods and people. As a result, private companies are more willing to invest in factories, offices, and logistics in those areas, because they expect higher productivity and profits)

White elephant projects - Great Eval for government spending

Projects that are poorly constructed without adequate cost-benefit analysis - can be used as an evaluation to crowding in (what if the gov project is poorly planned or collapses? May drive private investors away)

Disadvantages of export-lead growth

- Susceptible to shock, what if there is a war, or pandemic, or the trading partner enters recession

- Exchange rate risks (exporting firms often earn revenue in foreign currencies. If the domestic currency strengthens (appreciates), the value of those foreign earnings falls when converted back, reducing profits.)

Animal spirits

Term coined by John Keynes; basically means business confidence: the mood of managers and owners of firms about the future of their industry and the wider economy.

- If animal spirits are low, investments will be low

Give three evaluations as to why increased investment may not cause economic growth

1) Administrative costs, if the investment is poorly spent or goes towards administrative costs, then it may not cause a multiplier or increase economic growth

2) Opportunity cost, could the money have been better spent elsewhere?

3) Time lag, it may take months or years for the effects of the investments to be visible

Is national wellbeing and GDP per capita linked? (3)

- The Easterlin Paradox suggests that they are linked to some extent as with money happiness increases but only to a certain point.

- National wellbeing is assessed by examining a range of factors such as health, personal relationships and employment

- However, it is hard to measure national wellbeing.

Formula for Real GDP

% change in nominal GDP / original gdp - inflation

Base Year

year serving as point of comparison for other years in a price index or other statistical measure. Usually assigned the value 100

Index number

A number showing the variation in a price or value compared with the price or value at a specified earlier time

Why can changes in quality can be a problem when using the Consumer Price Index measure of inflation.

An increase in prices may be due to an improvement in quality and this is not the same as inflation.

Formula for AD

AD = C + I + G + (X-M)

Give a real-world example of how the economic performance of other economies affects the trade balance of the UK

The slow growth of the Eurozone in 2012 to 2014 affected the UK's export sales (we require demand from Europe for our financial services)

What's the difference between gross and net investment?

Gross investment is the total amount spent on new capital assets, while net investment is gross investment minus depreciation (the loss of value of existing capital).

How many work visas were issues in 2023

just under 500,000!

formula for net investment

gross investment - depreciation

What is depreciation?

Put simply, it's when a machine begins to deteriorate and becomes less productive and efficient

Formula for labour productivity

Output per time period / number of employees

Should we use GDP to compare living standards?

- GDP per capita is better

- doesn't include subsistence economies or hidden ones

- internationally recognized

- doesn't show what governments are spending money on

- doesn't highlight what goods are being produced

formula for gross investment

net investment + depreciation

definition of wealth

a person's total value of all their assets

definition of income

flow of money received

factors influencing SRAS

- changes in costs of raw materials and energy

- changes in exchange rates

- changes in tax rates

- changing in tax on imports

factors influencing LRAS

- technological advances

- changes in relative productivity

- changes in education and skills

- changes in government regulations

- demographic changes and migration

- competition policy

- minimum wage

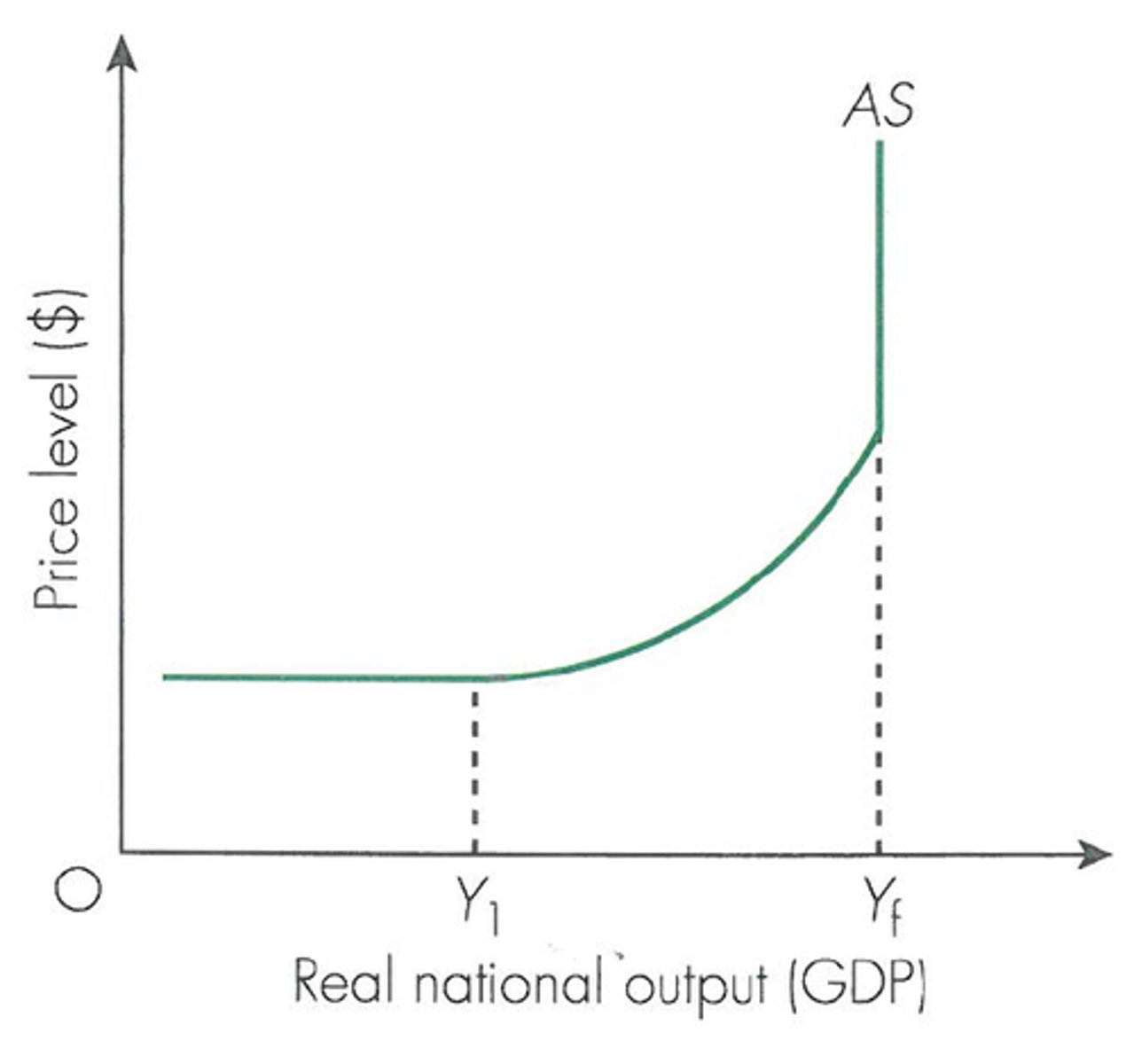

Draw a Keynesian LRAS and explain it

Keynesian LRAS suggests that there can be an output gap in the long run

At low levels of economic activity LRAS = elastic

Towards full employment - output at max - LRAS = inelastic

--> at this point LRAS can not be increased without an increase in quantity or improvement in quality of the factors of production

Keynesian economists believe in a long run equillibrium where markets do not clear and there can be spare capacity meaning LRAS can shift outwards

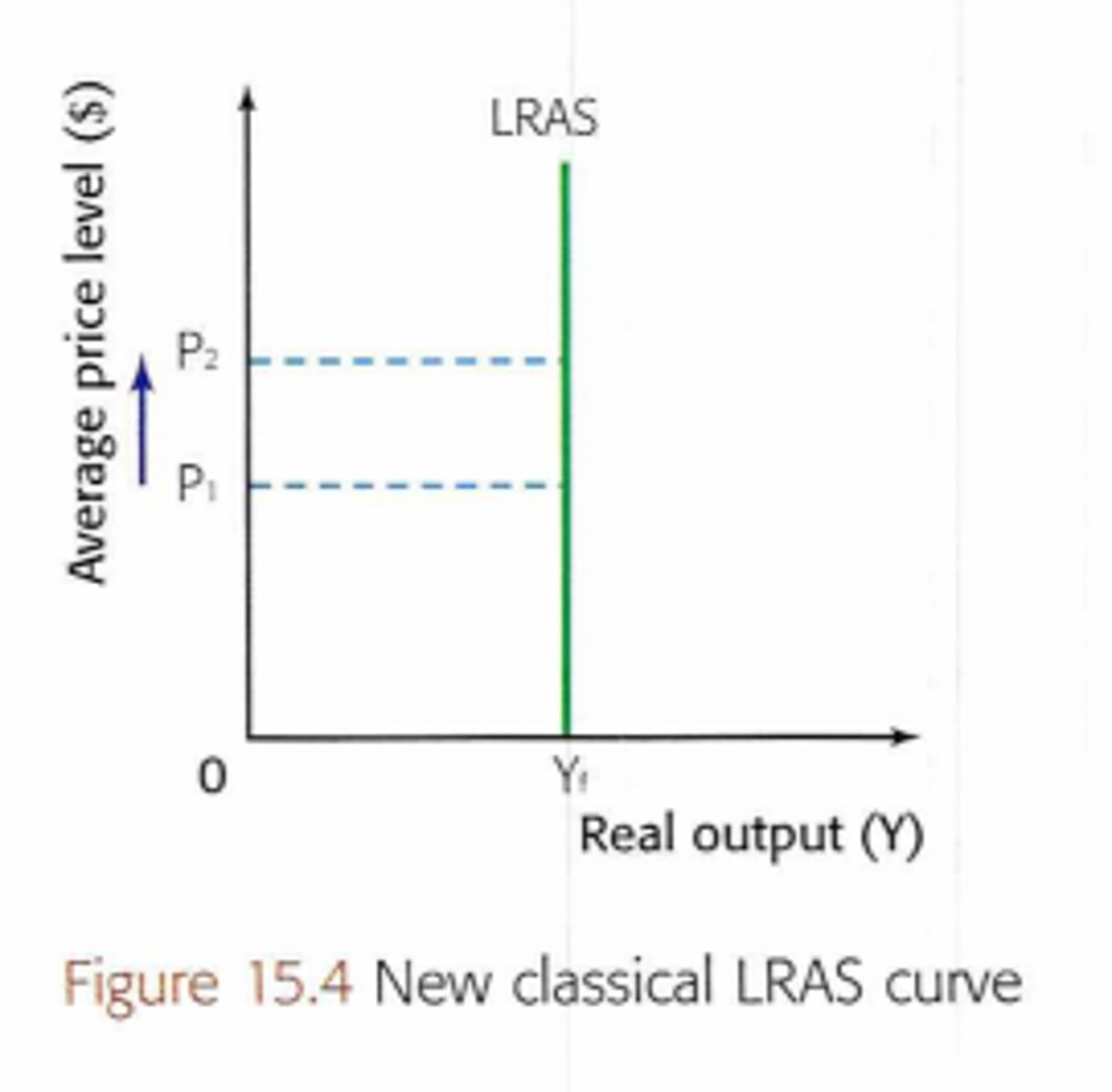

Draw a Neoclassical LRAS and explain it

In the long run if the price level changes there will be no increase in output as it is assumed the economy is working at full potential

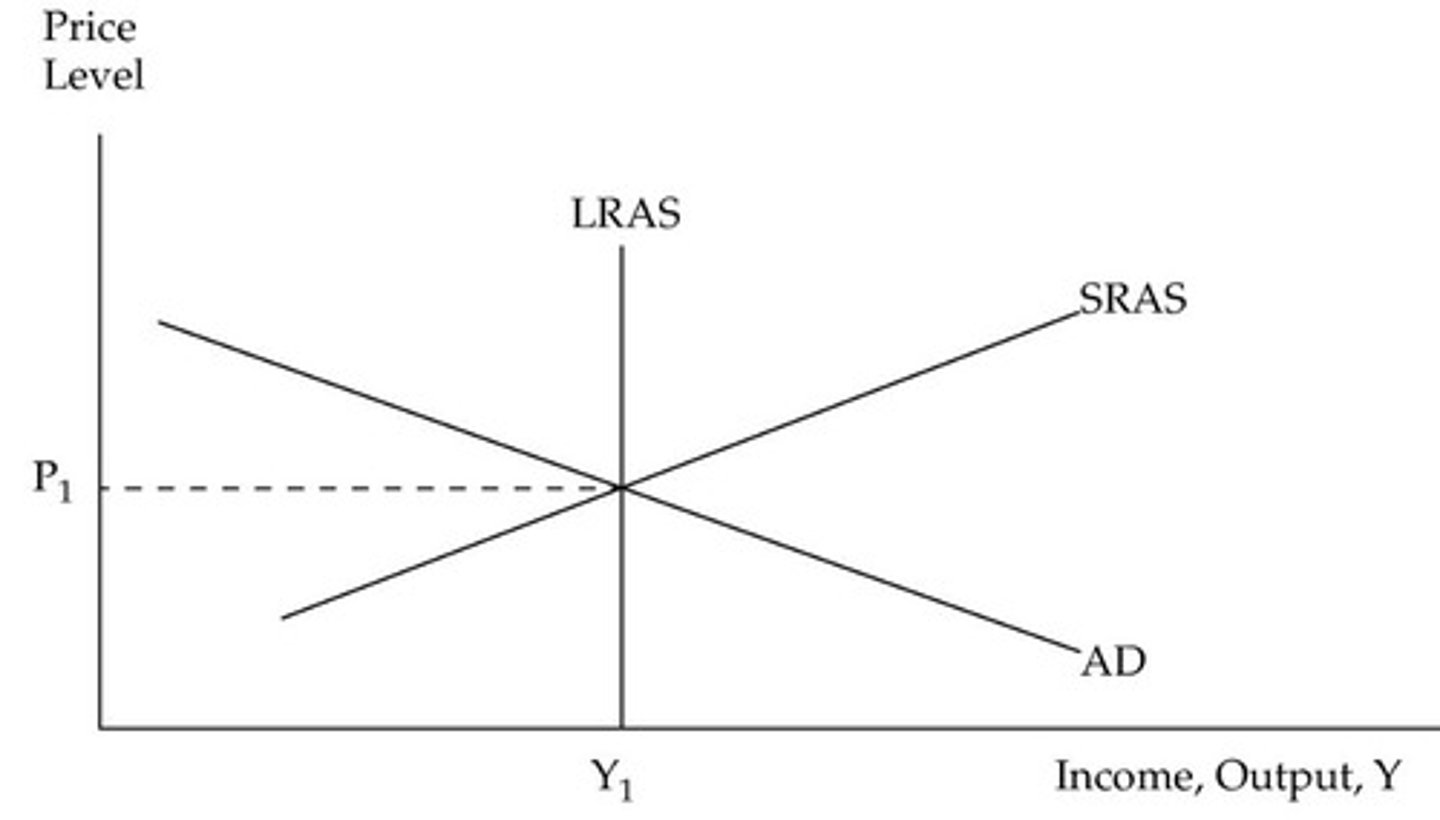

why is SRAS upward sloping

1. contracts make some wages and prices "sticky"

2. firms are often slow to adjust wages

3. menu costs make some prices sticky

4. all industry supply curves added together are upward sloping

Draw the SRAS Diagram

Why may a country's GNI be inaccurate?

- GNI usually misses out informal employment, which can account for a large proportion of national income

- informal employment is the part of any economy that is neither taxed nor monitored by any form of government

What are the trends of a recession

A recession is 2 periods of consecutive negative economic growth

Trends include:

- high unemployment

- less consumption

- firms going out of business

why may a country's GDP be higher than another's but its GDP per capita is lower

It may have a larger population, this is again a reason as to why GDP per capita is a better metric than GDP

What is PPP (Purchasing Power Parity)?

PPP (Purchasing Power Parity) is the number used by the World Bank. It measures value of a country's money in relation to what can be purchased with that amount.

How does deflation affect PPP?

Increases it as each unit of currency can buy more than before

purchasing power parity calculation

find a basket of goods in each country and compare the price needed to purchase each basket

Why use PPP?

To improve accuracy when comparing data between countries

- exchange rates are very volatile

- looking at two different RGDP's does not tell us what you can buy with those currencies (doesn't tell us the price levels)

- PPP compares cost of living/buying power between different countries

- PPP is calculated by comparing the price of a basket of comparable goods and services in different countries

Limitations of using GDP to compare living standards (8)

- difference in population

- different inflation rates

- different exchange rates

- different income distribution

- different expenditure from the government

- ignores types of goods and services being produced

- ignores underground economies

- ignores subsistence economies

Causes of unemployment

Demand-deficiency from slow growth or falling incomes

Occupational immobility.

Geographical immobility.

Imperfect information.

Seasonal, frictional, structural unemployment.

Real wage inflexibility.

How to calculate unemployment

- ILO survey

- Claimant count

ILO Labour Force Survey

Counts those who have been out of work for 4 weeks, and are ready to start within 2 weeks (provided that they are age of 16 or above)

Advantage and Disadvantage of ILO survey

Advantages - used internationally, so easy to make comparisons between countries

Disadvantage - can have expensive administration costs and only surveys 6000 households (not representative of the whole of the UK)

Advantage and Disadvantage of Claimant Count?

Advantages - it is easy to measure as it is just the number of people claiming it

Disadvantage - stigma associated with it and it won't measure those who are not eligible to claim it but are unemployed.

How to find unemployment rate

unemployed/active x 100

What will happen in the long run to real output if AD increases?

Nothing. Just inflation since classical economists believe the economy will be at

full employment in the long run.

can you have a LONG RUN output gap on neoclassical. Why?

no, need SRAS curve to show working overtime.

This is because classical economists believe that in the long run all markets will clear and the economy will always return to producing at maximum potential level of output because each factor of production is being utilized to its fullest extent without any idle capacity, therefore you cannot increase Q or Q of FoP for output gap

Why may a government value happiness more than economic growth?

happiness includes the quality of life rather than the income alone. Government policy can have a significant impact on happiness, for example, by spending money on sporting and leisure facilities. Happiness may be associated with a more productive economy.

How does the government find the happiness of its people?

Office for National Statistics national well-being survey. However people may not answer truthfully and it is based off of normative statements

Easterlin Paradox

High incomes do correlate with happiness, but long term, increased income doesn't correlate with increased happiness

Incredible evaluation against the wealth effect?

Does the wealth effect even exist?

in the UK only 50% of homeowners own their house, the other 50% are renting or saving, therefore that 50% actually increase their savings when wealth increases!

Wealth effect in America

6% - Ricardo Sousa

Wealth effect in Europe

0% - Ricardo Sousa

GNI

The value of the output of goods and services produced in a country in a year, including money that leaves and enters the country

GDP

Gross Domestic Product- the total market value of all final goods and services produced annually in an economy

GNP

total market value of all goods and services produced by domestic residents + income that residents have received from abroad - income claimed by non-residents

difference between GDP and GNI

GDP measures production and GNI measures income (GNI measures all income of a countrys residents and businesses regardless of where it's produced. GDP measure the income of anyone within a countrys boundaries.)

An increase in long-run aggregatwe supply causes...

an increase in potential growth

collateral

something pledged as security for repayment of a loan, to be forfeited in the event of a default.

explain how aggregatre supply increases if imports get cheaper

If imports become cheaper, then it means that foreign suppliers are willing to sell their goods at lower prices. This creates a downward pressure on the prices of similar goods produced domestically. As a result, domestic producers will have to lower their prices in order to remain competitive with the cheaper imported goods.

What are excise duties?

Levies on demerit goods such as alcohol, tobacco, petrol and gambling.

How does increasing interest rates lead to more expensive exports?

Two ways:

- Countries begin to save in UK which puts a lot of strain on the currency and appreciates its value which makes exports more expensive.

- Loans for businesses become more expensive, costs increase, shifting SRAS inwards, raising prices and decreasing exports

Define inflation

A sustained increase in the general price level

Define disinflation

A fall in the rate of inflation.

Define deflation

a sustained decrease in the general price level

what is CPI

a measure of the overall cost of the goods and services bought by a typical consumer

what is cpi used for

monitor changes in the cost of living over time

how is CPI and CPIH different

CPIH measures the housing cost and council tax

How to calculate inflation rate

CPI this year - CPI last year / CPI last year x 100

Where do they get the data for the CPI index basket?

They survey 7000 households and then use the 700 most-bought goods

what is the RPI?

Retail Price Index - Shows the rate of change of prices in everyday life, such as food, mortgage payments, heating and petrol

difference between RPI and CPI

lies in what is included in each 'basket'. Eg the RPI includes VAT and other taxes and mortgage interest payments, all of which are excluded from CPI

RPI will likely be higher

How to calculate CPI?

1. Fix the basket based off of family expenditure survey

2. Find the prices and assign weights to each item based on the % of income

3. Calculate the basket's cost by x the weights and prices and adding them

4. Choose a base year and calculate the index

5. Calculate the inflation rate each month

uses of CPI and RPI? These are measured on a monthly basis

- can measure the difference in UK's international competitiveness

- can tell the government whether to increase spending on welfare benefits or state pensions

limitations of using CPI to find the rate of inflation?

- does not include housing costs

- some people do not have representative spending habits

- list of 700 is only changed once a year

- some households may not provide accurate information

- doesn't include mortgages

- time lags

- doesn't include changes in quality

- one item's fluctuation can affect the whole valuation

- only 60% of people respond (they may also not provide correct information)

formula for CPI

change in index /original index x 100 Index = Current Number/Base Number x 100

Causes of deflation

- decrease AD

- increase AS

impacts of inflation on consumers?

- Fall in real wages

- value of savings decreases if levels of inflation outweigh interest rate.

What is RPI

Retail Price Index - Shows the rate of change of prices in everyday life, such as food, mortgage payments, heating and petrol

How is RPI calculated?

6000 households take the Living costs and Food surveys and mortgages are included in this

what is RPI used for

to make monetary policy decisions

what is core inflation?

CPI minus food and energy costs

when is inflation bad for savers

if it is larger than the interest rates, their savings lose real value

why is inflation bad for those on fixed incomes

because the inflation rate implies that their incomes will fall in real terms

Effects of inflation on firms

- Raw material costs rise, profit margins fall

- Staff may demand a raise, increases production costs

- People will import, lowers UK firm's profits

- less investment due to uncertainty

Effect of inflation on government

- national debt improves

- balance of trade worsens

- increased inequality (people on fixed incomes suffer)

Effect of inflation on workers

- those on fixed incomes suffer

- unemployment may occur due to lack of investment and decreased motivation if real wages are falling

when is inflation good for a firm

if it is caused by an increase in demand (signals there is profit to be made)

why are weights used to calculate CPI

because it is more important to use goods that are most important in a consumer's expenditure

Why may CPI not be representative for a pensioner?

they will not be spending money on similar goods (they may spend more on heating and food)

What is demand-pull inflation?

When AD increases faster than AS, leading to an increase in the price level

wage-inflationary Spiral

When demand-pull inflation drives workers to demand higher real wages, causing cost push inflation.

For example, the cost of living crisis in 2023

formula for real wage

nominal wage/CPI x 100

((1 + pay rise) / (1 + inflation rate) - 1) x 100

deflationary spiral (deflationary trap)

The spiral begins with deflation which is where there is a sustained fall in the general price level. Consumers notice the falling prices and decide to delay their purchases and wait for prices to fall further. This causes a reduction in AD as consumption is a component of AD. The fall in AD lowers the price level again and so consumers further delay their purchases. And the cycle repeats.

3 benefits and consequences of high inflation

- protects economy from deflationary spiral

- real value of debt decreases, improving inequality

- decreases real wages, lowering costs for firms and the government

but

- inflationary spiral leads to higher wages and more inflation... could lead to hyperinflation

- decreases real value of savings, effecting those who rely on their savings

- may decrease investment due to uncertainty of future prices

What is the current account?

Measures the international trade in goods and services, investment income, and net transfer payments.