Learning aim F

0.0(0)

Card Sorting

1/19

Earn XP

Description and Tags

Last updated 12:27 PM on 12/12/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

20 Terms

1

New cards

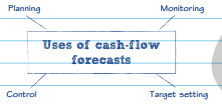

Cash flow forecasts

Cash flow forecasts are used by businesses to identify potential problems with cash flow. This will enable them to plan, monitor and control spending more effectively.

2

New cards

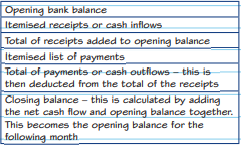

format of forecast

\

3

New cards

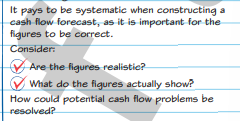

entering data

4

New cards

Use of cash flow forecast

The flow of cash into and out of a business has to be carefully managed. Having too little cash means that suppliers, and even employees, may not be paid on time.

5

New cards

profit and cash

Businesses selling lots of products and services may have major cash flow problems. If the business is selling products and services and recording them as being sold they may be short of cash if they have sold them on credit as they will not have yet received the money. They will need to replace the inventory but as they have not been paid for items they have already sold, they may not have funds to do this.

6

New cards

Benefits and limitations

Cash flow forecasts should help the business predict when they might have cash flow problems. If the business has predicted and planned for its financial needs, then banks may extend overdrafts or offer loans. Cash flows fail to consider that a business can delay payments to increase its net cash inflows and that it can buy using a leasing arrangement to avoid using cash.

7

New cards

ways to improve cash flow

8

New cards

what does break-even analysis identify?

it identifies the point at which a business’s costs are matched by the money it receives from sales.

9

New cards

Types of costs are?

Fixed, variable and semi-variable

10

New cards

Fixed costs

These are incurred by the business regardless of how well it is doing, e.g. business rates.

11

New cards

Variable costs

These increase when the business increases its activity or output, e.g. raw materials. total variable costs = variable cost per unit × quantity

12

New cards

Semi-variable costs

These are a combination of fixed costs and costs which become variable once a certain level of activity or output is reached, e.g. fixed phone line rental plus a variable charge based on the number of calls made.

13

New cards

Total costs (TC) =

fixed costs + variable costs + semi - variable costs

14

New cards

Types of sales are?

Selling price per unit, Sales in units, Sales in value.

15

New cards

Selling price per unit

Amount paid by each customer for each item bought

16

New cards

Sales in units

Quantity of sales, i.e. number of items sold

17

New cards

Sales in value

Monetary value of sales, i.e. selling price × the number of units sold.

18

New cards

Total sales (monthly/yearly) =

number of units sold OR value of units sold

19

New cards

Total Revenue (TR) =

Total revenue (TR) = Quantity of goods sold × Selling price per unit

20

New cards

Break-even =

Total revenue (TR) = Total costs (TC)