economics module 3

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

69 Terms

quota rent

the profit that arises when government sets quotas

progressive tax

high income payers pay a larger percent of their income than lower income than lower income tax payers

regressive tax

a tax that rises less than in proportion to income, high income pays less than low income

proportional tax

all tax payers pay the same tax percentage

excise tax

tax charged on each unit of good or service that is sold

tax incidence

a measure of who really pays a tax

tax wedge

size of tax

total tax revenue

total revenue from a tax

administrative costs

resources used by the government to collect the tax

lump-sum tax

a tax that is the same for everyone, example, a poll tax

domestic demand curve

shows how the quantity of a good demanded by residents of a country depend on the price of that good

domestic supply curve

shows how the quantity of a good supplied by producers inside a country depends on the price of that good

world price

fixed price abroad

imports

a product or service that is produced in one country and purchased in another

exports

goods and services made in one country and sold to buyers in a different country

exporting industries

firms that produce goods and services sold abroad

import-competing industries

produces goods and services that are also imported from abroad

free trade

government does not regulate exports and imports that occur naturally

trade protection

policies that limit imports to protect domestic producers from foreign competitors

tariff

a form of excise tax only levied on sales of imported goods

effects of tariff

1.raises domestic price

2.increases producer surplus

3.reduces consumer surplus

4.tariff yields revenue to government

import quota

the legal limit on the quantity of a good that can be imported

offshore outsourcing

business hire people in another country to perform various tasks

autarky

when countries don’t trade

utility

measure of satisfaction from consumption

utils

hypothetical units to measure utility

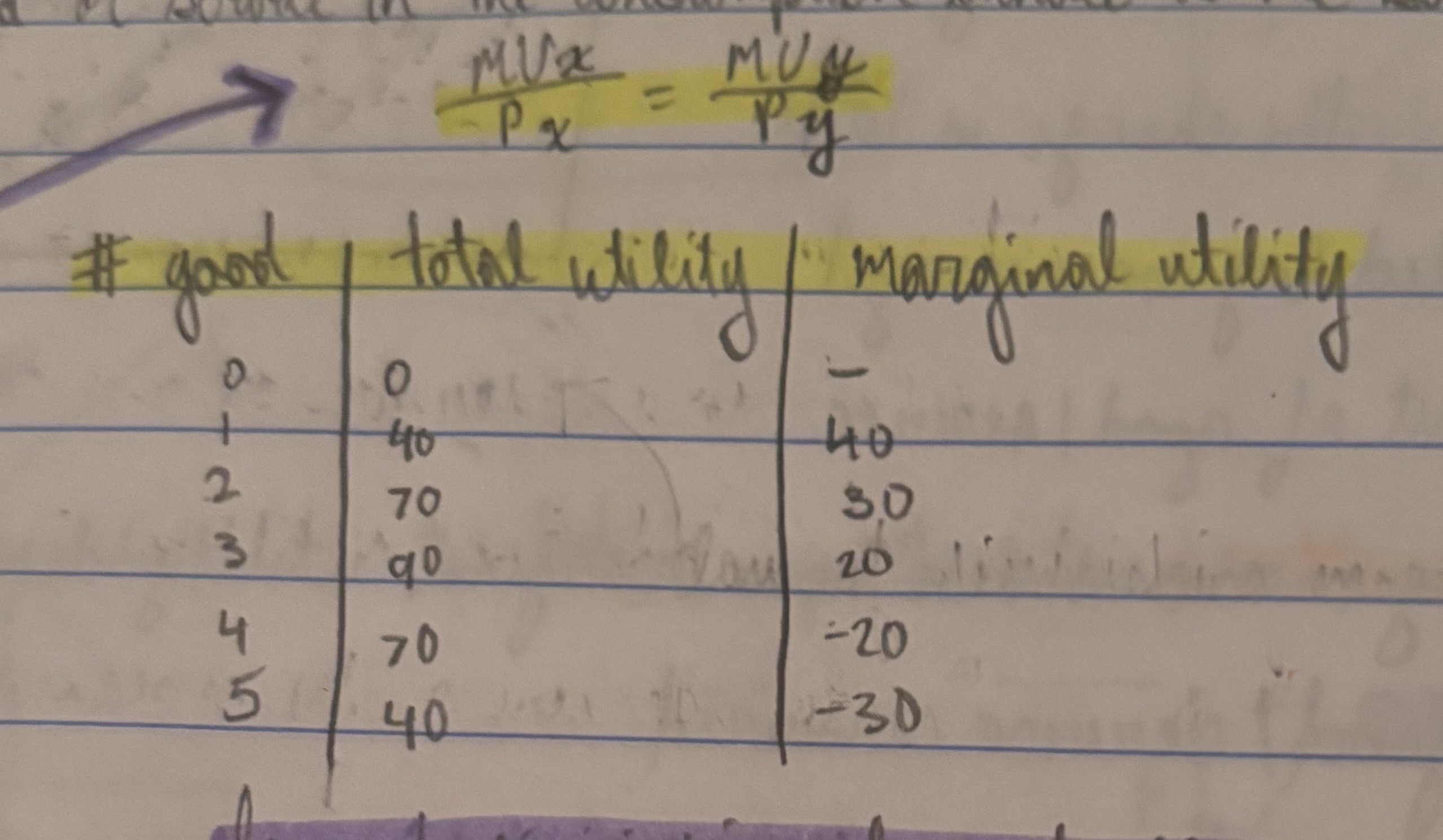

marginal utility

the change in total utility generated by consuming 1 additional unit of good/service

marginal utility curve

shows how marginal utility depend on the quantity of a good/service consumed

principle of diminishing marginal utility

each successive unity of a good or service consumed adds less to total utility than does the previous unit

budget constraint

consumers must choose a consumption bundle that costs no more than his or her income

consumption possibilities

the set of all of the affordable consumption bundles

budget line

the downward sloping line

optimal consumption bundle

maximizes total utility

marginal utility per dollar

spent on a good or service is the additional utility from spending one more dollar on that good or service,

MU good/P good

optimal consumption rule

when a consumer maximizes utility in the face of a budget constraint, the marginal utility per dollar spent on each good or service in the consumption bundle is the same

production function

the quantity of output a firm produces depends on the quantity of inputs

fixed input

an input whose quantity is fixed for a period of time and can’t be varied

variable input

an input whose quantity the firm can vary at any time

long run

the time period in while all inputs can be varied

short run

the time period in which 1 input is fixed

total product curve

shows how the quantity of output depends on the quantity of variable input, for a given quantity of the fixed input

marginal product

an input is the additional quantity of output produced by using 1 more unit of that input

diminishing returns to an input

when an increase of quantity holding the levels of all other inputs fixed, leads to a decline in the marginal product of that input

marginal product of labor

change in quantity of output/change in quantity of labor

long run average total cost curve

shows the relationship between output and average total cost when fixed cost has been chosen to minimize average total cost for each level of output

increasing returns to scale

when long run average total cost declines as output increases

decreasing returns to scale

when lobbying average total cost increases as output increases

constant returns to scale

when long run average total cost is constant as output increases

long run average total cost

combination of the short run cost curves, creates a :)

diseconomy of scale

caused by no coordination and communication

economies of scale

caused by specialization and set up costs in larger companies

sunk cost

money that is lost, doesn’t affect future decisions

explicit costs

outlay of money

implicit costs

benefits forgone, opportunity cost

total oppurtunity cost

total explicit cost + total implicit cost

accounting profit

revenue - explicit cost

economic profit

revenue - oppurtunity cost

optimal quantity

MR = MC, MR is change in revenue created by another unity of profit

4 market structures

perfect competition

monopoly

oligopoly

monopolistic competition

marginal revenue

the change in the total revenue generated by an additional unit of output, change in total revenue/ change in quantity of output

optimal output rule

says that profit is maximized by producing the quantity of output at which the marginal revenue of the last unity produced is equal to its marginal cost

price taking firm’s optimal output rule

a price taking firms profit is maximized by producing the quantity of output at which the market price is equal to the marginal cost of the last unit produced

marginal revenue curve

shows how the marginal revenue varies as output varies

break even price

the market price at which it earns zero economic profit

shut down price

the price at which a firm ceases production, equal to minimum average variable cost

profit equation

TR-TC=(TR/Q-TC/Q)Q

profit/q

TR/Q-TC/Q, TR/Q is average revenue and TC/Q is average total cost

public ownership

the good is supplied by the government or by a firm owned by the government

price regulation

limits the price a monopoly is allowed to charge