BM 3.4 Final Accounts

1/20

Earn XP

Description and Tags

The purpose of accounts to different stakeholders (AO2) - Profit and loss account (Statement of Profit or loss) - Balance sheet - Different types of intangible assets (AO2) - Depreciation using the following methods (HL only) (AO2, AO4): - Straight line method - Units of production method - Appropriateness of each depreciation method (HL only) (AO3) - Apply Knowledge of the Profit & Loss Account (AO2 – Application) - Explain the structure and purpose of a profit & loss account (income statement). - Identify key components, including revenue, cost of sales, gross profit, expenses, net profit, and retained profit. - Analyze how profit & loss accounts are used to assess a business’s financial performance. - Perform Profit & Loss Account Calculations (AO4 – Calculations) - Accurately calculate key financial figures, including: - Gross profit = Revenue – Cost of Sales - Net profit = Gross Profit – Expenses - Retained profit = Net Profit – Dividends - Use financial data to compute and interpret profitability metrics. - Solve profit & loss account problems in business scenarios. - Methods of depreciation (AO2, AO4) (HL) - Appropriateness of each depreciation method: Straight line and unit of production (AO3) (HL)

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

21 Terms

(AO2,4) Depreciation (HL): Definition and Methods

The fall in the value of a non-current asset due to wear and tear and obsolescence (need to replace older assets with better technologies).

Straight Line Method

Units of Production Method

Straight Line Method: Definition and Formula

Distributes depreciation evenly over the expected useful lifetime of the non-current asset: the value of the asset falls by equal amounts annually.

Annual Depreciation = (Purchase Cost - Residual Value) ÷ Lifespan

Straight Line Method: Advantages, Disadvantages, and Appropriateness

a:

Simple to calculate/understand/predict ;

suitable for depreciating assets with a known useful lifespan ;

d:

Unrealistic, abstract ;

Omits the loss of efficiency or higher repair costs over time, unsuitable if functional life span cannot be accurately estimated ;

Units of Production Method: Definition and Formula

Allocates equal amount of depreciation to each unit production: measures depreciation based on asset usage.

Depreciation per unit = (Purchase cost - Scrap value) ÷ Expected units of production over lifetime

Units of Production Method: Advantages, Disadvantages, and Appropriateness

a:

More accurately reflects wear and tear ; suited for fluctuating production

d:

more cumbersome to calculate: need to calculate depreciation based on varying usage rates ;

expected units are subjective &^ inaccurate ;

many tax authorities reject this method for taxing purposes ;

Historic Cost

Purchase cots of non-current asset

Scrap Value/Residual Value

Expected worth of an asset at the end of its useful life

Life expectancy

Intended or expected period of time the asset will be used for

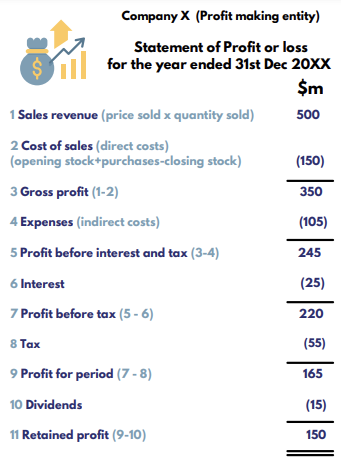

Statement of Profit or Loss: Contents

Company X (Profit or Non-profit entity)

Statement of Profit or Loss

For the year ended xst x 20xx //Date

Currency sign and unit at rightmost side

Sales Revenue (price sold * quantity sold)

Cost of sales (direct costs)

Gross profit

Expenses (indirect costs)

Profit before interest and tax

Interest

Profit before tax

Tax

Profit for period (net profit DO NOT USE NET PROFIT)

Dividends

Retained profit

Depreciation: Importance in Accounting

Provide a more accurate reflection of a company’s financial position

Relevant to government (tax purposes), banks, financiers

Decreases taxable income

Statement of Profit and Loss: Negative impact on net profit margin

Statement of Financial Position: Affect net assets, equity, and liabilities

Final Accounts: Purpose to Stakeholders (Managers, Employees, Shareholders, Financiers) (AO2)

Managers:

Measure performance of the business to organizational targets

Compare against competitors

Help with decision-making and strategic planning : assess whether the business has sufficient funds for new investment projects

Set budgets and targets for the future: Monitor business expenditure across various departments in the organization

Employees:

Gauge whether their jobs are secure: profitable business in solvency = + job security and promotional opportunities

Assist with negotiation process with labor unions: profitable and healthy business helps workers strengthen their case for pay rises

Shareholders:

Measure the value of the business and evaluate the business’s profitability trends

Calculate the return on their investment: profitability ratios

Determine dividends they receive

Decide growth and expansion prospects for the organization

Compare financial performances of different businesses to inform investment decisions: buying and selling shares

Financiers:

Evaluate the business’s stability and profitability: make investment decisions

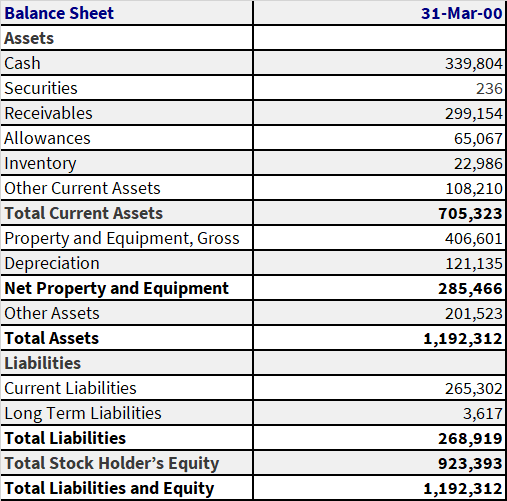

Balance Sheet / Statement of Financial Position

Snapshot of the business’s financial health at a particular point in time.

The reporting date is same each year, usually the last day of the financial year/ Legally required by all firms for auditing purposes.

Profit and Surplus: Definition and Differences

Profit:

Profit-making businesses earn after all expenses have been paid for from gross profit

Profit-making entities distribute profits in the following ways:

Rewarding shareholders in dividends

Reinvesting profits back into the business for its own use: retained profit

Surplus:

What non-profit business earns after all expenses has been paid

Reinvest all profits back into the business for its own use: retained surplus

Profit and Surplus: How to Improve Gross Value

Increasing sales revenue: Increase selling price, increase sold quantities → marketing strategies

Reducing cost of sales: Use cheaper suppliers, buy in bulk for discounts

Reducing rent: Moving to a cheaper location

Install energy efficient machinery: Solar panels

Find cost-effective suppliers for insurance

Reduce use of above-the-line promotion (expensive) to below-the-line promotion

Specifically Surplus:

Increase funding: seek corporate sponsors, fundraising strategies

Seek volunteers: reduce staffing costs

Statement of Financial Position: Contents

(AO2) Intangible Assets: Definition and Types

Fixed, non-physical assets with monetary value.

Including:

Goodwill: Reputation, brand image, and established understanding of an organization: increases market value above physical assets.

Licenses: Gives a business legal rights to operate, use intellectual property, and access resources → Long term value

Patents: Official rights given to a business to exploit an invention or process for commercial purposes: bars competitors from using the same invention or process without acquiring a license

Copyrights: Give the registered owner legal rights to creative works of others. Without copyrights, using creative works commercially may lead to legal consequences.

Trademarks: Gives the owner exclusive commercial use of registered brands, logos, and/or slogans: prevents competitors from following suit, builds unique brand image

(AO2) Profit & Loss Account: Purpose

Measure Profitability: Metrics such as gross and net profit are indicators of the business’s profitability, can be used to assess manager’s performance

Evaluate Cost Management: Displaying of costs and revenue allows managers to evaluate their cost management

Support Decision-Making: Data informs financial decisions

Compare Performance: Information can be compared to competitors or past reports

Profit & Loss Account: Assessing a business’s financial performance

Trend Analysis

Compare PL account over multiple years to identify growth/decline.

Look for:

Rising revenue but falling profits → Cost control issues.

Declining gross margin → Higher COGS or pricing pressure.

Benchmarking

Compare ratios with industry averages or competitors.

E.g., A 10% net margin may be good in retail but low in tech.

(AO4) Calculating Key Financial Figures: Gross profit, profit for period, retained profit

Gross profit = Revenue - Cost of Sales (direct costs)

Profit for Period = Gross Profit - Expenses (indirect costs)

Retained profit = Profit for Period - Dividends

The purpose of accounts to different stakeholders (AO2)

Profit and loss account (Statement of Profit or loss)

Balance sheet

Different types of intangible assets (AO2)

Depreciation using the following methods (HL only) (AO2, AO4):

Straight line method

Units of production method

Appropriateness of each depreciation method (HL only) (AO3)

Apply Knowledge of the Profit & Loss Account (AO2 – Application)

Explain the structure and purpose of a profit & loss account (income statement).

Identify key components, including revenue, cost of sales, gross profit, expenses, net profit, and retained profit.

Analyze how profit & loss accounts are used to assess a business’s financial performance.

Perform Profit & Loss Account Calculations (AO4 – Calculations)

Accurately calculate key financial figures, including:

Gross profit = Revenue – Cost of Sales

Net profit = Gross Profit – Expenses

Retained profit = Net Profit – Dividends

Use financial data to compute and interpret profitability metrics.

Solve profit & loss account problems in business scenarios.

Methods of depreciation (AO2, AO4) (HL)

Appropriateness of each depreciation method: Straight line and unit of production (AO3) (HL)

Learning objectives