Ch 19 Open Economy Macro Theory

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

What are the two markets?

Loanable Funds

Foreign-Currency Exchange

.Def of loanable funds

domestically generated flow of resources available for capital accumulation

-savers go to market to deposit, and borrowers go to market to borrow loans

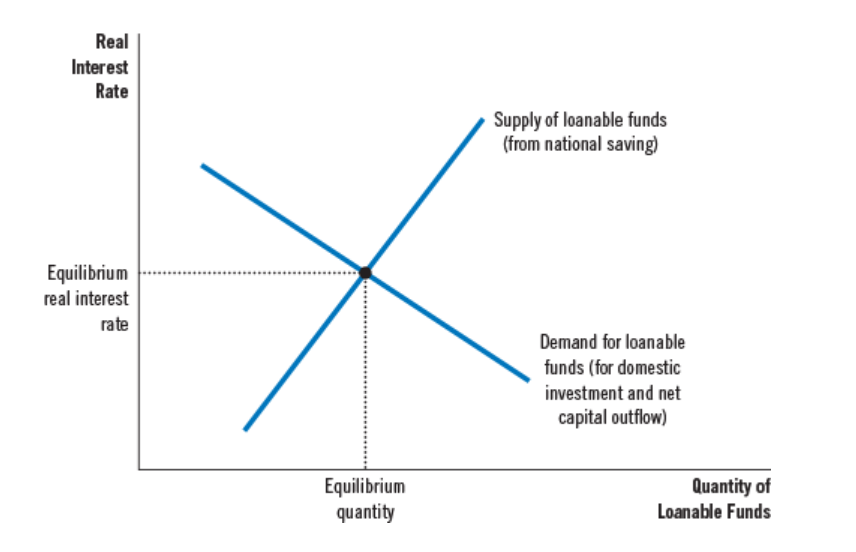

Equation for LF

S= I + NCO

Where do we find the demand for LF?

Investment AND NCO!

NCO (Net Capital Outflow): purchase of foreign goods by domestic residents MINUS purchase of domestic goods by foreigners

-purchase of capital adds to demand

Where do we find the supply for LF?

Saving

When NCO > 0, there is an increase or decrease in demand?

increase

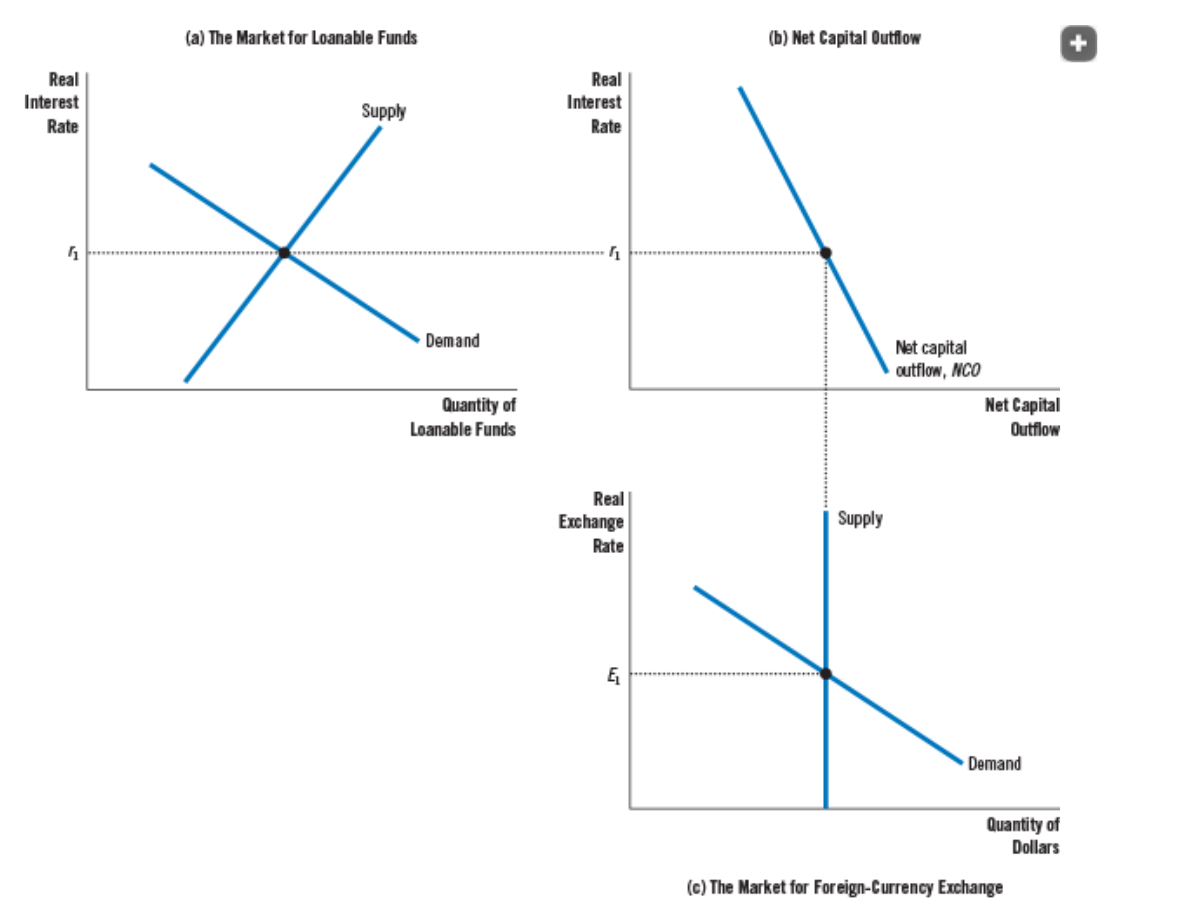

Graph for Market for Loanable Funds

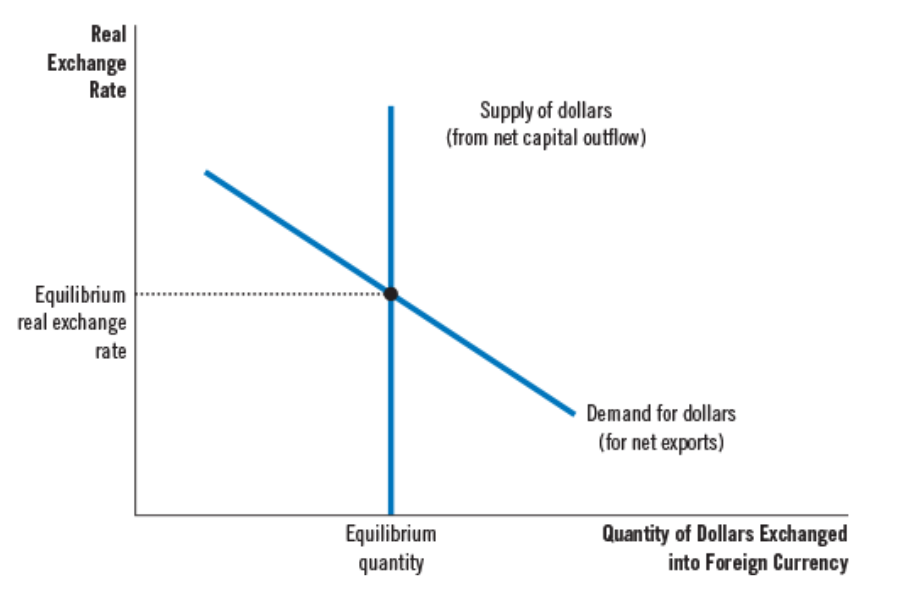

What is the key determinant for net exports?

Real exchange rate (the relative price of domestic and foreign goods)

an appreciation or depreciation of the real exchange rate reduces the quantity of dollars demanded in the market for foreign-currency exchange?

appreciation

A higher real exchange rate makes U.S. goods _____ expensive and ______ the quantity of dollars demanded to buy those goods

more

reduces

why is the supply curve vertical in a FC Exchange Market?

the quantity of dollars supplied for NCO does not depend on the real exchange rate. (net capital outflow depends on the real interest rate. When discussing the market for foreign-currency exchange, we take the real interest rate and net capital outflow as given)

why is the demand curve in the FCE Market downwards sloping?

a lower real exchange rate stimulates net exports

graph for FCE market

At the equilibrium real exchange rate, the ______ for dollars by foreigners arising from the U.S. net exports of goods and services exactly balances the ______ of dollars from Americans arising from U.S. net capital outflow.

demand

supply

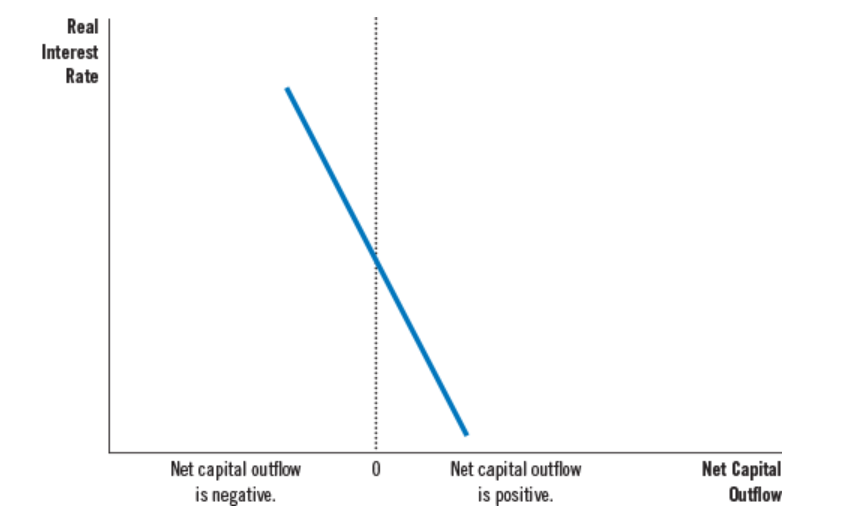

what links both the LF and FCE markets?

net capital outflow: it’s the demand in LF, and the supply for FCE

graph showing how NCO depends on interest rate

graph linking LF and FCE markets

The supply and demand for LF determines the _____ _________ _____

This then influences ___ ________ _______

This provides the _____ of dollars in the ____ market

The supply and demand for dollars in FCE market determines the ____ ________ _____

real interest rate

net capital outflow

supply/ FCE

real exchange rate

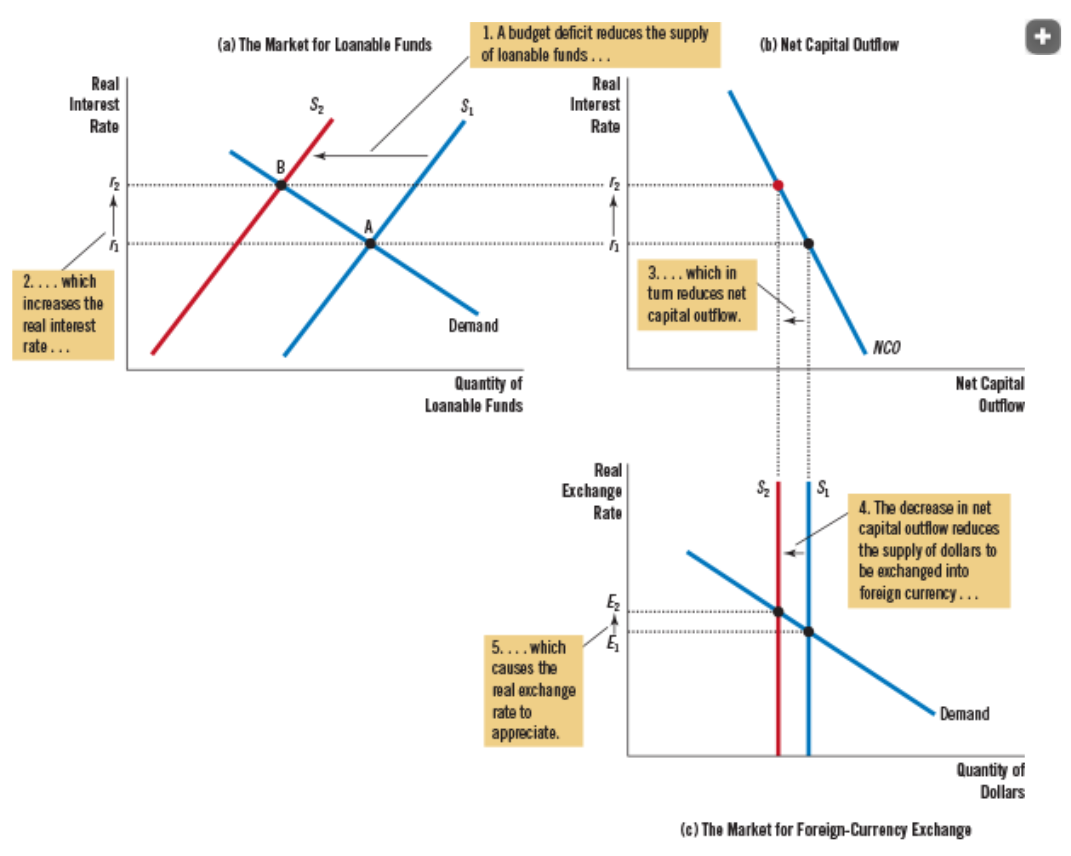

A government budget deficit

_______ the supply of LF

_______ the interest rate

______ ____ investment

reduces

increases

crowds out

Because a government budget deficit represents negative public spending, it shifts the curve to the _______

left

Graph representing effects of gov budget deficit

Essentially, a gov budget deficit

______ supply of LF, which ______ real interest rate

The higher interest rate _______ NCO, which _______ supply of dollars in FCE market

The fall in supply causes the RER to __________

This pushes the trade balance to a _________

reduces/ increases

reduces

appreciate

deficit

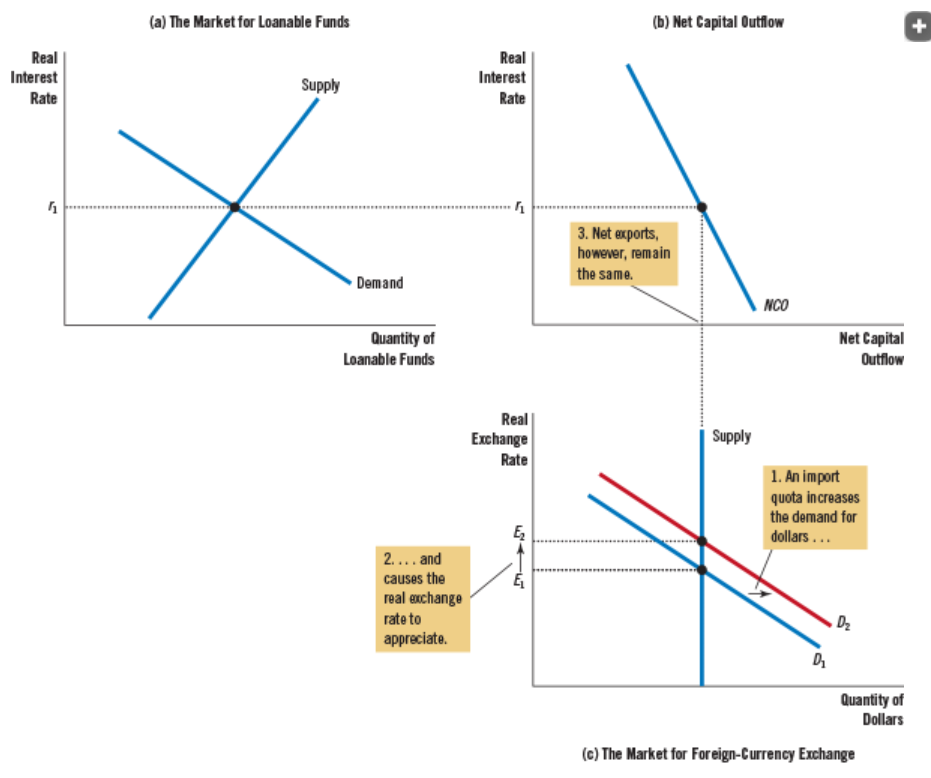

Graph of effect of import quota

What is the only effect of an import quota?

quota increases demand for $, so RER appreciates, causing rise in net exports

T/F: Trade policies do not affect trade balance

True

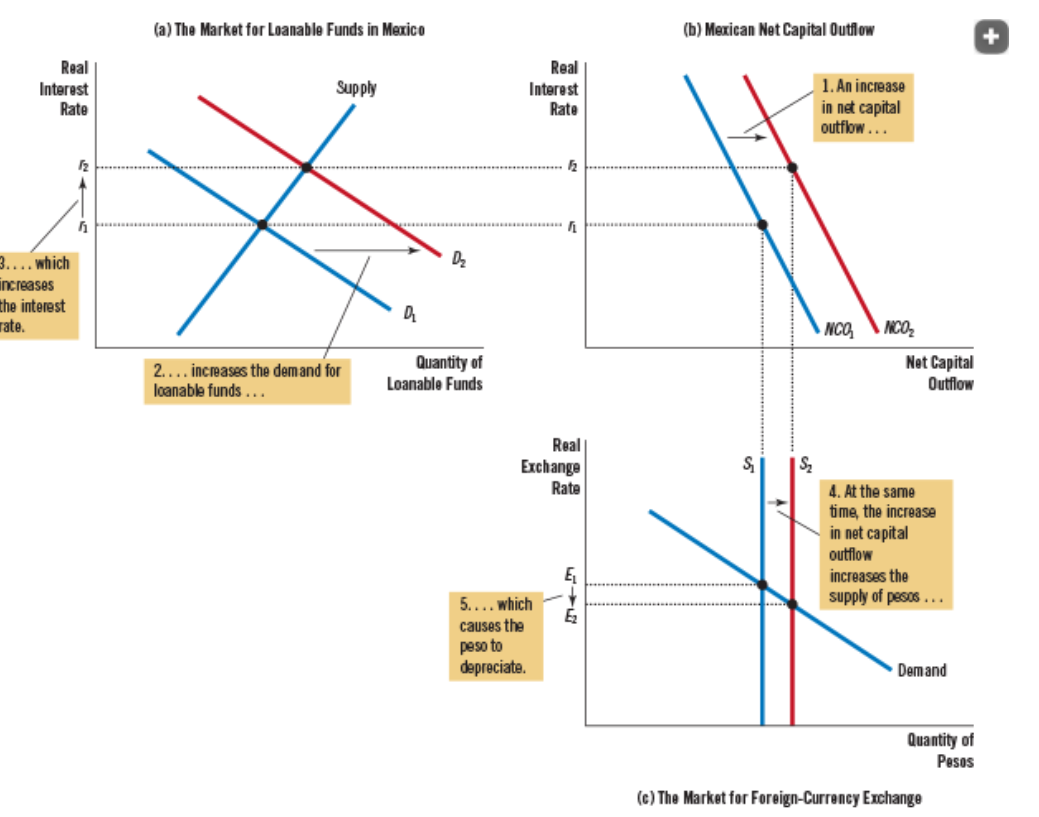

What is capital flight?

large and sudden reduction in demand for assets in a country

What is the effect of capital flight?

Reduction of funds _____ a country’s NCO

This __________ demand for LF, _______ real interest rate

The increase in NCO ___________ supply of money, causing the $ to ___________ and lose value

increases

increases

increases/ depreciate

Graph of effect of capital flight