Accounting Information Systems & Database Management Practice Questions

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

Information

Data that has been organized and processed so that it is meaningful to the user.

Value of Information

The benefits associated with obtaining the information minus the cost of producing it.

Timely Information

Information that reduces uncertainty, improves decision makers' ability to make predictions, or confirms expectations.

Reliable Information

Information that is free from error or bias and accurately represents the events or activities of the organization.

Useful Information

Information that is relevant, reliable, verifiable, and timely.

Query Languages

Languages that can gather relevant data for decision making and help choose among alternative courses of action.

Data Input Process

Commonly initiated by a business activity.

Source Document

A document that serves as evidence of a business transaction.

Expenditure Cycle

The cycle that includes responsibilities related to updating accounts payable based on purchase orders and checks.

Delivery Ticket

A document found in the expenditure cycle.

Purchases Journal

The type of accounting record where a delivery of inventory from a vendor would be initially recorded as part of the expenditure cycle.

Revenue Cycle Transaction

The most frequent transaction is the sale to customer.

Sarbanes Oxley Act

An act that requires public companies to prepare an annual internal control report.

Premier Life Company

A life insurance company that collects, stores, prepares and provides customized life insurance policy to customers.

Accounting Department Source Document

A document that initiates the data input process.

Credit Memo

A document that could be found in the expenditure cycle.

General Journal

The type of accounting record used to record transactions in the expenditure cycle.

Billing

A transaction in the revenue cycle.

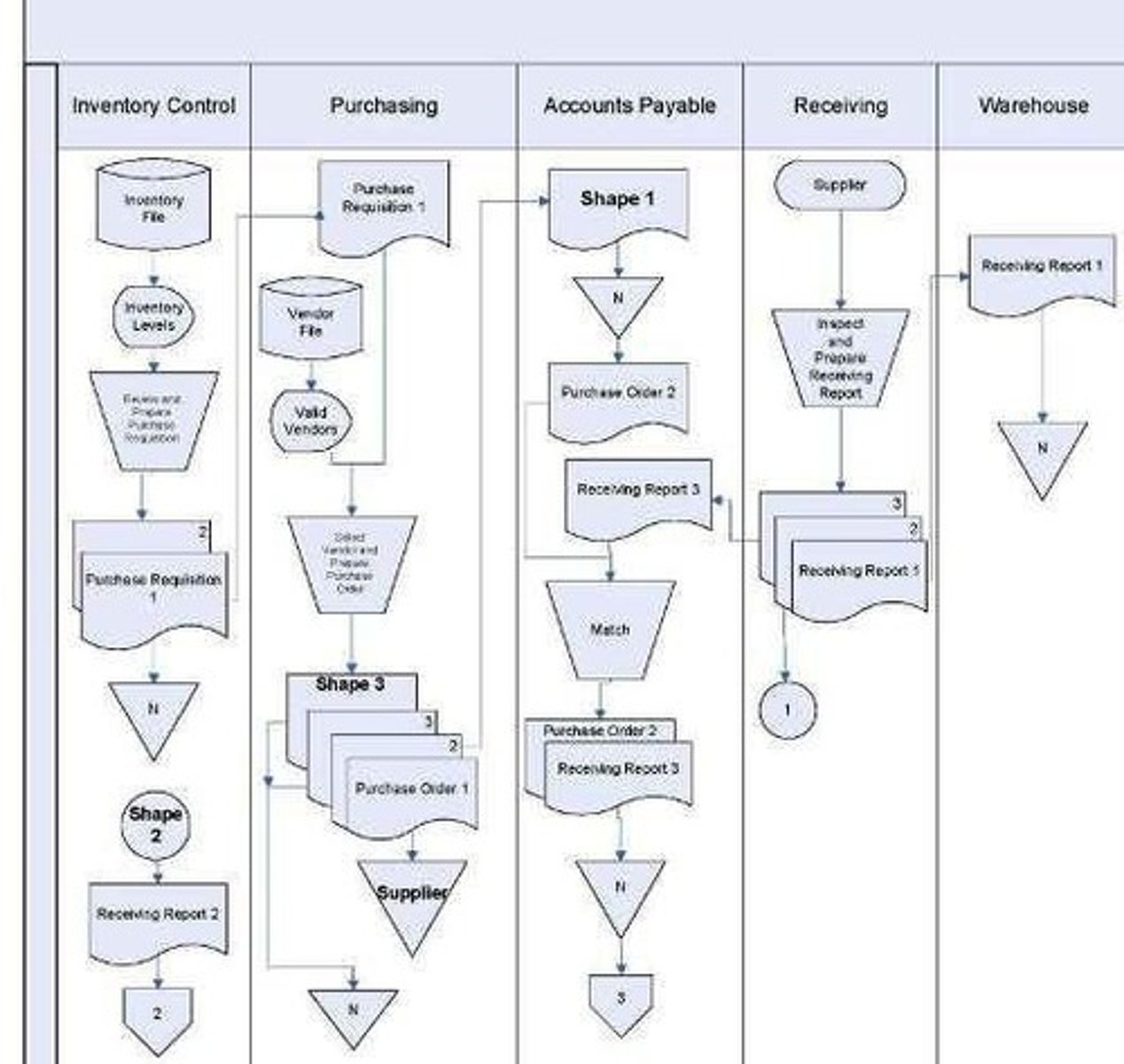

Flowcharts

Documentation tools that auditors must be able to prepare, evaluate, and read.

Timeliness

The characteristic of information that refers to its availability when needed.

Understandability

The characteristic of information that ensures it is comprehensible to the user.

Verifiable Information

Information that can be confirmed or substantiated.

Relevant Information

Information that is applicable and useful for decision-making.

Life insurance policy

A contract that provides financial protection to beneficiaries upon the death of the insured.

Data flow diagram

A visual representation of the flow of data within a system.

Flowchart symbol for purchase order

A specific shape used in flowcharts to represent a purchase order.

Invoice preparation

The process of creating an invoice from sales and shipping files stored on a hard drive.

Manual sale receipt

A receipt prepared by a sales clerk without electronic assistance due to a power outage.

ERP system

Enterprise Resource Planning system that integrates all facets of an operation, including finance, HR, manufacturing, and supply chain.

Master data destruction risk

The potential loss of critical data that can be mitigated by regularly updating the ERP system.

Cash theft controls

Measures implemented to minimize the risk of cash theft, such as separation of billing and shipping functions.

Separation of duties

A control mechanism that divides responsibilities among different individuals to reduce the risk of fraud.

Credit sales to poor credit customers

The risk of increasing uncollectible receivables due to sales made to customers with poor credit ratings.

Physical inventory count

A method of verifying inventory levels by physically counting items on hand.

Revenue cycle controls

Procedures that ensure proper handling of cash and receivables in a revenue cycle.

Symmetrical interdependence

A relationship where two cycles, such as expenditure and revenue, affect each other equally.

Mistakes in counting inventory

Errors that can occur during inventory counting, which can be minimized by implementing controls.

Safety stock

Extra inventory kept on hand to prevent stockouts during unexpected demand.

Approved supplier list

A list of vetted suppliers that helps reduce the risk of fraudulent disbursements.

Debit memo

A document issued to a supplier to adjust the amount owed due to returned goods.

Nonvoucher system

An accounting system that posts approved invoices directly to vendor accounts.