Unit 4: Financial Sector (Princeton Review AP Macroeconomics 2023 [21st Edition])

1/56

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

57 Terms

Financial Assets

subcategory of financial assets; entities over which institutional units or indivudals assert ownership rights

Four Characteristics of Money

portability (must be easily transferred between individuals), durability (must endure and hold value through time), divisibility (money must be broken down into smaller units to make change), and fungibility (must carry interchangeable value between people across place and time)

Why are cigarettes not fungible?

people who don’t smoke wouldn’t see this as money as compared to someone in prison

Three Primary Functions of Money

medium of exhcnage, store of value, and unit of account

Medium of Exchange

money facilitates transactions by serving as an intermediary in the exchange of goods and services rather than bartering

Double Coincidence of Wants

the situation where two parties each hold an item the other wants, making a direct exchange possible

Store of Value

a function of money that means it is nonperishable and will hold up in the future

What distinguishes money from currency?

store value

Unit of Account

standard unit price for price listings and comparisons that provides a consistent measure of value for goods and services

Currency

used as money but does not act as a store of value or carry intrinsic value

All money is ______, but not all currency is ______

currency; money

Commodity Money

any raw material with intrinsic value that is used in exchange for other goods in an economy (refers to money like silver coins)

Fiat Money

refers to currency without intrinsic value (like paper cash)

Wealth

the value of the total assets owned by an individual or entity (assets - debts = wealth)

Central Banks

influence the value and supply of money by setting a policy rate

Policy Rate

the interest rate at which depository institutions lend reserve balances to each other overnight

Arbitrage

a strategy in which banks invest and borrow from each other to instantaneously maximize returns

Consumers are more likely to borrow and spend when interest rates are…

low

Consumers are less likely to borrow and spend when interest rates are…

high

Federal Reserve Bank

the central bank of the US (the Fed) since 1913

The Fed’s Dual Mandate

to maximize the employment rate and to maintain price stability

Price Stability

limits inflation and maintains value of the US dollar

Federal Funds Rate (FFR)

the US policy rate

Money Supply

the supply of currency and any other liquid assets in the US

Liquidity

how easily an asset can be transferred into currency

M1

the sum of coin and paper money plus checking deposits and savings deposits

M2

M1 plus small-time deposits, money market mutual funds, and Eurodollar deposits

Small-Time Deposits

deposits less than $100,000 with a fixed term of maturity

Eurodollar Deposits

overnight, dollar-denominated deposits in European banks

Limited Reserves

a situation in which banks have little excess reserves

Ample Reserves

a situation in which a bank has much excess reserves

The Fed uses which three tools to control money supply with limited reserves?

adjustments in the required reserve ratio, adjustments in the discount rate paid by banks to borrow from the Fed, and open market operations (buying and selling of government securities)

Required Reserve Ratio

the ratio of a bank’s reserves to its total deposits

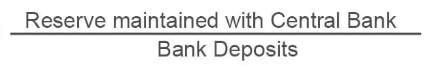

Reserve Ratio Formula

Discount Rate

the interest rate banks pay to borrow money from the Fed

Open Market Operations

The Fed’s purchase and sale of government securities (bonds, bills, and notes)

Fractional Reserve Banking System

used in a limited reserves economy in which only a fraction of total deposits is held on reserve and the rest is lent out to borrowers, allowing for increased money supply and economic activity

Balance Sheet or T Account

financial statement that summarizes a company's assets, liabilities, and equity at a specific point in time

Assets Side of Balance Sheet

shows required reserves, excess reserves, and loans

Liabilities Side of Balance Sheet

shows deposits and reserves that can be borrowed from the Fed

Money Creation

the generation of assets caused when an initial deposit to a bank is held partially in reserve and partially redistributed as a loan (fractional reserve system)

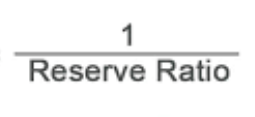

Money Multiplier Formula

Money Multiplier

a formula that determines the maximum amount of money that can be created in the banking system for each dollar of reserves

The money multiplier was used in the US when there was…

limited reserves

When the Fed has ample reserves and doesn’t use a reserve ratio…

the money multiplier is obselete

The Fed’s response to the 2008 financial crisis included…

interest on reserves, adjustmetns to discount rate, and open market operations

Interest on Reserves

the Fed allows banks to earn interest on what ever they choose to hold in reserve

Administered Interest Rates

interest held on reserves and adjustments to the discount rate

Monetary Policy

the way in which the Fed uses its tools to influence interest rates, inflation, exchange rates, unemployment, and real GDP

Lower interest rates lead to…

increased quantity of money

Higher interest rates lead to…

decreased quantity of money

Lower interest rates lead to…

increased investment

Higher interest rates lead to…

decreased investment

A decrease in supply of reserves…

increases policy rate

An increase in supply of reserves…

decreases policy rate

When central banks increase and decreases administered interest rates…

they are increasing and decreasing demand for reserves

In order to limit crowding out from expansionary fiscal policy…

it can be combined with expansionary monetary policy to increase money supply and decrease interest rates