Economics IA1 unit 3 definitions

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

47 Terms

Absolute advantage

the ability of a nation to produce commodities more efficiently than another nation

Comparative advantage

the ability of a nation to produce a product at a lower opportunity cost of production than another nation

Competitive advantage (of a nation)

trade advantage obtained through the capacity of a nation’s industries to innovate and upgrade

Currency appreciation

an increase in the value of a currency relative to other currencies under a floating exchange regime

Currency depreciation

a decrease in the value of a currency relative to other currencies under a

floating exchange regime

Currency devaluation

a deliberate downward adjustment to the value of a country’s currency relative to another currency, group of currencies or standard under a fixed exchange rate

Currency revaluation

a deliberate upward adjustment to the value of a country’s currency relative to another currency, group of currencies or standard under a fixed exchange rate

delete

later

Exchange rate

the value of the currency of a nation expressed in terms of the currency of another nation

Exchange rate (fixed)

the value of a currency that is determined by the government fixing it to the value of another currency at a certain level, and guaranteeing to maintain that level

Exchange rate (floating)

the value of a currency determined by the forces of supply and demand in the foreign exchange market

Exchange rate (managed/dirty)

a floating exchange rate system where the central bank (the RBA in Australia) intervenes in the foreign exchange market by buying or selling a nation’s currency

Exchange rate appreciation

see currency appreciation

Exchange rate depreciation

see currency depreciation

Factor endowment

the supply of the factors of production (land, labour, capital and enterprise) that exists in a country

Free trade

trade of exports and imports in which government exerts little influence on the decisions of private firms and individuals; competitive market forces determine trade patterns

Globalisation

the growing integration of national economies to form a single interdependent global economy

Internal stability

a state of the economy in which there is full employment and acceptable levels of inflation

Sustainable economic growth

a rate of growth that, if maintained correctly, should not create any significant economic problems for future generations; it sustains a nation’s natural resources and the environment

Trade liberalisation

is a policy designed to promote free trade and reduce protection levels between nations

Terms of Trade

The measurement of the change in export prices relative to the change in import prices.

BOGS

balance of goods and services = total value of exports – total value of imports

Trade balance

The difference between a country's total value of exported goods and services and its total value of imported goods and services over a specific period

KAFA

Capital Account small part of the balance of payments, it includes capital transfers – mainly involves the transfer of assets when someone moves in or out of the AUS.

Financial account is the bigger part of the KAFA and is a component of a countries BOP.

BOP

Balance of payments is a record of all economic transactions between a country and the rest of the world over a specific period, such as imports, exports, and financial flows

. BOP must equal 0 so a surplus in the current account is equal to a deficit in the capital and financial account.

Current Account

has three components- net goods, net services and net secondary income.

Net goods: is total exported goods minus total debits paid for purchase of imported goods.

Net services is income earned by residents from the provision of factors of production.

Net secondary income: refers to one way transfers of money between Aus and the rest of the world wehre no good, service or asset is exchanged in return.

Positives of currency appreciation

Cheaper imports

increased purchasing power

decreased debt

foreign investment

inflation

negatives of currency appreciation

decreased competitiveness

negative effect on tourism industry

decreased economic growth

trade balance deficit (due to more imports)

positives of currency depreciation

export competition

increased employment

increased domestic production

increase economic growth

negatives of currency depreciation

decreased access to imports

decreased foreign investment

increased inflation on imports

foreign debt

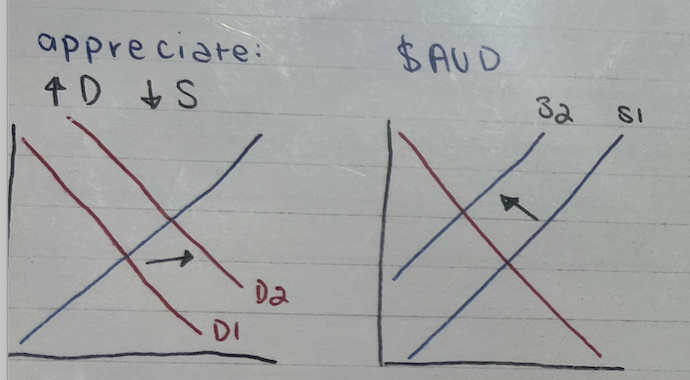

Appreciate AUD

increased demand decreased supply

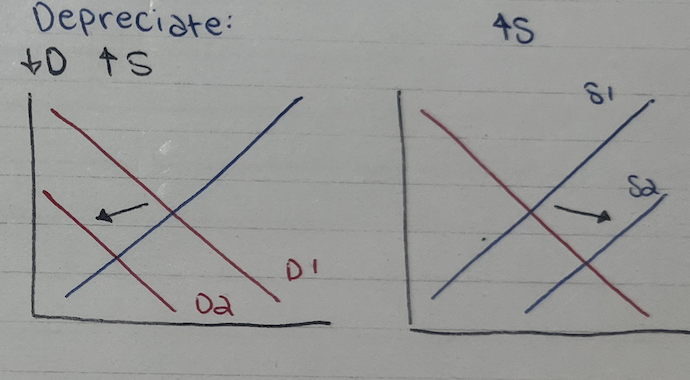

depreciate AUD

Decreased demand increased supply

advantages of fixed exchange rate

exchange rate stability

reduces inflation

encourages investment

disadvantages of fixed exchange rate

monetary policy indolence lost

balance of payments issue

maintaining is harder

positives of managed exchange rate

stability

flexibility

confidence for investors

negatives of managed exchange rates

policy mistake

limited long term stability

gov stability

foreign exchange market

(FOREX) market where intentional currencies are bought and sold

foreign reserves

assets held by countries central banking foreign currencies

positives of floating exchange rate

automatic adjustment

reflection of market condition

indépendant monetary policy

disadvantage of floating exchange rate

exchange rate volatility

short term investment

reduced investment confidence

benefits of feign investment

more capital investment

increase in exports

decrease in unemployment due to drive in economic growth

serves as an injection in circular flow of income

increased productivity by pushing curve out

increased technology and increased innovation

increase market output

costs of foreign investment

decreased control +owenership of industries/resources

higher returns on investment for external investors

increased profits = increased dividends + ROI (return on investment)

leakage to promot a foreign economy/market

types of foreign debt

public - gov owneed

private- individuals +businesses owed debt

costs of foreign debt

vunerable to change due to exchange rates

overseas currency appreciates making debt harder to pay

benefits of foreign debt

borrow from country with a favourable interest rate

capital investment - economic growth - develop economy

limited damage of fluctuations

foreign liabilities on the current account

borrow from abroad —→ inflow of capital recorded as credit on KAFA —→ interest repayments overseas —→ payments recorded as debits on the net primary income account and the current account