International Finance - Purchasing Power Parity and Real Exchange Rate

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

14 Terms

what is the Purchasing Power Parity

links exchange rates to the prices of goods in different countries

It provides a benchmark for determination of exchange rates

what is the formula of inflation/deflation

pi = Pt-Pt-1 / Pt-1

what is the law of one price

Two products or services should have the same price in two different markets if

They are identical

There are no transaction costs

There are no trade restrictions

A primary principle of competitive markets is that prices will equalize across markets if frictions (transportation costs) do not exist.

ex.: is it really good to go to Greece for cheaper haircut (transportation costs)

So in reality this law does not hold due to tarrifs, transaction costs, non-competitive markets, borders etc...

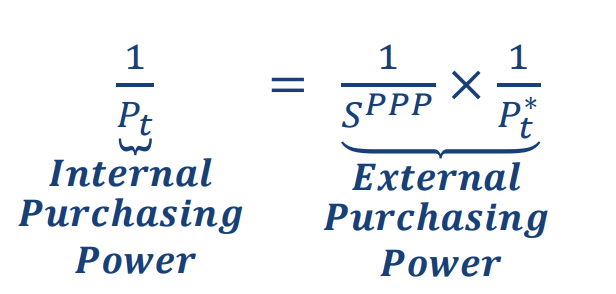

what is the internal purchasing power

The amount of goods and services that can be purchased with USD 1 in the U.S.

1/Pt

what is the external purchasing power

The amount of goods and services that can be purchased with USD 1 outside the U.S

1/St x 1/Pt*

what is the absolute purchasing power parity

external = internal

→Arbitrage is possible only if the exchange rate does not adjust

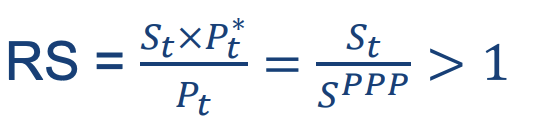

When its external purchasing power exceeds its internal purchasing power

Overvalued

→Currency must weaken (depreciate)

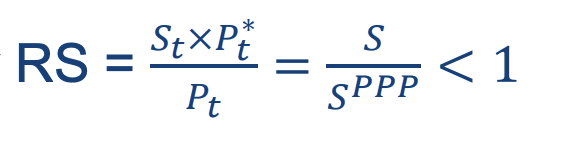

When its external purchasing power is less than its internal purchasing power (RS formula)

Undervalued

→Currency must strengthen (appreciate)

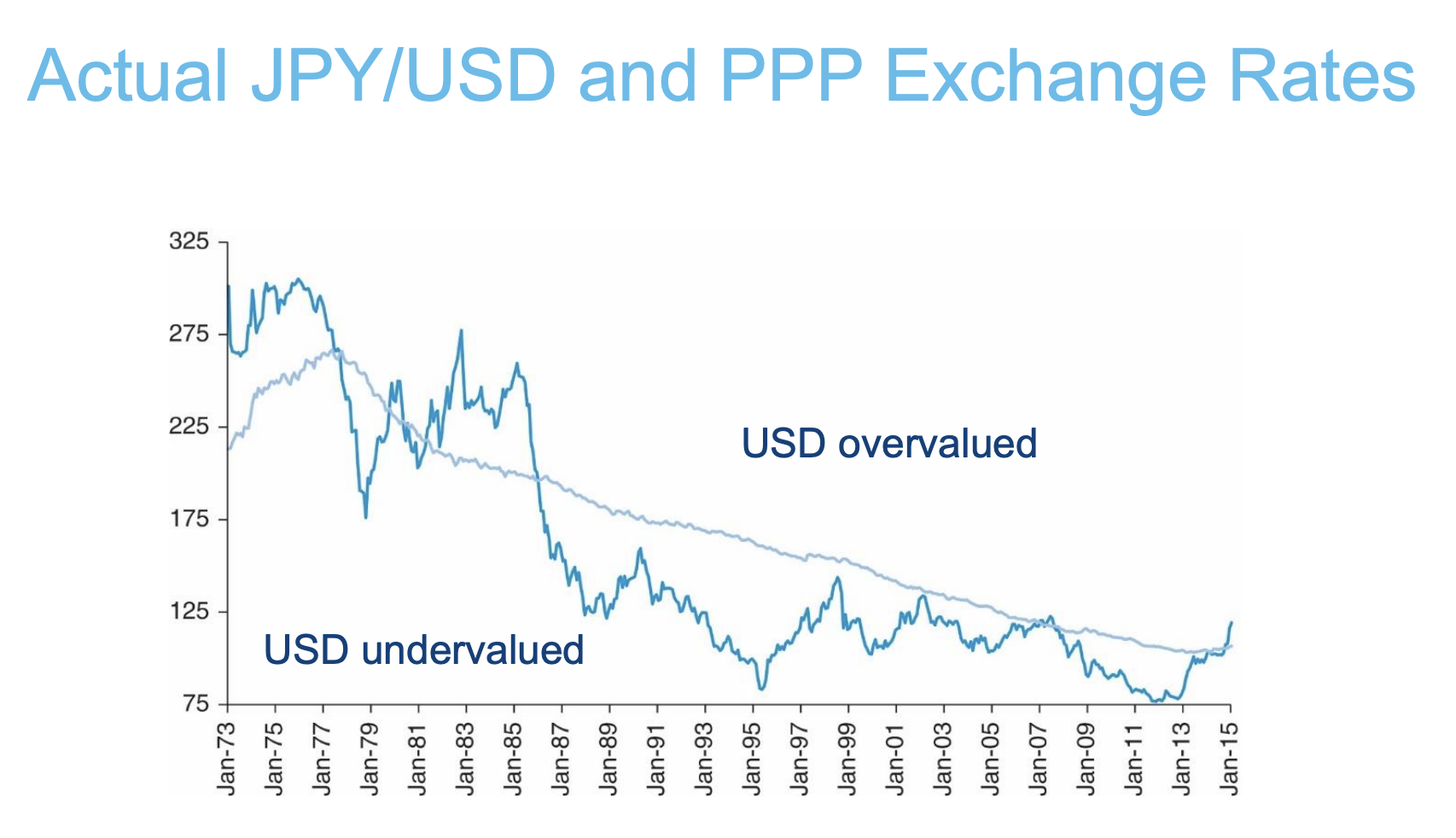

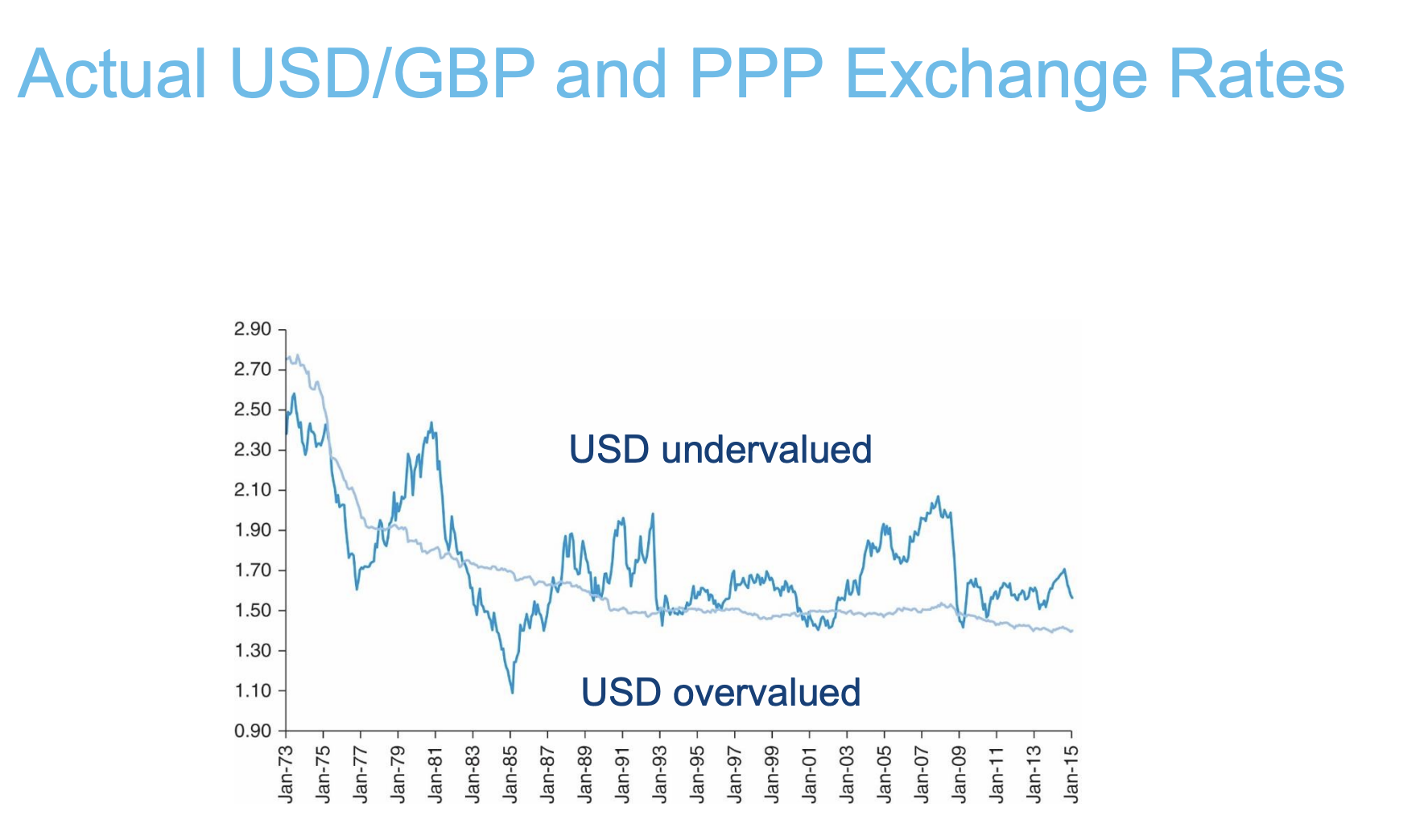

overvalued or undervalued above/below PPP line JPY/USD

overvalued or undervalued above/below PPP line USD/GBP

what is the relative purchasing power parity

takes market imperfections into account

says that exchange rates change over time to offset differences in inflation between two countries.

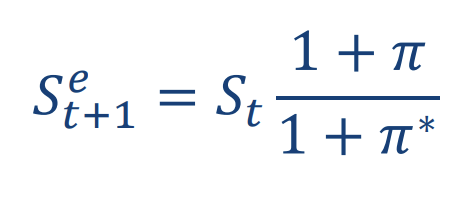

We can use the relative purchasing power parity to determine the future predicted value of the spot exchange rate (formula)

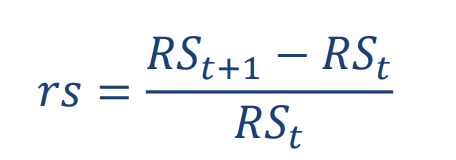

what is the percentage change in RS

If 𝒓𝒔 > 𝟎, the real exchange rate increases: we have a real appreciation of the foreign currency, and a real depreciation of the home currency

If 𝒓𝒔 < 𝟎, the real exchange rate decreases: we have a real depreciation of the foreign currency, and a real appreciation of the home currency

what is the real rate of interest (Fisher)

is the difference between the nominal rate of interest and the expected rate of inflation.

i(t) = re +pie