Note 9 - Recycling

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

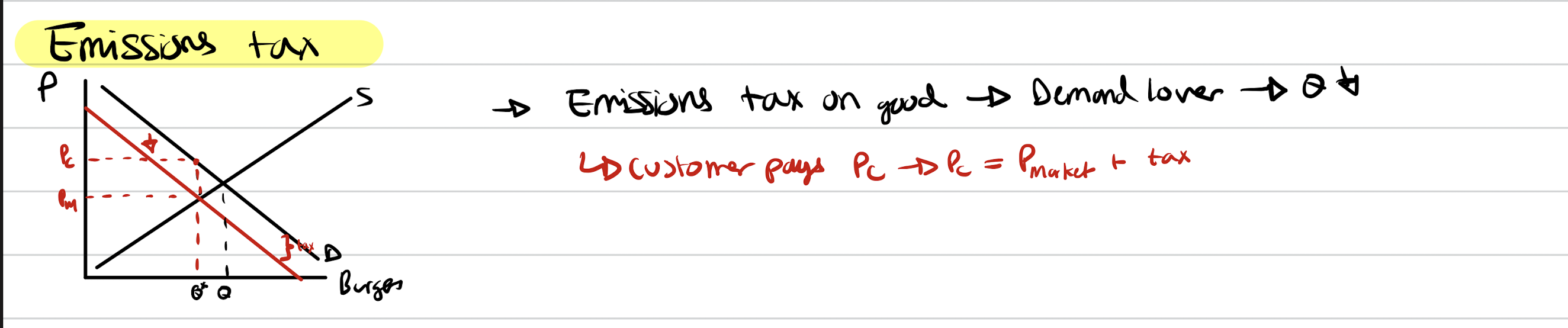

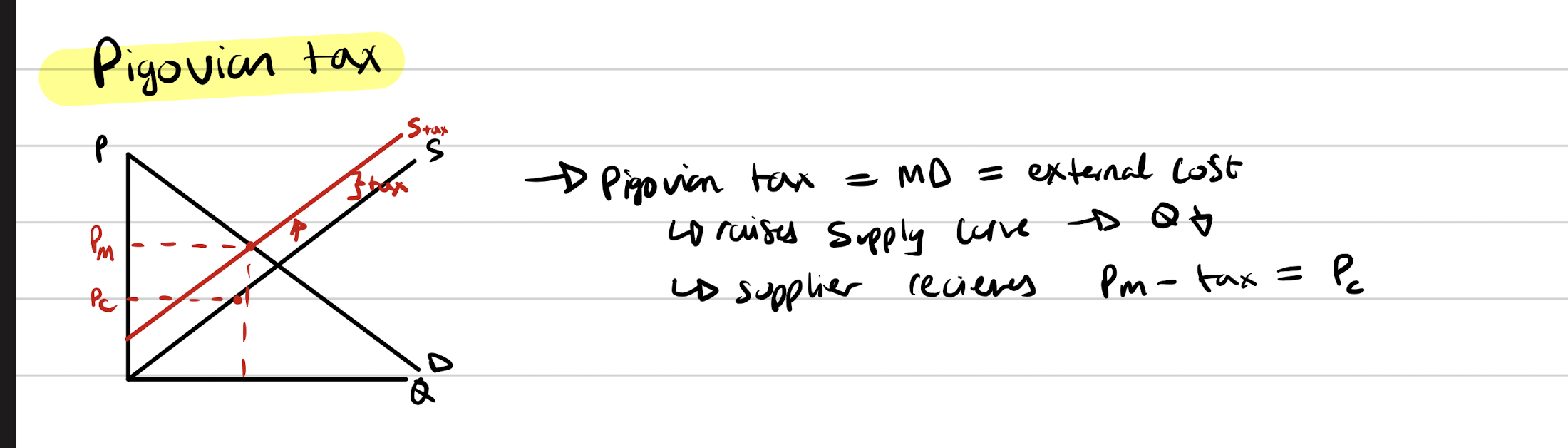

Two ways to reduce quantity of waste-producing goods?

1) Emissions tax

2) Pigovian tax

Emissions taxes and waste producing good

Emisions tax → shifts demand curve down. lower equilibrium quantity. We know that consumers do not consume the socially optimum quantity because they do not bear the full social cost of their waste-producing good.

Pigovian taxes and waste-producing good

Put a tax on the good → supply curve shifts up. Price up, Q down.

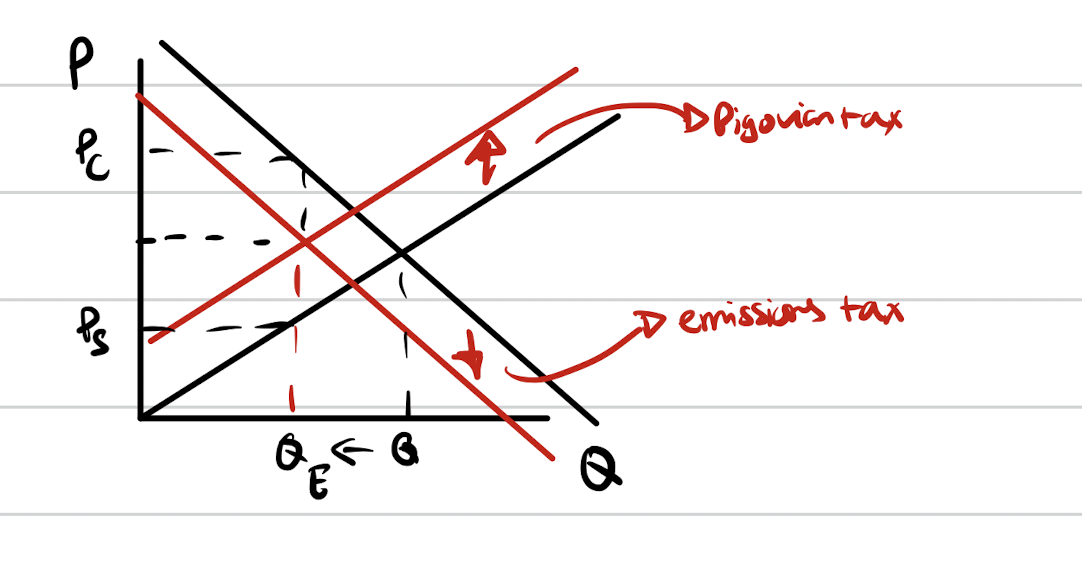

Ideal policy for reducing waste-producing good

Pigovian tax + Emissions tax

Both reduce quantity

Price consumer pays up

Price supplier gets down

Tax revenue in middle.

Total Materials =

Virgin materials + recycled materials

VM =

TM - RM

= TM( 1 - RM/TM)

RM/TM = reuse ratio = QV/QT

How to increase VM

By increasing RM or by decreasing TM

Can decrease TM by slowing down economic growth or by reducing material intensity

Material Intensity

the quantity of materials used per unit of production. (Amount of paper used to package burger)

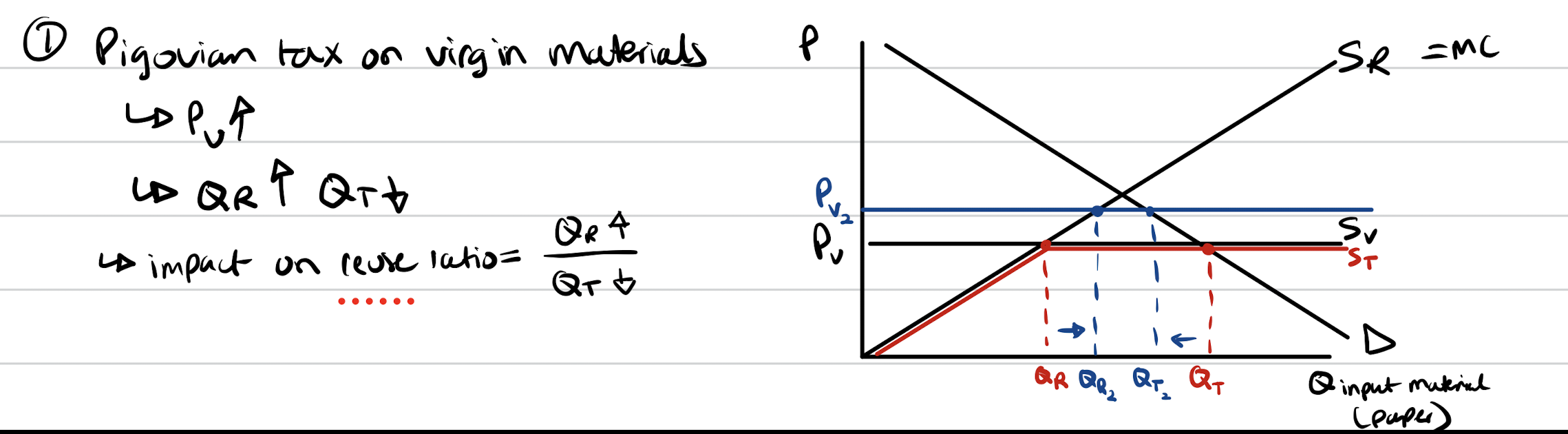

How to get producers to increase VM

1) Pigovian tax on virgin paper

2) Emissions tax

3) Subside recycling

4) Mandate certain % of recycled material (Control instrument)

5) Non-tradeable permits

Pigovian tax on virgin paper

Increases price of virgin paper. Supply of virgin paper is perfectly elastic. Causes TM to decrease and RM to increase. Reuse ratio up

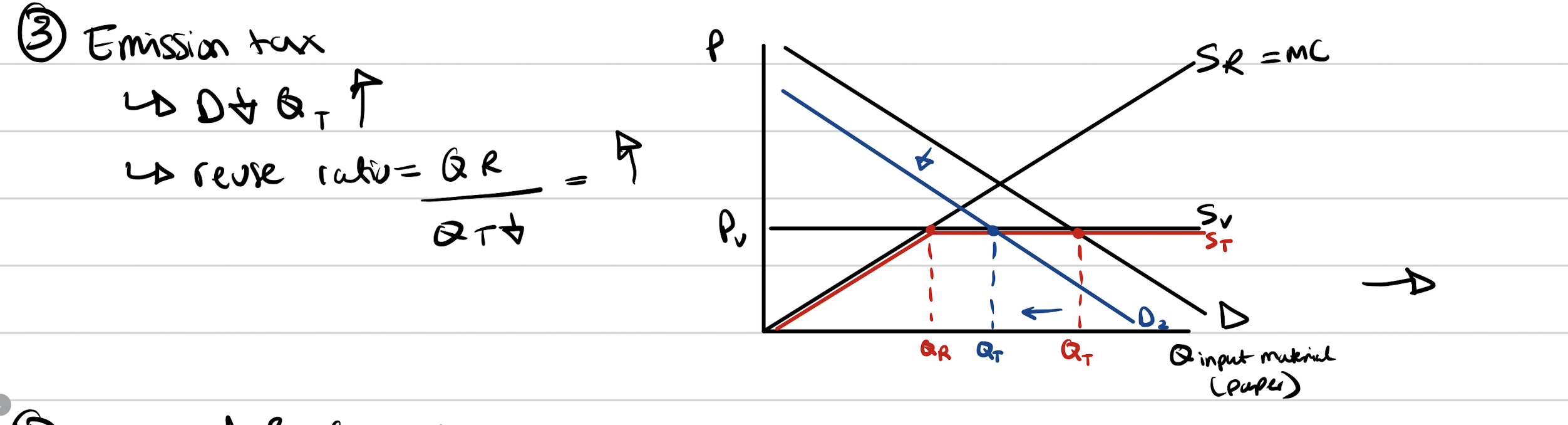

Emissions tax

Shifts demand curve down. TM down. RM unchanged. causes reuse ratio to increase.

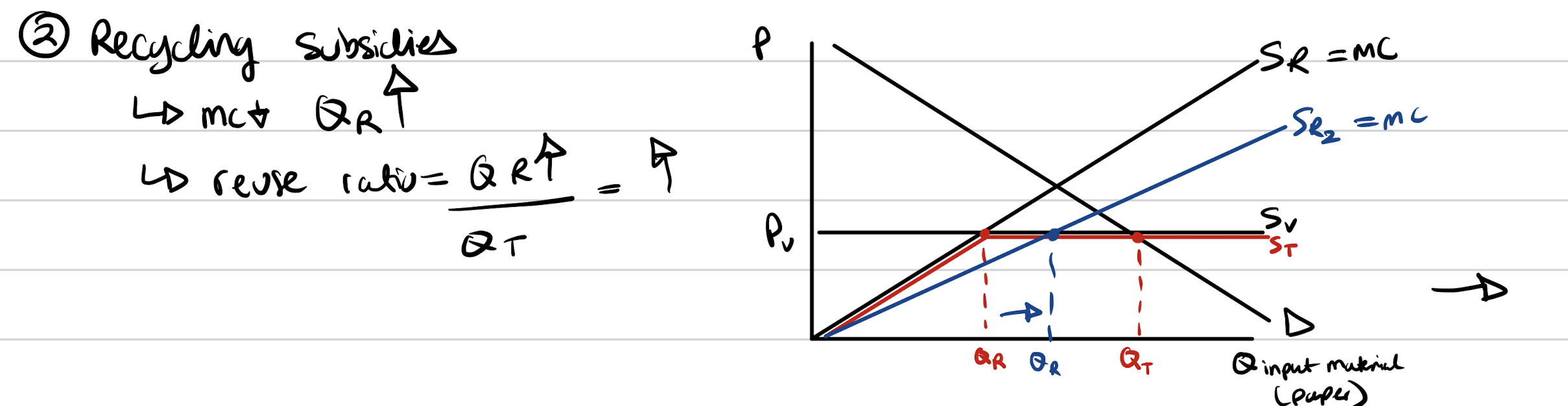

Recycling subsidy

Supply curve of recycling is upward sloping. MC of recycling is increasing. Subsidy moves Supply curve down. RM up, reuse ratio up.

Minimum content standards

Command and control instrument

Government requires certain % of material used to be recycled. inefficent as government does not know MCRecycling of production firms. Does not lead to least cost.

Tradeable permits

Allocate permits to people to use certain % recycled material.

Low cost firms recycle more than requirement and sell excess credits.

High cost firms recycle less than requirement and buy permits to make up difference.

3 recycling policies for consumers

1) Mandate recycling

2) Disposal tax

3) Disposal deposit/refund

Mandate recycling

Mandate recycling of recyclable resources. Removes option to garbage recyclable goods.

Disposal tax

tax consumers = external cost of good. Makes consumers make socially optimum decisions by facing the true social cost.

If recycle = no tax, subsidy = - cost of recycling + value of recovered materials

Deposit/refund

Charge deposit = External cost of not recycling. If recyle, get refund, if not, pay tax.

only on recycleable goods.