All 7 Canvas Quiz Questions + some menti

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

The economic recoverability test (“Step 1,” done to determine if an asset is impaired) for PP&E impairment testing compares which two amounts?

a. Fair value to Book Value

b. Historical cost to Fair Value

c. Book Value to Undiscounted Expected Future Cash Flows

d. None of the answer choices are correct

e. Fair value to Undiscounted Expected Future Cash Flows

c. Book Value to Undiscounted Expected Future Cash Flows

Presented below is information related to equipment owned by XYZ Company at December 31, 2023.

Historical cost | $6,000,000 |

Accumulated depreciation, to date | 1,000,000 |

Undiscounted Expected Future Cash Flows | 4,900,000 |

Fair value (discounted future cash flows) | 3,700,000 |

Assume that XYZ will continue to use this asset in the future. As of December 31, 2023, the equipment has a remaining useful life of 8 years.

If the asset fails the economic recoverability test, the journal entry to record the loss would include:

a. A debit to Loss on Impairment for $1,100,000

b. No Impairment Loss is necessary, so no journal entry would be made

c. A debit to Loss on Impairment for $1,300,000

d. A debit to Loss on Impairment for $2,300,000

e. A debit to Loss on Impairment for $100,000

c. A debit to Loss on Impairment for $1,300,000

Which of the following factors that determine how much depreciation expense a company records each year involves an estimate/judgment that must be made by the company’s management?

a. The asset’s useful life

b. None of the answers involve estimates/judgments

c. The asset’s salvage value

d. The method of depreciation used

e. All of the answers involve estimates/judgments

e. All of the answers involve estimates/judgments

ABC Corporation purchased machinery on January 1, 2020 at a cost of $711,000 and salvage value of $60,000. The useful life assigned to the machine at the time of purchase was 20 years. Using the Sum-of-the-years’-digits method, what should ABC record as the deprecation expense for 2020? Round answer to nearest dollar.

a. $32,550

b. $50,786

c. $62,000

d. $67,714

e. $46,500

c. $62,000

ABC Corporation purchased machinery on January 1, 2019 at a cost of $450,000 and salvage value of $40,000. The useful life assigned to the machine at the time of purchase was 10 years. Using the Double-declining balance method, what should ABC record as the deprecation expense for the year-ended December 31, 2020?

a. None of the answer choices are correct

b. $90,000

c. $72,000

d. $82,000

e. $73,600

c. $72,000

Use the following information for questions 1 and 2:

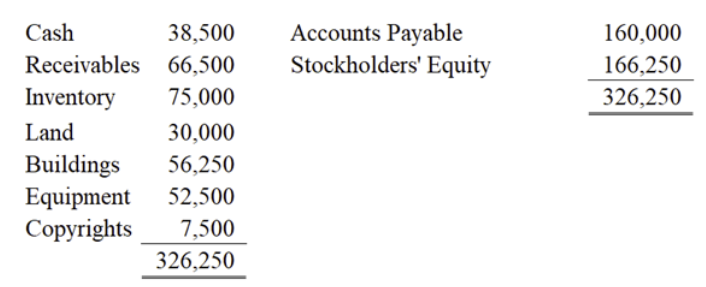

On July 1, 2020, Bear Inc. purchased Whistler Co. by paying $187,500 cash and issuing a $65,000 note payable. At July 1, 2020, the balance sheet of Whistler Co. was as follows.

The recorded amounts all approximate current fair market value (FMV) except for Land (FMV= $45,000), Inventory (FMV= $93,750), and Copyrights (FMV= $11,250). The copyrights have an estimated useful life of 5 years with an estimated residual value of $2,450.

How much, if any, Goodwill related to the purchase of Whistler Co. should be recorded by Bear Inc. on July 1, 2020?

a. $0, there should be no Goodwill recorded by Bear Inc.

b. $73,750

c. $85,750

d. $48,750

d. $48,750

Use the following information for questions 1 and 2:

On July 1, 2020, Bear Inc. purchased Whistler Co. by paying $187,500 cash and issuing a $65,000 note payable. At July 1, 2020, the balance sheet of Whistler Co. was as follows.

The recorded amounts all approximate current fair market value (FMV) except for Land (FMV= $45,000), Inventory (FMV= $93,750), and Copyrights (FMV= $11,250). The copyrights have an estimated useful life of 5 years with an estimated residual value of $2,450.

Bear’s December 31, 2020, journal entry to record the amortization of the copyright would include:

a. A debit to amortization expense for $1,010

b. A debit to amortization expense for $880

c. A debit to amortization expense for $505

d. A debit to amortization expense for $1,760

b. A debit to amortization expense for $880

On January 1, 2020, Buyer Co. purchased Hawaii Co. for $500,000. However, by the end of 2020, Hawaii Co was not performing as well as expected, and management decided to evaluate the Hawaii reporting unit for impairment. As of December 31, 2020, Buyer Co. had reported total Net Assets of Hawaii Co (including Goodwill) of $450,000. As part of the impairment analysis, Buyer gathered the following data:

Management’s estimated future net cash flows for Hawaii Co: $425,000

Management received recent offer to purchase Hawaii Co: $600,000

CNBC TV analyst’s estimate of the value of Hawaii Co: $400,000

Based on the above information, how much should Buyer Co. record as Goodwill impairment for the year ended December 31, 2020?

a. $0

b. $150,000

c. $50,000

d. $25,000

a. $0

Which of the following would be classified as an “Intangible Asset” on a company’s balance sheet?

a. Copyrights and Trademarks the company purchased from a competitor

b. All of the answers would be considered “intangible assets”

c. Investments purchased in the stock market

d. None of the answers would be considered “intangible assets”

e. Accounts Receivable owed from customers

a. Copyrights and Trademarks the company purchased from a competitor

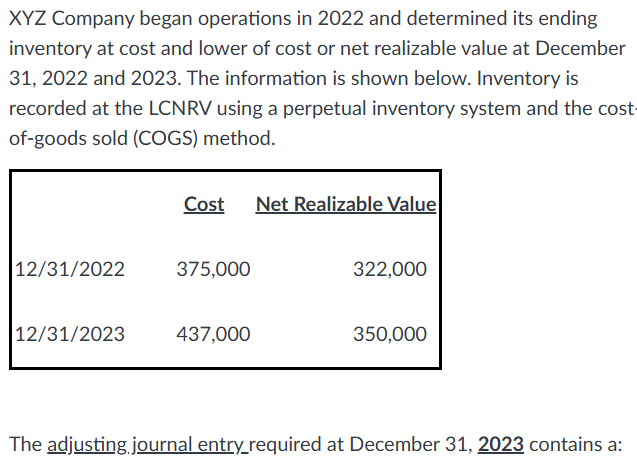

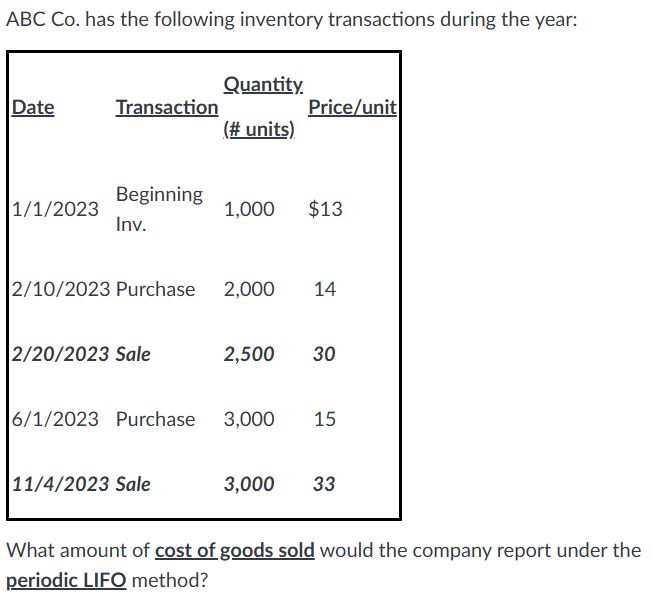

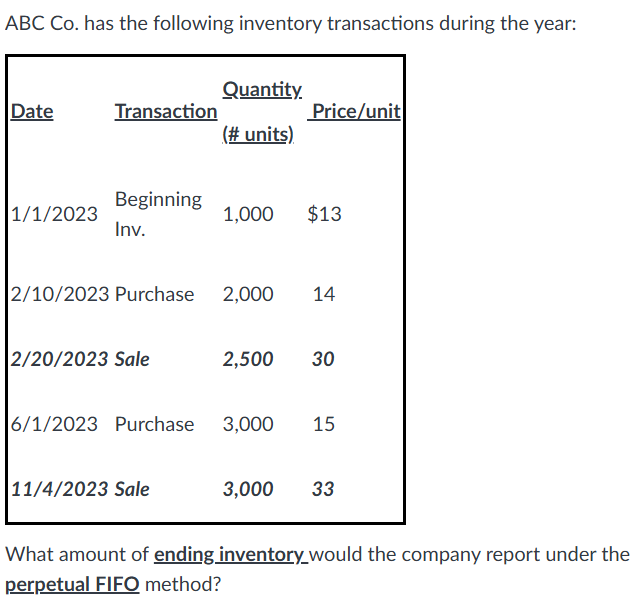

a. Credit to COGS for $34,000

b. None of the answer choices are correct

c. Debit to COGS for $87,000

d. Credit to COGS for $87,000

e. Debit to COGS for $34,000

e. Debit to COGS for $34,000

Which of the following is true for the lower of cost or net realizable value (LCNRV) inventory valuation approach:

a. LCNRV is permitted under U.S. GAAP but not permitted under IFRS

b. Both the “Loss method” and “COGS method” of recording inventory at LCNRV would result in the same ending balance in the Allowance to Reduce Inventory to NRV account

c. The “Loss method” of recording inventory at LCNRV lowers the company’s gross profit margins

d. None of these statements are true

e. All of these statements are true

b. Both the “Loss method” and “COGS method” of recording inventory at LCNRV would result in the same ending balance in the Allowance to Reduce Inventory to NRV account

When inventory is valued at “lower of cost or net realizable value (NRV),” how is NRV determined?

a. Market value – Estimated costs of completion/disposal

b. Historical cost + Estimated costs of completion/disposal

c. None of the answer choices are correct

d. Estimated selling price – Estimated costs of completion/disposal

e. Historical cost – Estimated costs of completion/disposal

d. Estimated selling price – Estimated costs of completion/disposal

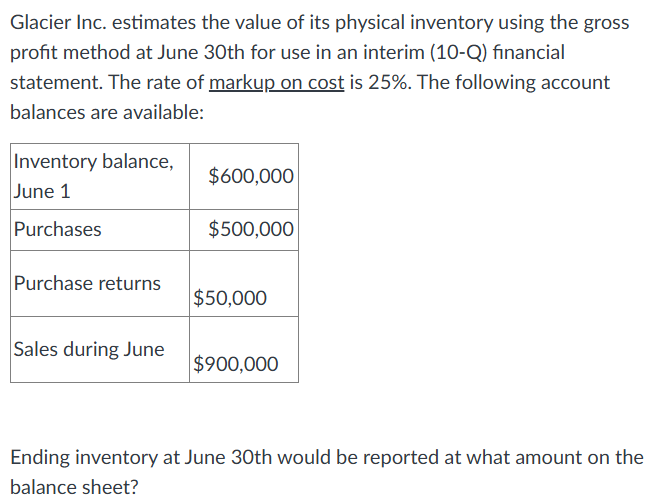

a. $720,000

b. $375,000

c. $330,000

d. $225,000

e. $675,000

c. $330,000

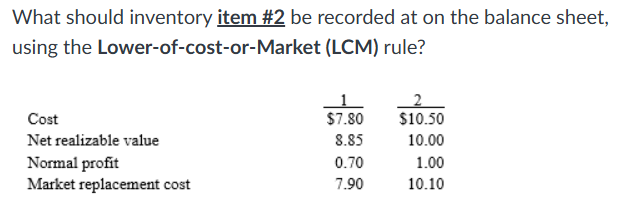

a. $10.00

b. $10.10

c. $10.50

d. $11.00

e. $9.00

a. $10.00

a. $77,000

b. None of the answer choices are correct

c. $86,000

d. $79,500

e. $78,500

d. $79,500

a. $7,500

b. $6,500

c. None of the answer choices are correct

d. $16,500

e. $79,500

a. $7,500

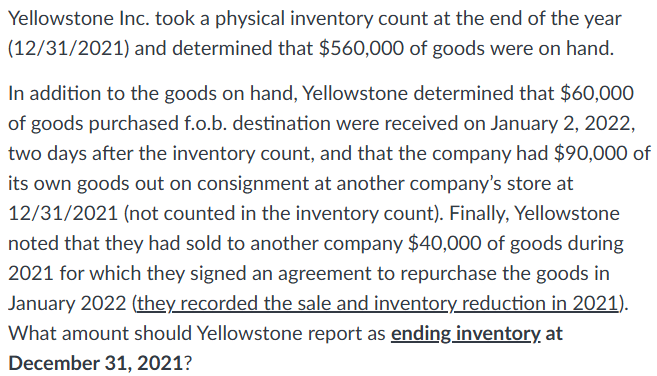

a. None of the answer choices are correct

b. $490,000

c. $690,000

d. $610,000

e. $670,000

c. $690,000

Which of the following three statements regarding Perpetual and Periodic inventory systems is true:

a. None of the statements are true

b. All of the statements are true

c. In a Periodic inventory system, a physical inventory count must be conducted at the end of the period in order for Cost of Goods Sold to be determined

d. In a Perpetual inventory system, a company records all purchases and sales directly through the Inventory account as they occur

e. The Purchases account is only used in a Periodic inventory system

b. All of the statements are true

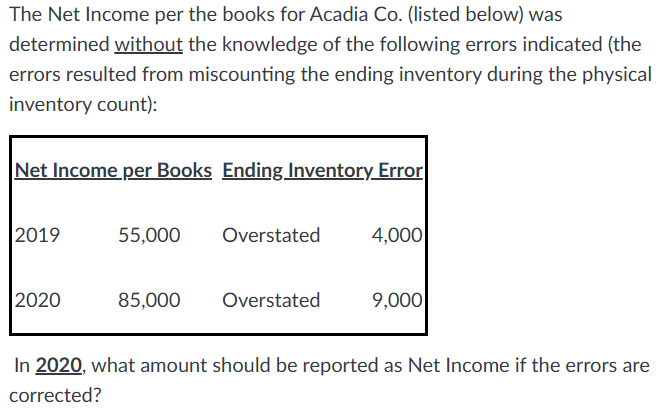

a. $85,000

b. $94,000

c. $76,000

d. $90,000

e. $80,000

e. $80,000

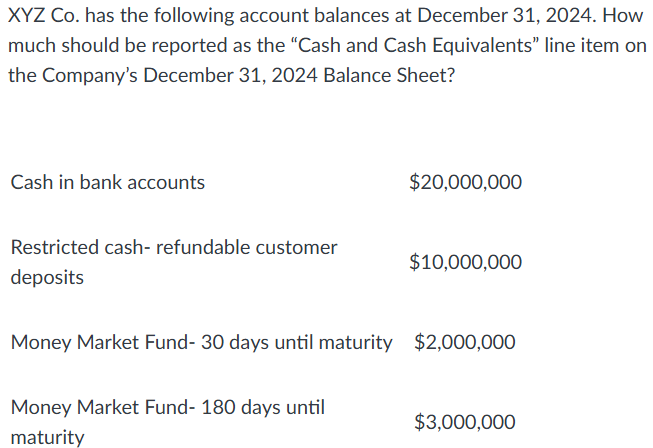

a. $25,000,000

b. $22,000,000

c. $20,000,000

d. $32,000,000

e. $35,000,000

b. $22,000,000

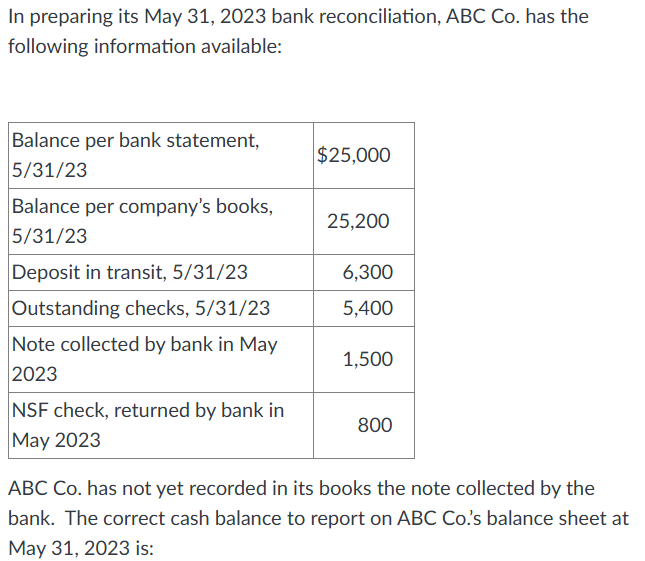

a. None of the answer choices are correct

b. $26,100

c. $25,900

d. $26,800

e. $25,200

c. $25,900

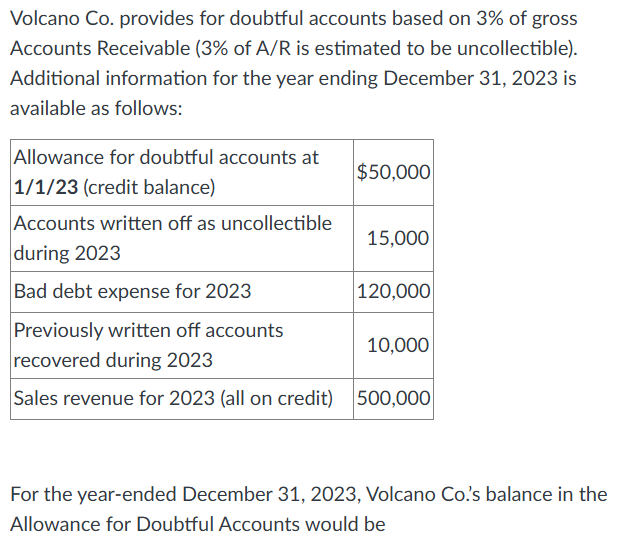

a. $175,000

b. $15,000

c. None of the answer choices are correct

d. $165,000

e. $120,000

d. $165,000

Under the allowance method of accounting for uncollectible accounts receivable, the journal entry to write off a specific account that is deemed uncollectible has what immediate effect (if any) on the financial statements:

a. No effect on the Net Realizable Value of Accounts Receivable

b. Decreases the Net Realizable Value of Accounts Receivable

c. No effect on the Allowance for Doubtful Accounts

e. Increases the Bad Debt Expense

a. No effect on the Net Realizable Value of Accounts Receivable

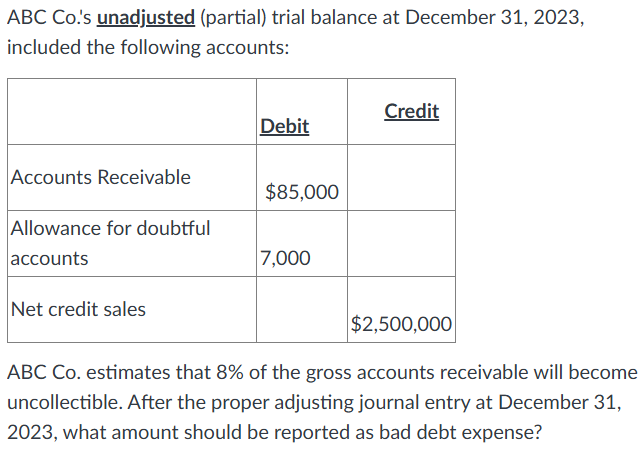

a. None of the answer choices are correct

b. $200

c. $13,800

d. $0

e. $6,800

c. $13,800

The potential capitalization period for interest related to a self-constructed asset begins when the expenditures for the asset have been made.

a. True

b. False

b. False

Companies can capitalize interest for a self-constructed asset, but interest capitalized is limited to the actual interest cost incurred.

a. True

b. False

b. False

Which of the following would not be capitalized as part of a fixed asset addition of equipment?

a. Insurance in transit on the equipment

b. Sales tax paid on the equipment purchase

c. Cost to repair part of the equipment that was dropped during installation

d. All of the above would be capitalized as part of the equipment cost

c. Cost to repair part of the equipment that was dropped during installation

Co. bought and & building for $100k total. Both had BV of $25K, and Land had FMV of $50K & Building’s FMV $75k. What should Co. put land at on the books?

a. 25,000

b. 40,000

c. 50,000

d. 100,000

b. 40,000

Which of the following steps comes first in calculating Ending Inventory under Dollar Value LIFO?

a. Re-inflate the inventory added during the year at its current year cost index

b. Restate ending inventory at end-of-year cost to Ending inventory in terms of base year cost

c. determine the change in ending inventory (EI) at base year cost (EI @ base yr cost-prior year EI @ base year cost)

d. Multiply each inventory layer by the cost index for that layer

b. Restate ending inventory at end-of-year cost to Ending inventory in terms of base year cost

Dollar Value LIFO is acceptable under both U.S. GAAP and IFRS

a. True

b. False

b. False

If the market rate of a note receivable differs from the stated rate, which of the following is true?

a. The difference between present value and face value is ignored.

b. The difference between present value and face value is always a Discount on Notes Receivable

c. The difference between present value and face value could be a discount or premium

c. The difference between present value and face value could be a discount or premium

For Non-interest bearing notes (“zero interest notes”), the face amount is the present value, as there are no periodic interest payments.

a. True

b. False

b. False

A co. wrote off a receivable from a customer. What impact does this have on the financial statements?

a. Increases bad debt expense

b. Decreases the Allowance for Doubtful Accounts

c. Decreases the Net Realizable value of the Receivables

d. Increases the Accounts Receivable balance

b. Decreases the Allowance for Doubtful Accounts

Deposits in transit and Outstanding Checks are common “bank-side adjustments” on a cash reconciliation

a. True

b. False

a. True

Fill in the blanks in the following statement: The ___ (1) ____ has delegated the accounting standard setting process to the ___ (2) ___ and the oversight of audits and audit firms to the ___ (3)___.

a. None of the above combinations is correct

b. (1) SEC; (2) PCAOB; (3) FASB

c. (1) U.S Congress; (2) PCAOB; (3) FASB

d. (1) SEC; (2) FASB; (3) PCAOB

e. (1) FASB; (2) SEC; (3) SEC

d. (1) SEC; (2) FASB; (3) PCAOB

Fill in the blanks in the following statement: U.S. GAAP utilizes five different measurement attributes, but the two most common are historical cost and fair value. Using the historical cost principle is generally considered to be more ____(1)____, which makes it more ___(2)___. Using the fair value principle is generally considered to be more ___(3)___, which often makes it more ___(4)___ for financial statement users.

a. (1) reliable; (2) useful; (3) relevant; (4) verifiable

b. (1) relevant; (2) useful; (3) reliable; (4) verifiable

c. (1) relevant: (2) verifiable; (3) reliable; (4) useful

d. (1) reliable; (2) verifiable; (3) relevant; (4) useful

d. (1) reliable; (2) verifiable; (3) relevant; (4) useful

Which of the following is a method that would be permitted by U.S GAAP in which managers can use to help meet their desired earnings target for the quarter?

a. None of the 3 choices are correct

b. Decreasing discretionary spending, such as advertising expenses, during the reporting period

c. Alter an accounting estimate slightly, but still keep the estimate within the reasonable and appropriate range

d. All three of the choices are correct

e. Delaying the start of a new planned project until the next reporting period

d. All three of the choices are correct

Yosemite Co prepares annual adjusting journal entries on December 31, 2024.

Salaries are paid to employees every Friday for the five-day workweek, ending on that day. On Fridays, Yosemite’s Accounting Department typically debits Salaries Expense and credits Cash for salaries as they are paid to employees. Salaries amount to $10,000/week for all employees. Assume the last day of the accounting period for December 31, 2024 ends on a Wednesday. The adjusting entry includes which of the following?

a. Salaries Expense (debit) $10,000

b. Salaries Payable (debit) $4,000

c. Salaries Expense (debit) $4,000

d. Salaries Payable (debit) $10,000

e. Salaries Expense (debit) $6,000

e. Salaries Expense (debit) $6,000

Yosemite Co prepares annual adjusting journal entries on December 31, 2024.

The Prepaid Insurance account showed a balance of $8,000 at January 1, 2024. Additional Prepaid Insurance costing $10,000 was purchased during the year and was debited to the Prepaid Insurance account when paid. Prepaid insurance remaining (related to future periods) at 12/31/2024 is $7,000. The adjusting journal entry at 12/31/24 should include which of the following?

a. Credit Insurance Expense for $8,000

b. Debit Insurance Expense for $3,000

c. Credit Prepaid Insurance for $11,000

d. Debit Insurance Expense for $7,000

e. Debit Prepaid Insurance for $7,000

c. Credit Prepaid Insurance for $11,000

Yosemite Co prepares annual adjusting journal entries on December 31, 2024.

On October 1, 2024, Yosemite borrowed $5,000 from First Bank by issuing a 5-year, 8% note. Interest is compounded annually and will be paid when the principal is due. Assume the company debited Cash and credited Note Payable on October 1 for the entire amount of the note. If Yosemite failed to record the annual adjusting journal entry at 12/31/24 related to this transaction, what would the effect of this error be on the 12/31/24 financial statements?

a. Liabilities would be understated by $100

b. Liabilities would be understated by $400

c. Net Income would be understated by $400

d. None of the above answer choices are correct

e. Net Income would be understated by $100

a. Liabilities would be understated by $100

Yosemite Co prepares annual adjusting journal entries on December 31, 2024.

On August 1, 2024 Yosemite received an upfront payment of $12,000 from a client for a 1-year service contract, which began on August 1, 2024. Assume Yosemite provides the services evenly by month. The company debited Cash and credited Service Revenue for the full amount on August 1, 2024. At 12/31/24, what is the balance in the Unearned Revenue account after the appropriate adjusting entry was made?

type answer

7000

Yosemite Co prepares annual adjusting journal entries on December 31, 2024.

On January 1, 2024, Yosemite bought $5,000 in office supplies they expected to use during the year. On January 1st, they debited the Office Supplies account for the purchase. During the year, they used $3,000 of the office supplies. The adjusting journal entry at 12/31/24 should include which of the following?

a. Credit Office Supplies for $2,000

b. Debit Office Supplies Expense for $3,000

c. Debit Office Supplies Expense for $2,000

d. Debit Office Supplies for $2,000

b. Debit Office Supplies Expense for $3,000