Jesus Emmanuel God With US! Valuation Stifel

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

What are the 3 major valuation methodologies?

Comparable Companies, Precedent Transactions and Discounted Cash Flow Analysis

When would you NOT use a DCF in a Valuation?

You don’t use a Discounted Cash Flow model if the company at hand has unstable or unpreditcable cash flows. Examples would be early bio-tech start ups.

You also don’t use a Discounted Cash Flow model in Valuation if debt and working capital serve a fundamentally different role, for examples banks and financial institutions use debt in different way

What other Valuation methodologies are there?

Liquidiation Valuation - valuing a company’s assets, assuming htey are sold off and then subtracting liabilities to determine how much capital. if any equity investors would receive

Replacement Value - Valuing a company based on the cost of replacing its assets

Leverged Buyout Analysis (LBO) - Determining how much a PE firm could pay for a company to hit a target IRR, usually in the 20-25% range

Sum of the Parts - Valuing each division of a company separately and adding them together at the end

Future Share Price Analysis - Projecting a company’s share price based on the P/E multiples of public company comparables then discounting it back to the present value

When would you use a Liquidation Valuation?

Usually you would use a Liquidation Valuation in Bankruptcy Scenarios to see if equity shareholders would receive any capital after a company’s debts have been paid off.

It’s often used to advise struggling businesses whether its better to sell off assets separately or try and sell the entire company.

When would you use Sum of the Parts?

Usually for large conglomerates like General Electric, where each division is highly unrelated and separate.

General Electric ended up spliting into General Electric Vernova, General Electric Aerospace, and General Electric Healthcare

When do you use an LBO Analysis as part of your Valuation?

Whenever you’re looking at a leveraged buyout and trying to establish how much a private equity firm should pay for your company and also when you’re trying to set the “floor” on a possible Valuation for the company you’re analyzing.

What are the most common multiples used in Valuation?

The most common multiples used in valuation are:

EV (enterprise value)/Revenue

EV/EBIT

P/E

P/Book Value

*p meaning price

What are some examples of industry-specific multiples?

Technology: EV/Unique Vistors (Traffic)

Infrastructure Projects: EV/ Annual Traffic (for planes and toll roads)

For Hospitals: EV/Occupied Beds

*For Safety Enterprise value to human traffic specific to the enteprise

When you’re looking at an industry specific multiple such as EV/Scientists or EV/subscribers, why do you use Enterprise Value rather than Equity Value?

You use Enterprise Value rather than Equity Value because those scientists or subscribers are available to all investors in a company both equity holders and debt holders.

Obviously you need to think through the multiple and see which investors the particular metric is available to. *this logic may not apply to everyone

Would a LBO or DCF give a higher valuation?

While it could go either way, in most cases a DCF model will give the higher valuation.

This is because in a DCF model you account both the company’s cash flows between its beginning and terminal values.

Meanwhile in an LBO you don’t get any value from the cash flows in between a company’s first year and final, you only value it based on its terminal value.

NOTE: Unlike a DCF, an LBO model itself does not give a specific valuation. Instead you set a desired IRR and determine how much you would be willing to pay for the company based on the desired IRR.

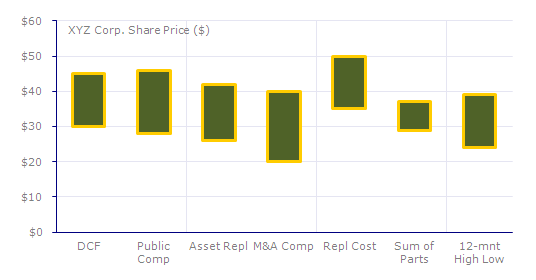

How would you present these different Valuation methodologies to a company or its investors?

I would use a “football field” chart where I’d show the valuation range implied by each methodology

How would you value an apple tree?

The same way I would value a company, by looking at the value of the apple tree’s future cash flows from the apples it will produce and discounting it to the present as well as by comparing it to similar apple trees that are already valued.

Why can’t you use Equity Value/EBITDA rather than EV/EBITDA?

Its because EBITDA is available to all investors in the company not just equity holders. And likewise Enterprise Value is available to all investors both debt holders and equity holders.

If you were to use Equity Value/EBITDA you’d be comparing apples to oranges because Equity Value does not reflect the company’s entire capital structure, it only reflects the part available to equity investors.

When would a Liquidation Valuation produce the highest value?

While this is uncommon, it could happen if a company had hard assets that the market was severely undervaluing due to a specific reason such as (cyclicality).

As a result the other methodologies of Comparable Companies and Precedent Transactions would likely produce lower values as well, and so Liquidation may give a higher value than these other methodolgies.

Lets go back to 2004 and look at Facebook back when it had no profit and no revenue. How would you Value it?

You would use Comparable Companies and Precedent Transactions and look at more “creative” multiples such as EV/Unique Vistors rather than EV/EBITDA or EV/Revenue.

You can’t use a DCF because cash flows for an early tech-start up are unstable.

KNOW THIS

What would you use alongside Free Cash Flow Multiples, Equity Value or Enterprise Value?

Well it depends.

If its Unlevered Free Cash Flow, you would use EV but for Levered Free Cash Flow you would use Equity Value.

*REMEMBER: Unlevered Free Cash Flow excludes Interest and thus represents money available to all investors

Levered Free Cash Flows already includes interest and the money is therefore only available to Equity Investors.

You rarely use Equity Value/EBITDA but are there any cases where you might use Equity Value/Revenue?

Though rare in comparing multiple financial and non-financial companies you may want to use Equity Value/Revenue.

However you’d still be using other multiples like P/E and P/BV

How do you select Comparable Companies / Precedent Transactions?

The 3 main ways to select companies and transactions would be:

Industry classification

Financial criteria and similarities (in areas like Revenue and EBITDA)

Geography

For Precedent Transactions you usually want to look at transactions that have occured within the last 2 years.

And for Comparable Companies (comps) Methodology the business model may be use as a criteria.

Examples for Comparable Company Filter: US Water Utilities Companies with EBITDA above $30 Million

Precedent Transaction Filter: Utilities Mergers & Acquisitions within last 2 years involving sellers generating at least $30 Million in EBITDA

How do you apply the 3 valuation methodologies to actually get a value for the company you’re looking at?

You take the median multiple from a set of companies or transactions

You find your company’s own relevant metric

Then multiply the median multiple it by the relevant metric you’re basing your valuation on

Example:

You find the median in the set of comparable companies’s EV/EBITDA multiples to be 8x

You find your companies's EBITDA is $500 Million

You multiply 8 by $500 Million and get a Enterprise Value of $4 Billion

What do you actually use a Valuation for?

You use a Valuation to put a concrete “price tag” on a business or asset so you can make informed decisions.

You usually use a Valuation in pitch books and in client presentations when you’re explaining to the company what they should expect for their own valuation.

Valuations are also used in a Fairness Opinions, which are documents a bank creates that proves the value their client is paying or receiving is “fair” from a financial point of view.

Why would a company with similar growth and profitability to its Comparable Companies (comps) be valued at a premium?

Well there’s various reasons for something like that:

The company may have a competitive advantage not reflected in its financials such as new tech patent or other IP (intellectual property).

It may be a market leader and have greater market share than its competitors.

It may have just won a favourable ruling in a lawsuit.

The company may have just had an earnings report well above expectations and so stock price may have risen recently.

What are the flaws with public company comparables?

In general no company is 100% comparable to another company

Public Company Comparables are determined by the Public Market. And the stock market is "emotional” and full of irrational investors so multiples may not accurately reflect the company.

And small companies are usually under the radar and less thoroughly analyzed.

How do you take into account a company’s competitive advantage in a valuation?

You could:

Look at the 75th percentile for the multiples when comparing rather than the medians

You can add premium to the multiples

You can make more optimistic projections

Do you ALWAYS use the median multiple of a set of public company comparables or precedent transactions?

While you usually do, if the company you’re valuing is not performing well and is at a competitive disadvantage you may want to use a lower percentile like the 25th percentile rather than the median multiple in comparison.

You mentioned that Precedent Transactions usually produce a higher value than Comparable Companies - can you think of a situation where this is not the case?

While usually Precedent Transactions produce a higher value than Comparable Companies if there hasn’t been a public M&A but plenty of smaller private transactions then the Precedent Transactions may produce a lower value than CC

What are some flaws with Precedent Transactions?

Well Past Transactions are rarely 100% comparable - the transaction structure (debt and capital structure), size of the company, and competitiveness of bidding are never 100% the same

Additionally data on precedent transactions is generally more difficult to find, though tools like PitchBook have made it slightly easier.

Two companies have the exact same financial profile and are bought by the same acquirer, but the EBITDA multiple for one transaction is twice the multiple of the other transaction - how could this happen?

Possible Reasons:

It could be that the bidding process for one company was more competitive and so the EV multiple was higher

It could be that one company recently faced bad news like unfavourable litigation and so it was acquired at a discount.

Why does Warren Buffet prefer EBIT multiples to EBITDA multiples?

Warren Buffett dislikes using EBITDA multiples because he feels like its unrealisitcally excluding major Captial Expenditures and giving a false idea of how much cash the company is actually using to finance their operations.

In some industries like manufacturing the gap between EBIT and EBITDA is very large.

EV/ EBIT, EV/EBITDA, and P/E multiples all measure a comapny’s profitability. What’s the difference between them, and when do you use each one?

P/E depends on a company’s capital strcuture

While EV/EBITDA and EV/EBIT are Capital Structure-Neutral

You’d use P/E for banks and financial institutions where interest payments are critical.

You would use EV/EBIT in industries where captial expenditures are large and you’d use EV/EBITDA in industries where capital expenditures are relatively smaller

If you were buying a vending machine business, would you pay a higher multiple for a business where you owned the machines and they depreciated normally, or one in which you leased the machines? *The cost of depreciation and lease are the same dollar amounts and everything else is held constant.

You would pay more for the company where you lease the machines.

This is because while the EV would be the same

in the company where you buy the machines the depreciation cost would not be reflected in the EBITDA and so the EBITDA would be higher, making the EV/EBITDA multiple lower.

However in the company where you lease the machines, the the lease would be reflected in SG&A which would be reflected in the EBITDA and reduce it making the EV/EBITDA multiple higher.

How would you value a private company?

You would use the same methodologies as with public companies: Public Company Comparables, Precedent Transactions, and DCF. However there are some differences:

You would likely discount the public company comparables 10-15% (or maybe more) because the private company you’re valuing is not as “liquid” as the public comps

You’d also probably estimate the WACC based on the public comparables’s WACC for the DCF

Why might we discount public company comparable multiples but not precedent transaction multiples?

Because in precedent transactions you’re acquiring the entire company, and so all shares become illiquid when its acquired. In precedent transactions illiquidity is already factored in.

But in public company comparable multiples you can buy “pieces” of the company or “shares” not the whole and they can be liquid or illiquid

Can you use private companies as part of your valuation?

Yes, but only in the context of precedent trasactions.

It would make no sense for them to be included in public company comparables or as part of the Cost of Equity/WACC calculation in a DCF because these formulas rely on public market inputs not deal multiples

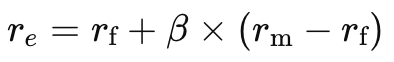

Cost of Equity

Cost of equity is equal to the risk free rate + beta * risk premium