Market research

1/121

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

122 Terms

What is market research?

Process of systematically collecting, analyzing and interpreting information about people / companies, market, product, or service

Why is market research important?

To understand customers, target market, industry, competitors

To make better decisions on strategy, operations, customer, products and services

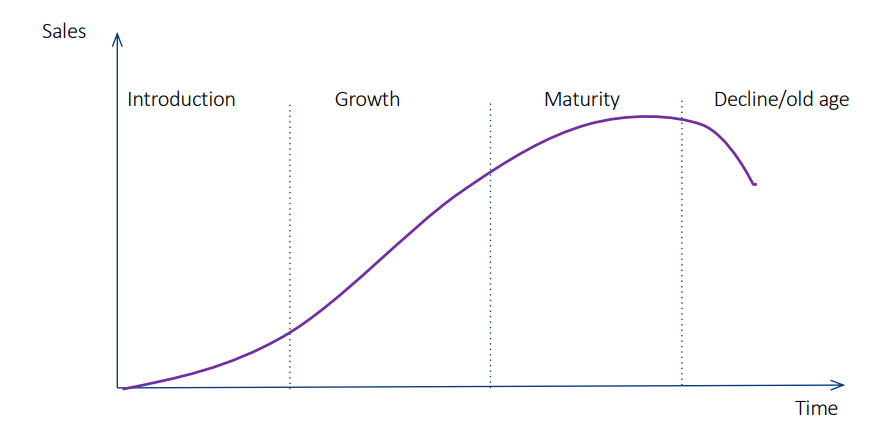

Product life cycle

INTRODUCTION • market potential assessment • needs analysis • price evaluation • competition analysis

GROWTH • distribution analysis • promotion research • customer satisfaction assessment • analysis of use and attitudes

MATURITY • brand positioning • market segmentation • market potential assessment • market monitoring

OLD AGE • Rejuvenate product • New markets • New features • Repositioning

Common types of market research

Market segmentation

Brand position

Customer satisfaction and loyalty

Optimum pricing

New market

New product

Advertising effectiveness

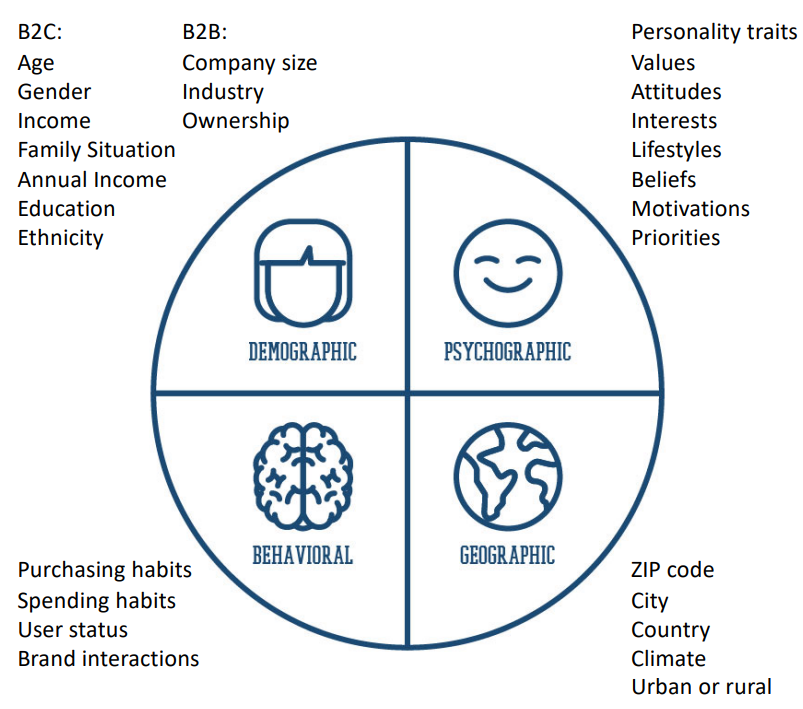

Market segmentation

helps to efficiently target marketing resources and messaging at specific groups of consumers

Segmentation bases: 4 primary categories

Demographic, psychographic, behavioral, geographic

Quant method

Rely on large samples

Representative sample important

Typically: conduct qual or exploratory research before designing main questionnaire

Multivariate techniques (cluster and factor analysis)

Purchasing data analytics

other kinds of web-based data, incl. social media

Survey questionnaire

• Contains as many descriptive/profiling questions as possible

• Question types well suited for cluster and factor analysis

Market segmentation tips

Clear objective – “how will the client be able to use this information?”. Make sure segments are easy to understand

• Good segments are distinct, recognizable, durable, sizeable, actionable, optimally sized and numbered.

Monadic testing

each respondent offered one design and asked for feedback (for brand positioning)

Brand health monitoring

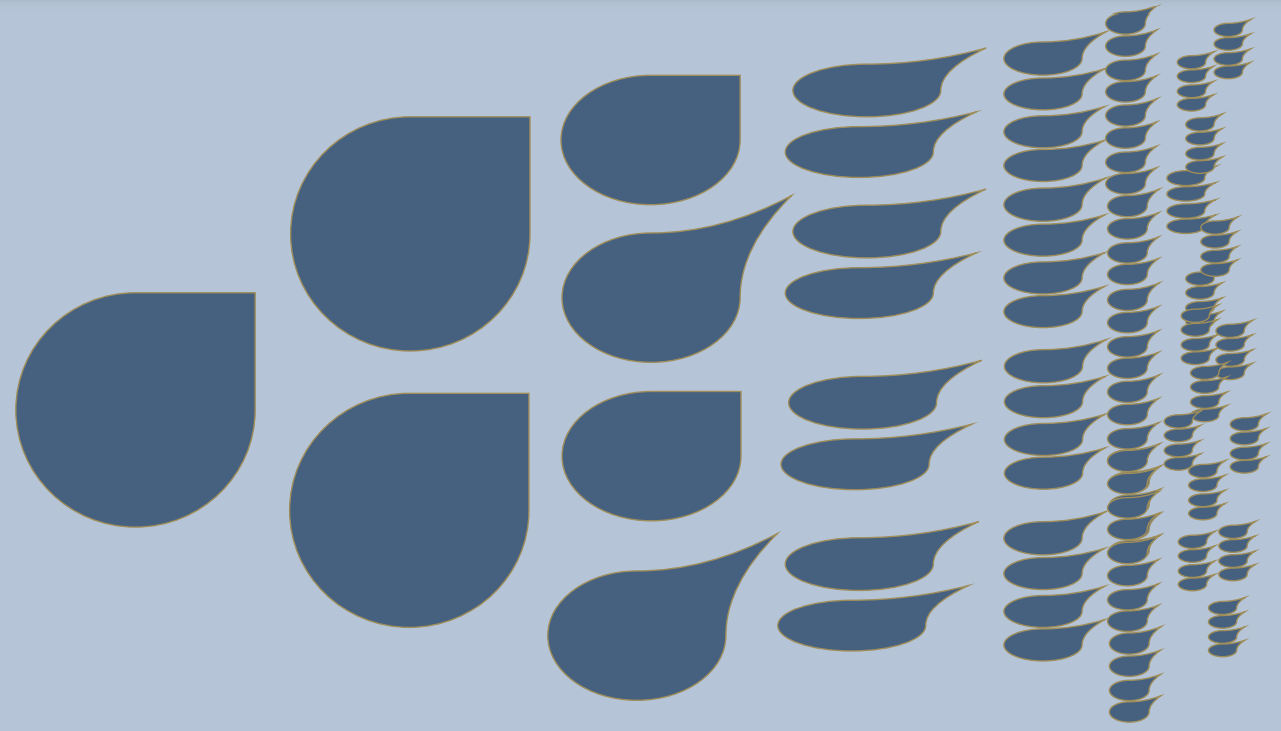

Awareness • Unaided: top-of-mind awareness, unprompted, spontaneous • Aided: prompted, provide the respondent a list of choices • Brand recall: ability to remember the brand

Familiarity (of those aware)

Consideration (of those familiar)

Use/purchase • As main brand • As another, secondary brand used

Advocacy / loyalty • Net promoter score (NPS): ”On a scale of 0-10, how likely are you to recommend [brand] to your family and friends?”

![<p><strong>Awareness</strong> • Unaided: top-of-mind awareness, unprompted, spontaneous • Aided: prompted, provide the respondent a list of choices • Brand recall: ability to remember the brand </p><p><strong>Familiarity</strong> (of those aware)</p><p><strong>Consideration</strong> (of those familiar) </p><p><strong>Use/purchase</strong> • As main brand • As another, secondary brand used </p><p><strong>Advocacy / loyalty</strong> • Net promoter score (NPS): ”On a scale of 0-10, how likely are you to recommend [brand] to your family and friends?”</p>](https://knowt-user-attachments.s3.amazonaws.com/80b06df2-bd36-46a7-945e-795d79c2e271.jpeg)

Methods to study satisfaction and loyalty

• Sales volumes

• Customer complaints

• Anecdotal feedback

• Reviews

• Social media and blogs

• Quant survey

• Robust samples

• Target audience (all customers incl. unsatisfied, lost, potential)

Net Promoter Score (NPS)

“How likely is it that you would recommend [Organization X/Product Y/Service Z] to a friend or colleague?

Customer Satisfaction (CSAT)

“How would you rate your overall satisfaction with the [goods/service] you received?”; only responses of 4 (satisfied) and 5 (very satisfied) are included in the calculation of CSAT

![<p>“How would you rate your overall satisfaction with the [goods/service] you received?”; only responses of 4 (satisfied) and 5 (very satisfied) are included in the calculation of CSAT</p>](https://knowt-user-attachments.s3.amazonaws.com/9525924b-f221-41d3-b549-dbc0784caff2.jpeg)

Why study demand side optimum price?

Understand the market’s willingness to purchase

Capture the highest return on the investment

Understand the psychologically optimal price

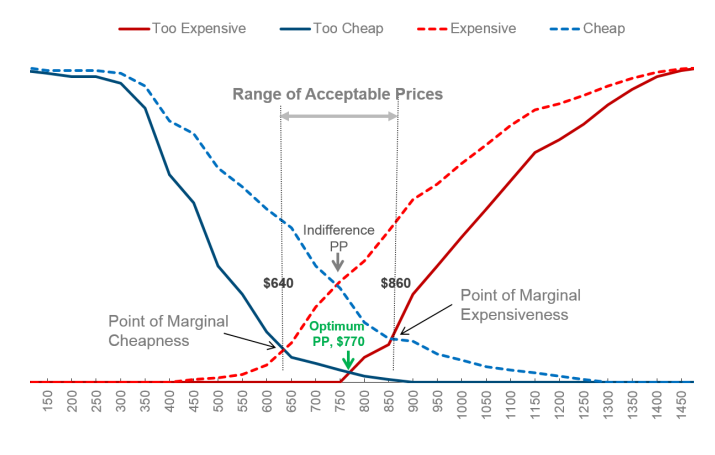

Van Westendorp’s Price Sensitivity Meter

Direct pricing research that constructs a range of acceptable prices for a given product.

Done by asking 4 questions about price

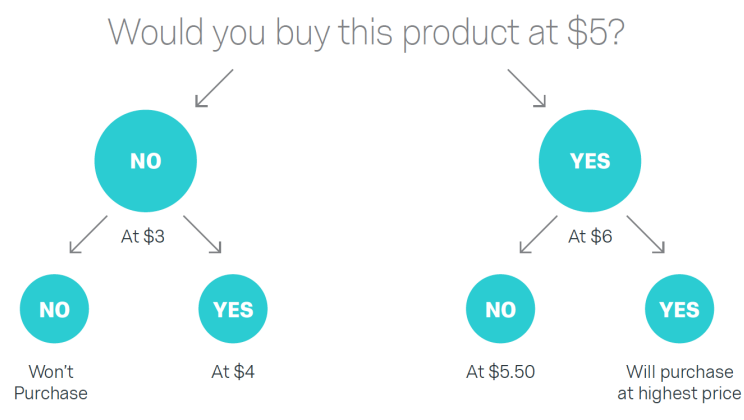

Gabor-Granger Direct Pricing Technique

Type of direct pricing that asks respondents if they would purchase a product or service at a specific price.

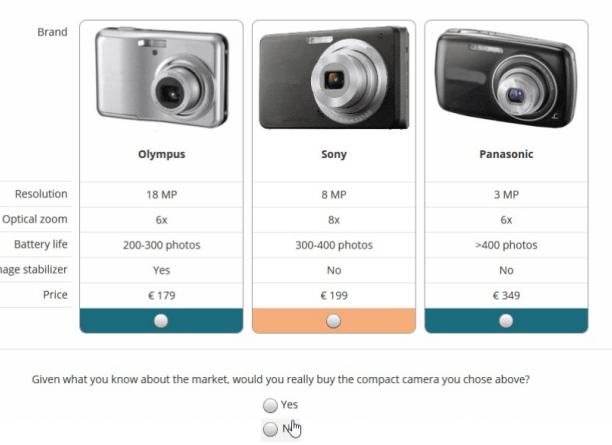

Conjoint Analysis

Measuring the value that consumers place on features of a product or service

Gives respondents a choice of two to five product configurations and asks them to choose one of the configurations

New market

Establish opportunities in new market and provide insights for successful entering

Information to be obtained:

• Size and nature of the opportunity

• total available market-segment/target market size

• Market threats, growth and trends

• Competitive landscape

• Structure of supply chain

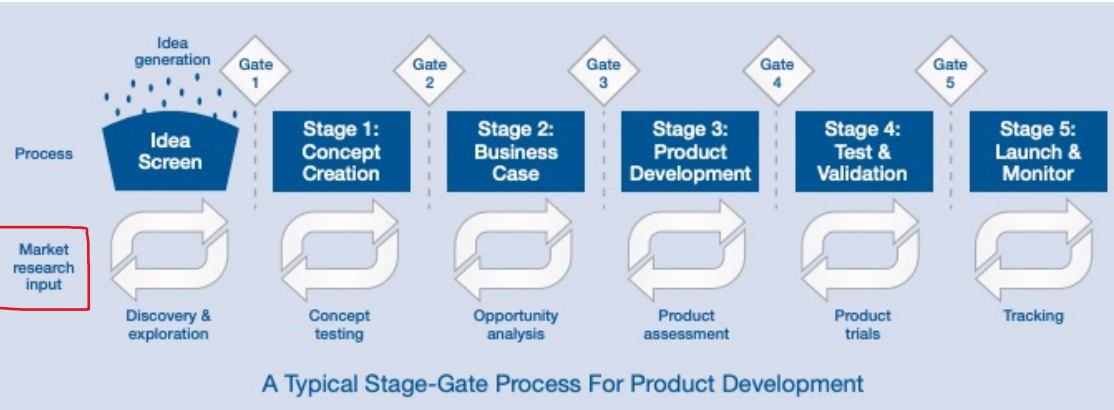

Stage-gate process idea-to-launch

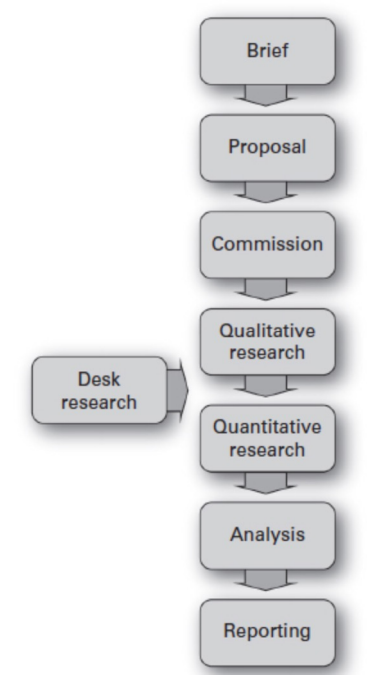

Market research process

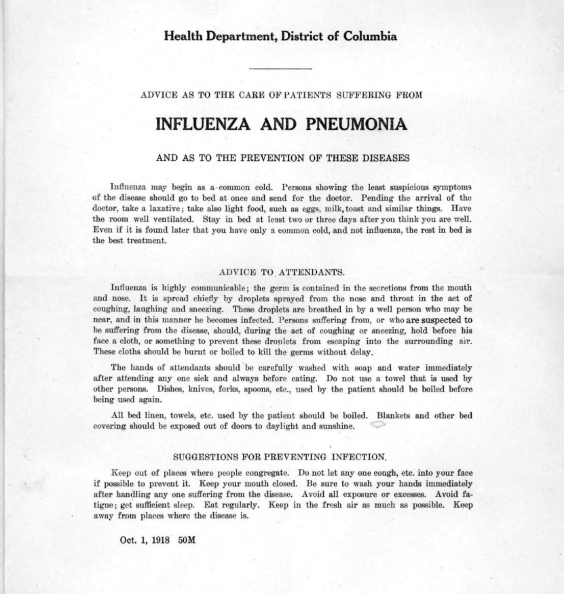

GDPR: General Data Protection Regulation

Personal data / personally identifiable information: information that relates to a person and allows him/her to be identified.

Case of email addresses

What is qualitative research?

• Group of scientific methods

• Gather non- numerical (== qualitative) data

• Differs by discipline, purpose

• Often used to exploratory research

Qualitative research to explore:

• The what, why and how

• Experience, meaning and perspective

• Beyond numbers

• How and why of behavior and thinking • Groups and individuals

Models: qualitative methods (6)

Phenomenological

Ethnographic

Grounded Theory

Case Study

Historical

Narrative

Phenomenological (qualitative method)

how any one participant experiences a specific event

Ethnographic (qualitative method)

immersion in culture/ group (testing products personally or in beta groups before release)

Grounded Theory (qualitative method)

why a course of action evolved the way it did (satisfaction surveys)

Case Study (qualitative method)

in-depth look at test subject (marketing to new clients)

Historical (qualitative method)

describes past events in order to understand present patterns and anticipate future choice (previous ad campaigns to find most effective campaign)

Narrative (qualitative method)

compiles information over extended periods of time ( define buyer personas to identify innovations that appeal to target market)

Card sorting

AIM: Gain insights into how potential consumers perceive, categorize, and prioritize

What: asking users to organise information into logical groups

Why: trends, categories How users understand it

Example: sorting coursemates, who are holding signs with animal names

Priming

Exposure to stimulus influences response

Often without participant noticing

Can be by design

Perceptual, semantic, conceptual

Positive and negative

Objectivity in research

There is no such thing as a neutral question

Question influences answer

Interviewer influences answer

People think !== people do

Answer is then interpreted

IMPARTIALITY IS THE AIM

Semantic (related to priming)

relating to meaning in language or logic

Cat → Tiger

Associative (related to priming)

Cat → Dog

When to use interviews?

Learn about group/ community

Validate results

Explore topics

Semi-structured interviews

Interview == script + toolkit

Your script = introduction + questions

Steps of interview

Steps 0 and 1: thinking and research (know what you want, see what was done before)

Step 2: preparation

Step 3: Recruit participants (Sampling, Information, Ethics)

Step 2: preparation of interview

Know what you want : your script

Have a plan: • Who will you interview? • Why interview? • How much time you spend on an interview? • Where will interviews take place?

Sampling

Quantitative: the aim is to generalize

Qualitative: provide in-depth understanding, target: group, type of individual, event, process

Quota sampling

Participant quotas before sampling

Meet certain characteristics (age, sex, class, marital status, health condition)

non-probability sampling technique

sample has the same proportions of individuals and the population ( traits, researched phenomenon)

USE TO: • observe relationships between subgroups • sample a subgroup that is of interest to the research

Quota sampling step-by-step

1. Divide population into exclusive groups

2. Identify proportion of subgroups in population (then apply in sampling process)

3. Select subjects from subgroups taking proportions above into consideration

4. Ensure sample is representative

Snowball sampling

• Referrals

• Recruit participants that are otherwise hard to reach

• Rare or limited

• Small subgroup of population

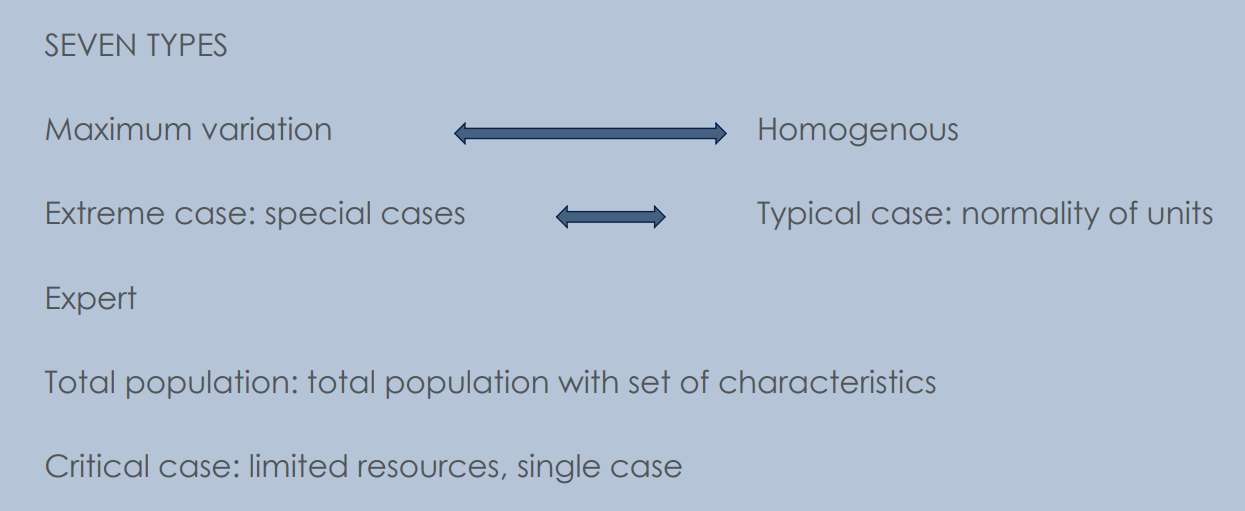

Purposeful sampling

Expert sampling

Particular expertise

Exploratory phase of research: highlight new areas what you did not think of

Used when lack of empirical evidence, uncertainty

Research findings will take a long time

Maximum variation

Heterogeneous

Capture wide range of perspectives related to your topic

Looking for : variation in opinions/ views/ perspectives/ understandings

Capture typical and extreme

Capture conditions == people, cases, companies, events

Looking at: experiences, qualities, situations, behaviors, incidents

Introducing your research

- Introduce yourself

- About research/ project

- How the interview will go (structure, questions, length)

- What your expectations are

- Why this is important

- How you will treat their data

Tips for interview questions

Open ended: you want as long an answer as possible

Don’t ask them to analyze, that is your job

Focus on their views, not views of other people they may know

Be aware of boundaries: personal – professional

Don’t ask to predict the future

Don’t use abbreviations/ jargon

Do be prepared to challenge what was said

Focus groups

Group; focused on one topic

Facilitator/ moderator (moderating methods: Standard, Dual, Fencing, Respondent)

Discussions are planned

Allows different perspective

Be aware of group dynamics

Interaction between participants; participant - interviewer

Size of focus group: 6-12

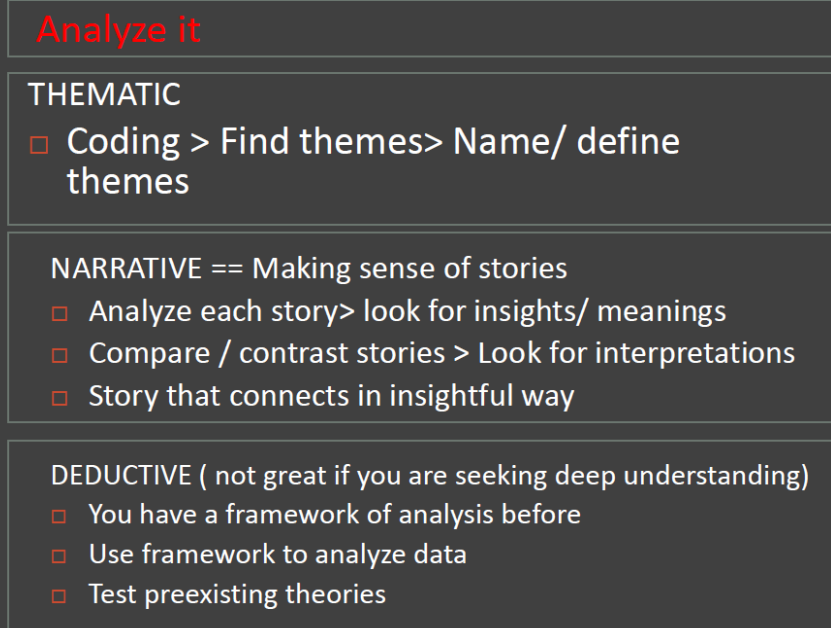

What to do with data?

The key elements of experiments

Goals

Systematic learning

Measurability

Scalability

Limited time-frame

Goals (The key elements of experiments)

clear goal with regard to:

i) the concrete learning outcome of the specific experiment and

ii) the broader societal challenges that the experiment is intended to contribute to solving

Systematic learning (The key elements of experiments)

Clear plan on:

i) how knowledge is gathered during the experiment

ii) where, to whom this knowledge is communicated.

Learning is also dependent on pre-determined evaluation criteria that enables one to draw conclusions on the basis of the experiment. If the experiment does not go as planned, the hypothesis is proven to be wrong, the experiment has not failed, since it has enabled learning.

Measurability (The key elements of experiments)

To enable systematic learning, experiments should be assessed on the basis of clear and specific evaluation criteria, remaining open to failure.

Scalability (The key elements of experiments)

While experiments should be implemented on a selected sample before scaling, there should be a clear and realistic plan on how an experiment, if proven successful, will be scaled - how the policy that has been tested in the experiment will be scaled in practice

Limited time-frame (The key elements of experiments)

An experiment should be limited to a specific period of time and have a predetermined end date.

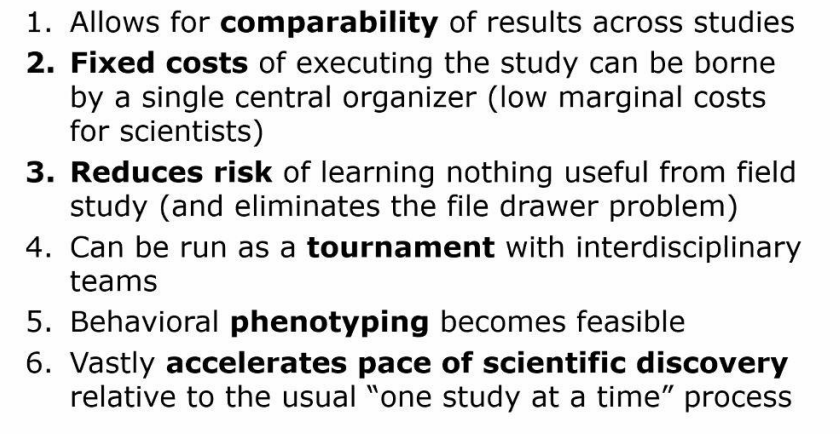

Mega study

a massive field experiment in which many different treatments are tested synchronously in one large sample using a common, objectively measured outcome

Benefits of megastudy approach

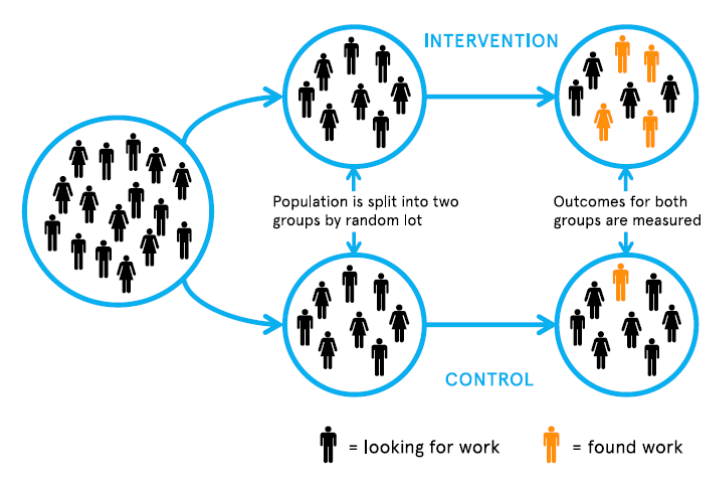

RANDOMIZATION

As a method of experimental control has been extensively used in human clinical trials and other biological experiments.

It prevents the selection bias and insures against the accidental bias.

It produces the comparable groups and eliminates the source of bias in treatment assignments.

Finally, it permits the use of probability theory to express the likelihood of chance as a source for the difference of end outcome

Randomized controlled trial

Technicalities to keep in mind when running experiments

Is random random? No selection bias? No differences in sociodemographic background?

Sample size, the bigger the better (identifying small vs large effects!)

What caused the effect? Have you controlled for other variables? Use regressions instead of comparing mean values.

If RCT not possible, compare the “before” (control/benchmark) and “after” (test) but make sure other factors are not influencing the results (seasons, holidays, trends, inflation etc.)

Incrementality (marketing)

Refers to additional sales caused by media exposure

A/B (or multi-variate) testing

great for isolating incremental sales / brand lift for individual digital campaigns

hard to aggregate or to use for non-digital channels

Econometric / regression / marketing mix modelling

great for aggregating incremental sales across all channels

can only be used with sufficient scale, not fast/granular enough for in-flight optimizations and relies on longer historic periods

Regular / direct / last click based attribution results

instantly available at no cost, most granular / frequent

can be highly inaccurate, so should be taken with a pinch of salt

Frequency =

Impressions / Reach

(expressed as total or weekly frequency for longer campaigns)

CPM =

(Cost per Mille)

how much does it cost to serve 1,000 impressions?

Cost / Impressions * 1,000

CTR =

(Click-through rate)

how often do impressions lead to link clicks?

Clicks / Impressions

CPC =

(Cost per Click)

how much does it cost to deliver one link click

Cost / Clicks

CVR =

(Conversion rate from click)

how often do link clicks lead to conversion?

Conversions / Clicks (Link clicks only)

CPA =

(Cost per Acquisition)

Cost / Conversions

best used when you don’t have conversion value

ROAS=

(Return on Advertising spend)

Conversion value / Spend

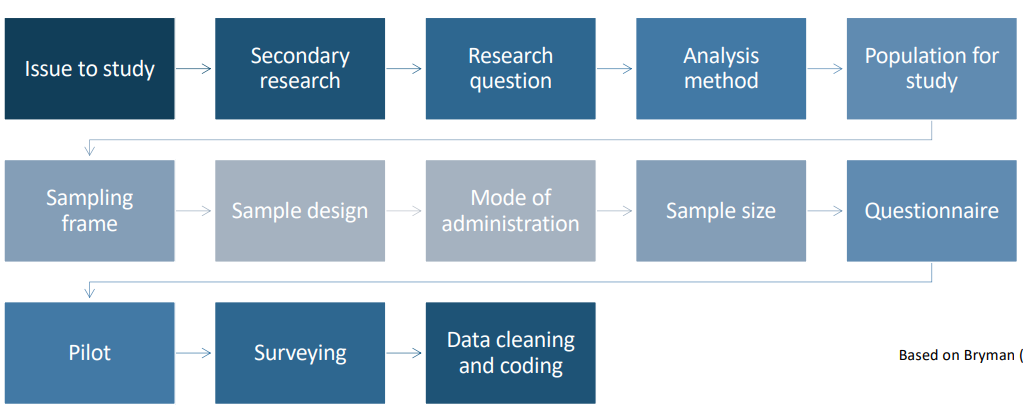

Surveying

data collection from a predefined group of respondents to collect quantitative information

Cross sectional surveying

observation of individuals at one specific point in time

Longitudinal surveying

the same survey run repeatedly in specific time intervals

Panels (repeated surveying)

observing the same individuals over a study period

Steps in conducting a survey

Census vs sample survey

Census: obtains data from every member of a population but cost and/or time required

Sample survey: obtains data from a subset of a population

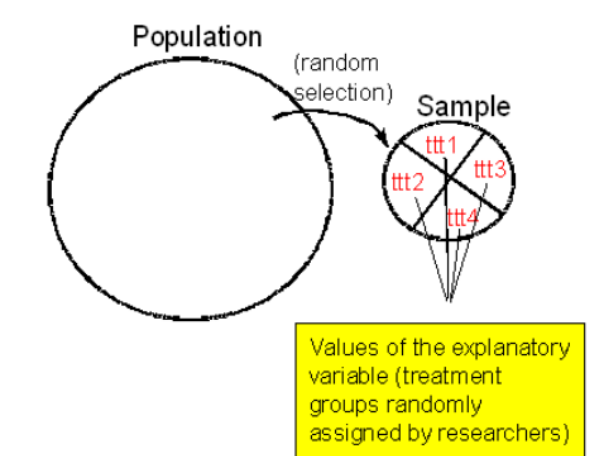

Probability sampling (sampling strategy)

each population element has an equal and known (non-zero) chance of being chosen for the sample

Random chance for everyone of the target population to be included

Best chance to create a sample that is truly representative of the population

Can conduct if you have full list of units – individuals, companies, households, employees, clients, etc

Non-probability sampling (sampling strategy)

we do not know the probability with which each population element will be chosen, and/or we cannot be sure that each population element has a non- zero chance of being chosen

Used if you have no resources (list or access) to conduct probability sampling

Selection of individuals into the sample happens by choice, not by random chance

Main disadvantage : does not allow you to estimate the extent to which sample statistics are likely to differ from population parameters

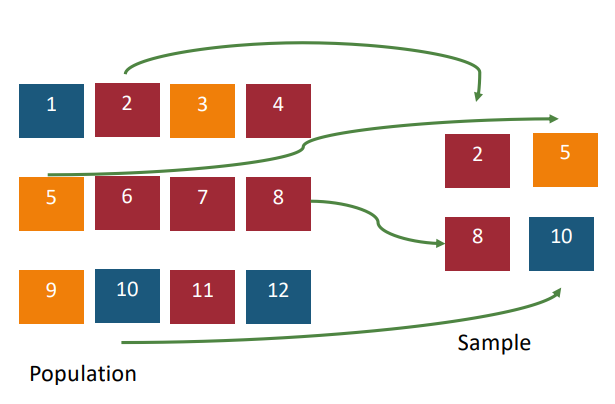

Simple random sampling

Key: every sample is equally likely

Strategy: choose/generate random numbers; draw from a hat etc.

Example: lottery

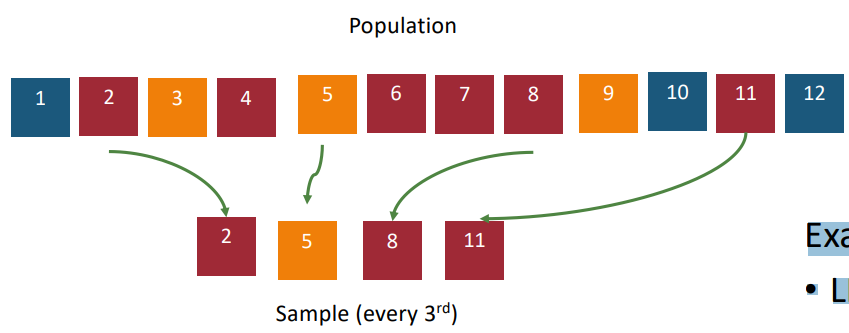

Systematic random sampling

Key: population is conveniently ordered

Strategy: calculate k=N/n, then choose every kth starting at random point between 1 and k

Example: • LFS • EU-Silc

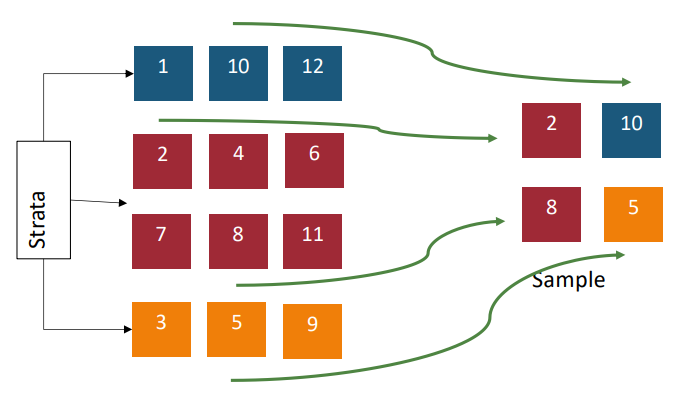

Stratified sampling

Key: sample needs to be chosen according to some characteristic

Strategy: sort population according to the characteristic, then randomly choose a proportional number from each category

Example: • Stratification by gender, nationality, company size

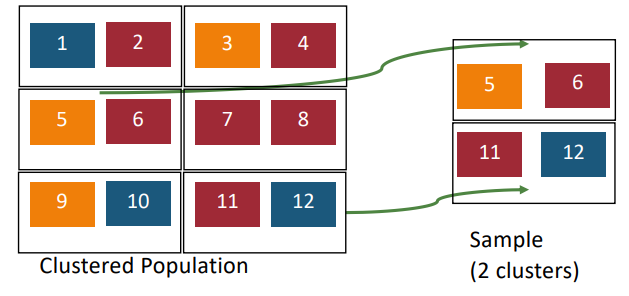

Cluster sampling

Key: population is grouped into clusters which each represent the population

Strategy: randomly choose an appropriate number of clusters

Example: • Health literacy research

Types of non probability samples

Voluntary sample-made up of people who self-select into the survey

Convenience sample-made up of people who are easy to reach

Snowball sample-a kind of convenience sample, when researcher makes initial contact with small group of people and then use these to establish contact with others

Quota sampling-produces a sample that reflects population in terms of certain characteristics (gender, age, nationality etc.)

How to ‘verify’ a non-prob sample?

1. Analyse descriptives & compare to target population

2. Think through and account for potential sources of bias with regards to your RQ • Do you have reasons to suspect that the bias will affect results in a specific way?

3. Martin & Bateson (1986) method for checking adequacy of sample: the split half-half analyis for consistency- Randomly divide sample in halves and analyse them separately. If conslusions from two sets are consistent, the samples are good, if conclusions differ – need more data / different sample

How small a sample is big enough?

Build up from sub-groups of your interest- Smallest sub-group should be 30-50

400-500 is typically large enough sample for a customer survey-produces results within 95% confidence level

Precision / reliability of estimates increase rather steadily up to 150- 200 observations increasing sample size

1000 is a standard offered by market research companies

Most important biases in survey research

1. Researcher bias

2. Poor match of the sample to the population

3. Lack of randomness/response bias

4. Cognitive biases (questionnaire)

Behavioral questionnaire

Observed by researchers

Watch customers / users do things

The most precise account of behaviour

A/B tests = experiments, Observations

Attitudinal questionnaire

Self-reported by users

Ask customers / users questions

What people think

When behaviour is impossible to observe, needed for buiding buyer personas

Surveys, Interviews, Focus groups

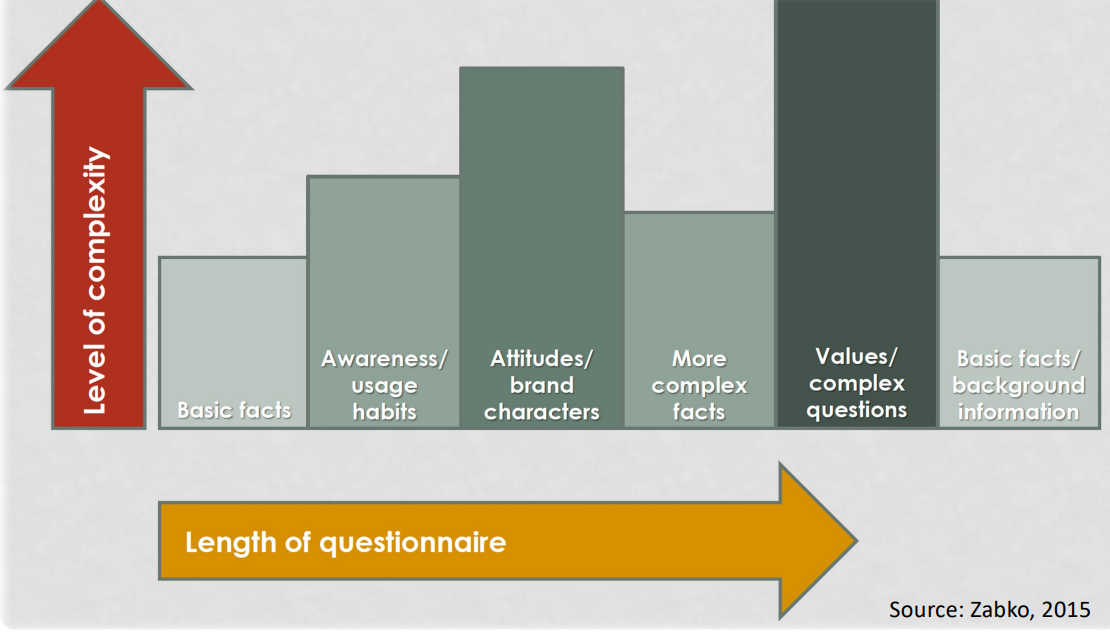

Sequencing questions

Principles of question design: Measurement rules

As accurate scale as possible- you always have a possibility to make more detailed scale to less accurate one, but never – vice versa. Eg. Age in full years vs age brackets

List of responses (scale) has to be-mutually exclusive, collectively exhaustive (all potential answers are listed)

Measurement scale asks too much effort to respond?- “Total number of employees vs brackets of number of employees”

Sensitive questions strategies

• Provide context, guarantee anonymity

• Positioning of questions

• Careful wording (but don’t be abstract and don’t leave space for interpretation)

• Question loading (normalise any behaviour)

• Ask about the neighbour (indirect inquiry)

"non-attitudes" or "pseudo-opinions" mitigation solutions

Knowledge Questions

Include a "Don't Know" Option (+/-)

Filter Questions

Vignettes

Probe for Certainty

Post-Survey Weighting

Social Desirability & Conformity bias

Tendency to modify behavior or opinions to fit societal norms or expectations.

Influenced by desire for social acceptance and fear of rejection.

Yea Saying and Acquiescing bias

Tendency to agree or comply without questioning or opposing.

Telescoping bias

The tendency to remember events as more recent than they actually were, leading to an inaccurate perception of time sequence.

Order Effects bias

The tendency for the order of presentation to influence decision-making or judgment