ECON200 Exam 2 (Chapters 7-14)

1/77

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

78 Terms

Utility

A measure of the amount of satisfaction a person derives from something

Revealed preference

People’s preferences can be determined by observing their choices and behavior

Utility function

A formula for calculating the total utility that a particular person derives from consuming a combination of goods and services (called a bundle of commodity)

Marginal utility

The change in total utility from consuming an additional unit of a good or service

Principle of diminishing marginal utility

The additional utility gained from consuming successive units of a good or service tends to be smaller than the utility gained from the previous unit or service (basically the more you have of something, the more your utility goes down)

Budget constraint

Provides all possible combinations of goods and services a consumer can buy for a given income

Income effect

When consumption changes from increased effective wealth due to a lower price

Substitution effect

The change in consumption that results from a change in the relative price of goods

Altruism

A motive for action in which a person’s utility increases simply because someone else’s utility increases

Reciprocity

Responding to another’s action with a similar action.

Information asymmetry

When one person knows more than the other person in an agreement

Adverse selection

Occurs prior to completing an agreement when buyers and sellers have different information about the quality of a good or the riskiness of a situation

Market failure

The economic situation defined by an inefficient distribution of goods and services in the free market

Moral hazard

The tendency for people to behave in a riskier way or to renege on contracts when they do not face the full consequences of their actions after an agreement has been made (based on ACTIONS)

Screening

Reveals private (not personal) information

Signaling

Taking action to reveal one’s own private information

Reputation

If interactions occur multiple times, parties can use their past history to indicate that the other party has full information

Statistical discrimination

Generalizing based on observable characteristics to fill in missing information

Regulation

The government requires information disclosure or requires participation in an active market

Behavioral economics

Studies why individuals appear to act irrationally by studying insights from psychology

Time inconsistency

The tendency for individuals to change their preferences over time, and this leads to inconsistent decision-making.

Commitment device

Can be used to help fulfill a plan for future behavior that would otherwise be difficult

Sunk cost fallacy

Many times individuals remain engaged in an activity even though the benefit of continuing is less than the opportunity cost, especially if a cost was incurred to engage in the activity

Game theory

This studies how people behave strategically under different circumstances

Game

Any situation that requires two or more people who have to think strategically

Three features of games

Rules, strategies, and pay-offs

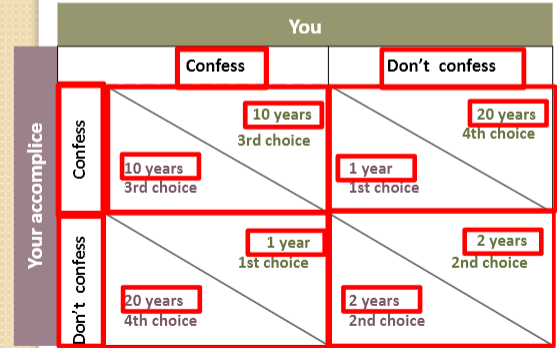

Prisoners dilemma

A one-time game of strategy in which two people in isolation make the choice to ‘confess’ or ‘don’t confess’ that together they committed a crime

Dominant strategy

The strategy that is the best one for a player to follow, no matter what strategy the other player chooses

Nash equilibrium (non-cooperative)

A concept in game theory where no player has an incentive to change their strategy, given the strategies of the other players. It is a stable outcome where no player can improve their payoff.

Commitment strategy

An agreement to submit to a penalty for defecting to obtain a certain outcome

Tit-for-tat

One player does the same action as the other did in the previous game

First-mover advantage

The player who chooses first gets the higher payoff

Backward induction

Determining optimal strategies by working backwards, by looking at the last choices

Profit Equation

Total revenue - Total Cost

Total Revenue Equation

Price x Quantity

Total cost

The amount that a firm pays for inputs used to produce goods or services (Fixed costs + Variable costs)

Fixed costs

Does not depend on the quantity of the output produced, can be on-going payments such as rent, or a one-time cost

Variable costs

Costs that depend on the amount of outputs being produced, increase with each additional unit produced

Explicit costs

Costs that require a firm to spend money

Implicit costs

These costs represent opportunities that could have generated revenue if the firm had invested its resources in another way

Accounting profits

Total revenue - explicit costs

Economic profits

Total revenue - explicit costs - implicit costs

Production function

The relationship between the quantity of inputs and the resulting quantity of outputs

Marginal product

The increase in output that is generated by an additional unit of input

The principal of diminishing marginal product

The marginal product of an input EVENTUALLY decreases as the quantity of an input increases

Average product

Total production divided by the number of workers

Average fixed cost (AFC)

Fixed cost / Quantity

Average variable cost (AVC)

Variable cost / Quantity

Average Total Cost (ATC)

Total cost / Quantity (AFC + ACV)

Marginal cost

Change in total cost / Change in quantity

Short-run

Period of time in which at least one factor of production is fixed, resulting in limited flexibility to adjust output levels.

Long-run

A period of time in which all inputs can be adjusted, allowing a firm to change its scale of production and make long-term decisions to maximize profits.

Economies of scale

As output increases, the average total cost decreases

Diseconomies of scale

The average total cost increase when production increases

Constant returns to scale

When the average total cost does not depend on the quantity of output

Efficient scale

When the average total cost is at its minimum

Characteristics of a competitive market

Buyers and sellers are price-takers

Standardized goods

Firms freely enter and exit the market

Full information exists

Market power

When a buyer or seller has the ability to noticeably affect market prices

Demand Curve in a Perfectly Competitive Market

Horizontal Line (demand is the same as price)

Average Revenue Equation

Total Revenue / Quantity Sold

Marginal revenue

The change in revenue after selling one more unit of a good (same as price in a p.c.m)

Profit-maximizing quantity

The quantity of output where a firm maximizes its profit by producing the level of output where marginal revenue equals marginal cost (MC = MR)

Competitive (socially optimal) price

Price = Marginal Cost (P = MC)

Non-competitive market

Firms in these types of markets can charge a price above the marginal cost

If P < AVC…

A firm should shut down.

If P > AFC+AVC…

A firm is making profit, keep producing

If P<AFC+AVC, but P > AVC

The loss per unit is less than the fixed cost. So the total loss is less than fixed cost. Keep producing in the short run.

Monopoly

A firm that is the only producer of a good that has no close substitutes (Perfect monopoly = controls entire market, and Monopoly power = manipulates the price)

Barriers to entry

Scare resources

Government intervention

Economies of scale

Aggressive business tactics

Natural monopoly

A market where a single firm can produce the entire quantity demanded in market at a lower cost than multiple firms

Monopoly demand curve

Downward sloping

Quantity effect

Total revenue increases after producing an additional unit (___ effect)

Price effect

Total revenue decreases after producing an additional unit

You have market power when…

Price is GREATER than marginal cost (P > MC)

Problems with monopolies

Monopolies charge a price higher than the socially optimal level

Monopolies produce less than the socially optimal level

Monopolies generate deadweight loss

Public policy responses to monopolies

Anti-trust laws

Public ownership

Vertical Split

Regulation

Do nothing

Price discrimination

The practice of charging customers different prices for the same good

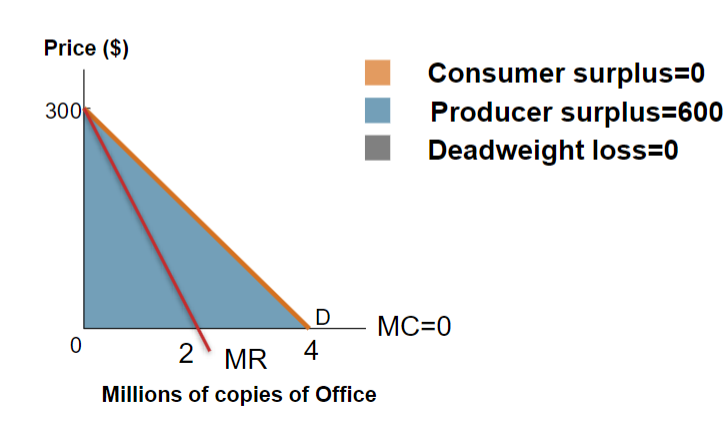

Perfect price discrimination

All producer surplus, no consumer surplus