Principles of Financial Accounting Finals (Part 2)

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

44 Terms

Inventory concepts

Inventory is property held for sale in the normal course of business

Manufacturing firms have:

Raw materials inventory

Work in process inventory

Finished goods inventory

Different industries have different types of inventory

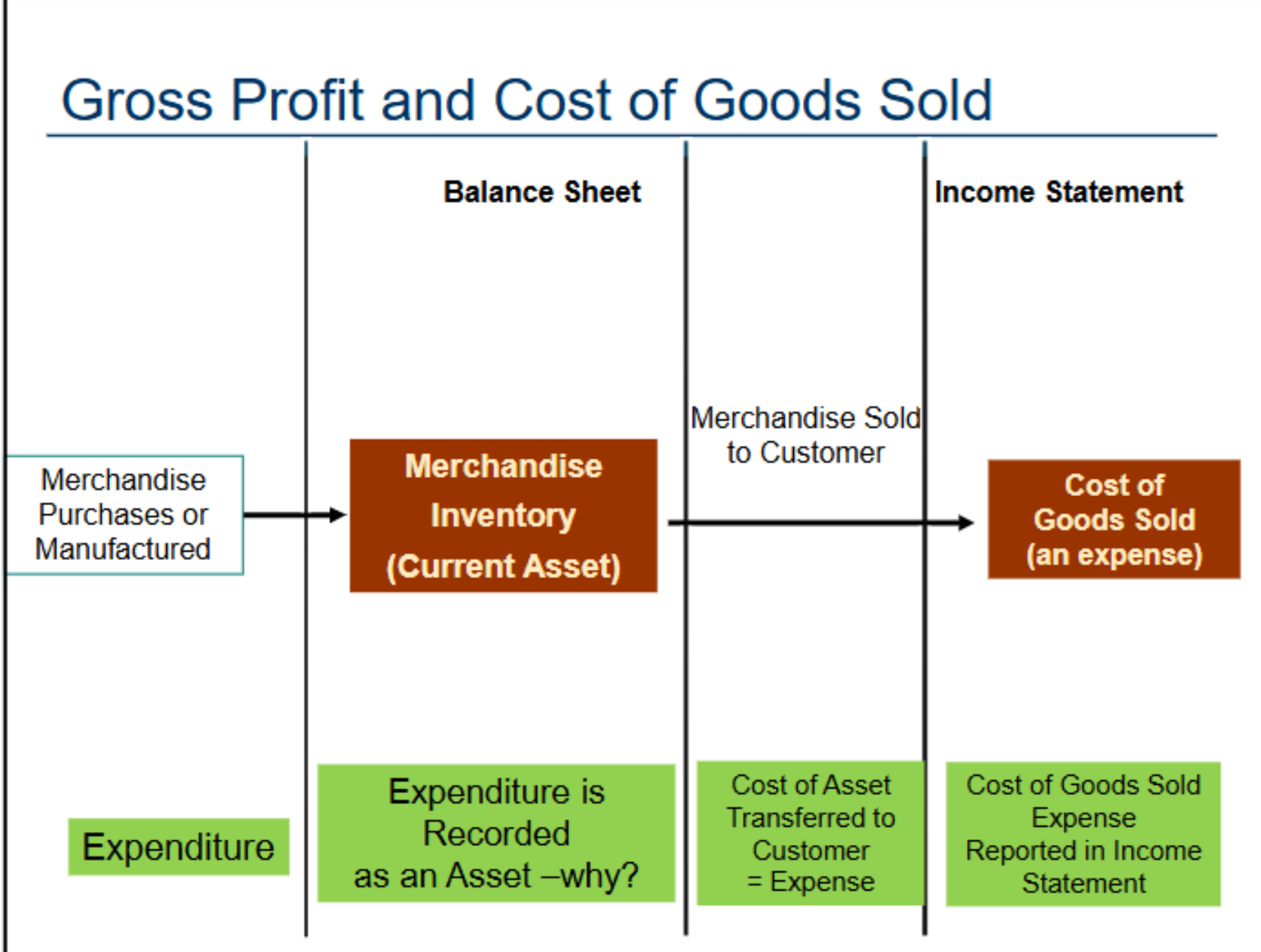

Gross profit and cost of goods sold

Expenditures for products manufactured or expenditures for goods purchased for sale

Expenditure → inventory (current asset)

When the products are sold

Cost of inventory sold → cost of goods sold (expense)

Gross profit = net sales - cost of goods sold

Net income = gross profit - expenses

Perpetual inventory basis vs periodic inventory basis

Perpetual inventory basis

Cost of goods sold recorded for each sale

Purchases of inventories are recorded directly in an inventory account

Inventory balance is reduced by cost of each sale

Information on cost of goods sold and ending inventory updated continuously, perpetually

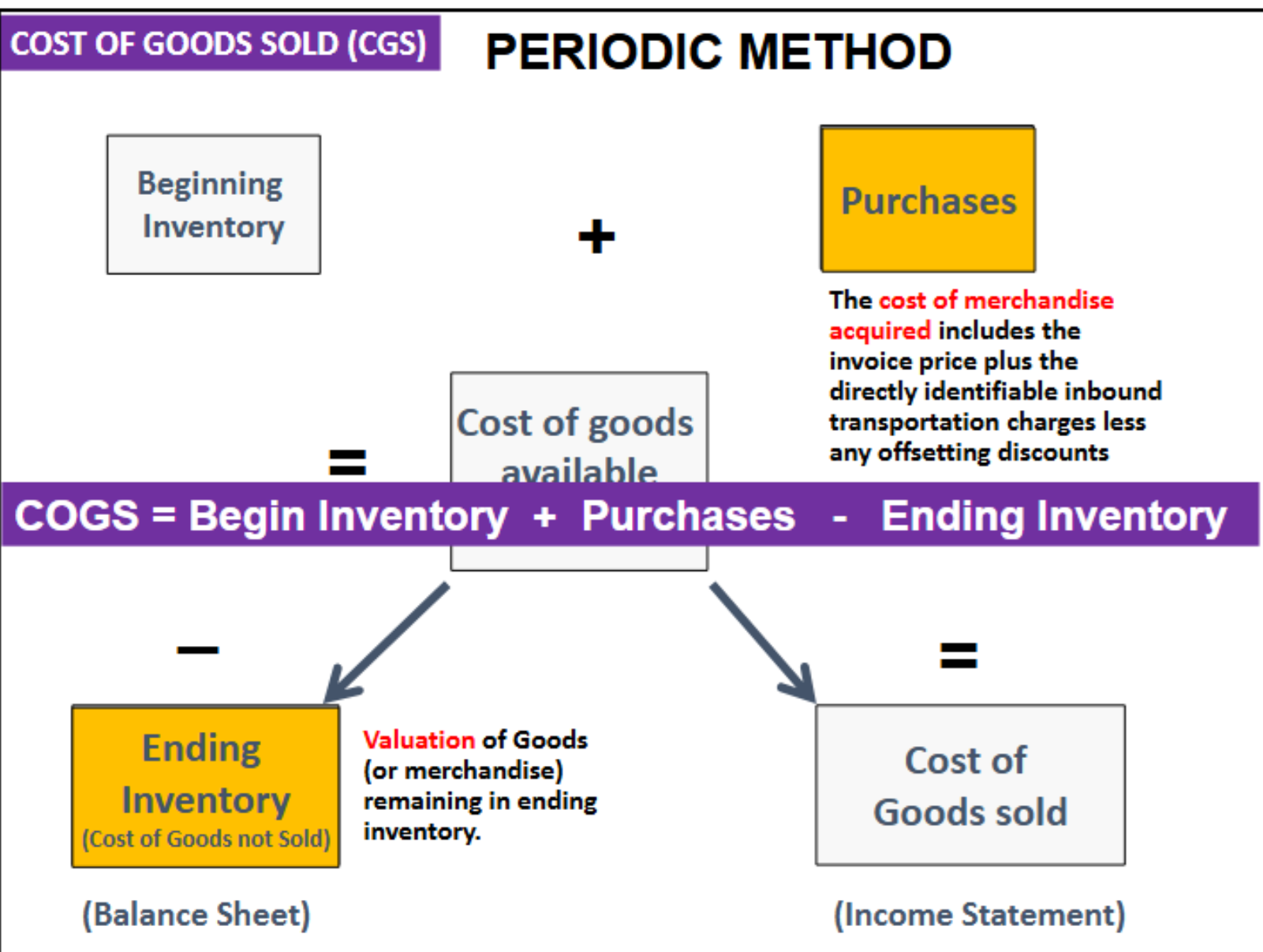

Periodic inventory basis

Cost of goods sold is calculated at the end of period using cost of goods sold equation after a physical count of unsold inventory

Inventory purchases are initially debited to an account called purchases

No up-to-date record of inventory is maintained during the period

Information on cost of goods sold and ending inventory updated only at the end of the period

Periodic method

GOGS = cost of beginning inventory + cost of merchandise acquired/purchases - cost of ending inventory

Cost of goods available = beginning inventory + purchases

*Cost of beginning inventory:

How much inventory you had in the beginning of a period

*Cost of merchandise acquired/Purchases: The cost of merchandise acquired includes the invoice price plus the directly identifiable inbound transportation charges less any offsetting discounts

How much inventory you bought

*Ending inventory (balance sheet): Cost of goods not sold. Valuation of goods (or merchandise) remaining in ending inventory

How much inventory you have left, leftover from beginning inventory

*Cost of good sold (income statement)

Cost principle

The cost of any asset is the sum of all the costs incurred to bring the asset to its intended use

Purchase price

Shipping cost (freight-in)

Insurance in transit

If manufacture yourself, include material, labor and overheard

Footnote disclosure

Cost of goods sold:

Total cost of products sold including freight expenses associated with moving merchandise inventories from our vendors to our distribution centers

Cost of services provided

Physical inventory losses

Markdowns (LCM - later)

Costs associated with operating our distribution network, including payroll and benefit costs, occupancy costs, and depreciation

Freight expenses associated with moving merchandise inventories from our distribution centers to our retail stores

Valuation of ending inventory

Ending inventory = beginning inventory + purchases - units sold

Beginning inventory of 2,000

Purchased 4,000 and then purchased 1,000 on a different day

Sold 4,000

2,000+4,000+1,000-4,000

There are different methods to compute COGS and the value of ending inventory allowed by GAAP:

1) First-in, first-out (FIFO) cost

2) Last-in, first-out (LIFO) cost

3) Weighted-average cost

FIFO

FIFO assigns the cost of the earliest acquired units to cost of goods sold

The cost of the newer units is assigned to the units in ending inventory

FIFO provides inventory valuations that closely approximate the actual market value of the inventory balance sheet date

Sells the old/cheaper inventory → low COGS → high profit → higher taxes

Oldest costs (earliest purchases) → cost of goods sold

Recent costs (latest purchases) → ending inventory

LIFO

LIFO assigns the most recent cost to cost of goods sold

LIFO provides an income statement perspective in that net income measured using LIFO combines current sales prices and current acquisition costs

THE IRS requires companies that use LIFO for tax purposes to also use it for financial reporting purposes

Sell sells the expensive new/latest inventory → high COGS → low profit → lower taxes

Recent costs (latest purchases) → cost of goods sold

Oldest costs (earliest purchases) → ending inventory

Weighted average method

Disregards beginning/ending inventory

Weighted average method = Cost of available for sale / Units

Comparing FIFO and LIFO methods

Summary of income effects: when inventory unit costs are increasing

FIFO:

Highest ending inventory

Lowest COGS

Highest gross profit

Highest pretax income

Highest income tax

LIFO:

Lowest ending inventory

Highest COGS

Lowest gross profit

Lowest pretax income

Lowest income tax

Summary of income effects: when inventory unit costs are decreasing

FIFO:

Lowest ending inventory

Highest COGS

Lowest gross profit

Lowest pretax income

Lowest income tax

LIFO:

Highest ending inventory

Lowest COGS

Highest gross profit

Highest pretax income

Highest income tax

Adjusting from LIFO to FIFO inventory amounts

Facilitate comparisons across firms with different inventory valuation methods

Use a disclosure called LIFO Reserve to restate LIFO inventories and income statement to FIFO

US GAAP: LIFO firms have to disclose LIFO reserve in their financial reports

LIFO Reserve = FIFO inventory amount - reported LIFO inventory amount

Difference between FIFO and LIFO inventories amounts

FIFO inventory amount = reported LIFO inventory + LIFO Reserve

Adjusting from LIFO based income statement to FIFO income statement

LIFO reserve = FIFO inventory valuation - LIFO inventory valuation

Beginning LIFO reserve = FIFO beginning inventory - LIFO beginning inventory

FIFO beginning inventory = LIFO beginning inventory + beginning LIFO reserve

Ending LIFO reserve = FIFO ending inventory - LIFO ending inventory

FIFO ending inventory = LIFO ending inventory + ending LIFO reserve

FIFO COGS = FIFO beginning inventory + purchases - FIFO ending inventory

FIFO COGS = LIFO COGS - change in LIFO reserve (fix pretax income under FIFO)

FIFO beginning inventory = LIFO beginning inventory + beginning LIFO reserve

FIFO ending inventory = LIFO ending inventory + ending LIFO reserve

Change in LIFO reserve = ending LIFO reserve - beginning LIFO reserve

Converting LIFO gross profit to FIFO gross profit

FIFO gross profit = LIFO gross profit + change in LIFO reserve

Valuation at lower of cost or market

Ending inventory is reported at the lower of cost or market (LCM)

Market cost

Replacement cost of inventory

The current purchase price for identical goods

Net sales price of damaged or obsolete inventory

Holding loss:

Difference between purchase cost and the lower market cost

added to the cost of goods for the period

Gross profit percentage/gross margin percentage

Gross profit percentage = gross profit/net sales revenue

*A 36% gross profit means that each dollar of sales generates 36 cents of gross profit and the goods cost the seller 64 cents

Rule of thumb: compare the company’s gross profit percentage with the industry average or that of another competitor. Also compare to historical gross profit percentages. A small downturn may signal an important drop in net income.

Inventory turnover

Measures how many times a company has sold and replaced inventory during a given period. Indicates how efficient a firm is managing its inventory. Higher inventory turnover is better.

Inventory turnover = sales revenue / average inventory OR COGS / average inventory

Note can use COGS instead of sales. More accurate because sales includes a markup over inventory cost.

Normally industries that have high profit margins have lower turnover and industries with low profit margins have higher turnover

Day to sell inventory = 365 / inventory turnover

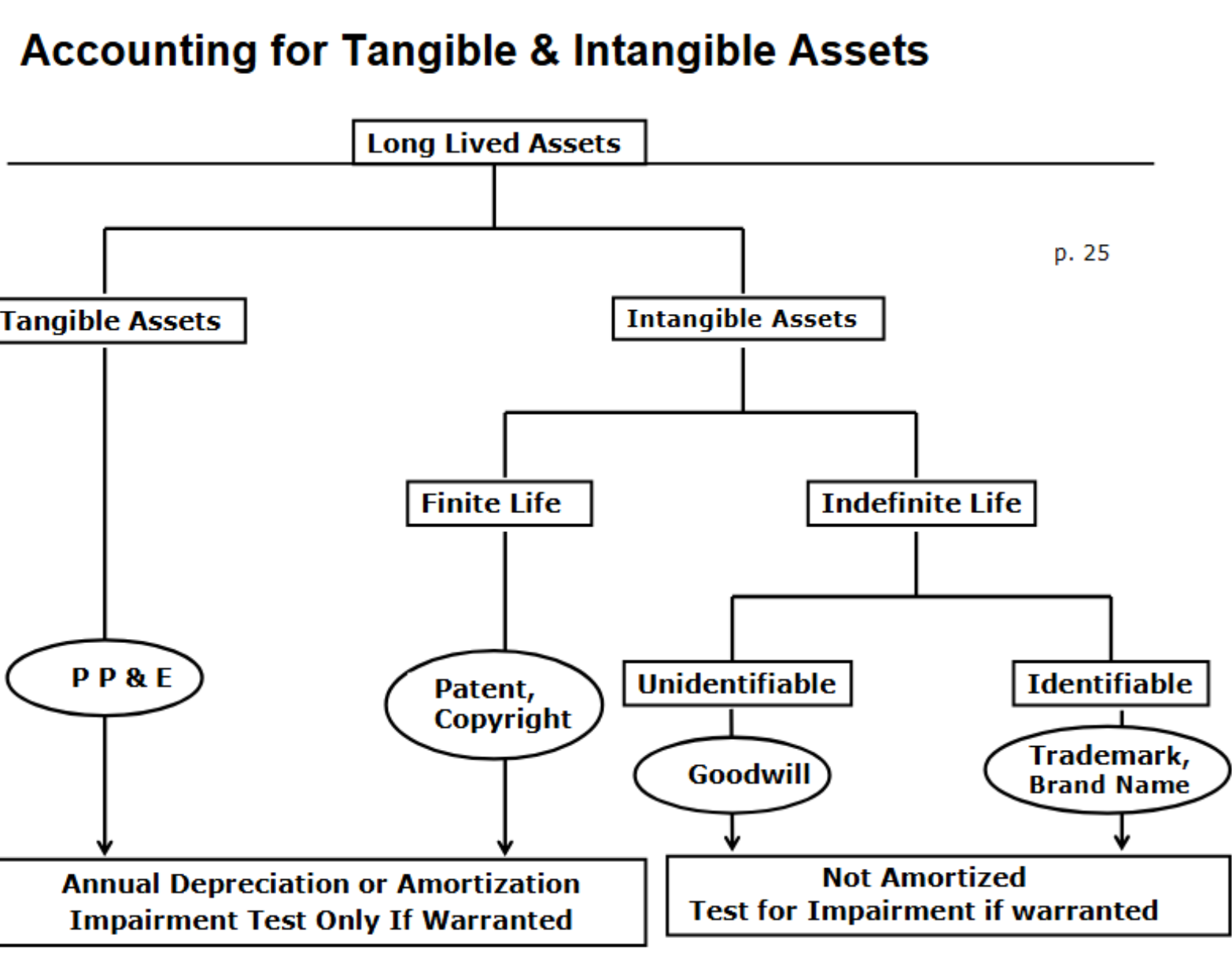

Valuation of long-lived tangible and intangible assets

Fixed/tangible assets:

Acquiring fixed assets

Depreciation

Disposal of fixed assets

Intangible assets:

Capitalization

Amortization

Impairment assessment

Fixed assets

Long-lived assets used in operations known as plant assets, fixed assets or PPE:

Land

Buildings

Equipment/machinery

Reported net of accumulated depreciation on balance sheet

Cost of asset expensed in income statement through depreciation

Land is typically not depreciated (exception of land used for garbage)

Assets vs. expenses

Conditions for an expenditure to be classified as an asset

a. probable long term benefit

b. reliable measurability of expected benefits

c. part of construction

Balance sheet

Otherwise classify as expense

income statement

Calculating long-lived assets example

Property and liability insurance on the land and building for the first year was $12,000, of which $4,000 applied to the period during renovation and $8,000 applied to the period after opening. The relative market values of the land and building are 20% for the land and 80% for the building.

20% X $4,000 = $800 = land

80% X $4,000 = $3,200 = building

During renovation: expenses during construction/renovation are considered as assets because they support future benefits

After opening: expenses after construction/renovation become regular operating expenses

Post-purchase costs: capitalization vs. expensing

When a company spends money on an asset, it must determine whether the cost was an improvement to the asset or simply a repair expense

Capital expenditures: increases the asset’s capacity or efficiency or extend its useful life. Record as an asset (capitalize) and depreciate.

Ex: replacing an old engine in a car

Assets in balance sheet

Ordinary repairs: do not extend the asset’s capacity or useful life, but merely maintain it or restore it to working order. Expense immediately.

Ex: pumping oil in car

Expenses in income statement

Allocation of cost of long-lived asset - depreciation and amortization

Cost of long-lived asset similar to prepaid expense

Depreciation expense: cost of asset allocated to periods used

Accumulated depreciation: portion of cost of asset written off as depreciation expense

Amortization expense: refers to depreciation of intangible assets

Book value of long-lived asset/net asset = cost of asset - accumulated depreciation

Measuring depreciation and amortization

To measure depreciation, we must know:

1) Cost

2) Estimated residual value (scrap or salvage value)

The expected value of an asset at the end of its useful life

Estimated residual value is not depreciated because the business expects o receive this amount from disposing of the asset

Depreciable cost = cost - residual value

3) Estimated useful life or economic life

The length of service the business expects to get from the asset - an estimate of how long an asset will be useful

Useful life may be expressed in years, units of output, miles, or another measure

Three common methods for computing depreciation

Straight line

Units depreciation - usage

Accelerated depreciation

Double declining-balance

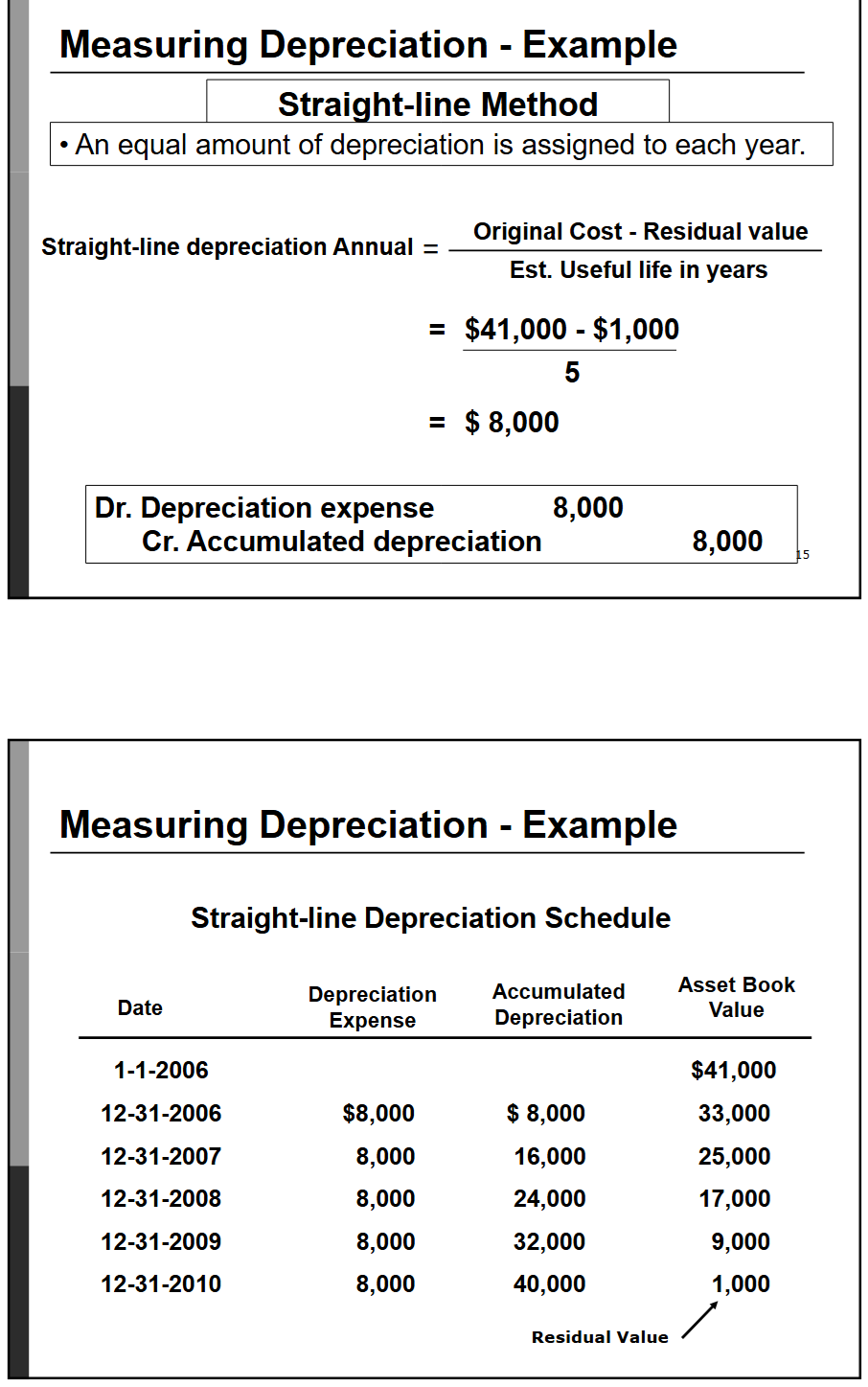

Measuring depreciation - straight line

An equal amount of depreciation is assigned to each year

Cost - residual value = depreciable cost

Straight-line depreciation per year = cost - residual value / economic life (years)

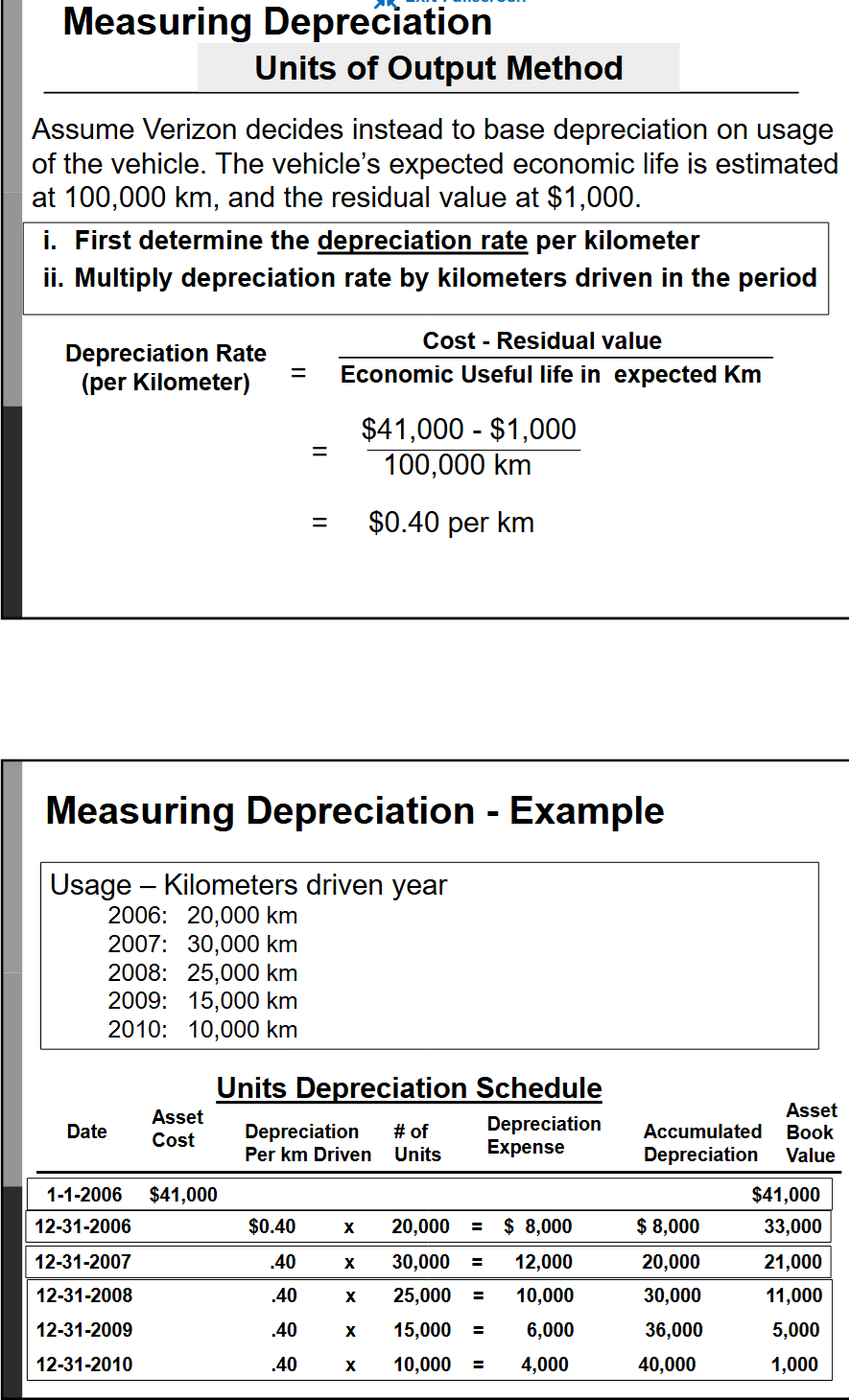

Measuring depreciation - units of output method

Depreciation rate (per km) = cost - residual value / economic useful life in expected km

Depreciating the cost, evenly

Quantity usage = how much the vehicle was driven → more quantity usage = more depreciation

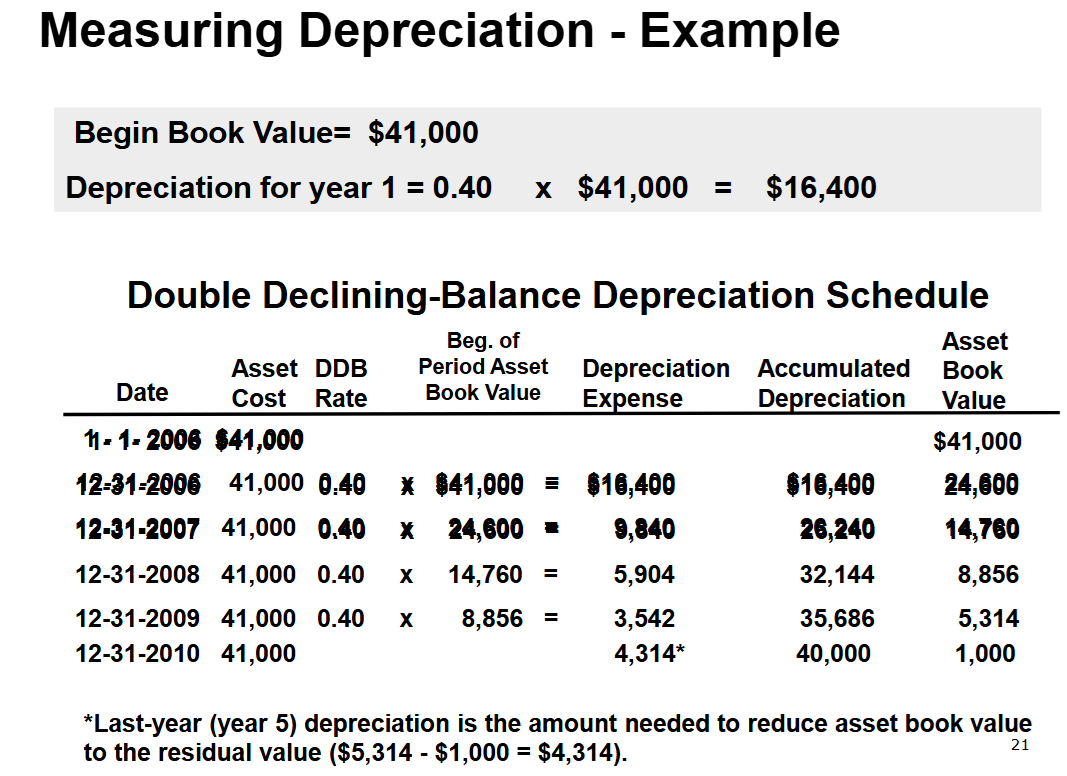

Measuring depreciation - acceleration depreciation method

Double declining-balance (DDB) method

A method that writes off a relatively larger amount of the asset’s cost nearer the start of its useful life than the straight-line method

Computes annual depreciation by multiplying the asset’s book value by a constant percentage, which is twice the straight-line depreciation rate hence the “double”.

Differs from other methods in two ways:

The asset’s residual value is ignored initially. In the first year depreciation is computed on the asset’s full cost

Depreciation expense in the final year is whatever amount is needed to reduce the asset’s book value to its residual value

DDB depreciation rate per year = 1 / useful life, in years X 2

Depreciation expense = beginning book value of asset X DDB rate

Comparing depreciation methods

1) The straight line method best meets the matching principle for a plant asset that generates revenue evenly over time

97% of companies use SL

More predictable

2) The units method best fits those assets that wear out because of physical use rather than obsolescence

5% of companies use units

3) The accelerated method (DDB) applies best to those assets that generate greater revenue earlier in their useful lives

11% of companies use an accelerated method

Using fully depreciated assets

A fully depreciated asset is:

An asset that has reached the end of its estimated useful life

An asset on which no more depreciation is recorded

The asset and its depreciation account remain in the ledger with no additional depreciation entries

An asset can be used after it is fully depreciated; foresight is not perfect

Depreciation changes

Depreciation may change because of:

Assumptions change

Method change

Apply new assumptions or method prospectively

Use going forward without changing prior years’ financial statements

Companies must disclose the effects of the change and justify why the new method is preferable

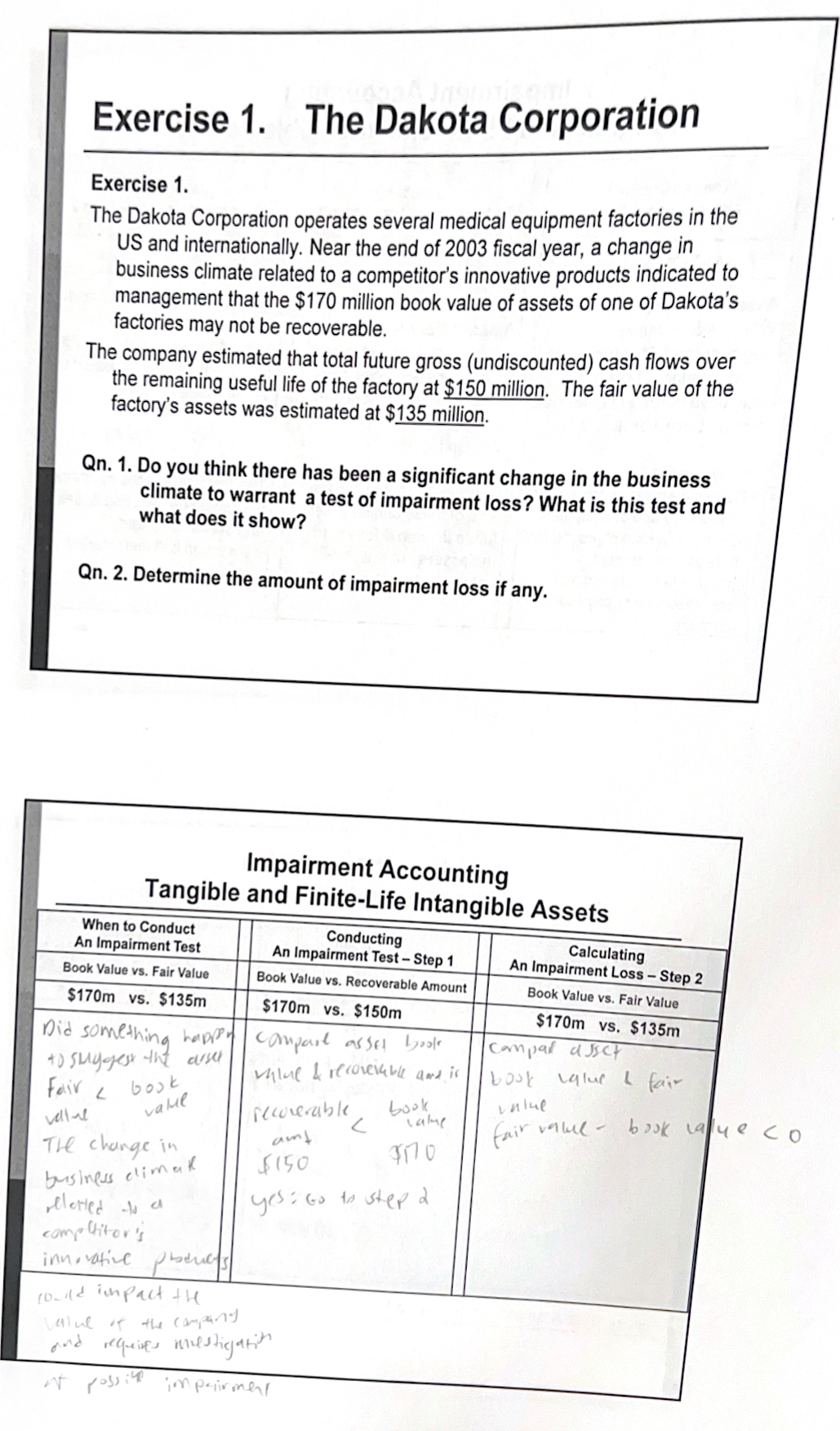

Impairment tests for tangible

If events and circumstances indicate that impairment is more likely than not, an interim impairment test must be conducted:

Uninsured or partially insured disasters

Adverse change in business climate

Unanticipated competition

Impairment tests for tangible assets

Changes in the fair value (aka market value) of long-lived assets

The market value of assets may change over time - it may increase or decrease

U.S. GAAP does not permit firms to increase carrying values of tangible and intangible long-lived assets when the fair values of their assets increase. IFRS allows fair values to be increased under certain circumstances.

Impairment accounting tangible and finite-life intangible assets

Type of operational asset: to be held and used

Tangible assets

Finite-life intangible assets

Periodic depreciation/amortization:

Yes - amortized or depreciated over expected useful life

When to test for impairment:

When events or circumstances indicate book value may not be recoverable

Impairment test:

Step 1

i. An impairment loss is required only when book value is not recoverable

ii. When is it unrecoverable?

When undiscounted sum of estimated future cash flows less than book value

Step 2

The amount of the impairment loss is the excess of book value over fair value

Impairment accounting tangible and finite-life intangible assets

When to conduct an impairment test: book value vs. fair value

Dis something happen to suggest the asset

Fair value < book value

No: stop, do nothing

Yes: Go to step 1

Conducting an impairment test - step 1: book value vs. recoverable amount

Compare asset book value & recoverable amount

Recoverable amount < book value

No: stop, do nothing

Yes: Go to step 2

Conducting an impairment loss - step 2: book value vs. fair value

Compare asset book value & fair value

Fair value - book value < 0

No: stop, do nothing

Yes:

i. Calculate impairment loss: fair value - book value = $ loss

ii. Dr. Operating expense $ loss, Cr. Asset $ loss

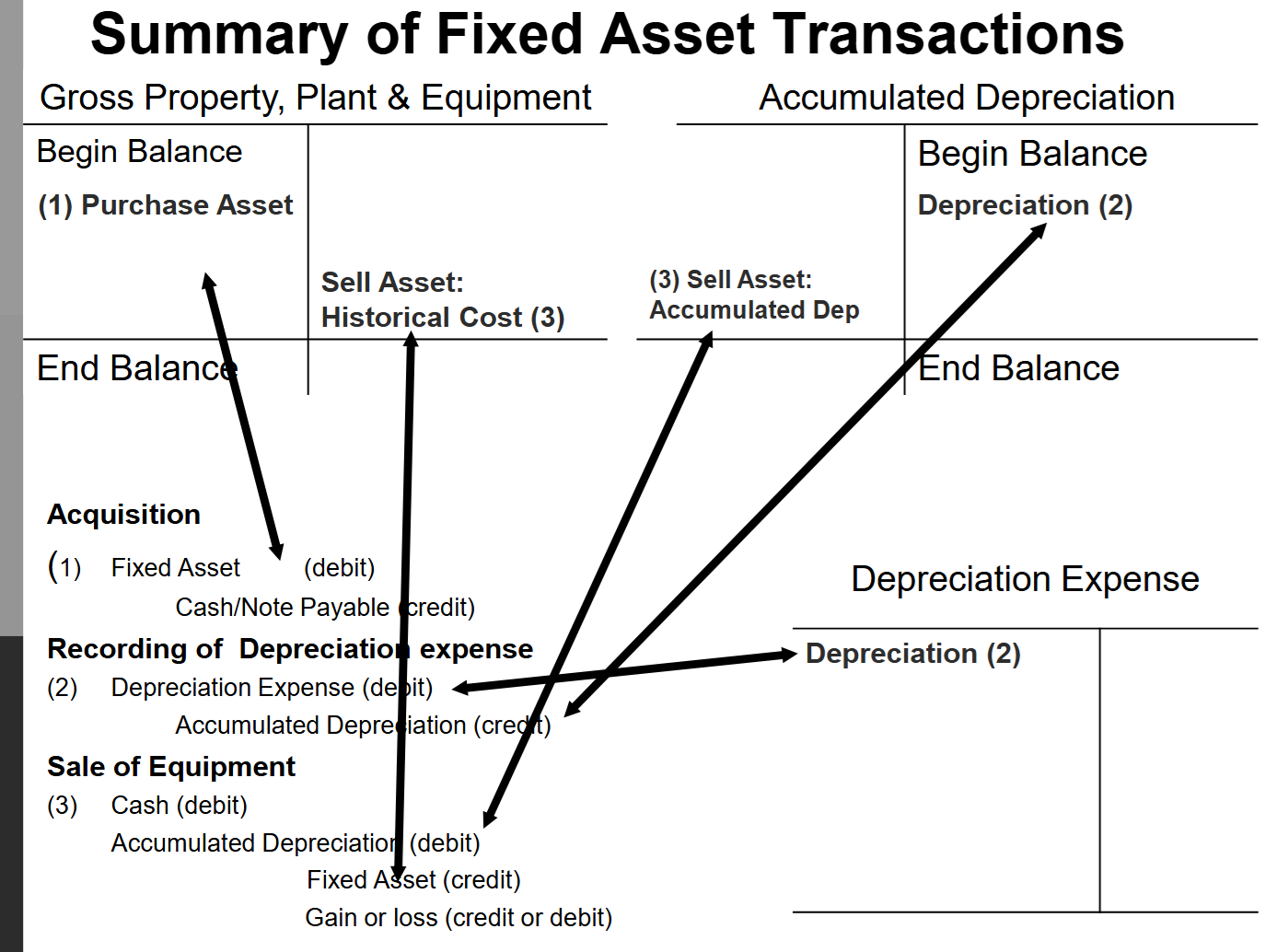

Disposal of fixed assets

A gain is recorded when an asset is sold for a price greater than the asset’s book value

Gains increase net income (credit, similar to revenue)

A loss is recorded when the sale price is less than book value

Losses decrease net income (debit, similar to expense)

Any cash proceeds from sale are reported in investing section of cash flow statement

Sales price (cash proceeds)

- book value of asset sold

= Gain (loss)

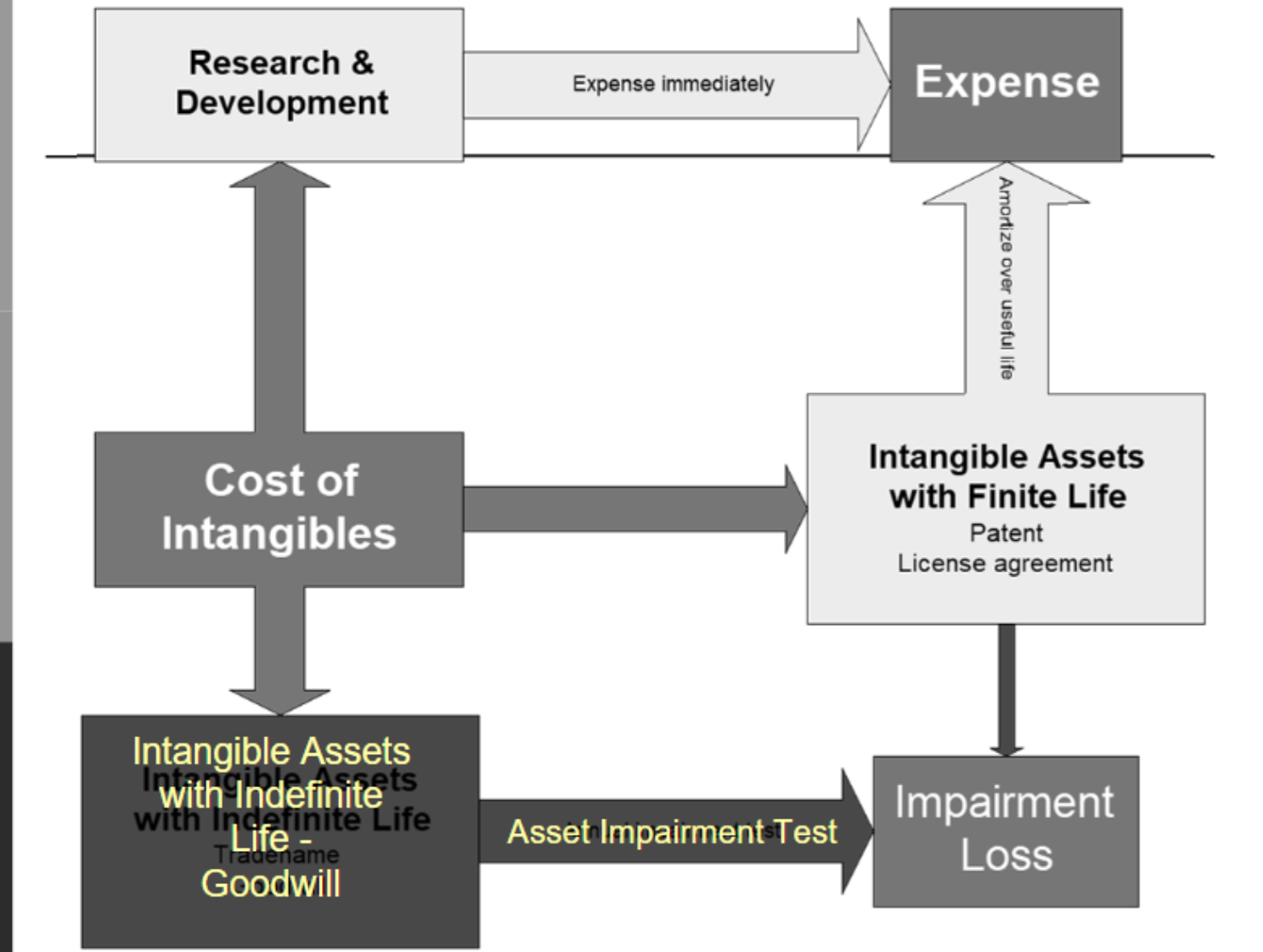

Accounting for intangible assets

Intangible assets are long-lived assets that are contractual, not physical in nature

Patents

Copyrights

Trademarks

Franchises and licenses

Computer software costs incurred after technological feasibility

Goodwill (the excess cost of an acquired company over the sum of the market value of its net assets)

Internally-generated research and development costs, advertising and employee training are NOT assets as defined by FASB. They must be expensed immediately.

Amortization methods for finite life - intangible assets

Residual value is presumed to be zero unless

Another entity which has committed to purchase it for a certain price at a future date

A market for intangible exists and is expected to exist at end of asset’s useful life to current owner

Amortization expense = cost / economic life

Accounting for goodwill

Before acquisition - two separate companies

Diversified company

Target company

After acquisition - one company with a subsidiary

Diversified company and target company

Goodwill formula

Goodwill = price paid for acquired company - fair value of net assets of acquired company

Amortization of indefinite life intangibles

Goodwill:

Not amortized

Subject to impairment test. Any goodwill impairment is recognized as an expense.

Other indefinite life intangible assets:

Not amortized

Subject to impairment test at least.

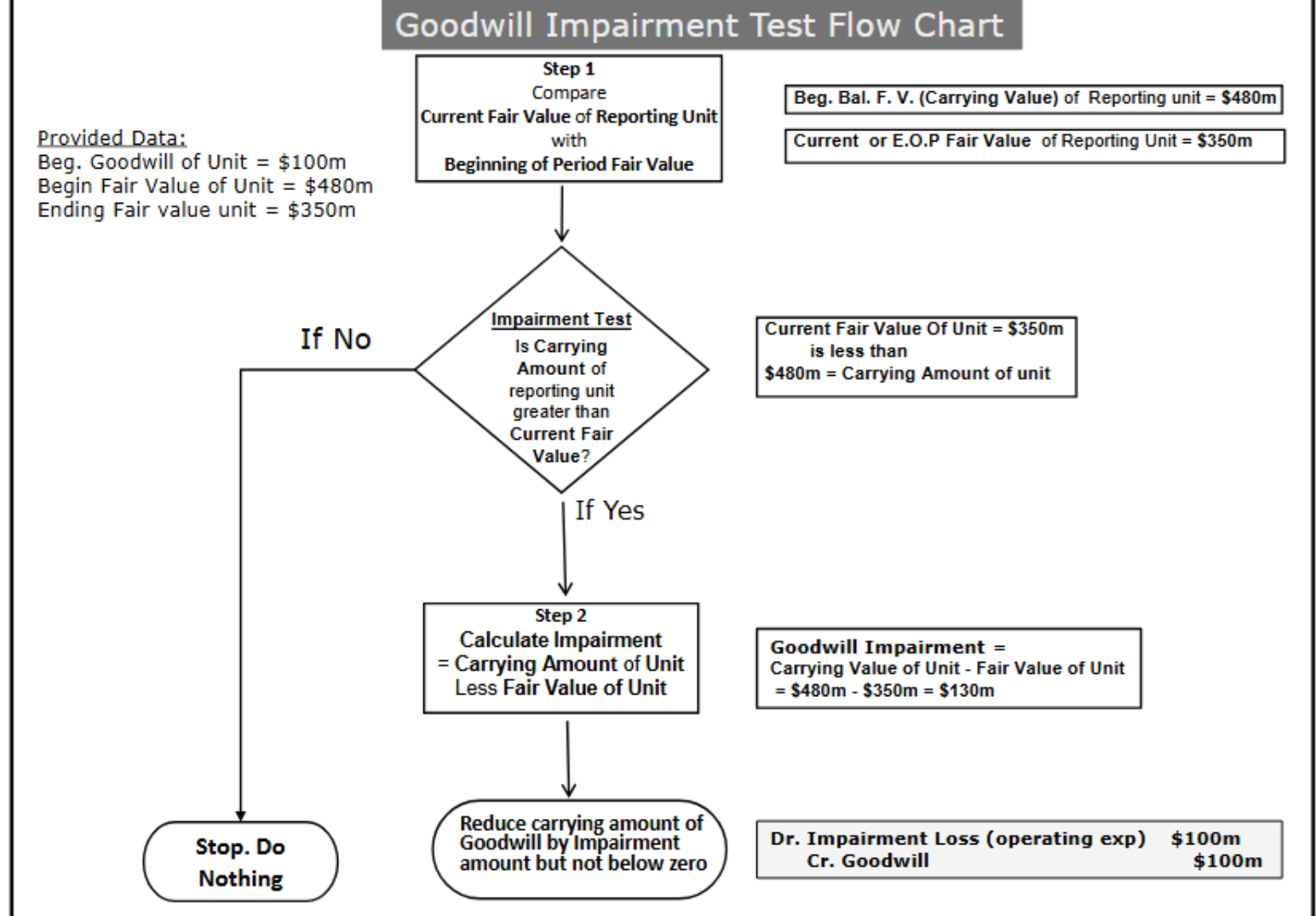

Impairment test of goodwill

Another two step process

Reporting unit:

The acquired company (operates as a subsidiary)

Carrying value (of the acquired company)

Fair value (market value) of the acquired company at the beginning of the current period

Current value (of the acquired company)

Fair value (market value) of the acquired company at the end of the period

Classifying assets

Tangible asset - finite life

Physical assets

Identifiable intangible asset - finite life

Patents

Franchises and licenses

Identifiable intangible asset - infinite life

Copyrights

Trademarks

Computer software costs incurred after technological feasibility

Unidentifiable intangible asset - infinite life

Goodwill

Goodwill impairment - illustration

In 2001, the Upjane Corporation acquired Pharmacopia Corporation for $500

million. Upjane recorded $100 million in goodwill related to this acquisition

because the fair value of the net assets of Pharmacopia was $400 million. After

the acquisition, Pharmacopia continued to operate as a separate company and

was considered a reporting unit for accounting purposes.

Upjane performs a goodwill impairment test at the end of every fiscal year. The

carrying value (i.e., book value) of the entire Pharmacopia unit was $480 at end

of 2002. This amount was unchanged from the estimated market value of the

unit at the end of 2001. The carrying value (i.e., book value) of goodwill

associated with the Pharmacopia unit at the beginning of 2003 was $100m.

For the purposes of the goodwill impairment test, the fair value (i.e., market

value) of the entire Pharmacopia’s unit was estimated at $350 million.