Booklet 6 - Exchange Rates

1/41

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

42 Terms

What do you Discuss when asked about the Concept of an Exchange Rate, Including Australia’s Exchange Rate:

Define Exchange Rate:

Define Floating Exchange Rate:

Define Fixed Exchange Rate:

Define - Exchange Rate:

The relative price of the Australian Dollar expressed in terms of another country’s currency.

Define - Floating Exchange Rate

The price of the $AUD is normally decided by overseas currency buyers (demanders of $AUD) & local currency sellers (suppliers of $AUD).

Define - Fixed Exchange Rate

The government determines the price of country’s currency in terms of another currency.

Calculating Exchange Rates:

Assume 1AUD = 0.71USD

Calculate how much it would cost an Australian Citizen to purchase a computer from the US worth $2000USD

2000 / 0.71 = AUD$2816.9

Expressing an Exchange Rate in terms of the USD:

Assume 1AUD = 0.71USD

1 / 0.71 = $1.41AUD , therefore 1USD = 1.41AUD

What do you Discuss when asked about the Concept of the Trade Weighted Index:

Define Trade Weighted Index

Two Reasons why the TWI is the Preferable Measure of Valuing the AUD apposed to a Bilateral Exchange Rate:

Top Five Weighted Currencies in Australia’s TWI:

Define Trade Weighted Index

Measures the Australian dollar against a basket of 17 currencies of Australia’s main trading partners

Two Reasons why the TWI is the Preferable Measure of Valuing the AUD apposed to a Bilateral Exchange Rate:

TWI provides a broader measure of whether the Australian dollar is appreciating or depreciating against its trading partner’s currencies - it is a better measure of the general trends in the Exchange rate.

Bilateral exchange rates tend to be more volatile whereas the TWI is less volatile

Top Five Weighted Currencies in Australia’s TWI:

Chinese Renminbi

United States Dollar

Japanese Yen

European Euro

South Korean Won

What do you Discuss when asked bout the Determination of & movements in the Exchange Rate Demand for Currency (Credits in the Balance of Payments)

The demand for AUD represents all people who wish to buy AUD, the demand for currency is determined by credits in the Balance of Payments - this means it is concerned with:

Effect of a Change in Credits on the Exchange Rate

Increase in Credits

Decrease in Credits

The demand for AUD represents all people who wish to buy AUD, the demand for currency is determined by credits in the Balance of Payments - this means it is concerned with:

Exports of goods and services: Foreign buyers need AUD to pay Australian exporters.

Primary income receipts: Earnings from investments abroad, such as dividends, interest, and profits, which are repatriated to Australia.

Secondary income receipts: Transfers such as foreign aid, remittances, or pensions received from abroad.

Effect of a Change in Credits on the Exchange Rate

Increase in Credits: Increase demand for AUD, shifting the demand curve to the right. this causes an appreciation of the AUD.

Decrease in Credits: Decreased demand for AUD, shifting the demand curve to the left, this causes a depreciation of the AUD.

What do you Discuss when asked about the Supply of Currency (Debits in the Balance of Payments):

The supply of AUD represents all those people who wish to sell AUD. The supply of currency is determined by debits in the balance of payments. This means it is concerned with:

Effect of a Change in Debits on the Exchange Rate

Increase in Debits

Decrease in Debits

The supply of AUD represents all those people who wish to sell AUD. The supply of currency is determined by debits in the balance of payments. This means it is concerned with:

Imports of Goods & Services

Payments of Income to Overseas

Foreign Investment Outflows

Effect of a Change in Debits on the Exchange Rate

Increase in Debits: Increase in supply of AUD, shifting the supply curve right, this causes a depreciation of the AUD.

Decrease in Debits: Decrease in supply of AUD, shifting the supply curve to the left, this causes an appreciation of the AUD.

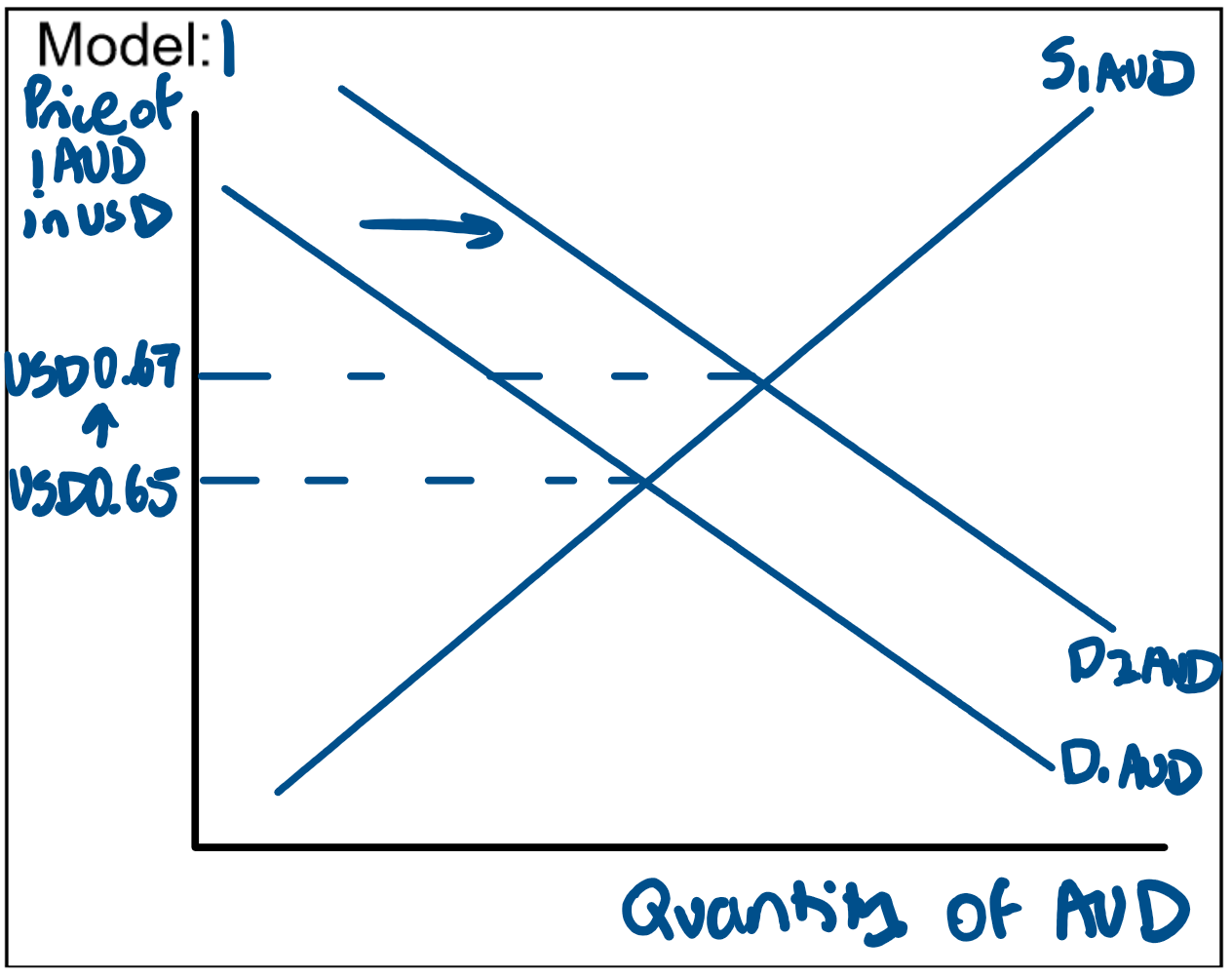

Demand Side (Increased Credits in the Balance of Payments) Model for an Appreciation of the AUD:

An increase in the demand for AUD leads to a shift of the demand curve to the right from D1AUD to D2AUD.

This causes an increase in the equilibrium price from USD0.65 to USD0.67 & an appreciation of the AUD.

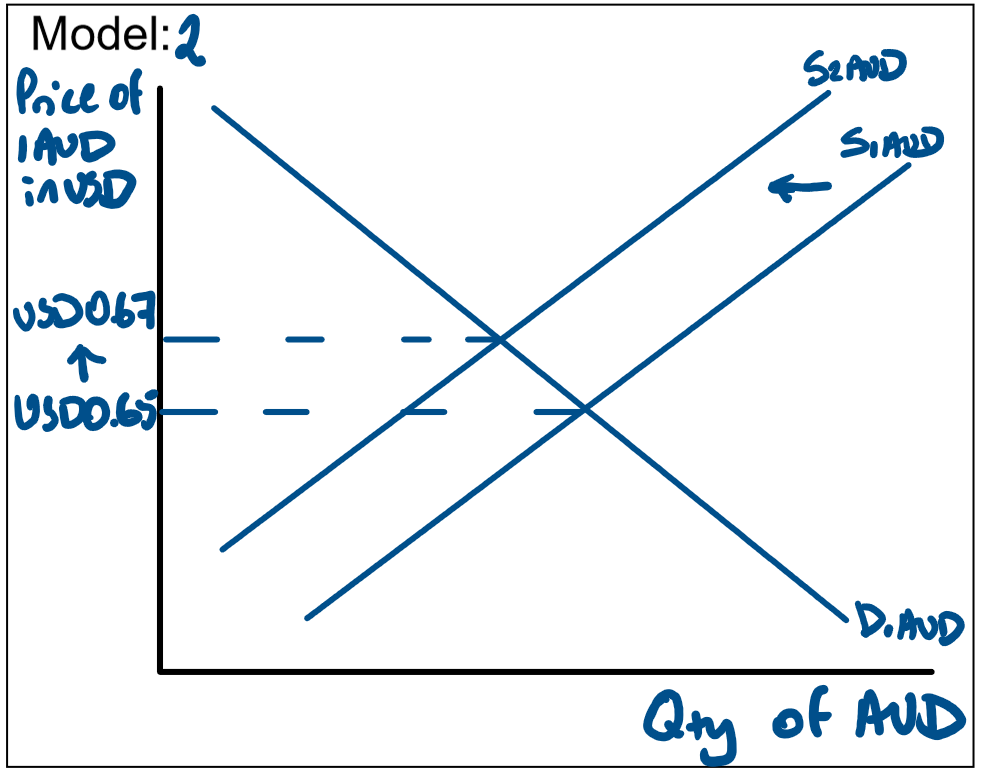

Supply Side (Decrease in Debits in the Balance of Payments) Model for an Appreciation of the AUD:

A decrease in the supply of AUD leads to a shift of the supply curve to the left from S1AUD to S2AUD.

This causes an increase in the equilibrium price from USD0.65 to USD 0.67 & an appreciation of the AUD.

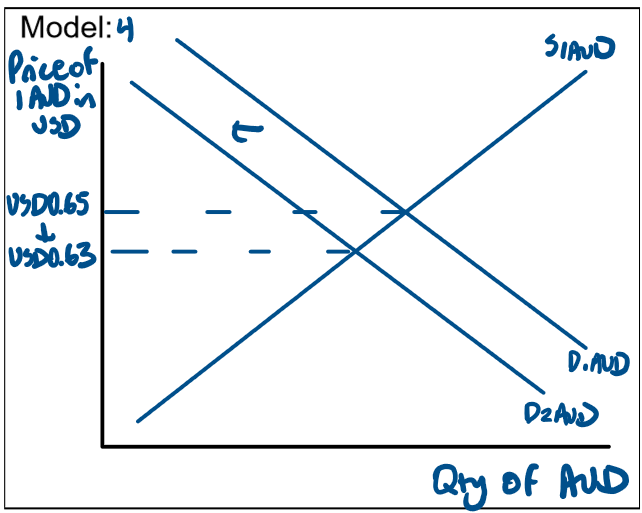

Demand Side (Decrease in Credits in the Balance of Payments) Model for a Depreciation of the AUD:

A decrease in demand for AUD leads to a shift of the demand curve to the left from D1AUD to D2AUD.

This causes a decrease in the equilibrium price from USD0.65 to USD 0.63 & a depreciation of the AUD.

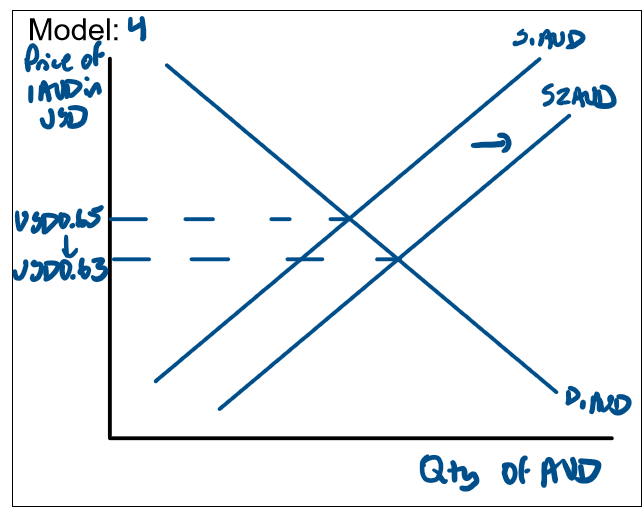

Supply Side (Increase in Debits in the Balance of Payments) Model for a Depreciation of the AUD:

An increase in the supply of AUD leads to a shift of the supply curve to the right from S1AUD to S2AUD.

This causes a decrease in the equilibrium price from USD 0.65 to USD 0.63 & a depreciation of the AUD.

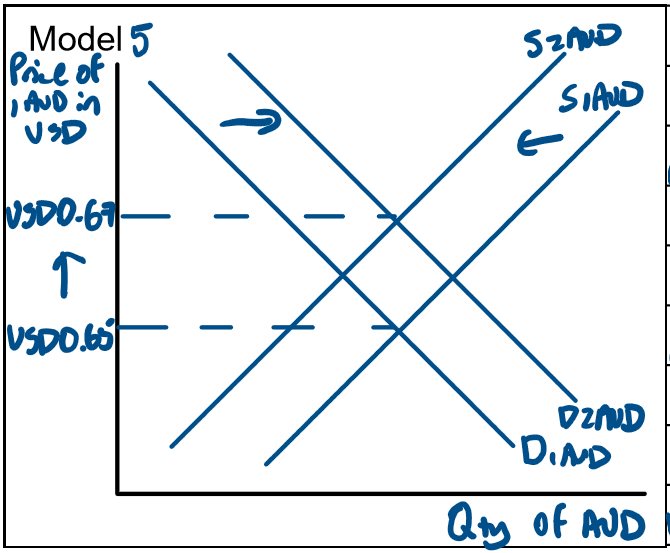

Simultaneous Shifts - Appreciation (Increase in Credits & Decrease in Debits in the Balance of Payments):

An increase in demand for AUD causes a shift of the demand curve to the right from D1AUD to D2AUD.

A decrease in supply of AUD causes a shift of the supply curve to the left from S1AUD to S2AUD.

This causes an increase in the equilibrium, price from USD0.65 to USD0.67 & an appreciation of the AUD.

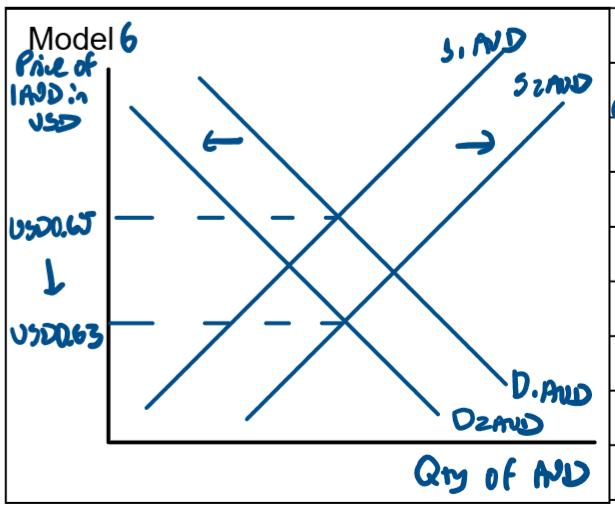

Simultaneous Shifts - Depreciation (Decrease in Credits & Increase in Debits in the Balance of Payments):

A decrease in demand for AUD causes a shift of the demand curve to the left from D1AUD to D2 AUD.

An increase in supply of AUD causes a shift of the supply curve to the right from S1AUD to S2AUD.

This causes a decrease in the equilibrium price from USD0.65 to USD0.63 & a depreciation of the AUD.

Factors that Affect the Exchange Rate - Simultaneous Shifts:

Inflation Rate Relative to Trading Partners:

Interest Rate Differential Relative to Trading Partners:

Increase in Foreign Investment:

Factors that Affect the Exchange Rate - Singular Shifts:

Global Economic Conditions - Affects Demand

Terms of Trade/Commodity Prices - Affects Demand

Speculators - Affects Demand

What do you Discuss when Asked about Effects of Movements in the Exchange Rate (Appreciation):

International Trade:

Appreciation:

Exports

Imports

Trade Balance

Depreciation:

Exports

Imports

Trade Balance

Households/Consumers:

Appreciation

Depreciation

Producers/Firms/Businesses

Appreciation:

Benefits

Losses

Depreciation:

Benefits

Losses

Foreign Investment:

Appreciation:

Capital & Financial Account Balance

Current Account Balance

Depreciation:

Capital & Financial Account Balance

Current Account Balance

Macroeconomy (Inflation, Unemployment & Economic Growth):

Inflation

GDP Growth & Increase in Unemployment

Business Cycle

Effect of Movements in the Exchange Rate (Appreciation) on International Trade:

An appreciation of the AUD makes Australian exports more expensive and imports cheaper. This reduces exports (except USD-priced commodities), increases imports, and worsens the trade balance and current account, while benefiting households through cheaper imported goods.

Effect of Movements in the Exchange Rate (Appreciation) on Households/Consumers:

An appreciation of the AUD increases household purchasing power, allowing access to cheaper imports and raising living standards, though households employed in export sectors may experience lower income.

Effect of Movements in the Exchange Rate (Appreciation) on Producers/Firms/Businesses:

An appreciation of the AUD benefits firms that import inputs or sell imported goods by lowering costs and increasing profits, but harms exporters and domestic producers competing with cheaper imports, reducing their income and profitability—a phenomenon known as Dutch Disease.

Effect of Movements in the Exchange Rate (Appreciation) on Foreign Investment:

An appreciation of the AUD reduces inflation by lowering imported costs and increasing competitive pressure, but can decrease GDP growth and raise unemployment as domestic producers earn less from net exports, potentially triggering a contractionary phase in the business cycle.

Effect of Movements in the Exchange Rate (Depreciation) on International Trade:

A depreciation of the AUD makes Australian exports cheaper and imports more expensive, increasing exports, reducing imports, and improving the trade balance and current account, while potentially lowering household living standards due to costlier imports.

Effect of Movements in the Exchange Rate (Depreciation) on Household/Consumers:

A depreciation of the AUD reduces household purchasing power by making imports more expensive, lowering short-term living standards, though households employed in export sectors may benefit from higher incomes.

Effect of Movements in the Exchange Rate (Depreciation) on Producers/Firms/Businesses:

A depreciation of the AUD benefits exporters and domestic firms competing with foreign products because their goods and services become relatively cheaper for overseas buyers, increasing demand and revenues (e.g., inbound tourism, education, and retail sectors). Conversely, it raises costs for businesses that rely on imported inputs or capital goods—such as farmers importing machinery or manufacturers importing components—reducing profitability. Firms that sell imported goods and services domestically also face higher costs, which can lower sales and profits (e.g., travel agencies catering to Australians travelling abroad).

Effect of Movements in the Exchange Rate (Depreciation) on Foreign Investment:

A depreciation of the AUD raises the cost of servicing Australia’s foreign debt because more AUD is needed to buy the foreign currency required for repayments, increasing debits in the primary income component of the current account. At the same time, Australians with foreign assets earn more in AUD terms, increasing credits. However, since Australia has a substantial net foreign liability position—meaning liabilities exceed assets—the negative effect dominates, resulting in an overall decrease in the current account balance.

Effect of Movements in the Exchange Rate (Depreciation) on the Macroeconomy (Inflation, Unemployment & Economic Growth):

A depreciation of the AUD makes Australian exports cheaper and imports more expensive, increasing demand for domestically produced goods and services. This boosts export revenues, encourages firms to expand production, and reduces unemployment. Higher production and spending raise GDP growth and aggregate demand, while increased demand for goods and services can generate higher inflationary pressures. Collectively, these effects can push the economy into an expansionary phase (upswing), reinforced by a positive multiplier effect as higher incomes and employment further stimulate consumption and investment.

What do you Discuss when asked about the Relationship between the Balance of Payments & the Exchange Rate - Appreciation:

Current Account

Trade Balance

Income Balance

Capital & Financial Account

Relationship between the Balance of Payments & the Exchange Rate - Appreciation - Current Account (Trade Balance):

When the AUD appreciates, Australian exports become more expensive for overseas buyers, reducing demand and decreasing credits in net goods and services. Simultaneously, imports become cheaper, increasing demand and debits in net goods and services. Together, these effects lower the trade balance and reduce the current account balance.

Relationship between the Balance of Payments & the Exchange Rate - Appreciation - Current Account (Income Balance):

When the AUD appreciates, it reduces debits in primary income because Australians can more cheaply service foreign debt and equity, which tends to increase the income balance. At the same time, it reduces credits from income earned on foreign assets, which tends to decrease the income balance. Since Australia has a net foreign liability position, the net effect is typically an increase in the current account balance.

Relationship between the Balance of Payments & the Exchange Rate - Appreciation - Capital & Financial Account:

When the AUD appreciates, foreign investment inflows decrease because it becomes more expensive for foreigners to invest in Australia, reducing credits in the financial account. Simultaneously, Australian investment abroad rises as it becomes cheaper for residents to invest overseas, increasing debits. Together, these effects lower the capital and financial account balance.

Relationship between the Balance of Payments & the Exchange Rate - Depreciation - Current Account (Trade Balance):

When the AUD depreciates, Australian exports become cheaper for overseas buyers, increasing credits in the balance of goods and services. At the same time, imports become more expensive, reducing debits. Together, these effects raise the trade balance and increase the current account balance.

Relationship between the Balance of Payments & the Exchange Rate - Depreciation - Current Account (Income Balance):

When the AUD depreciates, servicing Australia’s foreign debt and equity becomes more expensive, increasing debits in primary income, while income from Australian-owned foreign assets increases credits. Because Australia has a net foreign liability position, the rise in debits outweighs the rise in credits, resulting in a decrease in the income balance and a reduction in the current account balance.

Relationship between the Balance of Payments & the Exchange Rate - Depreciation - Capital & Financial Account:

When the AUD depreciates, foreign investment inflows increase because it becomes cheaper for foreigners to invest in Australia, raising credits in the financial account. At the same time, Australian investment abroad decreases as it becomes more expensive, lowering debits. Together, these effects increase the capital and financial account balance.

Trends in the Exchange Rate

GO BACK & FILL IN