Understanding the Accounting Cycle and Financial Statements

1/216

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

217 Terms

Accounting Cycle

Sequence of steps in financial reporting.

Measurement Process

Recording and posting transactions and adjustments.

Reporting Process

Preparation of financial statements.

Closing Process

Recording closing entries at period end.

Cash-Basis Accounting

Records transactions when cash is received or paid.

Accrual-Basis Accounting

Records transactions when economic events occur.

Assets Recognition

Recorded when resources are obtained.

Liabilities Recognition

Recorded when obligations occur.

Revenues Recognition

Recorded when goods/services are provided.

Expenses Recognition

Recorded when costs are incurred.

Economic Events

Transactions affecting financial position recorded timely.

Deferred Revenue

Liability until service is provided.

Prepaid Rent

Asset until rent period expires.

Supplies Asset

Recorded until supplies are used.

Accrual vs Cash-Basis

Comparison of revenue and expense recognition methods.

Transaction Description

Details of financial transactions recorded.

Financial Statements

Summarized reports of financial performance.

Adjusting Entries

Entries made to update account balances.

Closing Entries

Entries to reset temporary accounts.

Revenue Recognition Principle

Guideline for recognizing revenue in accounting.

Expense Recognition Principle

Guideline for recognizing expenses in accounting.

Cash Received

Revenue recorded when cash is received.

Cash Paid

Expense recorded when cash is paid.

Service Provided

Revenue recorded when service is completed.

Cost Used

Expense recorded when cost is incurred.

Learning Objectives

Goals for understanding accounting principles.

Concept Check

Assessment of understanding accounting concepts.

Financial Reporting

Process of disclosing financial information.

Accrual-Basis Accounting

Records revenues when goods/services are provided.

Cash-Basis Accounting

Records revenues when cash is received.

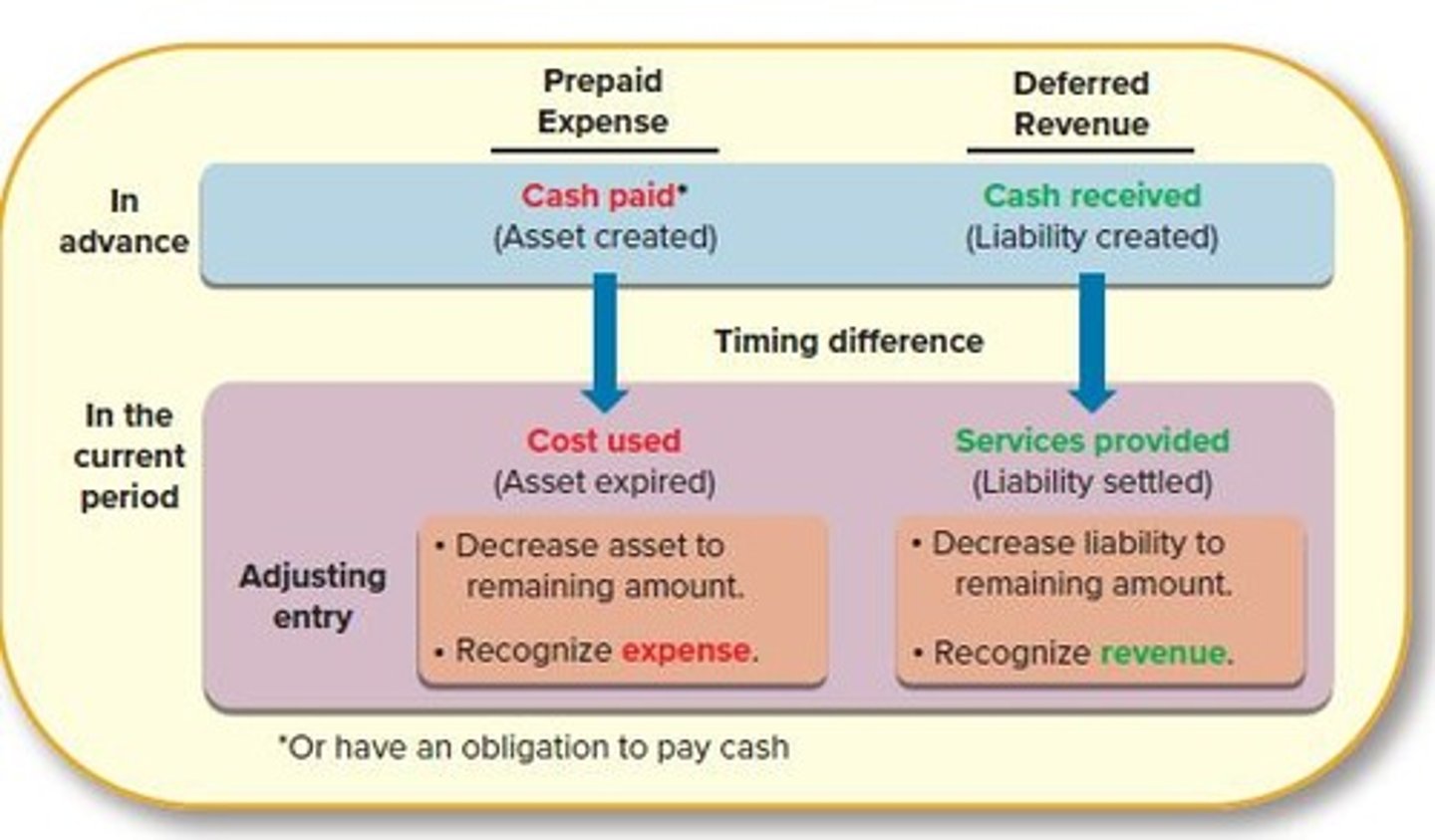

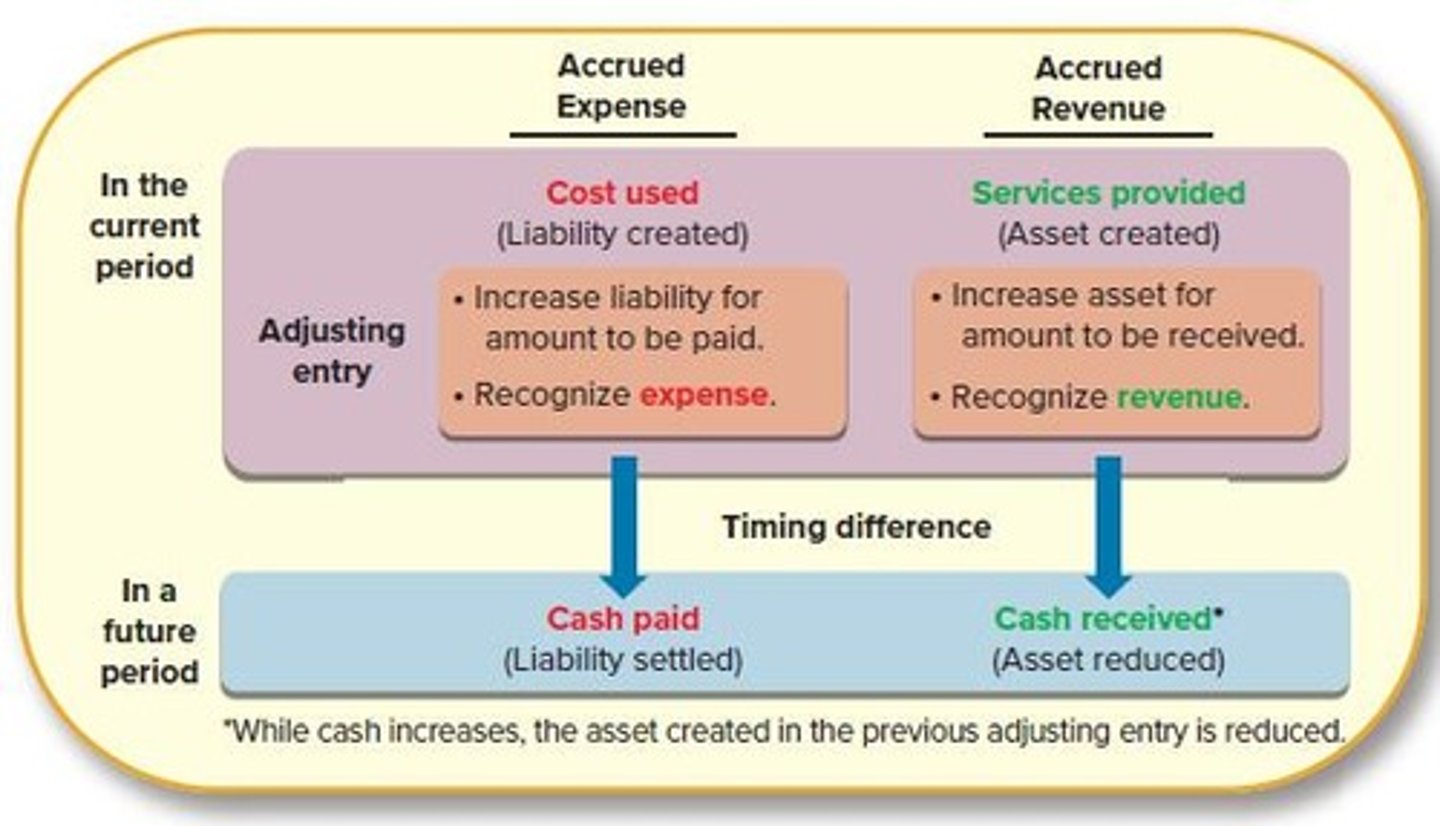

Timing Differences

Discrepancies in recording revenues/expenses timing.

Generally Accepted Accounting Principles (GAAP)

Standards guiding financial accounting practices.

Revenues Recognition

Accrual: when earned; Cash: when received.

Expenses Recognition

Accrual: when incurred; Cash: when paid.

Adjusting Entries

Updates balances of assets and liabilities.

Assets and Liabilities

Reported due to timing differences in accrual accounting.

Supplies Expense (Cash-Basis)

Recorded when cash is paid for supplies.

Utilities Expense (Accrual-Basis)

Recorded when utilities are used, not paid.

Financial Reporting

Cash-basis accounting is not permitted for major companies.

Office Supplies Purchase

Expense recorded when cash is paid, not used.

Service Revenue (Cash-Basis)

Recorded when cash is received from customers.

Equipment Purchase

Recorded as liability if borrowed funds are used.

Cost Incurred

Expense recognized when it helps generate revenue.

Accrual Accounting Principle

Focuses on matching revenues and expenses.

Cash Accounting Principle

Focuses on cash transactions only.

Accrual vs Cash Basis

Key difference is timing of revenue/expense recognition.

Adjusting Entries Purpose

To align cash flows with revenues/expenses.

Concept Check 3-2

Identifies cash-basis expense recording.

Concept Check 3-3

Identifies accrual-basis expense recording.

Prepayments

Payments made before the related expense is incurred.

Revenue Recognition Principle

Guides when to recognize revenue in accounting.

Expense Recognition Principle

Guides when to recognize expenses in accounting.

Major Companies

Must use accrual-basis accounting for reporting.

Cash Flow Timing

Accrual accounting reflects timing differences in cash flows.

Revenue and Expense Matching

Accrual accounting matches revenues with incurred expenses.

Financial Statements

Prepared based on accrual-basis accounting principles.

External Transactions

Business activities involving cash and credit exchanges.

Common Stock Sale

Selling shares for $200,000 to fund business.

Bank Loan

Borrowing $100,000 with a three-year repayment.

Equipment Purchase

Buying soccer training equipment for $120,000.

Prepaid Rent

Paying $60,000 for one year of rent in advance.

Supplies Purchase

Acquiring $23,000 of supplies on account.

Cash Training Revenue

Earning $43,000 from cash soccer training sessions.

Accounts Receivable Revenue

Generating $20,000 from training on account.

Unearned Revenue

Receiving $6,000 cash for future training sessions.

Salaries Expense

Paying $28,000 in salaries to employees.

Cash Dividends

Distributing $4,000 in dividends to shareholders.

Prepaid Expenses

Payments made for future benefits, recorded as assets.

Adjusting Entry

Entry to recognize expenses or reduce asset balances.

Rent Expense

Expense recognized for one month of prepaid rent.

Supplies Expense

Expense for consumed supplies, reducing asset value.

Depreciation Expense

Monthly expense for equipment usage, $2,000 per month.

Accumulated Depreciation

Contra asset account tracking total depreciation.

Timing Difference

Cash paid now, expense recognized later.

Asset Decrease

Reducing asset balance to reflect usage.

Expense Recognition

Recording costs associated with asset usage.

Monthly Rent Cost

Rent expense calculated at $5,000 per month.

Supplies Remaining

Remaining supplies valued at $13,000 after usage.

Depreciation Formula

Depreciation calculated as cost divided by useful life.

Adjusting Entry for Prepaid Expense

Involves debiting an expense and crediting an asset.

Concept Check 3-4

Identifies adjusting entry components for prepaid expenses.

Expense Debit

Adjusting entry debits always increase expense accounts.

Property and Equipment

Assets used in business operations.

Accumulated Depreciation

Total depreciation expense recognized over time.

Book Value

Asset's cost minus accumulated depreciation.

Carrying Value

Another term for book value of an asset.

Deferred Revenues

Cash received before services are provided.

Adjusting Entry

Entry to update accounts for accrued items.

Liability

Obligation to pay for services or goods.

Service Revenue

Income earned from providing services.

Accrued Expenses

Costs incurred but not yet paid.

Current Liabilities

Obligations due within one year.

Short-term Borrowings

Loans due within one year.

Current Maturities of Long-term Debt

Portion of long-term debt due soon.

Accounts Payable

Money owed to suppliers for goods/services.

Accrued Compensation

Salaries and wages owed to employees.

Employee Benefits

Compensation provided to employees beyond salary.

Total Current Liabilities

Sum of all current obligations.

Cash Basis Accounting

Revenue recognized when cash is received.

Accrual Basis Accounting

Revenue recognized when earned, not received.