Savings, Capital Formation and Financial Markets

1/74

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

75 Terms

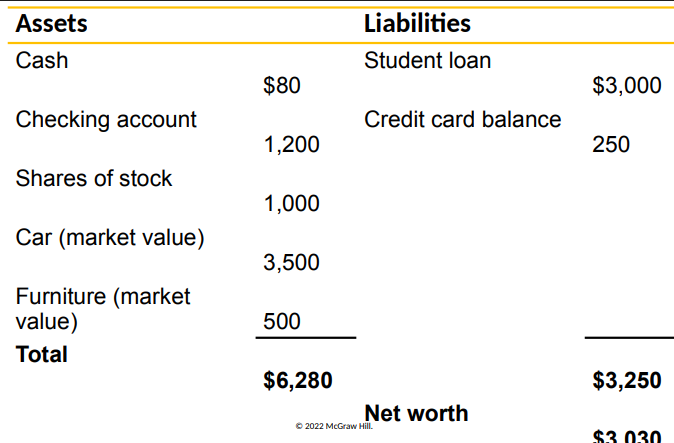

Balance Sheet

a list of an economic unit’s assets and liabilities

Specific date

Economic unit (business, household, etc.)

Saving Formula

current income - spending on current needs

Saving Rate

saving / income

Wealth

value of assets - liabilities

Assets

anything of value that one owns

Liabilities

the debts one owes

Flow Values

Defined per unit of time

Dynamic movement of goods, services, or money over time and measured as a rate

Income

Spending

Saving

Wage

Help to explain changes in the economy over time

What does the Flow of Savings do?

Causes the stock of wealth to change

Stock Value

Defined at a specific point in time and is static

Wealth

Debt

Investment / Saving Flow

Provide a snapshot of the current state of the economy

Capital Gains

increase the value of existing assets

Higher value for stock

Higher housing values

Selling price higher than purchase price

taxed at a lower rate than ordinary income to incentivize investment and stimulate economic growth

Capital Losses

decrease the value of existing assets

e.g. selling an asset at a price that is lower than its purchase price

Change in Wealth Formula

saving + capital gains - capital losses

Reasons for Household Saving

Life-Cycle Saving

Precautionary Saving

Bequest Saving

Wealth Accumulation:

Consumption Smoothing

Life-Cycle Saving

to meet long term objectives - expenditures

e.g. retirement, home purchase, children’s college, healthcare costs

Precautionary Saving

for protections against setbacks and income fluctuations

e.g. loss of job, medical emergency

Bequest Saving

to leave an inheritance

mainly for higher income groups

Wealth Accumulation

Wealth can be used to purchase assets, such as a home or a business, that generate income or appreciate in value over time

Consumption Smoothing

People save to smooth out their consumption over their lifetime. By saving during periods of high income and consuming during periods of low income, individuals can maintain a relatively stable standard of living throughout their lifetime

Why do People Save when they are Younger?

they have relatively low incomes and then are able to consume when they are older and have higher incomes

Savings

Often take the form of financial assets that pay a return

Examples of Savings

Interest-bearing checking

Bonds

Savings

Mutual funds

Stocks

Real Interest Rate Formula

r = i - π

RIR = nominal interest rate - rate of inflation

What is the Real Interest Rate?

the increase in purchasing power from a financial asset

marginal benefit of the extra saving

Explaining US Household Savings Rate

May be depressed by

Social Security, Medicare, and other government programs for the elderly

Mortgages with small or no down payment

Confidence in a prosperous future

Increasing value of stocks and growing home values

Readily available home equity loans

Demonstration effects and status goods

Low interest rates

Formula for Aggregate Income/Expenditures

Y = C + I + G + NX

Y = aggregate income or expenditures

C = consumption expenditure

G = government purchases of goods and services

I = investment spending

NX = net exports

Calculating National Savings

Assume NX = 0 for simplicity

National savings (S) is current income less spending on current needs

Current income is GDP or Y

Spending on current needs

Exclude all investment spending (I)

Most consumption (C) and government spending (G) is for current needs

For simplicity, we assume all of C and all of G are for current needs

S = Y - C - G

Net Taxes Formula

taxes - transfers - government interest payments

Private Saving Formula

SPRIVATE = Y - T - C

Y = households total income

T = net taxes

C = consumption expenditure

Private Saving

Household plus business saving

Household's total income is Y

Households pay taxes (T) from this income

Government transfer payments

Interest is paid to government bond holders

After-tax income less consumption

Done by households and businesses

Transfer Payments

made by the government to households without receiving any goods in return

increase household income

Household/Personal Saving

done by families and individuals

Business Saving

makes up the majority of private saving in the US

Revenues - Operating Costs - Dividends to Shareholders

can purchase new capital equipment

Public Saving

the amount of the public sector’s income that isn’t spent on current needs

income is net taxes

spending on current needs is G (government spending)

Public Saving Formula

SPUBLIC = T – G

T = net taxes

G = government spending

National Saving Formula

private savings + public savings

SPRIVATE + SPUBLIC = (Y – T – C) + (T – G)

S = Y – C – G

Balanced Government Budget

occurs when government spending = net tax receipts

Government Budget Surplus

the excess of government net tax collections over spending

(T - G)

pubic savings

Government Budget Deficit

the excess of government spending over net tax collections

(G - T)

public dissavings

What does National Savings determine?

a country’s ability to invest in new capital goods

National Saving

the source of funding for investment

Investment

the creation of new capital goods and housing - necessary to increase average labour productivity

When is Investment Spending undertaken?

if it is expected to be profitable

i.e., the benefit, or value of marginal product, exceeds the cost of the investment

Why do Firms buy new Capital?

to increase profits

cost-benefit principle

cost = cost of using the machine/other capital

benefit = value of the marginal product of the capital

What factors affect the Value of the Marginal Product (VMP) of capital?

Net of operating and maintenance expenses and of taxes on revenues generated

Technical innovation increases benefits

Lower taxes increase benefits

Higher price of the output increases benefits

Influenced by the relative price of the good or service produced by the capital

Rate of Return of an Investment Formula

= VMP / PK

VMP = value of marginal product

PK = price of investment

if VMP / PK > r the investment is profitable

where r = the real interest rate

What are financial Intermediaries?

firms that extend credit to borrowers using funds raised from savers e.g. banks

How do Banks help Savers?

by evaluating the quality of potential borrowers and directing savings towards higher-return investments

provide information about the possible uses of their funds

help share risks by pooling funds for investment projects, enabling risk sharing

Why is Risk Sharing Important in Banking?

makes funding possible for risky but potentially very productive projects

Principle of Comparative Advantage in Banking

banks specialise in evaluating borrowers more efficiently and cost-effectively than individuals

How do Banks reduce the cost of evaluating Investment opportunities?

thorough specialisation and pooling of resources which allows them to make large loans and spread out risks

Bond

a legal promise to pay someone a debt, usually including both the principal amount and regular interest payments

Principal Amount

the amount originally lent

Coupon Rate

the interest rate promised when the bond is issued

Coupon Payments

regular interest payments made to the bondholder

A Share of a Stock

a claim to partial ownership of a firm

receive dividends, a periodic payment determined by management

receive capital gains if the price of it increases

What are Share and Bond Markets?

help ensure savings are devoted to the most productive users

they gather information about prospective borrowers, and help savers share the risks of lending, provide information on investment projects and their risks, and provide risk sharing and diversification across projects

channel funds from savers to borrowers by facilitating the sale of new bonds/stock to finance capital investment

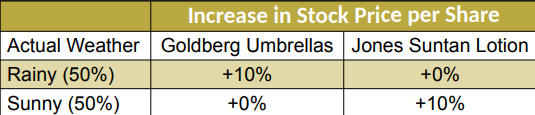

What is Diversification in the context of Investment?

spreading one’s wealth over a variety of investments to reduce risk

Benefits of Diversification Example

Vikram has $1,000 to invest in stocks

Put all in one stock

50% chance of 10% gain and 50% chance of zero

Diversify and put half in each

One stock will gain 0% and the other gain 10%

Return is 5% with no risk

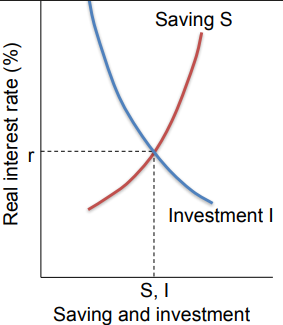

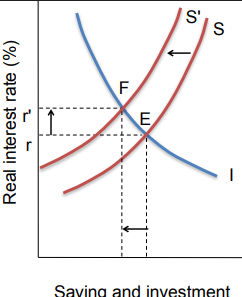

Supply of Savings (S)

The amount of savings that would occur at each possible real interest rate (r)

The quantity supplied increases as r increasest

Demand for Investment (I)

The amount of savings borrowed at each possible real interest rate

The quantity demanded is inversely related to r

Equilibrium Interest Rate

equates the amount of saving with the investment funds demanded

If r is above equilibrium, there is a surplus of savings

If r is below equilibrium, there is a shortage of savings

Financial Markets

Adjust to surpluses and shortages as any other market does

Equilibrium Principle holds

Changes in factors other than real interest rates will shift the savings or investment curves

New equilibrium

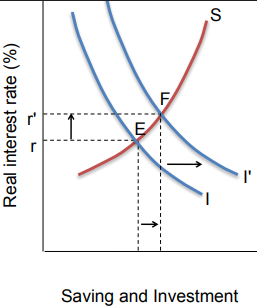

What happens when New Technology raises Marginal Productivity of Capital?

Increases the demand for investment funds

Movement up the savings supply curve

Higher marginal product of capital makes firms more eager to invest

Investors race for new technologies

Higher interest rate (as in the U.S. during the 90s)

Higher level of savings and investment

High rate of investment reflecting opportunities created by new technologies

Government Budget Deficit Increases

Reduces national saving

Government has dipped further into the pool of private savings to borrow funds to finance deficit

Investors compete for a smaller quantity of available saving

Movement up the investment curve

Higher interest rate

Investments less attractive

Lower level of savings and investment

Private investment is crowded out

Benefits of increased National Saving Rates according to Policymakers

Reducing government budget deficit would increase national saving

Political problems

Increase incentives for households

Federal consumption tax

Reduce taxes on dividends and investment income

What does higher National Saving Rate lead to?

greater investment in new capital goods and a higher standard of living

Austerity

fiscal policy

cutting government spending to reduce deficits

often arrives too late

Stimulus

fiscal policy

increasing spending to boost demand during downtimes

political difficulty in enforcing during good times

When did Keynes support Stimulus and Austerity?

stimulus in recessions

austerity during booms

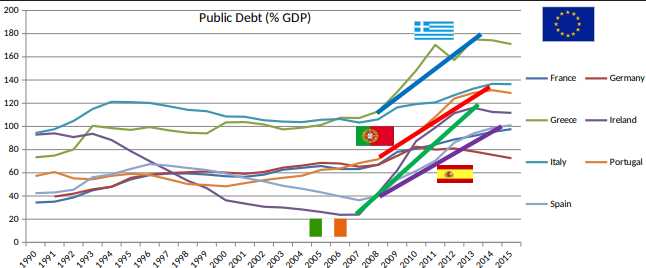

Eurozone Debt Crisis

With austerity, debt/GDP ratios continued to rise sharply: Declining GDP outweighed progress on reduction of budget deficits

What happened when a Government borrows?

it issues debt in the form of bonds

Purchasers of Government Bonds Include:

pension funds

insurance companies

overseas investors

Yield on a Bond

the interest rate paid on state borrowing

Arguments in Favour of Austerity

Reducing debt in long-run interests of economy – helps to keep U.K. taxes lower

Shrinking state encourages private sector growth

High opportunity cost from billions on debt interest

Cutting deficits increases investor confidence

Upturn of cycle is time for government to borrow less – ahead of another downturn

Some economists argued that the UK government austerity programme had resulted in growth that was higher than the European average and that the UK's economic performance had been much stronger than the International Monetary Fund had predicted

Austerity can be expansionary in situations where government reduction in spending is offset by greater increases in aggregate demand

Arguments Against Austerity

Austerity is self-defeating if it leads to deflation

Government bond yields are low – a time to invest more

Infrastructure investment will increase aggregate demand

Wrong to cut spending when economy is in a zero interest rate environment – liquidity trap

Economic growth is needed to pay back the debt and fiscal austerity makes this harder to achieve

Keynesian macroeconomists argued that the austerity programme pursued by the Coalition Government in its first two years was both too severe and unnecessary and set back the economic recovery which was underway in the first half of 2010