Intro to Econ: Final Exam Study Guide

1/128

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

129 Terms

what are the three basic economic questions?

1.) what to produce?

2.) how to produce?

3.) for whom to produce?

what is the basic economic problem?

economics is concerned with the efficient use of limited productive resources to achieve the maximum satisfaction of economic wants

microeconomics vs. macroeconomics

micro- studies the economic behavior of individuals, particular markets, firms or industries

macro- looks at the entire economy or its major aggregates or sectors, such as households, businesses, or government

division of labor/ specialization

produce more goods

opportunity costs

the value of the next best alternative or choice that was not taken

factors of production

fixed/constant

land

anything not made by humans

water

farmland

cattle

labor

human

talent/ skills

quantity/ quality

economic interdependence

every price depends to some extent on every other place

capital goods

tools and equipment used to produce final goods and services

ex.) tractor, factory

consumer good

any good purchased for consumption and not used later to produce another consumer good

standard of living

the quantity and quality of material goods and services available to a given population

conspicuous consumption

the purchase of goods or services for the specific purpose of displaying one's wealth

wealth

an accumulation of valuable economic resources that can be measured in terms of either real goods or money value

trade-offs

when you choose one thing which causes you to have to give up, or sacrifice, another

scarcity

the demand for a good or service is greater than the availability of the good or service

strengths and weaknesses:

traditional economy

command economy

market economy

traditional

strength- the answers to what, how, and for whom to produce are determined by customs and tradition

weakness- tends to discourage new ideas and new ways of doing things

command

strength- it can be more efficient in the allocation of resources

weakness- it stifles innovation and creativity because the government leaves no room for competition

market

strength- increased efficiency, production, and innovation

weakness- monopolies, no government intervention, poor working conditions, and unemployment

adam smith and the invisible hand

the father of economics

a metaphor that describes the unseen forces of self-interest that impact the free market

what is the role of government in a market economy?

to protect property rights, ensure infrastructure and public services are adequate, and protect both consumers and the environment

capitalism

trade and industry are controlled by private owners for profit

private property

the ownership of property by private parties

economic equity

the fairness and justice in the distribution of wealth, income, and other economic resources

entrepreneur

someone who organizes, manages, and assumes the risks of a business or enterprise

free enterprise

the market determines prices, products, and services rather than the government

profit motive

the intent to achieve a monetary gain in a project, transaction, or material endeavor

mixed economy

a system that combines aspects of both capitalism and socialism

change in quantity demanded vs. change in demand

change in quantity demanded- due to change in price

change in demand- due to a change in non price reason

when does the demand curve shift and in which direction?

population increases = curve to the right

population decreases = curve to the left

what factors cause a change in demand?

1.) change in taste of preferences

2.) change in consumer information

3.) change in number of consumers

4.) change in income

5.) change in price of a good related good

a.) change in price of substitute good

b.) change in price of a complementary good

6.) change in future price (expectation)

What are the determinates of demand elasticity?

1.) is there an adequate substitute?

yes - elastic no - inelastic

2.) can the purchase be delayed

yes - elastic no - inelastic

3.) does the purchase require a large amount of income?

yes - elastic no - inelastic

4.) is the price change temporary or permanent?

temporary - elastic permanent - inelastic

law of demand

as the price increases (decreases) the quantity demanded decreases (increases) inverse

diminishing marginal utility

(satisfaction) each additional unit of good is worth less and less

marginal utility

the added satisfaction a consumer gets from having one more unit of a good or service

demand curve

downward slopping

demand elasticity

how responsive consumers are to change in price

demand schedule

a table that shows the quantity demanded of a good or service at different price levels

complement goods

a good whose use is related to the use of an associated or paired good

substitute goods

a product or service that consumers see as essentially the same or similar-enough to another product

change in quantity supplied vs. change in supply

quantity supplied- due to increased price/ movement along

change in supply- shift/ due to change in non price

when does the supply curve shift and in what direction?

supply increase = curve to the right

supply decrease = curve to the left

what factors cause a change supply?

1.) change in input costs

2.) change in technology

3.) change in number of suppliers

4.) change in future price

5.)change in price of similar good

6.) change in government

a.) change in taxes

b.) change in subsidies

c.) change in government regulations

law of supply

as the price increases (decreases) the quantity supplied increases (decreases)

subsidy

a direct or indirect payment to individuals or firms, usually in the form of a cash payment from the government or a targeted tax cut

supply schedule

a table that shows the quantity supplied at each price

supply curve

upward slopping

price floor

government sets a minimum price, usually above the equal

price ceiling

government sets a maximum price, usually below the equilibrium

surplus

the amount of an asset or resource that exceeds the portion that's actively utilized

shortage

a condition where the quantity demanded is greater than the quantity supplied at the market price

equilibrium

the state in which the market forces are balanced, where current prices stabilize between even supply and demand

equilibrium price and equilibrium quantity

equilibrium price - the price at which the quantity demanded equals the quantity supplied

equilibrium quantity - the quantity bought and sold at the equilibrium price

prices

the amount of money that a buyer gives to a seller in exchange for a good or a service

natural monopoly

a type of monopoly in an industry or sector with high barriers to entry and start-up costs that prevent any rivals from competing

geographic monopoly

occur when a business is the only one offering its products or services in a particular location

laissez-faire

no taxes, regulations, or tariffs

pure competition

a marketing situation in which there are a large number of sellers of a product which cannot be differentiated and, thus, no one firm has a significant influence on price

monopoly

a market structure where a single seller or producer assumes a dominant position in an industry or a sector

monopolistic competition

a type of market structure where many companies are present in an industry, and they produce similar but differentiated products

oligopoly

a market in which the industry is dominated by a few companies that are each influential participants in the market

what are the sources of revenue for local?

intergovernmental revenues

sales taxes

interest on invested funds

property taxes

utility revenues

taxes from individuals and profits taxes from corporations

what are sources of revenue for state?

intergovernmental revenues

sales taxes

employee retirement

individual income taxes

what are sources of revenue for federal government?

individual income taxes

corporate income taxes

borrowing

excise, estate, and gift taxes

payroll taxes

progressive tax

the effective tax rate increases as a person’s income goes up

proportional tax

the effective tax rate stays the same regardless of income

regressive tax

the effective tax rate decreases as income goes up

W-4 Form

tells your employer how much money to with hold for your future tax bill

W-2 Form

get one form every employer (by Jan 31st)

needed to file tax retain

shows how much income and tax

gross pay

pay before deductions

net pay

pay after deductions

FICA

(federal insurance contribution act) federal tax used to pay for social security and medicare

excise tax

a special tax on gasoline

property taxes

real estate, buildings, and anything permanently attached to them

sales taxes

general tax levied on consumer purchases of almost all products

social security

federal program of disability and retirement

medicare

health care for the elderly

what is included and excluded when calculating GDP?

includes- all USA companies regardless of where they are located (worldwide)

excludes- any foreign companies within the US borders

GDP

a measure of the value of all the final goods and services newly produced within a period time (usually a year)

per capita GDP

a measure of the total output of a country that takes gross domestic product (GDP) and divides it by the number of people in the country

net exports

exports minus imports

real GDP

value or number not adjusted for inflation

nominal GDP

value or number that has been adjusted for inflation

underground economy

involves the exchange of goods and services which are hidden from official view

transfer payment

a payment of money for which there are no goods or services exchanged

market basket

a selected mix of goods and services that tracks the performance of a specific market or segment

intermediate product

products that are used in the production process to make other goods, which are ultimately sold to consumers

non market transaction

transactions covering goods or services that their producers supply to others free or at prices that are not economically significant

disposable income

what is left over after taxes, and is what households used for consumption of needs and wants

base year

the first of a series of years in an economic or financial index

CPI

a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services

secondhand sales

sales of used good; category of activity not included in GDP computation

Y=C+I+G+Xn

C = consumption

I = investment

G = government

Xn= net exports

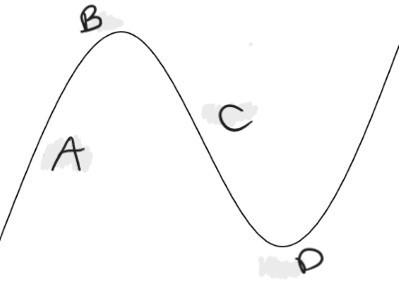

what are the phases of the business cycle?

A.) expansionary/ recovery

B.) peak/ prosperity

C.) contractionary/ recession

D.) trough

frictional unemployment

in between jobs, new graduates, new careers

structural unemployment

lack of skills, long term change in demand for job (not related to a downtown in the economy), replaced by technology

seasonal unemployment

(part of structural) farm workers, holiday help

cyclical unemployment

due to recession, a down turn in the economy. may effect only certain sectors. will get job back when economy recovers

demand pull inflation

too many dollars chasing too few goods. supply can’t keep up with demand

cost push inflation

cost of production is higher

wage-price spiral inflation

occurs as a result of demand pull and cost push happening one right after the other

hyperinflation

caused when the government or central bank of a country prints too much currency