1.2.9 Indirect taxes and subsidies

0.0(0)

Card Sorting

1/6

Earn XP

Description and Tags

Last updated 8:40 PM on 3/7/24

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

7 Terms

1

New cards

Indirect tax

tax on firms by the government on the sale/production of specific goods/services

2

New cards

Subsidies

a grant/sum of money paid by the government to firms to produce a certain good/service

3

New cards

indirect tax effect on graph

supply left

shortage

price rises

contraction along the demand curve

4

New cards

subsidy effect on graph

supply right

surplus

price falls

extension along the demand curve

5

New cards

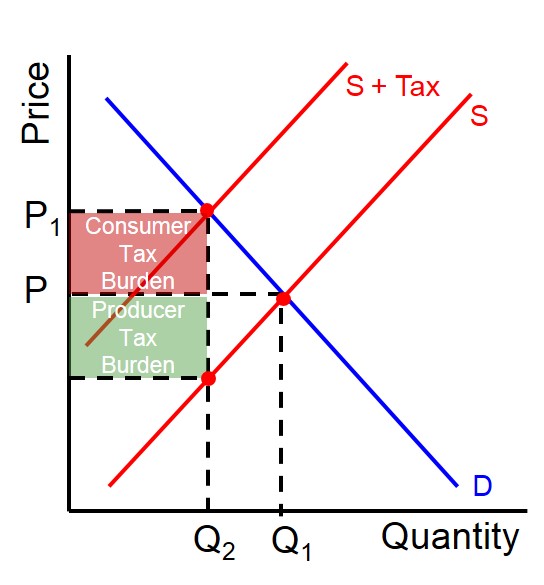

incidence of indirect tax on consumers and producers

6

New cards

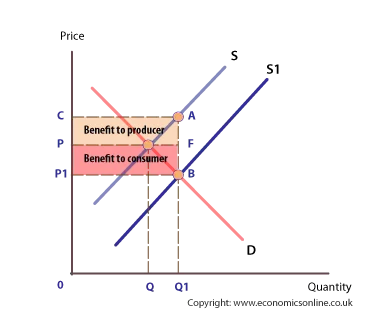

impact of subsidy on producers and consumers

7

New cards

Ad - Valorem tax

An ad valorem tax is expressed as a percentage. For example, VAT is charged at a rate of 20% in the UK.