Economics 100 Midterm Practice Exam

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

50 Terms

Because of its effect on the amount of capital per worker, in the short term an increase in the working population is likely to

A. raise productivity. Other things the same, this increase will be larger in a poor country.

B. raise productivity. Other things the same, this increase will be larger in a rich country.

C. reduce productivity. Other things the same, this decrease will be larger in a poor country.

D. reduce productivity. Other things the same, this decrease will be larger in a rich country.

C. reduce productivity. Other things the same, this decrease will be larger in a poor country.

The one variable that stands out as the most significant explanation of large variations in living standards around the world is

A. productivity.

B. population.

C. preferences.

D. prices.

A. productivity.

If a newly elected government takes actions that makes its country’s courts more efficient and less corrupt, then

A. producers will have greater confidence that they will benefit from their efforts.

B. producers are likely to be more specialized.

C. buyers and sellers will be more likely to honor contracts.

D. All of the above are correct.

D. All of the above are correct.

Suppose a country increases trade restrictions. This country would be pursing an

A. inward policy, which most economists believe has beneficial effects on the economy.

B. inward policy, which most economists believe has adverse effects on the economy.

C. outward policy, which most economists believe has beneficial effects on the economy.

D. outward policy, which most economists believe has adverse effects on the economy.

B. inward policy, which most economists believe has adverse effects on the economy.

If an American-based firm opens and operates a new clothing factory in Honduras, then it is engaging in

A. foreign portfolio investment.

B. foreign financial investment.

C. foreign direct investment.

D. indirect foreign investment.

C. foreign direct investment.

Which of the following is generally an opportunity cost of investment in human capital?

A. future job security

B. forgone present wages

C. increased earning potential

D. All of the above are correct.

B. forgone present wages

Sandra uses her sewing machine, thread, and yards of denim to produce jean skirts. The sewing machine is an example of

A. labor.

B. physical capital.

C. human capital.

D. natural resources.

B. physical capital.

Janet is a farmer. Which of the following are included in her human capital?

A. her tractor and what she’s learned from experience

B. her tractor but not what she’s learned from experience

C. what she’s learned from experience but not her tractor

D. neither her tractor nor what she’s learned from experience

C. what she’s learned from experience but not her tractor

Suppose a person receives an education in her home country. Which of the following will tend to make the increase in GDP of the person’s home country larger than the increase in this person’s income?

A. externalities and brain drain

B. externalities but not brain drain

C. brain drain but not externalities

D. neither externalities nor brain drain

B. externalities but not brain drain

Once an idea enters society's pool of knowledge, the idea becomes a

A. societal good.

B. private good.

C. public good.

D. proprietary good.

C. public good.

In which of the following cases would it necessarily be true that national saving and private saving are equal for a closed economy?

A. Private saving is equal to government expenditures.

B. Public saving is equal to investment.

C. After paying their taxes and paying for their consumption, households have nothing left.

D. The government’s tax revenue is equal to its expenditures.

D. The government’s tax revenue is equal to its expenditures.

Institutions that help to match one person's saving with another person's investment are collectively called the

A. Federal Reserve system.

B. banking system.

C. monetary system.

D. financial system.

D. financial system.

Two bonds have the same term to maturity. The first was issued by a state government and the probability of default is believed to be low. The other was issued by a corporation and the probability of default is believed to be high. Which of the following is correct?

A. Because they have the same term to maturity the interest rates should be the same.

B. Because of the differences in tax treatment and credit risk, the state bond should have the higher interest rate.

C. Because of the differences in tax treatment and credit risk, the corporate bond should have the higher interest rate.

D. It is not possible to say if one bond has a higher interest rate than the other.

C. Because of the differences in tax treatment and credit risk, the corporate bond should have the higher interest rate.

All else equal, when people become more optimistic about a company's future, the

A. supply of the stock and the price will both rise.

B. supply of the stock and the price will both fall.

C. demand for the stock and the price will both rise.

D. demand for the stock and the price will both fall.

C. demand for the stock and the price will both rise.

If the Apple corporation sells a bond it is

A. borrowing directly from the public.

B. borrowing indirectly from the public.

C. selling shares of ownership directly to the public.

D. selling shares of ownership indirectly to the public.

A. borrowing directly from the public.

Kathleen is considering expanding her dress shop. If interest rates rise she is

A. less likely to expand. This illustrates why the supply of loanable funds slopes downward.

B. more likely to expand. This illustrates why the supply of loanable funds slopes upward.

C. less likely to expand. This illustrates why the demand for loanable funds slopes downward.

D. more likely to expand. This illustrates why the demand for loanable funds slopes upward.

C. less likely to expand. This illustrates why the demand for loanable funds slopes downward.

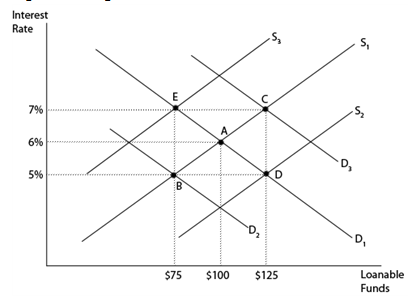

Figure 26-5. Figure 26-5 shows the loanable funds market for a closed economy.

Refer to Figure 26-5. Starting at point A, the enactment of an investment tax credit would likely cause

A. the quantity of loanable funds traded to increase to $125 and the interest rate to rise to 7% (point C).

B. the quantity of loanable funds traded to decrease to $75 and the interest rate to fall to 5% (point B).

C. the quantity of loanable funds traded to decrease to $75 and the interest rate to rise to 7% (point E).

D. the quantity of loanable funds traded to increase to $125 and the interest rate to fall to 5% (point D).

A. the quantity of loanable funds traded to increase to $125 and the interest rate to rise to 7% (point C).

Atlas Corporation is in sound financial condition. It sells a long-term bond. Which of the following make the interest rate on this bond lower than otherwise?

A. Both Altas’ sound finances and the long term of the bond.

B. Atlas’ sound finances but not the long term of the bond.

C. The long term of the bond but not Atlas’ sound finances.

D. Neither Atlas’ sound finances nor the long term of the bond.

B. Atlas’ sound finances but not the long term of the bond.

If Canada goes from a large budget deficit to a small budget deficit, it will

A. increase private saving and so shift the supply of loanable funds right.

B. increase investment and so shift the demand for loanable funds right.

C. increase public saving and so shift the supply of loanable funds right.

D. reduce national saving and shift the supply left.

C. increase public saving and so shift the supply of loanable funds right.

A low price-earnings ratio indicates that either the stock is

A. undervalued or people are relatively optimistic about the corporation's prospects.

B. overvalued or people are relatively optimistic about the corporation's prospects.

C. overvalued or people are relatively pessimistic about the corporation's prospects.

D. undervalued or people are relatively pessimistic about the corporation's prospects.

D. undervalued or people are relatively pessimistic about the corporation's prospects.

There is a clear consensus among economists that unions are

A. good for the economy because they result in higher wages for most workers.

B. good for the economy because they are a necessary antidote to the market power of employers.

C. bad for the economy because they are cartels and therefore detrimental to an efficient allocation of resources.

D. None of the above is correct; there is no clear consensus among economists about whether unions are good or bad for the economy.

D. None of the above is correct; there is no clear consensus among economists about whether unions are good or bad for the economy.

Caroline is the owner of a hair-styling salon and spa. She decides to raise the wages of her workers even though she faces an excess supply of labor. Her decision

A. might increase profits if it attracts a better pool of workers to apply for jobs at her salon.

B. will increase the excess supply of labor.

C. may increase the quality of her work force.

D. All of the above are correct.

D. All of the above are correct.

Three employers have justified their actions as follows. Whose logic is not consistent with the logic of efficiency wage theory?

A. Instead of spending money on an electronic timing system that monitors worker hours, Tom spends an equivalent amount of money on higher wages.

B. Dick pays his workers less than the equilibrium wage so that they will not have the time or money to look for work somewhere else.

C. Harry pays his workers in a developing country more than the going wage hoping that they will get a better diet and so be more productive.

D. None of the above is consistent with the logic of efficiency wage theory.

B. Dick pays his workers less than the equilibrium wage so that they will not have the time or money to look for work somewhere else.

Satchel loses his job and immediately begins looking for another. Other things the same, the unemployment rate

A. increases, and the labor-force participation rate decreases.

B. and the labor-force participation rate both increase.

C. increases, and the labor-force participation rate is unaffected.

D. is unaffected, and the labor-force participation rate decreases.

C. increases, and the labor-force participation rate is unaffected.

According to the theory of efficiency wages, if a firm stops paying efficiency wages it is likely to see a(n)

A. increase in the number of job applicants and an increase in how long workers stay on the job.

B. increase in the number of job applicants and a decrease in how long workers stay on the job.

C. decrease in the number of job applicants and an increase in how long workers stay on the job.

D. decrease in the number of job applicants and a decrease in how long workers stay on the job.

D. decrease in the number of job applicants and a decrease in how long workers stay on the job.

John is a stockbroker. He has had several job offers, but he has turned them down because he thinks he can find a firm that better matches his tastes and skills. Curtis has looked for work as an accountant for some time. While the demand for accountants does not appear to be falling, there seems to be more people applying than jobs available.

A. John and Curtis are both frictionally unemployed.

B. John and Curtis are both structurally unemployed.

C. John is frictionally unemployed, and Curtis is structurally unemployed.

D. John is structurally unemployed, and Curtis is frictionally unemployed.

C. John is frictionally unemployed, and Curtis is structurally unemployed.

Buddy is the owner of a firm that bottles beer in St. Louis, Missouri. There are many other such firms in the area. Buddy decides that if he pays his workers a wage higher than the going market wage, his profits will increase. Which of the following is a likely explanation for his decision?

A. The higher the wage, the less often his workers will choose to leave his firm.

B. The higher the wage, the lower will be the costs of obtaining needed supplies.

C. The higher the wage, the more he can charge for his beer

D. The higher the wage, the more he will have to monitor his workers for shirking.

A. The higher the wage, the less often his workers will choose to leave his firm.

If a country signs a trade agreement so that employment in some industries rises and employment in some industries fall, then

A. structural unemployment rises temporarily.

B. structural unemployment rises permanently.

C. frictional unemployment rises temporarily.

D. frictional unemployment rises permanently.

C. frictional unemployment rises temporarily.

Karena was laid off, but she is expecting to be recalled. She has not looked for work since being laid off. Nathan is not employed, nor was he laid off. Who is counted as “unemployed” in the U.S. labor force statistics?

A. 1) Karena and 2) Nathan, even if Nathan has not looked for work during the previous four weeks

B. 1) Karena and 2) Nathan, if Nathan has looked for work during the previous four weeks

C. 1) not Karena but 2) Nathan, even if Nathan has not looked for work during the previous four weeks

D. 1) not Karena but 2) Nathan, if Nathan has looked for work during the previous four weeks

B. 1) Karena and 2) Nathan, if Nathan has looked for work during the previous four weeks

Minimum-wage laws and unions are similar to each other but different from efficiency wages in that minimum-wage law and unions

A. cause unemployment, but efficiency wages do not.

B. cause the quantity of labor supplied to exceed the quantity of labor demanded, but efficiency wages do not.

C. cause wages to be above the equilibrium level.

D. prevent firms from lowering wages in the presence of a surplus of workers.

D. prevent firms from lowering wages in the presence of a surplus of workers.

When prisoners use cigarettes or some other good as money, cigarettes become

A. commodity money, but do not function as a unit of account.

B. commodity money and function as a unit of account.

C. fiat money, but do not function as a unit of account.

D. fiat money and function as a unit of account.

B. commodity money and function as a unit of account.

The Fed’s control of the money supply is not precise because

A. Congress can also make changes to the money supply.

B. there are not always government bonds available for purchase when the Fed wants to perform open-market operations.

C. the Fed does not know where all U.S. currency is located.

D. the amount of money in the economy depends in part on the behavior of depositors and bankers.

D. the amount of money in the economy depends in part on the behavior of depositors and bankers.

The Fed can increase the money supply by conducting open-market

A. sales or by raising the discount rate.

B. sales or by lowering the discount rate.

C. purchases or by raising the discount rate.

D. purchases or by lowering the discount rate.

D. purchases or by lowering the discount rate.

Which of the following increases when the Fed makes open-market sales?

A. currency and reserves

B. currency but not reserves

C. reserves but not currency

D. neither currency nor reserves

D. neither currency nor reserves

On a bank's T-account, which are part of the banks liabilities?

A. both deposits made by its customers and reserves

B. deposits made by its customers but not reserves

C. reserves but not deposits made by its customers

D. neither deposits made by its customers nor reserves

B. deposits made by its customers but not reserves

The confidence you have that a retailer will accept dollars in exchange for goods is based primarily on money

A. being a unit of account.

B. being a medium of exchange.

C. serving as a store of value.

D. having intrinsic value.

B. being a medium of exchange.

The money stock in the economy is

A. the amount of wealth accumulating in the economy, such as currency and demand deposits.

B. the amount of wealth accumulating in the economy, such as money market mutual funds and stocks.

C. the quantity of money circulating in the economy, such as currency and demand deposits.

D. the quantity of money circulating in the economy, such as money market mutual funds and stocks.

C. the quantity of money circulating in the economy, such as currency and demand deposits.

Which of the following statements is correct? In the special case of the 100-percent reserve banking the money multiplier is

A. 0 and banks create money.

B. 0 and banks do not create money.

C. 1 and banks create money

D. 1 and banks do not create money.

D. 1 and banks do not create money.

If $500 of new reserves generates $1000 of new money in the economy, then the money multiplier is

A. 2 and the reserve ratio is 50 percent.

B. 2 and the reserve ratio is 2 percent.

C. 0.5 and the reserve ratio is 50 percent.

D. 0.5 and the reserve ratio is 2 percent.

A. 2 and the reserve ratio is 50 percent.

If the reserve ratio increased from 5 percent to 10 percent, then the money multiplier would

A. rise from 5 to 10.

B. rise from 10 to 20.

C. fall from 20 to 10.

D. fall from 10 to 5.

C. fall from 20 to 10.

In the 1970s, in response to recessions caused by an increase in the price of oil, the central banks in many countries increased their money supplies. The central banks might have done this by

A. selling bonds on the open market, which would have raised the value of money.

B. purchasing bonds on the open market, which would have raised the value of money.

C. selling bonds on the open market, which would have raised the value of money.

D. purchasing bonds on the open market, which would have lowered the value of money.

D. purchasing bonds on the open market, which would have lowered the value of money.

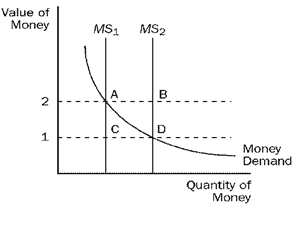

Figure 30-1

Refer to Figure 30-1. If the money supply is MS2 and the value of money is 2, then

A. the quantity of money demanded is greater than the quantity supplied; the price level will rise.

B. the quantity of money demanded is greater than the quantity supplied; the price level will fall.

C. the quantity of money supplied is greater than the quantity demanded; the price level will rise.

D. he quantity of money supplied is greater than the quantity demanded; the price level will fall.

C. the quantity of money supplied is greater than the quantity demanded; the price level will rise.

On a given morning, Franco sold 40 pairs of shoes for a total of $80 at his shoe store.

A. The $80 is a real variable. The quantity of shoes is a nominal variable.

B. The $80 is a nominal variable. The quantity of shoes is a real variable.

C. Both the $80 and the quantity of shoes are nominal variables.

D. Both the $80 and the quantity of shoes are real variables.

B. The $80 is a nominal variable. The quantity of shoes is a real variable.

When the money market is drawn with the value of money on the vertical axis, an increase in the price level causes a

A. shift to the right of the money demand curve.

B. shift to the left of the money demand curve.

C. movement to the left along the money demand curve.

D. movement to the right along the money demand curve.

D. movement to the right along the money demand curve.

When we assume that the supply of money is a variable that the central bank controls, we

A. must then assume as well that the demand for money is not influenced by the value of money.

B. must then assume as well that the price level is unrelated to the value of money.

C. are ignoring the fact that, in the real world, households are also suppliers of money.

D. are ignoring the complications introduced by the role of the banking system.

D. are ignoring the complications introduced by the role of the banking system.

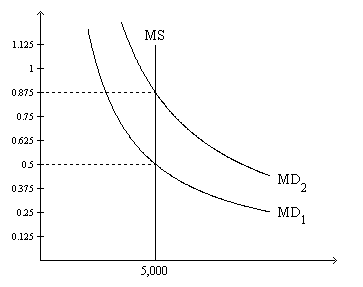

Figure 30-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.

Refer to Figure 30-2. Suppose the relevant money-demand curve is the one labeled MD1; also suppose the velocity of money is 4. If the money market is in equilibrium, then the economy’s real GDP amounts to

A. 2,500.

B. 7,500.

C. 10,000.

D. 40,000.

C. 10,000.

Last year, Jane spent all of her income to purchase 200 units of corn at $5 per unit. This year, she spent all of her income to purchase 180 units of corn at $6 per unit.

A. Jane’s nominal income and real income decreased this year.

B. Jane’s nominal income decreased this year, but her real income increased.

C. Jane’s nominal income and real income increased this year.

D. Jane’s nominal income increased this year, but her real income decreased.

D. Jane’s nominal income increased this year, but her real income decreased.

The claim that increases in the growth rate of the money supply increase nominal interest rates but not real interest rates is known as the

A. Friedman Effect.

B. Hume Effect.

C. Fisher Effect.

D. the inflation tax.

C. Fisher Effect.

People go to the bank more frequently to reduce currency holdings when inflation is high. The sacrifice of time and convenience that is involved in doing that is referred to as

A. inflation-induced tax distortion.

B. relative-price-variability cost.

C. shoeleather cost.

D. menu cost.

C. shoeleather cost.

An associate professor of physics gets a $200 a month raise. She figures that with her new monthly salary she can buy more goods and services than she could buy last year.

A. Her real and nominal salary have risen.

B. Her real and nominal salary have fallen.

C. Her real salary has risen and her nominal salary has fallen.

D. Her real salary has fallen and her nominal salary has risen.

A. Her real and nominal salary have risen.