Principles of Insurance

1/3

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

4 Terms

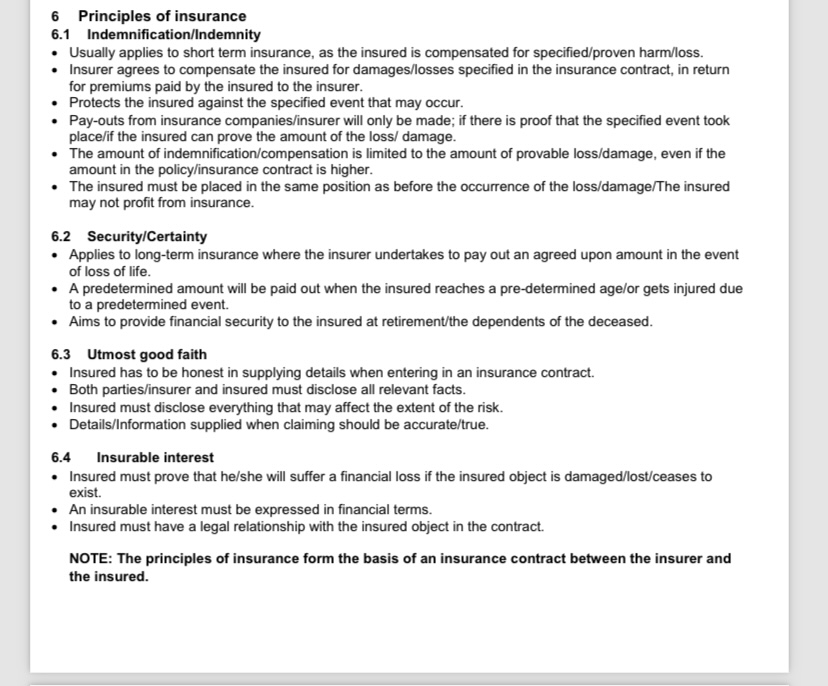

Utmost good faith

Insured has to be honest in supplying details when entering in an insurance contract.

Both parties/insurer and insured must disclose all relevant facts.

Insured must disclose everything that may affect the extent of the risk.

Details/Information supplied when claiming should be accurate/true.

Insurable interest

Insured must prove that he/she will suffer a financial loss if the insured object is damaged/lost/ceases to exist.

An insurable interest must be expressed in financial terms.

Insured must have a legal relationship with the insured object in the contract.

Indemnification/Indemnity

Usually applies to short term insurance, as the insured is compensated for specified/proven harm/loss.

Insurer agrees to compensate the insured for damages/losses specified in the insurance contract, in return

• Protects im insure i age insure poie in sent that may occur.

Pay-outs from insurance companies/insurer will only be made; if there is proof that the specified event took place/if the insured can prove the amount of the loss/ damage.

The amount of indemnification/compensation is limited to the amount of provable loss/damage, even if the amount in the policy/insurance contract is higher.

The insured must be placed in the same position as before the occurrence of the loss/damage/The insured may not profit from insurance.