Indirect Tax

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

Why would a government implement an indirect tax

Raise gov revenue

Reduce consumption of demerit goods

Define direct taxes

Taxes on income which cannot be transferred to anyone else

e.g: Income, Corporation tax and national insurance

Define indirect taxes

Extra taxes on goods and services - can be transferred to consumers by increasing price of goods - best applied on elastic goods as they cannot pass on costs

What are the types of indirect taxes

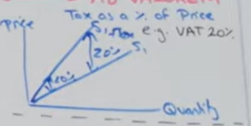

Ad Valorem - Tax is a percentage of price

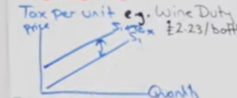

Specific - Tax on each product sold

Show the effect of a specific tax being implemented on a diagram

Supply shifts inwards - wherever on the supply curve there will always be the same distance apart from the new supply curve as each product is taxed the same no matter the price

Show the effect of an ad-valorem tax being implemented

Supply does not shift but increases in steepness. This is because as price increases the tax increases as well and so it adds even more to the firms costs causing them to cut back further on supply

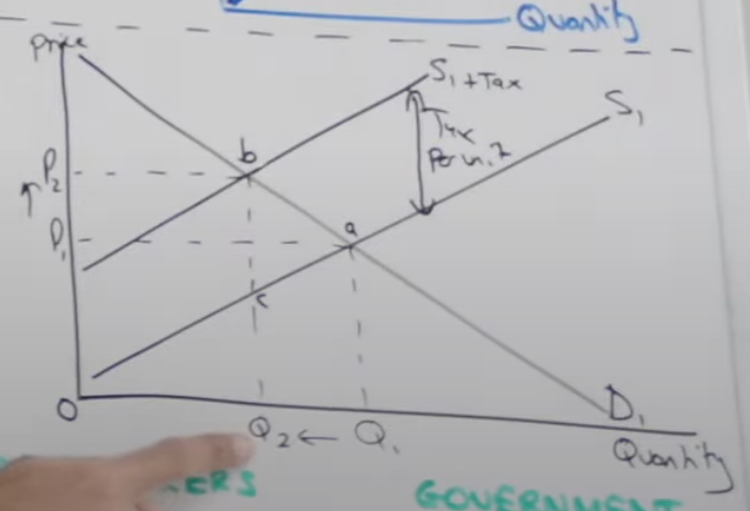

Identify the tax per unit

Identify tax revenue

What is the consumer burden

What is the producer burden

Producer Revenue

P(b) - P(c ) = Tax per unit

C, B, Q2 square though

Top bit of tax revenue

Bottom bit of tax revenue

C, Q2, 0 square though

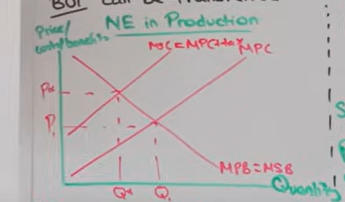

Draw an indirect tax implementation on a negative production externality

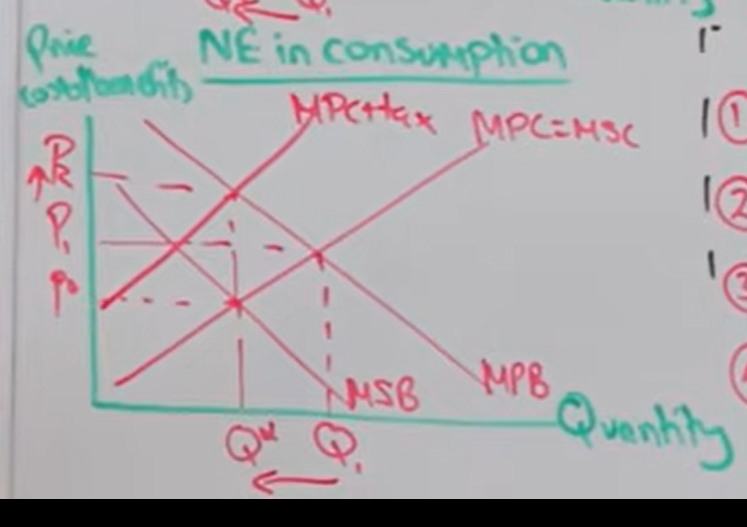

Draw indirect tax implementation on a negative consumption externality

What does it mean to ‘Internalise’ an externality

Usually an externality is unaccounted for by producer and consumer however when a tax is implemented the price increases and accounts for the negative externality (Internalised)

Analyse the effect that indirect tax has on correcting market failure

Indirect tax is implemented

This increases a firms costs of production

So price increases which mean negative externality is internalised

This solves overconsumption / production

Promotes allocative efficiency and increases gov revenue

Problems with implementing an indirect tax on a negative externality

Price increase may result in black markets forming

Imperfect information -Tax may be set too high/ low

Indirect tax is regressive = worse inequality

If price is inelastic all extra costs will be passed onto the consumer

What is a hypothecated tax

A tax which has a stated purpose for the collected revenue