3.3 cost, revenue and profit

1/66

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

67 Terms

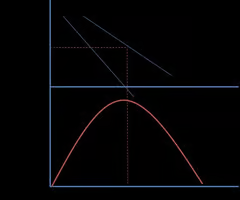

Total Revenue

Revenue from sales calculated as price x quantity.

Marginal Revenue

Extra revenue from selling one additional unit.

Average Revenue

Total revenue divided by quantity sold.

Price Elasticity of Demand (PED)

Measures responsiveness of quantity demanded to price changes.

Total Cost

Cost to produce a given level of output.

Total Fixed Cost

Costs that do not vary with output level.

Total Variable Cost

Costs that change with output level.

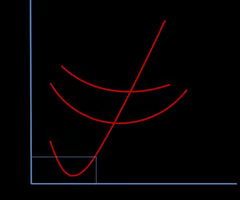

Average Total Cost (ATC)

Total costs divided by quantity produced.

Average Fixed Cost (AFC)

Total fixed costs divided by quantity produced.

Average Variable Cost (AVC)

Total variable costs divided by quantity produced.

Marginal Cost

Cost of producing one additional unit of output.

Demand Curve

Graph showing relationship between price and quantity demanded.

Price Takers

Firms that accept market price; horizontal AR curve.

Price Makers

Firms that set prices; downward sloping AR curve.

Diminishing Marginal Productivity

Decreasing additional output from increasing one input.

Elastic Demand

Demand where quantity changes significantly with price changes.

Inelastic Demand

Demand where quantity changes little with price changes.

Revenue Maximization

Occurs when marginal revenue equals zero.

Short Run

Period where at least one production factor is fixed.

Long Run

Period where all production factors can change.

Indirect Costs

Costs not directly tied to production, like rent.

Direct Costs

Costs directly associated with production, like materials.

AR Curve

Average revenue curve; represents price of goods.

Short Run

Period with some fixed costs in production.

Long Run

All costs are variable in production.

Very Long Run

State of technology can change significantly.

Diminishing Marginal Productivity

Output increases initially, then marginal output declines.

Marginal Cost (MC)

Cost of producing one additional unit of output.

Average Total Cost (ATC)

Total cost divided by quantity of output.

Average Variable Cost (AVC)

Variable cost per unit of output produced.

Average Fixed Cost (AFC)

Fixed cost per unit as output increases.

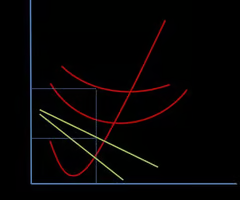

Minimum Efficient Scale

Lowest point on LRAC where costs are minimized.

Diseconomies of Scale

Average costs increase as production expands.

Economies of Scale

Average costs decrease as production increases.

Short-Run Average Cost (SRAC)

Average cost curve in the short run.

Long-Run Average Cost (LRAC)

Average cost curve in the long run.

Cost Curves

Graphical representation of costs at different outputs.

Marginal Output

Additional output resulting from one more input.

Total Costs

Sum of fixed and variable costs in production.

Macroeconomic Factors

External factors affecting a firm's production costs.

Competitiveness

Ability to compete based on cost and pricing.

Risk-Bearing Economies

Larger firms spread costs of uncertainty across products.

Financial Economies

Larger firms access cheaper loans and credit.

Managerial Economies

Specialization in larger firms reduces average costs.

Production Range Expansion

Larger firms can diversify product offerings effectively.

Diminishing Returns

Increased inputs lead to reduced marginal output.

Economies of Scale

Cost advantages as output increases for firms.

Technological Economies

Larger firms invest in advanced machinery, lowering costs.

Marketing Economies

Larger firms spread advertising costs over more units.

Purchasing Economies

Bulk-buying reduces cost per unit for larger firms.

Network Economies of Scale

Low-cost expansion through ecommerce for large retailers.

External Economies of Scale

Industry growth leads to lower costs for local firms.

Diseconomies of Scale

Increased costs per unit after optimal output level.

Control Issues

Monitoring productivity becomes challenging in larger firms.

Coordination Challenges

Managing thousands of employees complicates operations.

Communication Problems

Employee alienation can reduce motivation and productivity.

Long Run Average Cost Curve

Graph showing costs decrease then increase with output.

Normal Profit

Minimum profit to keep entrepreneurs in business long-term.

Supernormal Profit

Profit exceeding normal profit, above opportunity costs.

Losses

When total costs exceed total revenue for a firm.

Profit Maximization Condition

Occurs when marginal cost equals marginal revenue (MC=MR).

Short-Run Shutdown Point

Firm shuts down if price is below average variable cost.

Long-Run Shutdown Decision

Firm exits industry if total revenue is less than total costs.

Average Variable Cost (AVC)

Variable costs per unit of output produced.

Total Revenue (TR)

Total income from sales of goods or services.

Total Cost (TC)

Sum of fixed and variable costs for production.

Opportunity Cost

Cost of forgoing the next best alternative.