Indirect Taxes

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

indirect tax

A tax levied on expenditure on goods or services

They reduce the supply of the good by artificially increasing the cost of production

E.g. Value added tax (VAT) & excise duties such as those on cigarettes or petrol

Different to a 'direct' tax, which is a tax charged directly to an individual based on a component of income

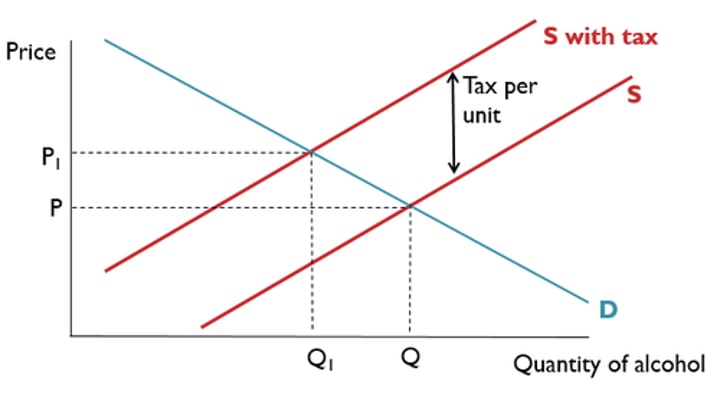

Specific taxes definition

a fixed tax per unit of the good or service produced

Shifts the supply curve inwards and maintains gradient

E.g. Air passenger duty of £12 per flight for domestic flights

Specific taxes diagram

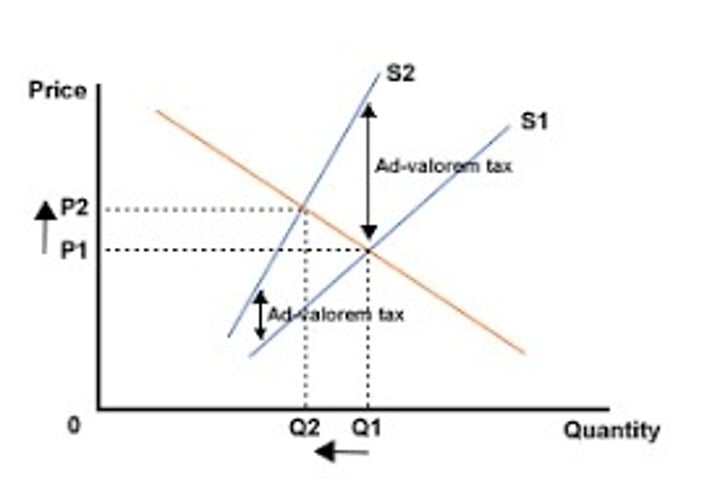

Ad Valorem taxes diagram

Ad Valorem taxes definition

a percentage tax of the unit cost of a good

Pivots the supply curve inwards and increases gradient

E.g. VAT (currently at 20% in the UK)

Impact of Indirect taxes

Indirect taxes lead to an increased price and reduced quantity traded of the good or service

Why would a government want to implement an indirect tax?

To raise tax revenue to fund government spending

To change (a) the level of demand and (b) the pattern of demand for different goods and services

Indirect taxes are flexible - easy to change

To raise tax revenue to fund government spending

Indirect taxes can be a powerful fiscal policy tool

To change (a) the level of demand and (b) the pattern of demand for different goods and services

To deter and reduce the consumption of goods and services considered to be harmful (de-merit goods and negative externalities)

To encourage the longer-term conservation of scarce economic resources (e.g. fuel)

Indirect taxes are flexible - easy to change

Allowing governments to quickly intervene in markets when necessary

Also harder to avoid

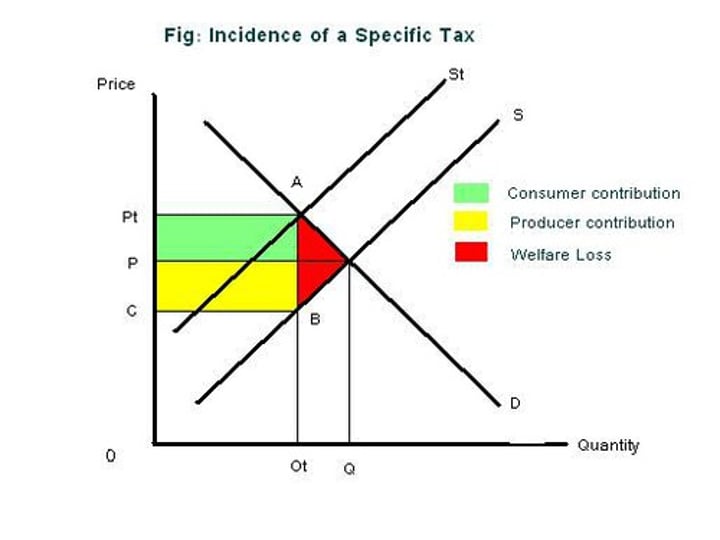

Economic Incidence (or burden)

Indicates the extent to which someone is made worse off by the tax, i.e. the amount they pay.

incidence of tax diagram

who pay's most of the tax based on PED?

Elastic PED: Producers pay most of the tax

Perfectly Elastic PED: Producers pay all the tax!

Inelastic PED: Consumers pay most of the tax

Perfectly Inelastic PED: Consumers pay all the tax!

Limitations of Indirect Taxes

Indirect taxes can be regressive

Inflation

Gov failure

Can be ineffective

Uncertain government revenue

Loss of economic welfare

Indirect taxes can be regressive

The implementation of indirect taxes on certain goods can mean that poorer individuals pay a greater proportion of their income on these taxes

The tax burden is heaviest on poorer households, meaning a more unequal distribution of income

E.g. Alcohol duties

If a person earning £200 a week buys two pints of lager on a Friday and pays about £1 in total in beer duties, representing 0.5% of their income

But a richer person earning £600 a week buys four pints of the same lager, paying £2 in total in beer duties, representing only 0.33% of their income, despite consuming twice as much!

Inflation

Higher taxes leads to higher prices as suppliers pass on part of the tax by raising prices

Particularly an issue when PED is inelastic

Gov failure

If indirect taxes are set too high, it creates an incentive to avoid taxes through "boot-legging" and smuggling

These boot-legged goods can often be even more harmful are less likely to be made to same standards as legitimate products.

Can be ineffective

If demand is inelastic, indirect taxes have little effect on the amount consumed

The tax just pushes up prices, potentially further worsening income equality through their regressive nature

Uncertain government revenue

If a market is volatile, the amount raised from indirect taxes can be uncertain

Particularly during a recession / downturn

Loss of economic welfare

Higher prices and lower output causes a loss of consumer and producer surplus

The fall in CS and PS outweighs the gain in government revenue, leading to a DWL