common pool resources and negative externalities

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

common pool resources

resources not owned by anyone

don’t have a price

free to use without payment or other restrictions

eg: clean air, lakes, rivers

common pool resources are…

rivalrous: the consumption by one person reduces the availability for someone else

non-excludable: it is not possible to exclude people from using the resources since there is no price

tragedy of the commons

situation in which individuals sharing a common resource act based on self-interest

ultimately, depleting the resource

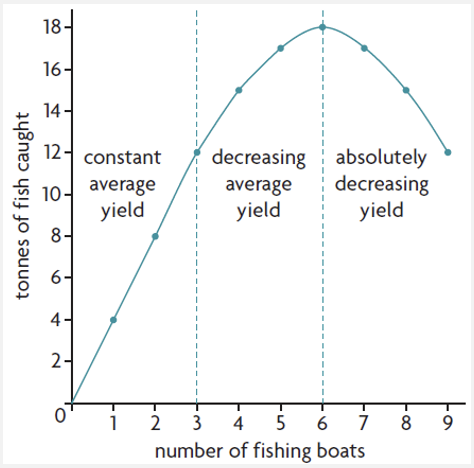

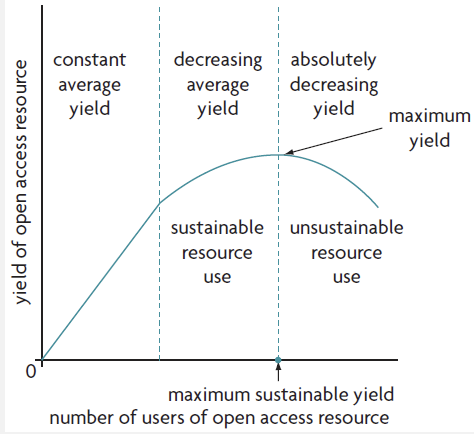

unsustainable production

production that uses resources unsustainably

maximum sustainable yield

maximum use that can be made of a resource that is also sustainable, in that the resource can reproduce itself.

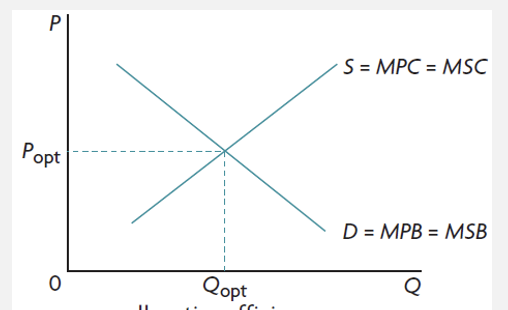

market failure

the failure of market to allocate resources efficiently

results in allocative inefficiency

private benefit, external benefit and social benefit

private: the benefit gained directly by the consumer

external: the benefit gained by a third party

social: private + external

private cost, external cost and social cost

private: cost firm pays when producing a good

external: cost incurred by third parties

social: private + external

externality

occurs when the actions of consumers or producers give rise to negative or positive side effects on other people who are not part of these actions and whose interests aren’t taken into consideration

MSB>MPB

MSC>MPC

allocative efficiency

when MSC=MSB

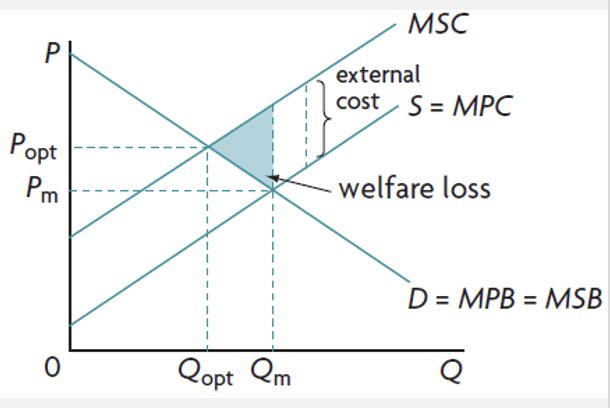

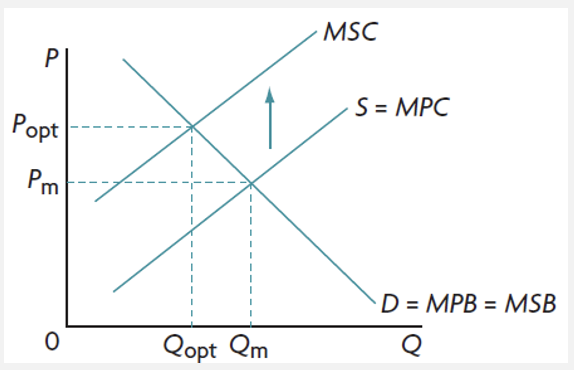

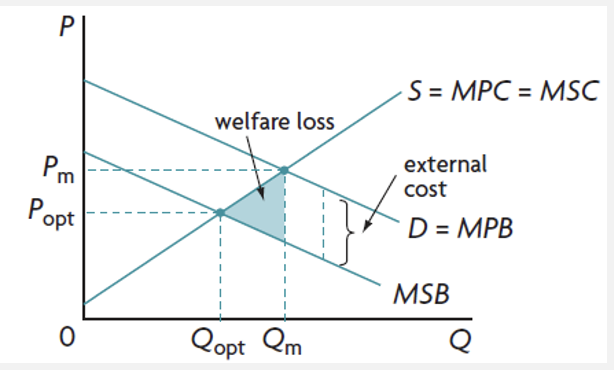

negative production externalities

costs created by producers, in the form of pollution as a side-effect of production

the free market overallocates resources to the production of a good and more produced than what is socially optimal

negative production externalities graph

when Qm > Qopt

MSC > MSB at Qm

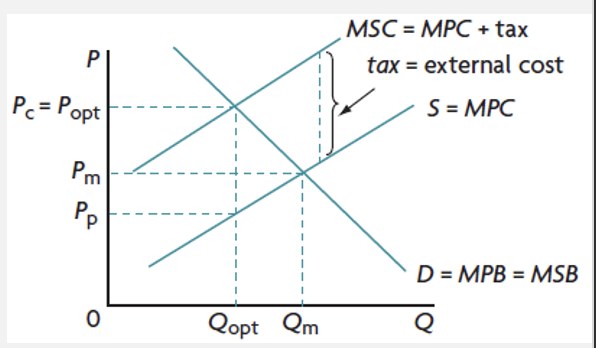

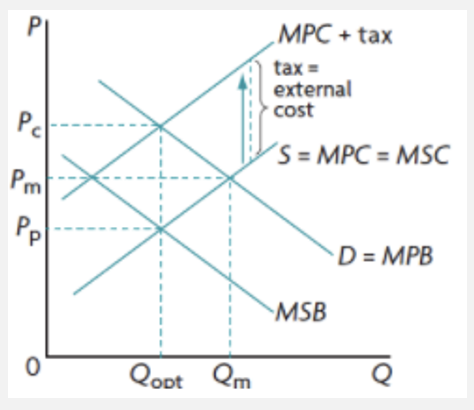

indirect tax to correct NPE and overuse of CPR

increases the cost of production and results in a shift of the supply curve to the left, reducing supply

if tax is same as the external cost, externality will be corrected and will result in allocative efficiency

consequences of an indirect tax

advantages: internalise the externality (polluter pays principle), generate govt revenue, lower pollution at a lower overall cost to society

disadvantages: difficult to design, politically difficult to impose taxes high enough to make a difference, administrative costs, regressive

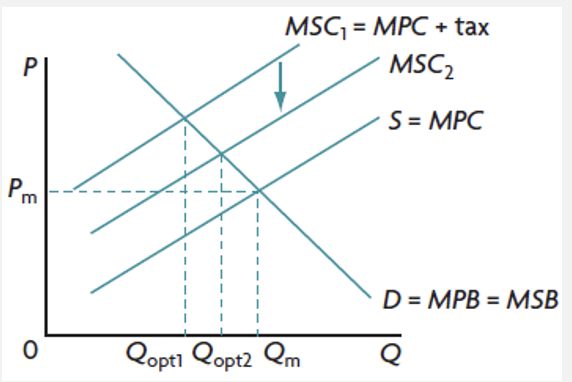

carbon tax to correct NPE and overuse of CPR

designated to deal with emissions of greenhouse gasses

tax/unit of carbon emitted, so the more carbon emitted the higher the tax

since there are substitutes for carbon, firms may be incentivised to switch to less polluting sources to lower their costs

Qopt increases because the external cost of production will be smaller

consequences of carbon taxes

advantages: provides an incentive for firms to switch to less polluting resources, makes energy prices more predictable, internalises the externality, directly targets emissions, govt revenue

disadvantages: regressive, political pressures to be set too low to make a difference, can’t target a particular level of carbon reduction

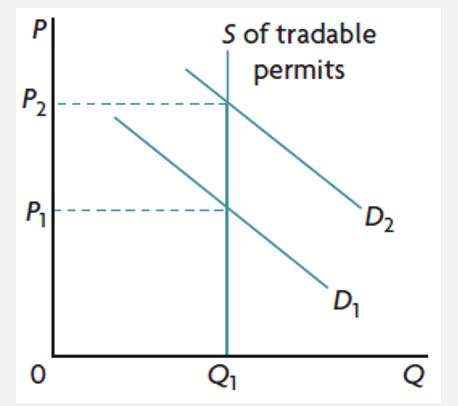

tradable permits to correct NPE and overuse of CPR

involve a system of permits to pollute issued to firms by the government

permits can be traded in a market, so firms that can produce using less of the permits, can sell them for a profit

supply of permits is perfectly inelastic and is set at a level lower than what would be the level of pollution without the permits

As the economy grows, the number of permits demanded increases, increasing their price

consequences of tradable permits

advantages: internalise the externality, governments can manipulate the distribution, gives the market some freedom, if it’s set at the right level pollution will be lower, exact amount is set

disadvantages: cap may be set too high due to political pressures so will be ineffective, firms may abuse market power, trading costs

government legislation and regulation

the government uses its authority to enact legislation and regulations in the public’s interest. Could involve: emission standards, quotas, licenses, permits

examples:

banning of harmful substances

prohibiting construction in protected areas

restrictions in the form of quotas

requirement for firms to install smokestack scrubbers to reduce emissions

consequences of legislation and regulation

advantages: simple to put into effect and reinforce, easier to implement compared to market-based policies, force firms to comply

disadvantages: don’t always offer incentive to reduce emissions, no ability to distinguish between firms with lower/higher pollution levels, partially effective since they don’t have specific knowledge on the cause, monitoring costs

collective self-governance

Users take control of the common pool resources and use them in a sustainable manner.

Communities that can come together to discuss the best use and allocaiton of resources with future generations in mind, but if the communities cannot communicate or if the cost of self-organizaion are too high, there will be failures.

education and awareness creation

Provision of information regarding the polluting activities of firms may turn consumers away from their products- negative impact on their sales. Companies are forced to take the consumer’s opinions into consideration

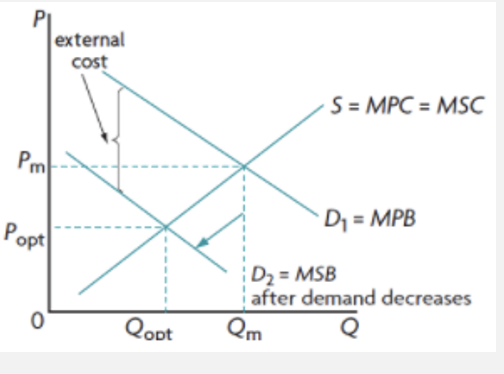

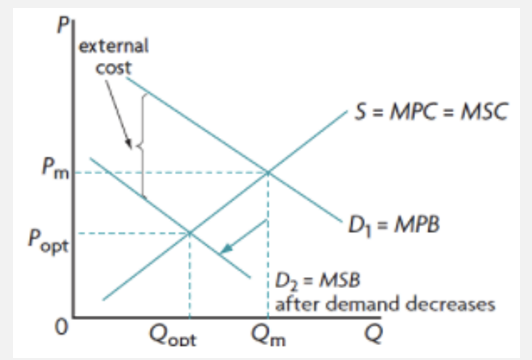

negative consumption externalities

costs created by consumers in the form of externalities on third parties

the free market overallocates resources to the provision of the good and more is consumed than what is socially optimal

negative consumption externalities graph

when Qm > Qopt

MSC > MSB at Qm

indirect taxes to correct NCE and prevent overuse of CPR

internalise the externality

difficult to estimate the external cost

inelastic demand so increase in price doesn’t reduce consumption by much but increases govt revenue- can be reinvested in education programmes to discourage consumption

government legislation and education to correct NCE and prevent overuse of CPR

used to prevent/limit activities by consumers

restrictions on activities such as in public places or age restrictions

education and awareness is simple but costly to the govt

may be ineffective

nudges to correct NCE and prevent overuse of CPR

designing methods to influence consumer behaviour

unhealthy foods can be placed in less accessible places or graphic pictures can be used to discourage consumption

desirable behaviour can be stimulated through incentives