Classic Price Action Trading Daily Review List

1/25

Earn XP

Description and Tags

Inspired by classic technical analysis and modern educators like Dr. Al Brooks, Ali Moin-Afshari, Edwards & Magee and others.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

Trend lines

Bear trend line is above / Bull trend line is below

Draw from spike vs draw from 1st pullback along channel

Trend lines

Entry

Stick with Always in Direction

Fade the CT (pullback)

What if you got stuck? How to manage it?

Trend channel line

Bull draw above / Bear draw below

Trend channel line

Use as an exit? Show overshoots

When is it a BO+FT?

Double Top

Neckline MM down

Double top failed

Sideways? MM up?

Drift back to Breakout point?

Double bottom

Neckline MM Up

Double bottom failed

Sideways? MM down?

Drift back to Breakout point?

Wedge top

2 legs sideways to down

Is the wedge trend or counter-trend?

Did it break a trend line?

Correction - ½ # bars and last 2 BX

WBRF variations

Wedge top failed

MM Up

Test later on

Wedge bottom

2 legs sideways to up

Is the wedge trend or counter-trend?

Did it break a trend line?

Correction - ½ # bars and last 2 SX

WBLF variations

Wedge bottom failed

MM Down

Test later on

Reasonable buy the close / sell the close

Reasonable buy the close / sell the close failed

Reasonable Stop Entries:

Buy on a stop 1 tick above the high of prior bar

Sell on a stop 1 tick below the low of prior bar

Examples

Spike H1 / L1

Spike H2 / L2

Spike H3 / L3

Reasonable Stop Entries Failed:

Buy on a stop 1 tick above the high of prior bar failed

Sell on a stop 1 tick below the low of prior bar failed

Examples

Spike H1 / L1 Failed

Spike H2 / L2 Failed

Spike H3 / L3 Failed

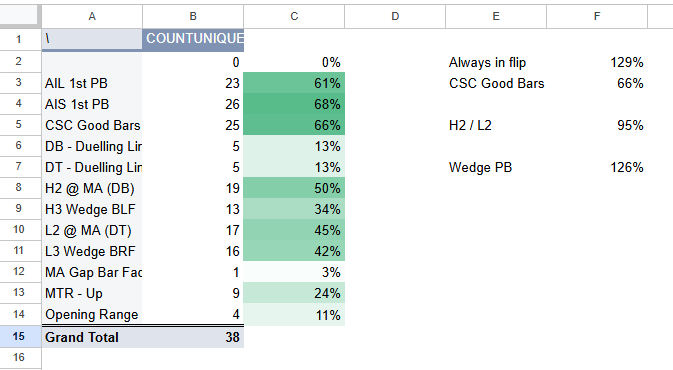

Always In / Always in 1st PB

Always in

Find Always in areas

Where does always-in finish?

ie Find TR areas / BOM

Moving Average Gap Bar entries

MAG

Moving Average Gap Bar entries

Success v Failure

Scalp v Swing?

Breaks trendline

Test Extreme

Pullbacks

Pullbacks - 2LPB Entries

Fade the BO of the 1st pullback entry

Leg Counting

Spike and 3 legs vs 3 legs

TR so 2 legged moves? Or 2nd leg has 2 legs

Best Trades

What were the best 1 - 3 - 5 trades of the day?

When was it

Examples

AIL 1st PB / AIS 1st PB

CSC bars

Spike H1 / L1

MTR Up / MTR Down

Yesterday Magnets

YDH and YD Low

BO / FBO

Trades to / from them

Fenster - Bar Flip

Good bar stop entry triggered

Went above more ½ bar - 1 bar

Come back and MM bar up

Consecutive (CSC) good bars

Consecutive bull bars (good size) closing on high and at least one above MA

Consecutive bear bars (good size) closing on low and at least one below MA

Target:

½ - 1R - 2R?

Notes:

Better if breaking out of something (anything)

What happens if its in a late leg?

Microchannel Entries

Swing Stop Hit - 1 more leg

Last swing stop was hit

Don’t reverse yet

Last leg coming and final profits soon

Remember look at inside bar (IB)

MM up / down from here?

Spike, Pullback, Channel

Find Spike, PB, CH, TR areas

Channel is a test target

Spike Channel then,

TR tests start of channel

BO and 2nd leg training

Zig zags - find all 2nd legs

BO and ½ BO distance in that direction?

Where did it fail?

Did that get a MM?

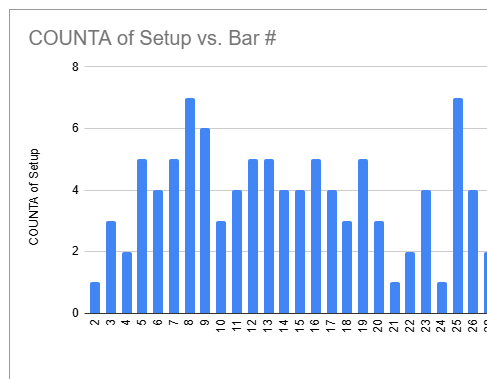

Are there 10+ trades a day?

Leg 2 / 3 Breaks - MM Up / Down

Bear case:

Going down leg 2 then leg 3,

Then we trade above leg 3 - measured move up?

We go above leg 2 - measured move up?

Hit MM?

2x MM?

Miss MM and return to BOP?

MTR

Trendline Break New H Reversal

MTR

Trendline Break New L Reversal

Walmart - Swing trade

Every day 40% range trade

Possible candidates that worked vs failed?

How to stay in or chase it?

Opening Range BO MM

What about other BO + FT outside of a range for a MM in that direction?

Pullback entries

50% PB → MM (Mixi)

CHPB

Pullback into lower 1/3 / ¼ - TR trading

Opposite side tries then and loses? Magnet test target

Spikes

3 CSC + 1

4 CSC + 1

4 CSC + 1

Spike succeed vs fail

1R vs ½ R