market failure

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

Market failure

When the free market leads to a misallocation of resources

Types of market failure

Positive and negative externalities, public goods, information gaps

Using an example, explain why the government imposes specific taxes on many gods and services

Specific taxes are a set unit amount on each product sold, one example of this is alcohol and tobacco duty. This is in order to increase the price of the good, so consumers demand for it decreases, which reduces the negative externality and external costs it produces

External benefits

When the social benefits are higher than the private benefits

Marginal private benefit

Benefits gained by producers

Marginal external benefit

Benefit gained by third party

Marginal social benefit

Benefit to society

Marginal private cost

Costs Consumed by seller and buyer

Marginal external cost

Cost incurred by third party

Marginal social cost

Total cots to society

Third arty

People no apart of the transaction

Consumption and production externality

Consumption- benefit or cost third party endures when good is consumed, production opposite

Negative externality

When a god causes external costs to the third party

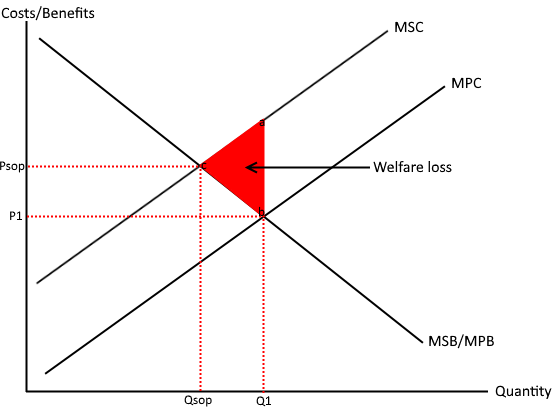

Negative externality diagram

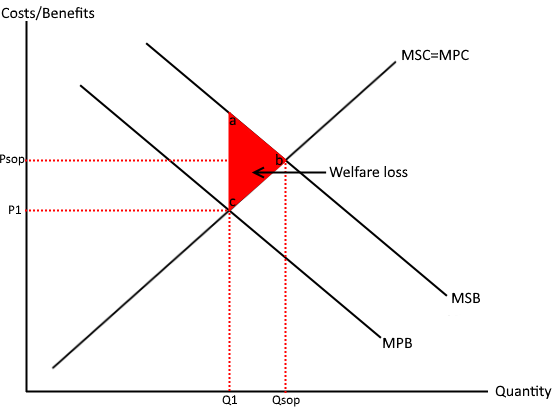

Welfare loss

Output when costs to society are greater than benefits

Positive externality

When a good creates external benefits for the third party

Positive externality diagram

Examples are

Vaccinations, education, public transport

Public goods

Non rival and non excludable- can’t stop someone from using it

Quasi public goods

Aren’t perfectly non rival or rival or non excludable and excludable

Free rider problem

Benefits without paying

Asymmetric information

Where one party has superior knowledge compared to another, sellers take advanategs of buyers lack of knowledge