Management accounting & Controlling

1/107

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

108 Terms

Economics

Production, distribution/exchanges and consumption of goods and services/resources

Finance/Financial economics

Money transactions

Corporate Finance

Funding businesses

Finance

Financing – 2 angles: finance-user and finance-provider

Business strategy – decision tool

Accounting

Collecting Analysing Communicating management data

Set of tools

2 main categories

Management accounting

Financial accounting/reporting >> stakeholders

Share of a population (measure)

percentage

growth (measure)

percentage & percentage points

margin vs. result (profit/loss) (measure)

percentage

percentage points

interests rate (measure)

inflation — purchasing power

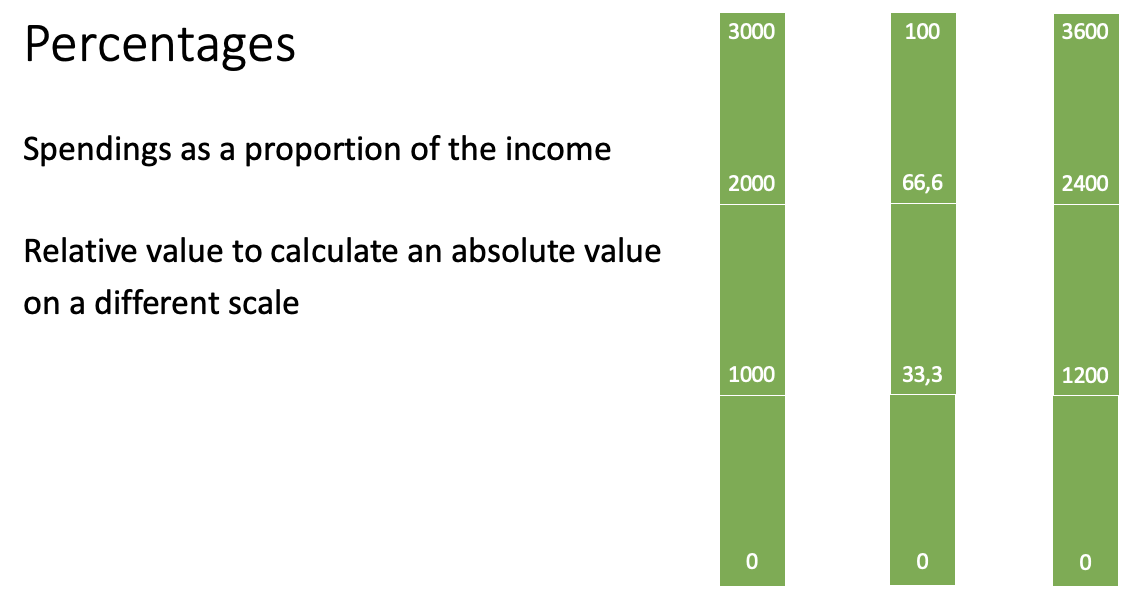

calculation for percentages

1- 1000/3000= 1 - 0,3334 = 0,667

calculation for percentages—

100 × 1800 : 3000 = 60 —> 60%

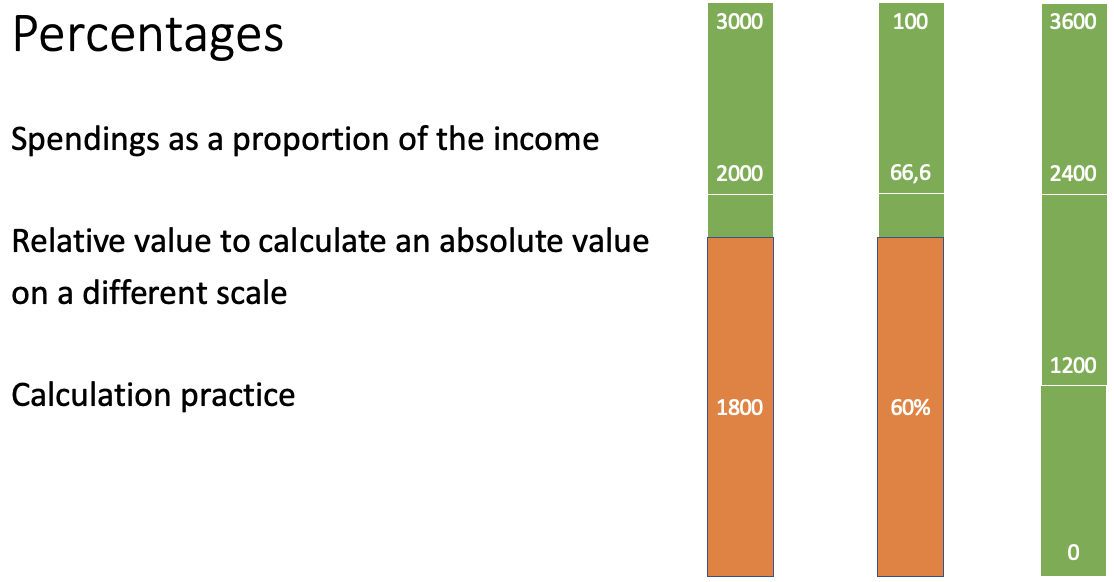

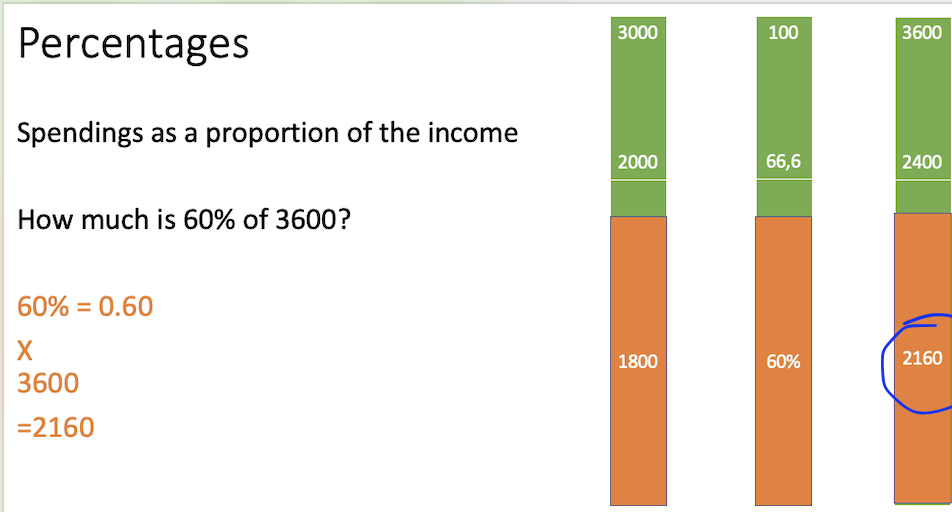

Percentages— spendings as a proportion of the income

How much is 60% of 3600?

60% = 0.60 X 3600 =2160

Note on numbers— European vs. Anglosaxon

European vs. Anglosaxon

0,2 <> 0.2

1.000 <> 1,000

Note on numbers— Accountants vs mathematicians

(56) <> -56

1k <> 1,000

Share of a population

Population:

In statistics, a population is a representative sample of a larger group of people or even things with one or more characteristics in common.

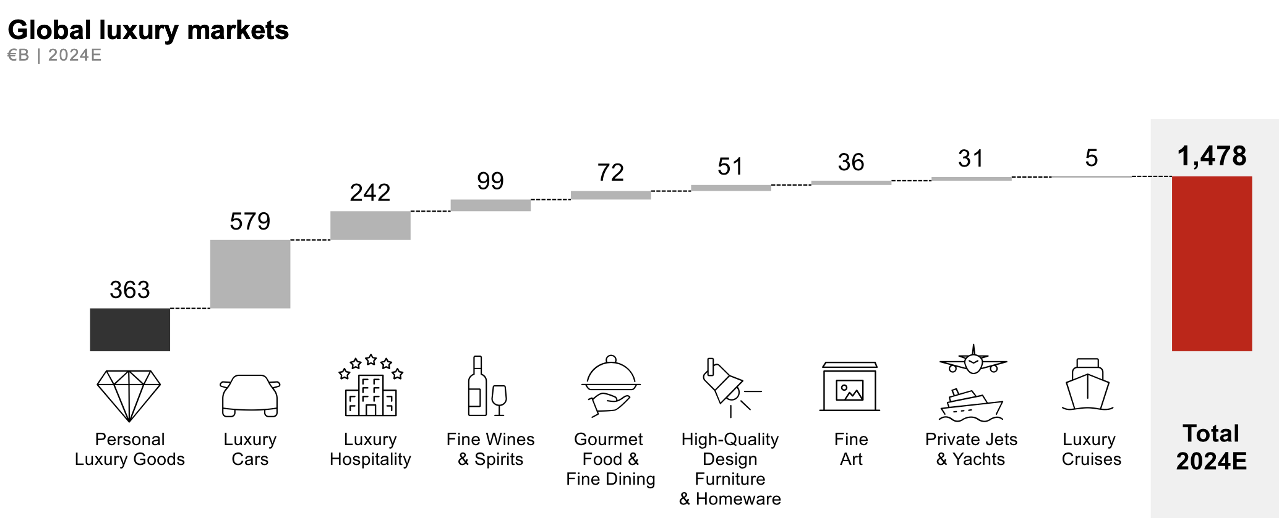

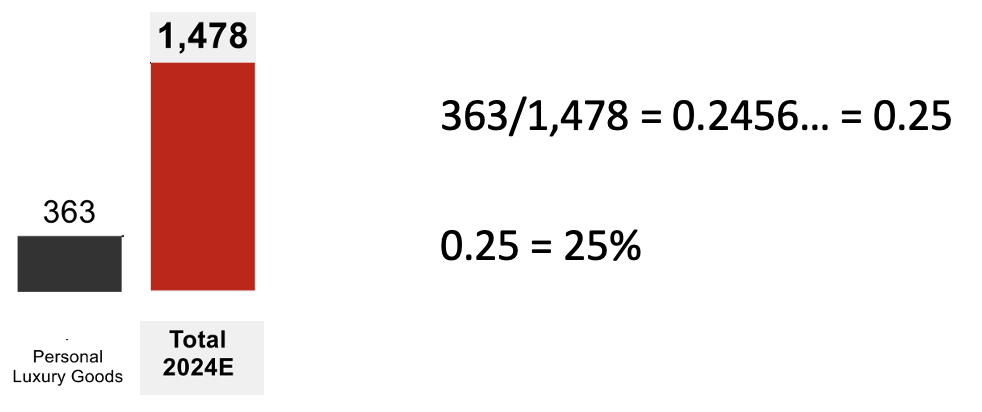

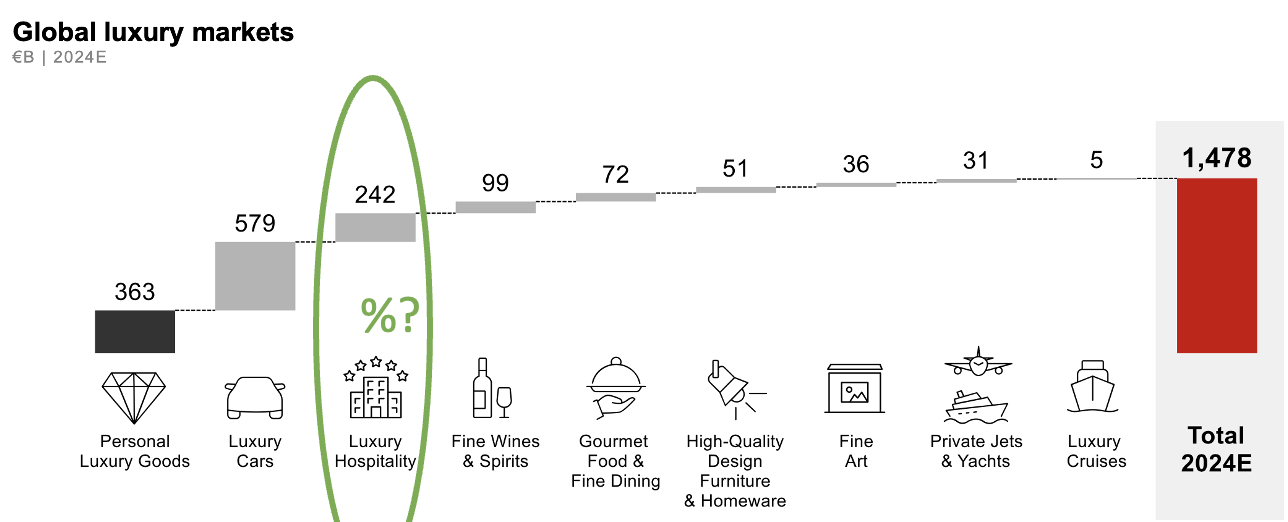

What percentage of total luxury spendings for each category?

Absolute value of a category Divided by Absolute value of total spendings = Proportion expressed as a decimal

363/1,478 = 0.2456… = 0.25

0.25 = 25%

What percentage of total luxury spendings for each category ?

Absolute value of a category Divided by Absolute value of total spendings = Proportion expressed as a decimal

242/1,478 = 0.1637… = 0.16

0.16 = 16%

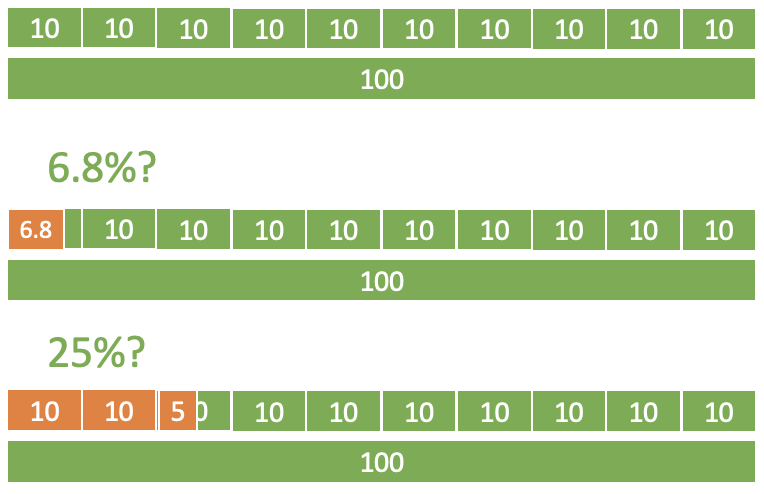

Visualizing the meaning: Share of a population— What does 6.8% mean ?

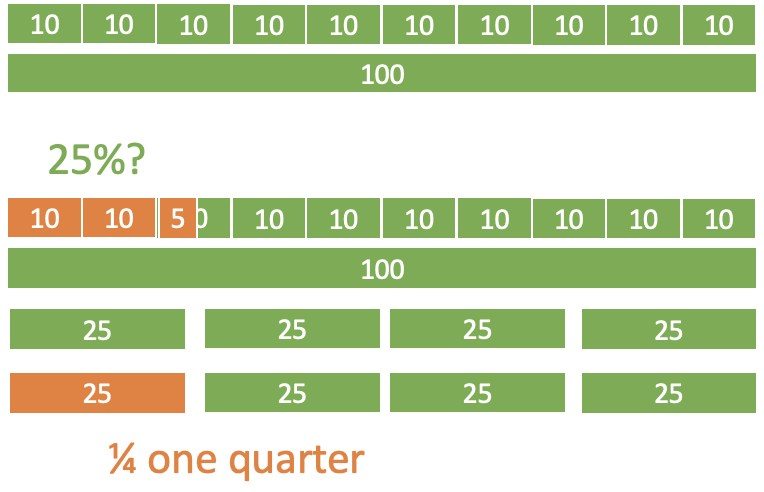

Visualizing the meaning: Share of a population— What does 25% mean ?

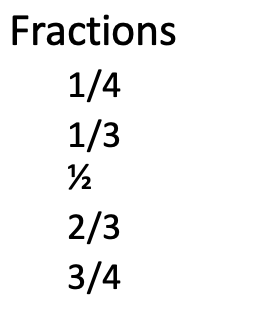

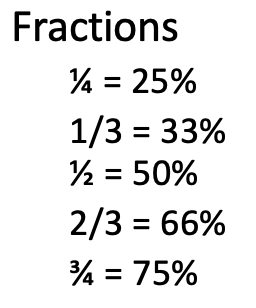

fractions

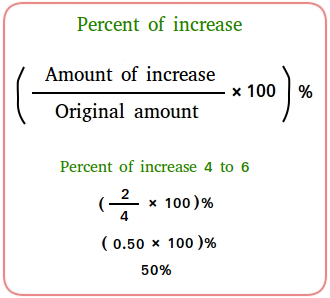

Percentage of increase formula #1

with actual value

Percent increase formula #2

with percentages

If spendings are stable in proportion of total spendings and the following year total spendingsare 1600 billion euros

How much is spent on personal luxury goods?

25% times 1600 = 0.25 x 1600 = 400

(Previously 363)

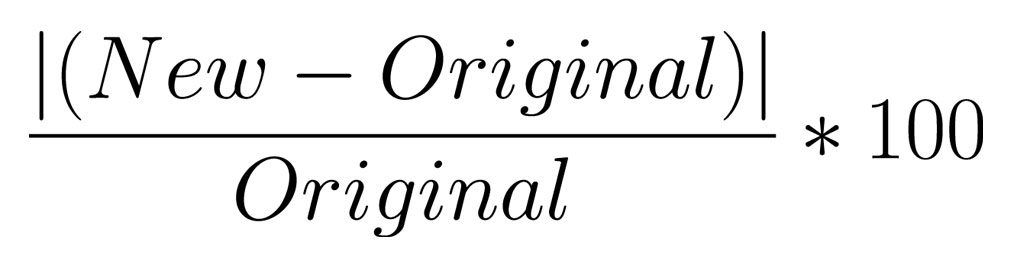

Percentage variation def

Percentage to reflect the evolution of any given quantity

(vs what we looked at which is a proportion/shareof a population)

formula

Variation to be compared with the original value

Variation/original value = 0,XX = XX%

Sales variation— percentages

Percentage variation:

FORMULA: (difference between Final and orignialvalue)/original value

ex:

I sell for 100,000 euros in year 1

Sales go up to 120,000 in year 2

(120,000-100,000)/100,000 = 20,000/100,000 = 0.2 = 20%

Sales have increased by 20%

Percentage variation from 100 to 120

Percentage to reflect the evolution of any given quantity

From 100 to 120

I sell for 100,000 euros in year 1

Sales go up to 120,000 in year 2

Percentage variation:

(difference between Final and orignialvalue)/original value

(120,000-100,000)/100,000 = 20,000/100,000 = 0.2 = 20%

Sales have increased by 20%

Percentage variation from 140 to 175

Percentage to reflect the evolution of any givenquantity

From 100 to 120

From 140 to 175

Variation = 175-140 = 35 to be compared with the original value 140

35/140 = 0,25 = 25%

Salary variation— 30k example

I earn 30,000 euros

At the end of the year my boss offers an increase of 500 euros

Percentage increase:

Variation / original value

500/30 000 = 0.016666 = 1,66%

Is that generous?

Sales variation

(ex:100k selling)

I sell for 100,000 euros in year 1

Sales go down to 90,000 in year 2

Variation = final value-original value = 90,000 – 100,000

-10,000 NEGATIVE also noted (10,000) betweenbrackets

Percentage variation

Variation/original value = -10,000/100,000 = -0.1 = -10% = (10%)

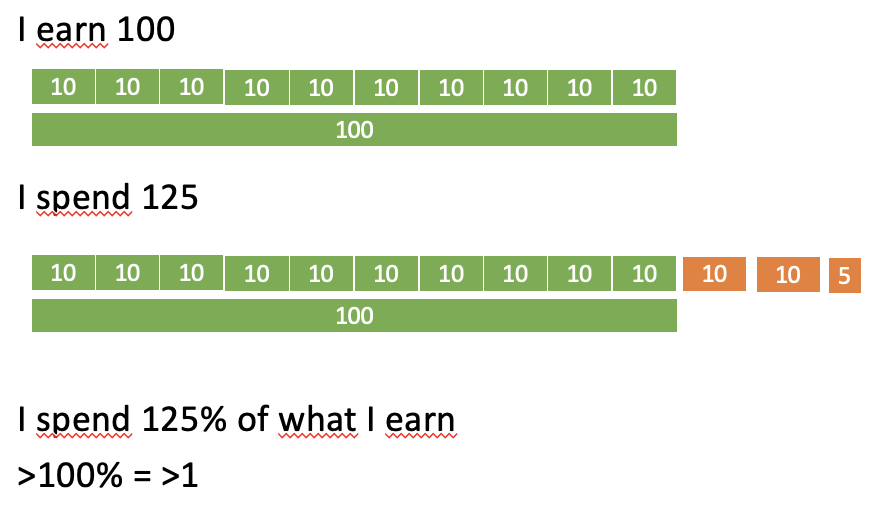

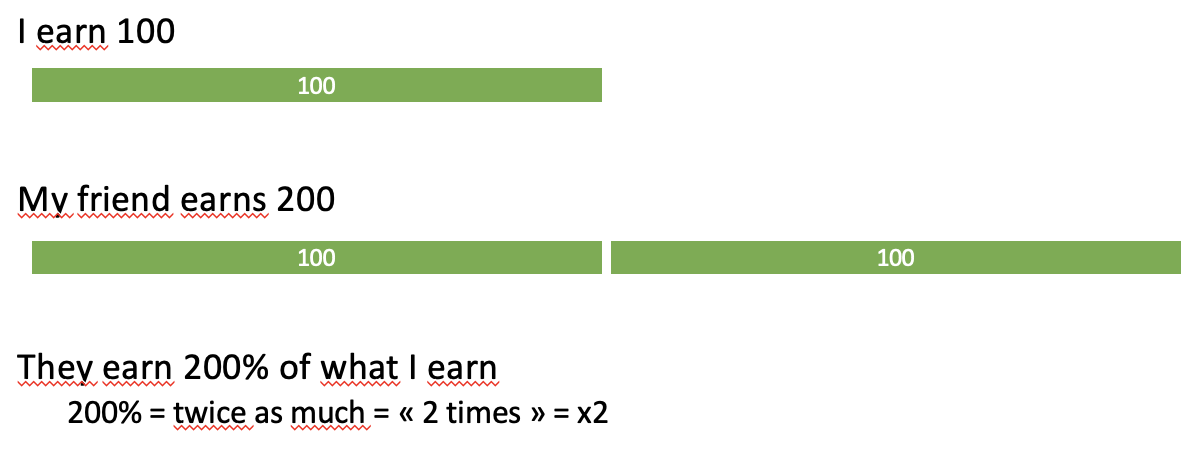

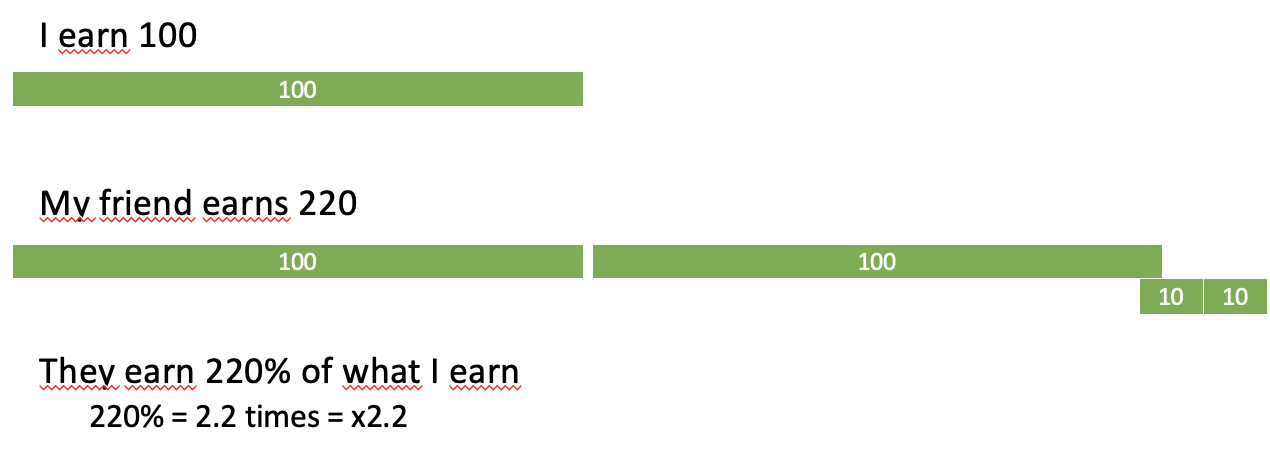

Percentages higher than 100%

exhibit A:

exhibit B:

exhibit C:

Sales variations

Growing on top of previous growth

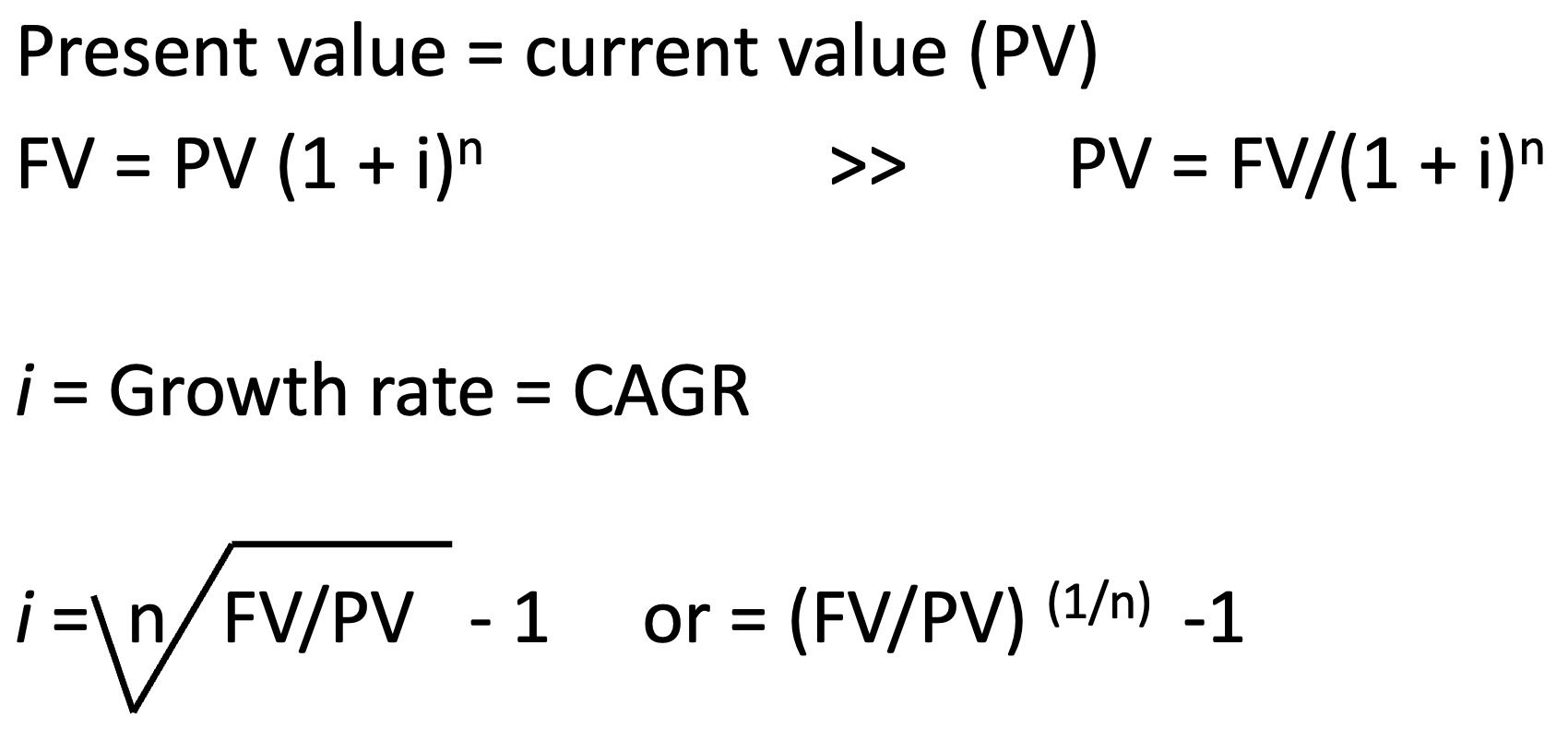

Compound Annual Growth Rate (CAGR)

Growing on top of previous growth

Compound Annual Growth Rate (CAGR)

(CAGR) measures the rate of return for an investment — such as a mutual fund or bond — over an investment period, such as 5 or 10 years.

(CAGR) is defined as the mean annual growth rate of a value over a specific time period, commonly expressed in percentage terms

Sales variation— example 1/ part.A

I sell for 100,000 euros in year 1

Sales increase by 20% in year 2 and another 20% in year 3

Increase in year 2 = 20% of 100,000 = 0.2 x 100,000 = 20,000

—> Sales in year 2 reach 100,000 + 20,000 = 120,000

Increase in year 3 = 20% of 120,000 = 0.2 of 120,000 = 24,000

NOTE 24,000 > 20,000

—> Sales in year 3 will be 144,000

Sales variation— example 1/ part.B

I sell for 100,000 euros in year 1

Steady increase of 20% each year

Sales in year 2: 100,000 + 20,000 = 120,000

Sales in year 3: 120,000 + 24,000 = 144,000

Sales in year 4: 144,000 + (0.2*144,000) = 144,000 + 28,800 = 172.8

—> NOTE 172.8 > 144 > 120…

Stable in percentage… Acceleration in absoluteincreases

Steady increase of 20% each year…

Increase in year 2: 20,000

Increase in year 3: 24,000

Increase in year 4: 28,800

Stable in percentage… Acceleration in absoluteamounts of the increases

COMPOUND GROWTH (Cumulated)

What is a loan ?

A loan is a financial arrangement in which a lender provides funds to a borrower. In this arrangement, the borrower must repay the borrowed amount along with interest over a set period of time.

A loan is a sum of money that one or more individuals or companies borrow from banks or other financial institutions so as to financially manage planned or unplanned events. In doing so, the borrower incurs a debt, which he has to pay back with interest and within a given period of time.

Interest rate

The interest rate is the amount a lender charges a borrower and is a percentage of the principal—the amount loaned

If you are borrowing money, the interest rate (or lending rate) is the amount you are charged for doing so – shown as a percentage of the total amount of the loan. The higher the percentage, the more you must pay back.

Vs. Repayment/Instalment

When you take out a mortgage, you'll need to decide how you're going to repay it. With an interest-only mortgage, your monthly payments only cover the interest charged on your loan. With a repayment mortgage, your monthly payments are also used to pay back the initial sum you borrowed.

What is the difference between interest rate and payment?

Interest rates are the cost of borrowing, shown as an annual percentage. They can be either fixed, meaning they stay the same, or variable, where they can change based on market conditions. Monthly payments, meanwhile, are determined by the loan amount, the interest rate, and the loan term

What is a loan – vocabulary and grammar

I lend you some money = you borrow some money from me

Lending vs borrowing

I grant you a loan = you get a loan from me

Loan – credit – bond – obligation – debt

I finance you with some debt = you have a debttowards me

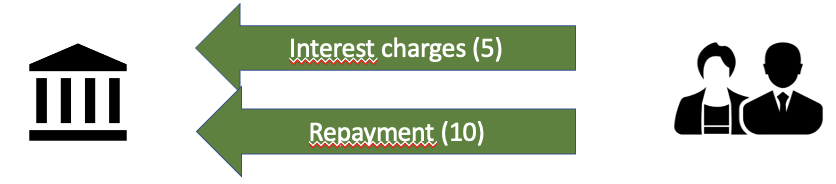

Basic loan (1)

Phase 1 – the borrower draws the loan

Conditions for this loan

Interests are charged at a rate of 5%

Yearly repayment of 1/10th of the principal –fully reimbursed in 10years

What is a loan (2)

Phase 2 – end of year 1 – the borrower pays some interest charges and partly repays the loan

Conditions for this loan

Interests are charged at a rate of 5%

Yearly repayment of 1/10th of the principal – fully reimbursed in 10 years

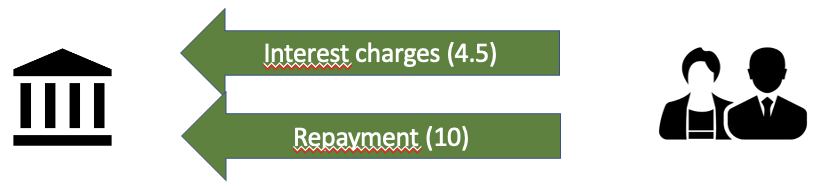

Basic loan (3)

Yearly transactions

Interests are charged at a rate of 5%

Repayment of 1/10th of the principal

Phase 3 – end of year 2 – what are the flows?

Basic loan (4)

Yearly transactions

Interests are charged at a rate of 5%

Repayment of 1/10th of the principal

Phase 3 – end of year 2 – the borrower pays someinterest charges and partly repays the loan

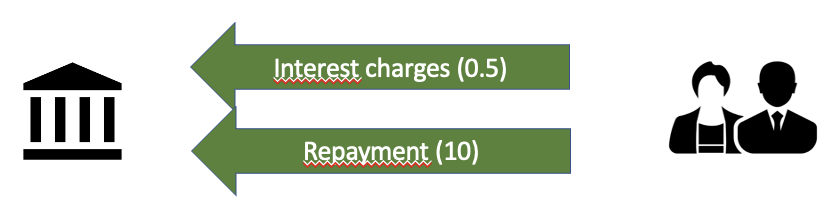

Basic loan (5)

Phase 11 – end of year 10 – the borrower pays someinterest charges and partly repays the loan.

The loan has been fully repayed.

What is a loan

A contract > room for negotiation

Some prepackaged formats for individuals and SMEs

Differences between countries

Largely flexible for corporates

Why do interest rates exist?— 4 reasons

The compensation of expected inflation

The cost of availability

The cost of risk

The administrative cost

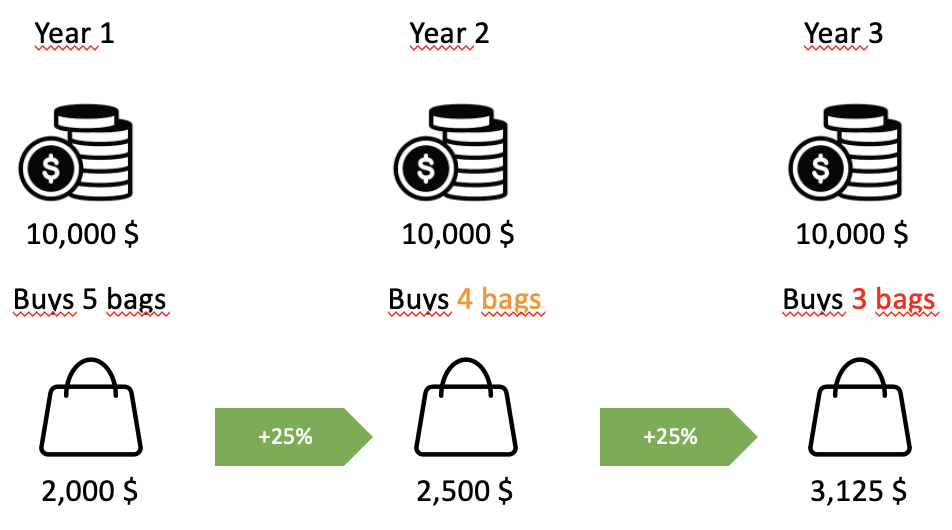

Inflation— definition

Inflation is the decline of purchasing power of money (economists would say « a given currency ») over time.

Purchasing power is the value of money (a currency) expressed in terms of the volume of goods or services that one unit of money can buy.

It can weaken over time due to inflation. That'sbecause rising prices effectively decrease the number of goods or services you can buy.

Inflation— what it looks like

The cost of availability (1)

I am going to hire you but I am not going to payyour salary at the end of the first month…

Do you accept? What are the limits?

What do you ask for in compensation?

The cost of risk (1)

I am setting up this new business and the new company is going to hire you but it cannot pay youfor the first six months, because it will only make cash later…

Technically it is a loan:

The recruiter is asking you to grant a loan to your employer: it will owe you money for 6 months

The cost of risk (2)

I am setting up this new business and it is going to hire you but it cannot pay you for the first six months, because it will only make cash later…

Technically it is a loan.

It makes a difference to be paid in 6 months than in a couple of months…

Availability cost and… risk that the borrower can’trepay the loan!

The cost of risk (3)

The cost of risk is the cost of incurring losses.

Figuring out this risk

How likely is the loss likely

How acceptable is the loss:

an employee not being paid <> a bank not being paid

Note – vocabulary

To default = being unable to meet the commitments as a borrower

A default = failed payment of principal or of interests

The administrative cost

Bank infrastructure to produce and market loans

Bank’s profit requirements

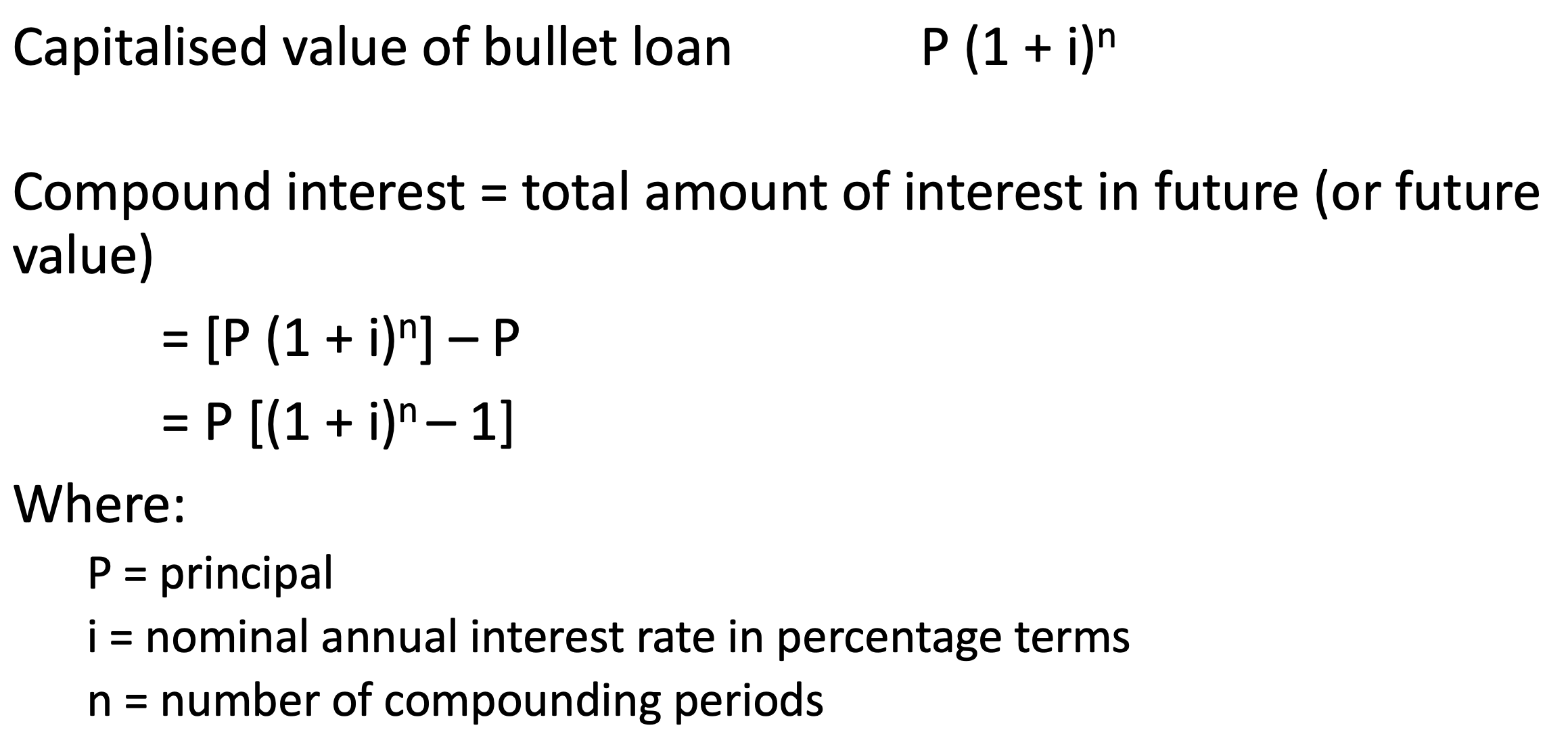

Compound interests - definition

Compound interest is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan.

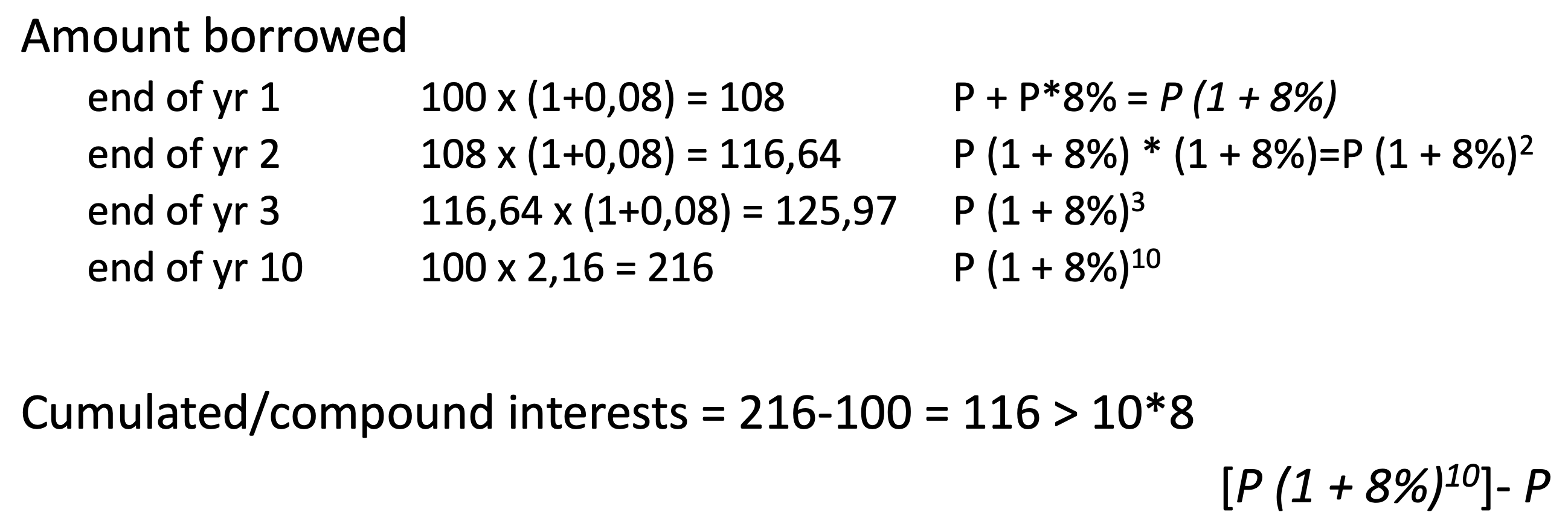

Compound interests – example calculation (1)

Bullet Loan

Interest and principal are paid back at the end in one instalment (one shot)

Assumptions

Initial amount borrowed 100 euros

10pc yearly interest rate (capitalised)

Compound interests – example calculation (2)

End of year 1: 100 borrowed bearing 10 of interest: 110 due

End of year 2: 110 borrowed bearing 11 of interest: 121 due

End of year 3: 121 borrowed bearing 12.1 of interest: 133.1 due

End of year 4: 133.1 borrowed bearing 13.3 of interest: 144.4 due

Compound interests on 100 of borrowing are 44.4

→ not 4x10=40

Compound interests – examplecalculation (3)

Bullet loan of 100 (principal = P) bearing interest rate of 8pc per year

Amount borrowed

Compound interests - calculation

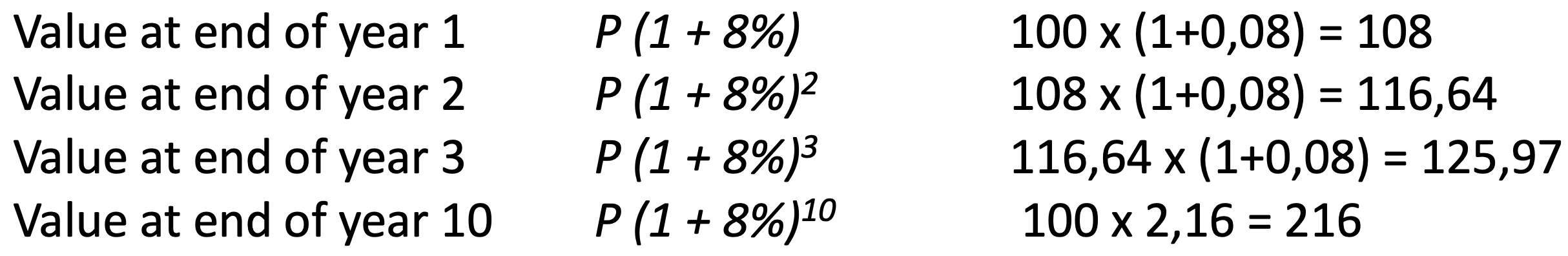

From compound interests to future value

Assume the current value of a product is 100 and yearly price inflation is on average 8pc per annum for the next 10 years.

Future value

(in 10 years with constant 8% inflation/interest vs current value of 100) is 216

Future value – calculation

Future value (FV) = the value of a current asset at a future date based on an assumed rate of growth

FV = PV (1 + i)n

Where:

PV = present value

i = growth rate in percentage terms

n = number of compounding periods

Present value vs Future value

Present or current value (PV)

FV = PV (1 + i)n >> PV = FV/(1 + i)n

where:

FV=Future Value

i = Growth rate

n = Number of periods

Present and future value – CAGR

Trade media example

WWD

BoF

Vogue Business

+ international print press: Financial Times, NY Times, The Cut (NY Mag)…

(unfortunately Continental European ones, Le Monde, Les Échos, Italians etc not in the sameleague – business model issues)

Interest rates— Case study: Should George buy or rent?

Buy or rent a flat?

George is a successful advertising exec previously based in London who accepts a new job in Paris.

He is French and wonders if he should buy or rent the flat he needs for his family (partner plus one kid), that is a two-bedroom flat between 60 and 90 square meters. He has limited savings, approx. 100 k euros.

George Case: information on the market

A good quality flat in central Paris sells for between 11 000 and 16 000 euros per square meter

A good quality two-bedroom flat in central Paris is rented out for between 2200 and 3200 euros a month

The transactional tax for real-estate buyers is 7%.

The yearly real-estate tax for real-estate owners is 0,5%.

Interest rates for deposits are zero and for 10-year borrowings 3.5% including insurance

Should George invest in a flat?

Flat between 60 and 90 square meters

George’s savings 100 k euros

Sales value: 11 000 and 16 000 euros per square meter

Rent value: 2200 and 3200 euros a month

Transactional tax for real-estate buyers = 7%

Yearly real-estate tax for real-estate owners = 0,5%

Interest rate for deposits = zero

Interest rate for 10-year borrowings = 3.5%

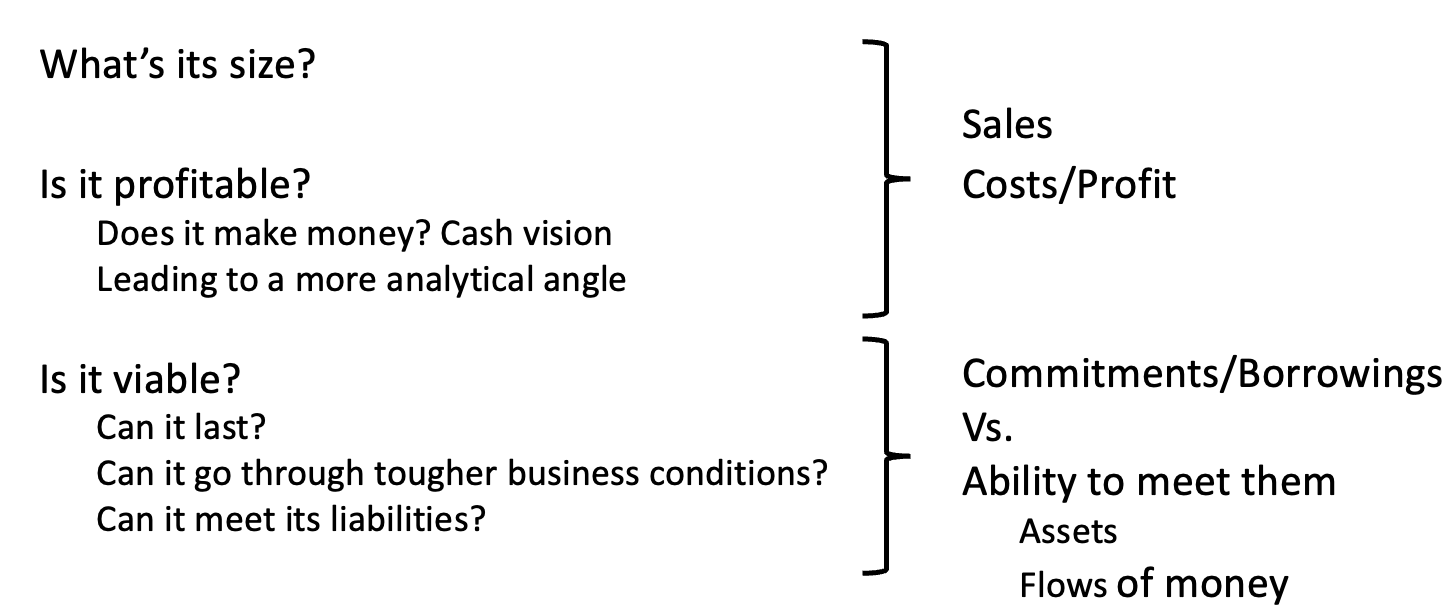

Performance in numbers (2)

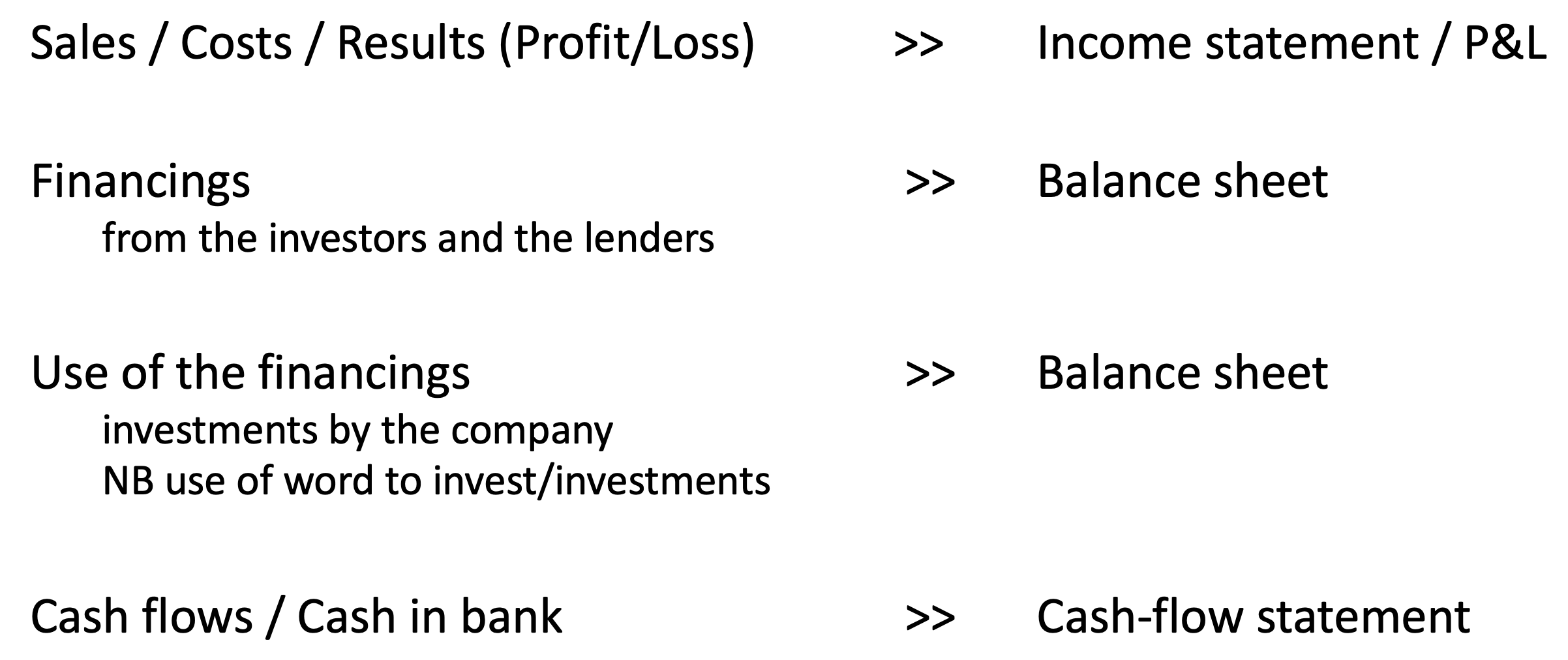

Information in the financial statements

Sales / Costs / Results (Profit/Loss)

Financings

from the investors and the lenders

Use of the financings

investments by the company

NB use of word to invest/investments

Cash flows / Cash in bank

Financial statements

How are financial statements divided

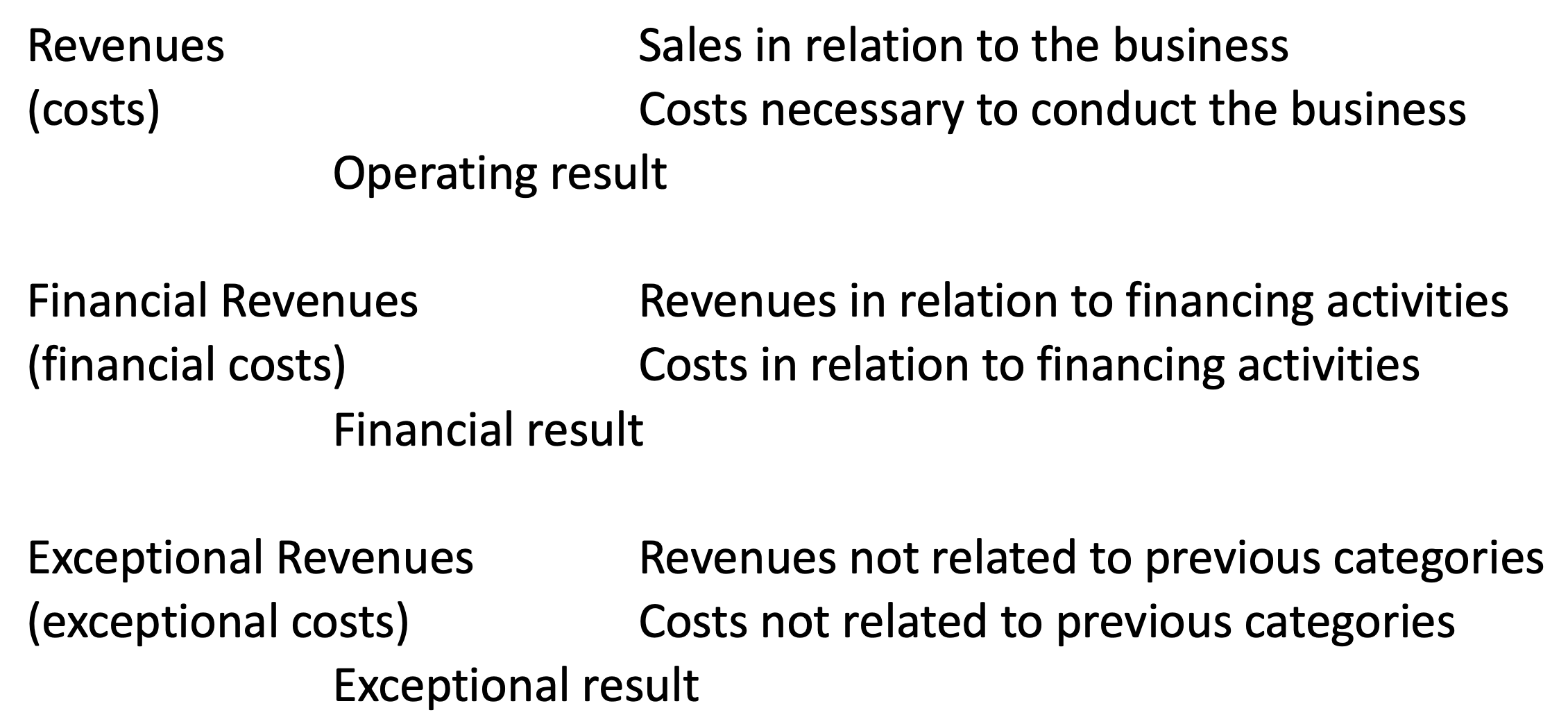

P&L— build up

P&L – build up: operating side

Revenues Sales in relation to the business

(costs) Costs necessary to conduct the business = Operating costs

Result/profit Operating result

P&L – build up: beyond the operations

Operating result

Revenues —> Sales in relation to the business

(costs) —> Operating costs

Result/profit —> Operating result

Non operating revenues and costs

Financial revenues and costs

Exceptional items

Taxes on profits

P&L – build up (cont’d)

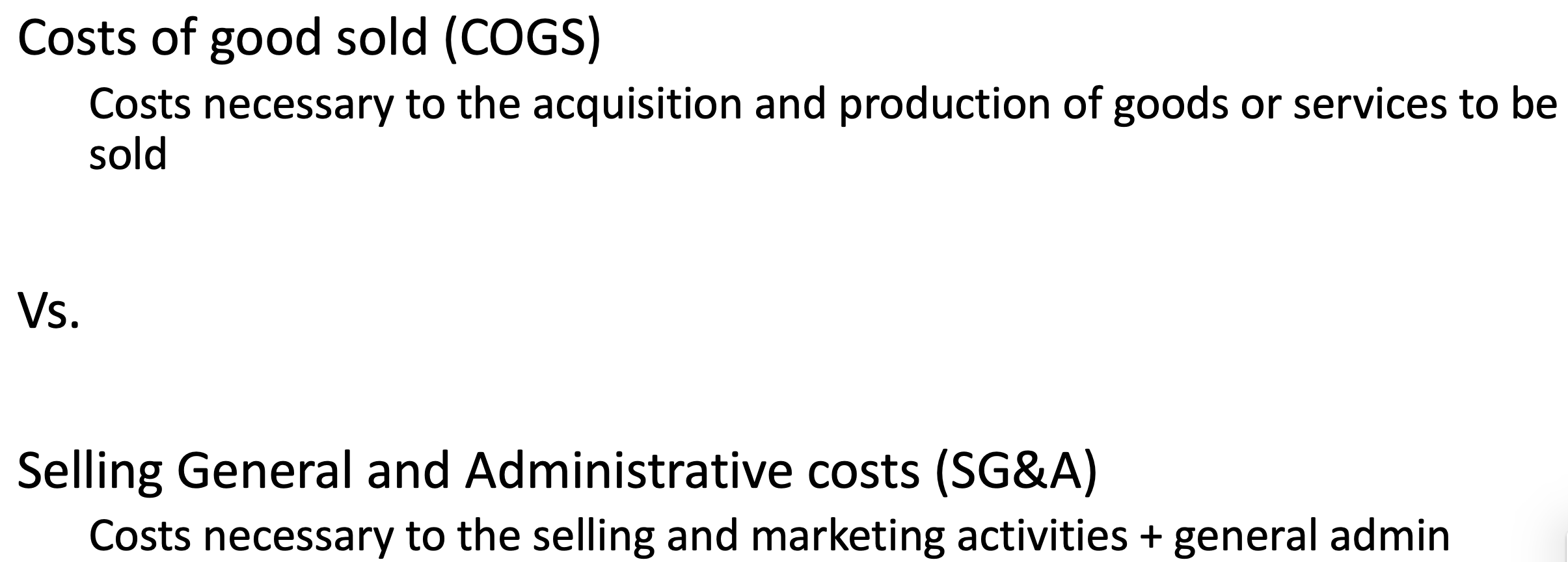

P&L – more scrutiny on operating performance

Looking into 2 types of operating costs

P&L – detailed operating performance

Revenues —> Sales in relation to the business

(costs of good sold - COGS) —> costs necessary to the acquisition and production of goods or services sold

Result/profit —> Gross profit

(Selling General and Admin. —> costs necessary to the selling and SG&A) marketing of goods or services sold

Result/profit —> Operating profit

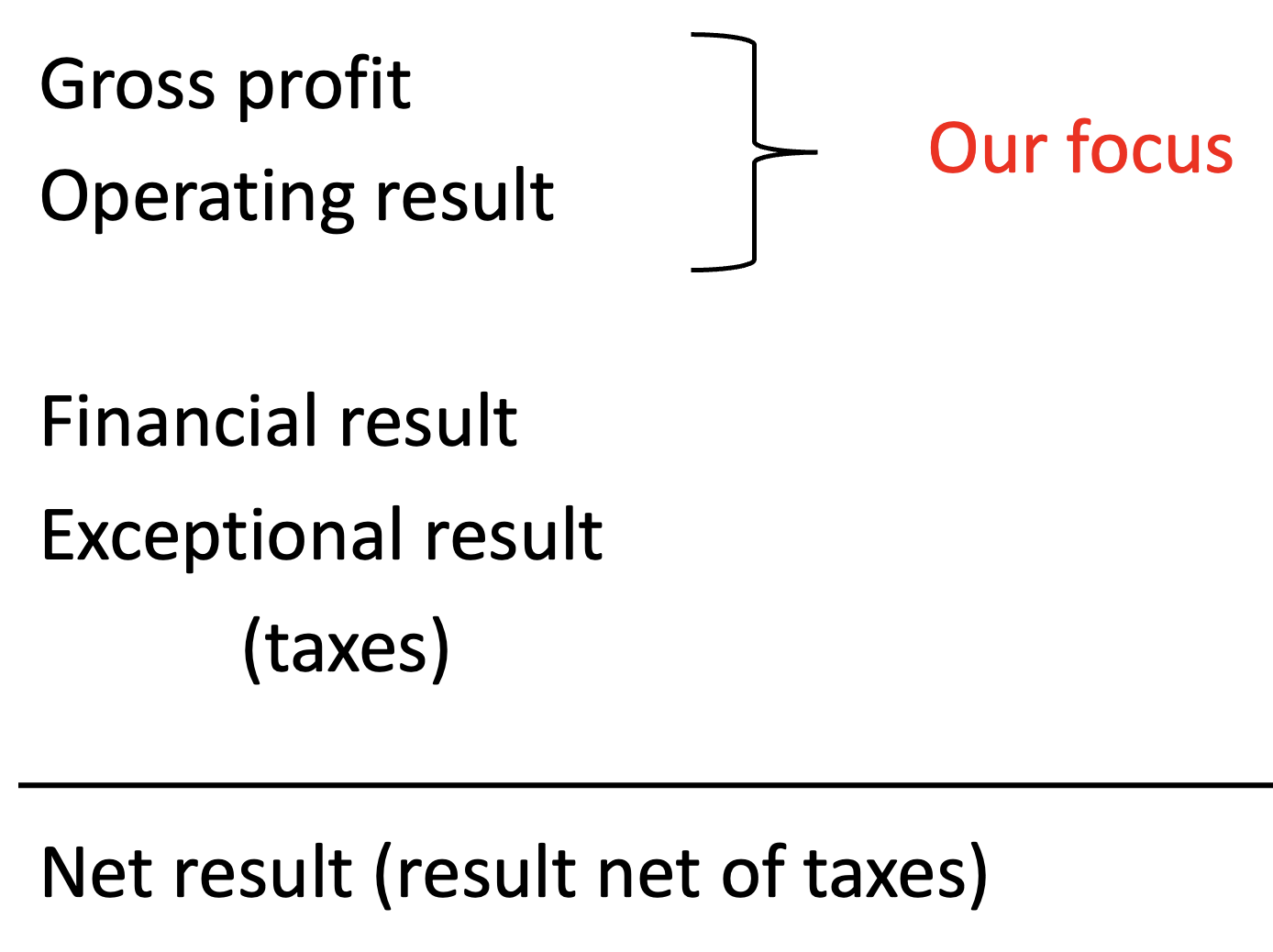

P&L – Full P&L

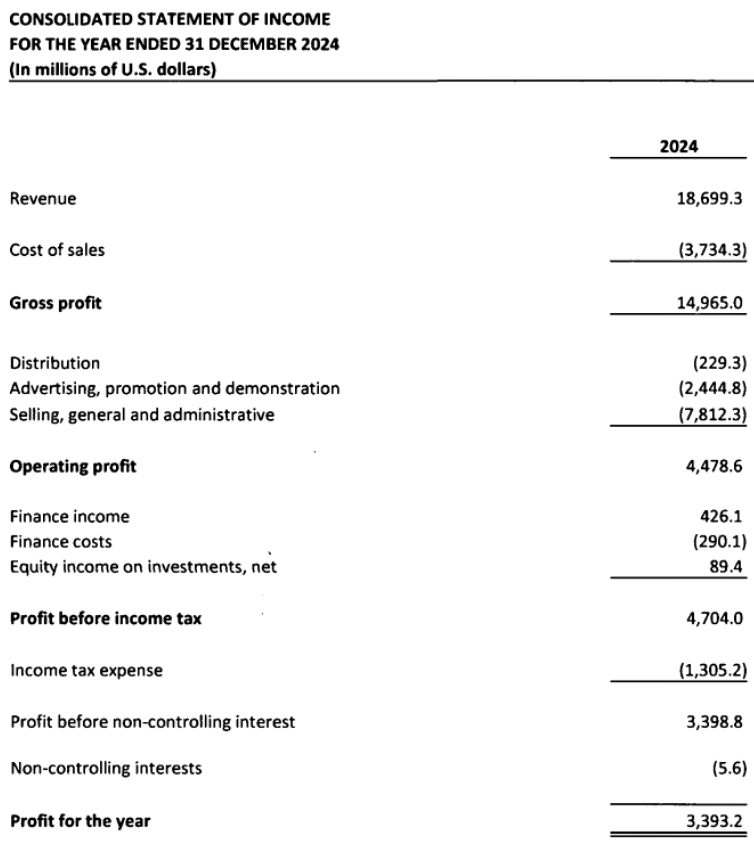

P&L – what does it look like: public information + listed companies who volunteer

ex:

Purpose of a P&L

Comprehensive view of the profitability of doing business

Exhaustive coverage of revenues/gains and of costs/losses

Revenues which are certain but not materialised yet

Costs incurred but not paid yet

Costs in relation to investments made by the company which are used and losing value

P&L – Costs incurred but not paid yet

Bonuses

Pension planning

P&L – Use of assets

Assets needed for production/distribution/administration… whenbought are accounted for as assets in a separatestatement (balance sheet)

—> Their use is progressively accounted for… it is a cost affecting the P&L

It’s reflecting the depreciation of those assets as they ageand progressively lose their interest (wear and tear)

It’s a non cash cost

P&L – synonyms

Profit and loss account

Statement of income / income statement

Statement of earnings / earnings statement / earnings report