Public Sector Exam 1

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

Utilitarianism

Adding up all the utility individuals received, and attempting to maximize that. Any policy that increases total utility is in public interest then.

Issues of quantitative comparison and objectionable social arrangements (such as slavery).

Pareto Criteria

Try to increase utility of some without decreasing utility of others since it’s impossible to compare, hence impossible to know whether decreasing utility would truly help.

Pareto superior if it increases one’s utility without decreasing another

Pareto optimal if no changes can be made without decreasing one’s utility

Issues of infeasibility, status quo bias, and does not rank negative effects

Potential Compensation

Proposed change benefits the gainers by enough they could use some excess gains as compensation for losers, then it is in public interest

Issues on inefficiency, trying to find compensation schemes to benefit the losers is often burdensome

Social Welfare Function

Set of indifference curves that depict welfare of the entire society rather than just one individual.

Issues coincide with utilitarianism due to being very similar.

Positive Economics

Economics of what is currently happening with no value judgement

Normative Economics

Economics of what ought to be, assigning value judgements to the world’s economic state

Goals of Public Policy

To reallocate resources in ways that are equitable and efficient.

Equity is a normative issue, while efficiency is a positive issue

Government Activities Framework

What, how, and why does the government do what it’s doing?

How does the government finance what it’s doing?

Government In Place of Pure Market: 3 Reasons

Market system may not function without a government to protect rights of those engaged with production and exchange

Government might be able to undertake certain economic activities than the market

Market allocation might treat individual inequitably.

Property Rights

A set of rights to engage in specific activities if the owner chooses, along with a set of responsibilities

There are limitations from the government.

Poorly defined rights to certain property can allow individuals to use those resources without paying for them, like companies polluting the air

Often poorly defined because if they were, it would still be difficult to enforce

Leads to overuse of those resources, leading to issues such as extinction

Coase Theorem

In the absence of transaction costs, the allocation of resources will be independent of the assignment of property rights.

AKA, if there is nothing to stop a profitable trade from taking place, the trade will take place

Transaction costs are lower with less people, higher with more people (time cost of negotiation). Hence why issues of air pollution aren’t solved.

Therefore, minimal government intervention with less, more with more people involved (since it can be more efficient than the market)

The Common Pool Problem

Assume that an underground pool of oil extends below the land of four landowners. Each must decide how rapidly to pump oil out of the ground, and since if one pumps the oil, the others have less; it’s optimal for one to pump it all out as fast as possible.

When a resource is owned in common, owners have an incentive to overuse the resource (and little incentive to maintain its value).

Solutions: Divide the commonly owned resource and make each common owner the exclusive owner of a smaller part of the resource. The owners also may all lease their rights to the oil to a single, agreed on person.

Government ownership of property rights

Government can own land, such as natural parks. Issue is, differing groups, like oil companies vs environmental groups, will disagree on usage of that land. This ends up being decided by political pressure, the resources it allocates proportional to how much each of those groups pressures it.

Additionally, when resources are owned by the government, there is rarely a permanent victory, who has what power over the land being a fight each and every year. Private ownership is much more likely to be bought once and then have no more concern.

Incentives of Government Managers

Incentivized to help themselves rather than help taxpayers as taxpayers have less direct recourse (as compared to a stock investor in a company).

Entitlements vs Rights

Creation of a right requires nothing from others other that they refrain from violating that right. Creation of an entitlement creates an obligation on someone else to fulfill the entitlement.

Zoning Laws

Zoning requirements that specify what a property can and cannot be used for. Helps clearly define property rights (a confectioner factory cannot make too much noise in a doctor’s neighborhood).

Houston has none, but still has separate residential, commercial, and industrial areas. Land use segregates naturally based on natural traffic of people (less in small suburban neighborhoods for example).

Zoning is a method whereby property rights can be established and property owners can be protected from activities arising from incompatible uses of property by their neighbors.

Restrictive Covenant

A contract agreed to by all owners of land in a particular area that specifies the uses to which the land can be put. This is done without zoning laws, with have the same effect except done by city planners rather than the land owners in the area (oft done in Houston).

Externality

Resources that are allocated outside of the market (such as air when a company pollutes it.

Negative Externality

Cost imposed on others outside of the market system as a by-product of productive activity.

When a firm does not have to pay for a resource, it will use too much of that resource.

But in cases in which a negative externality is created, the market price understates the true opportunity cost of production because it does not take into account the cost of the externality

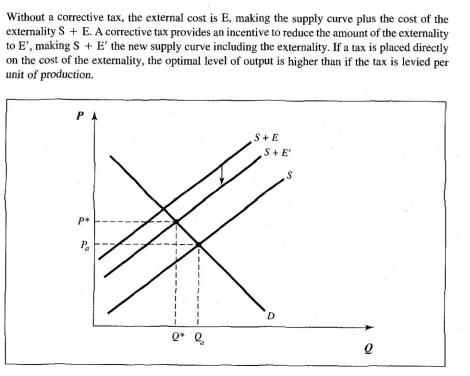

Private actions can fail in large numbers to account for the issue, so a corrective taxation can work (See graph). Has a couple of issues, such as putting a price on the externality and deciding who is responsible for how much (covered in the image).

Compensation fails due to being inefficient. Individuals would be indifferent towards the externality, but they can also decrease its effect in a variety of ways. By being encouraged to decrease its effect on themselves, it can increase net utility.

Governments may also regulate externalities to remove them rather than providing a tax, which has limitations but can be more feasible.

Marketable Pollution Rights

You give a set of firms a the right to a certain amount of pollution which they can sell to eachother. Keeps pollution from rising above current levels while making efficient uses of resources via selling additional pollution usage.

More politically likely, since current polluter receive no disadvantages, but are incentivized to pollute less regardless.

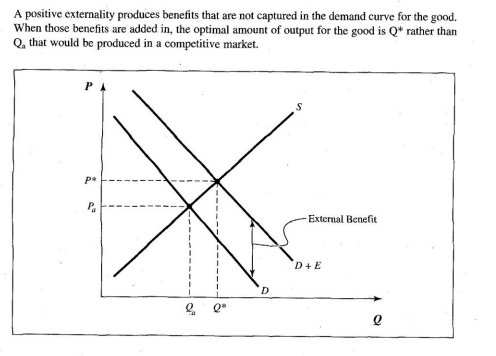

Positive Externalities

They produce a benefit to others, but this benefit is not allocated within the market. This means the true value of an activity is not reflected in the market demand for the activity, and too little of the activity will occur (such as renovating your home increasing the property value of those around you).

This is often used to justify subsidization, such as government subsidization of education (and well educated populace benefits everyone).

Excess Burden and Excess Benefit

Costs in addition to the direct financial value, such as the added burdens taxes on individuals can have due to filing.

Corrective taxes carry excess benefit in that it decreases the need for taxes in other areas.

Technological vs Pecuniary Externalities

Tech: Directly affect a firm’s production or an individual’s utility, such as smoke producing industries

Pec: Influence market supply and demand conditions, such as a McDonald’s opening next to a burger king (burger king will have to deal with increased competition).

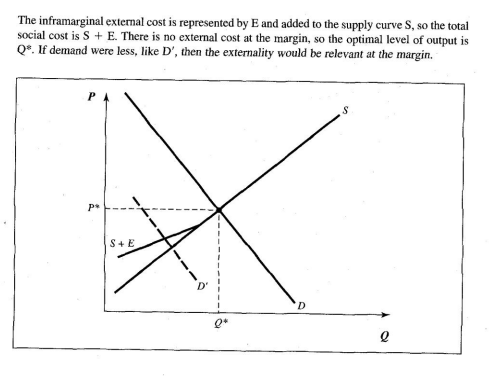

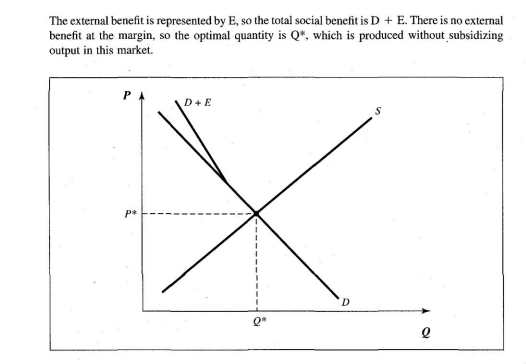

(Infra)Marginal Externalities

Infra - Although there may be spillovers of benefits or costs to others, there are no marginal benefits or costs. Individuals are taking account of the full benefits and costs of their actions at the margin.

Marginal decisions involve the extent to which resources are allocated to a pre-determined set of activities. Inframarginal decisions are about what activities to engage in (or whether or not to engage in an activity).

Negative Inframarginal Externality

Consider an industry that pollutes a lake, making it uninhabitable. A marginal reduction or increase in pollution wouldn’t make anyone better off, hence inframarginal.

Positive Inframarginal Externality

An educated population creates a positive externality, so some argue government should subsidize. However, there are also private incentives to receive an education (such as income).

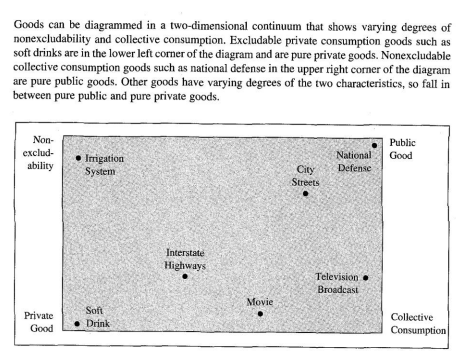

Collective Consumption Good

A good where consumption by one consumer will not reduce the consumption of any other consumer, such as digital movies.

Argument for Public Sector Production

Take the example of a digital movie viewer (a collective consumption good) like Netflix. If Netflix charges $5 a month, it loses out on customers who are willing to pay $4, and so on, losing out on pareto optimal decisions.

This is inefficient. However, if it was ran publicly through tax dollars an no up front charge, the inefficiency would be reduce.

However, many goods that seem to fit this bill do not, such as highways, which can get congested. Such would be an example of a private consumption bill, as it would need to be expanded to allow for more people to use it. Additionally, there would be no market signals about relative values of programs if ran by the government, as its done for free. This means its unclear how many resources should be placed on it in the future.

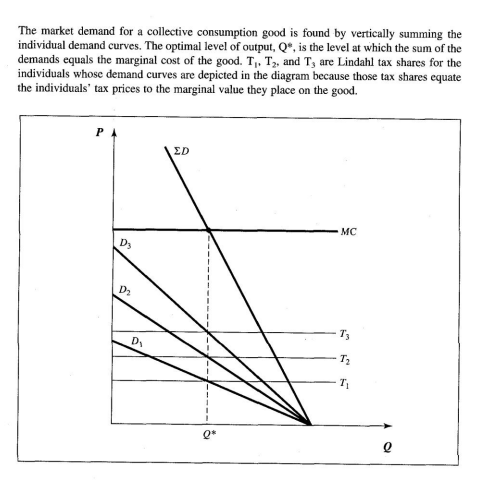

Optimal Output of a Collective Consumption Good

Lindahl Pricing

Prices for individual goods are set such that each individual pays a marginal price equal to the marginal benefit they receive from consuming the good.

This would lead to efficient allocation of resources, but is not necessary. Since individuals cannot quantity adjust, prices don’t equal the consumer’s marginal valuations for the output of the collective consumption good for output to be efficient.

Can violate common ideas of fairness, but still allows an efficient level of output.

This may not be useful in many cases, but can be approximated, such as through property taxes funding education tending to work since bigger families need bigger, and therefore more expensive homes.

The closer something is to Lindahl pricing, the easier it is to agree on the amount to produce and that that amount will approximate efficiency.

Pure and Impure Collective Consumption Goods

Many goods can accommodate additional users at low cost but not necessarily at zero cost, such as the congested highways, which can be referred to as an impure collective consumption good.

Because individuals cannot pay more or less to get more or less of a public sector good, regardless of it being pure or impure, the optimality condition holds.

Nonexcludability

A good is nonexcludable if, once produce, it is difficult to stop people from consuming it. National defense is an example, since if some people pay to protect the country, people who didn’t pay will also be protected. These individuals would be free riders, who receive goods of others produce without paying their share of consumption.

This leads to the good not being produced efficiently. Since everyone has the same incentive, no individual does, waiting for another to do it.

Nonexcludability in Prisoner’s Dilemma

Since it’s easier to screw someone else in favor of your own self interest, you should do it. This unfortunately leads to a lower social good being performed. Say you’re waiting for your neighbor to plow snow off the driveway so you can use it, but they’re doing the same. Applying this issue to many people, free riders would be a wide issue.

The solution is forced taxation, which overcomes the free rider problem.

Exclusion is sometimes possible, but too costly to be feasible. For example, toll roads work for highways, but not city streets.

Nonexcludability and Public Goods

Protection of Rights from the State

The protective right of states, in an economic framework, can be viewed as that the protection of rights is necessary for a functioning economy and that the protection makes up a sizable fraction of the public budget.

This is done through police protection, to stop fellow citizens from violating rights, national defense, to stop violation of rights from foreign aggressors, and a justice system so disputes can be resolved without force from either party.

This provides the government a monopoly on force, which has issues since the government can also violate a citizen’s right, which then adds the question of how to limit a government so it cannot (checks and balances, democracy).

Resources should only be spent to protect rights up until the marginal cost of additional protection is equal to the marginal benefit.

Information and Regulation

Governments are not omniscient, and as such have limited information to push toward optimal resource allocation. For example, the FDA takes a while to confirm if a new medicine is good to ensure its long term and widespread safety.

Politics and Regulation

Often in a political system, the interests of those who are to be regulated are represented more strongly than those the regulations are intended to benefit. This leads to regulations favoring firms over citizens. For example, monopolies like electric utilities are often pushing new policy on themselves while citizens are unaware.

Redistribution

Changing the distribution of wealth in some way. This is done for several rationales.

Improve the well being of less fortunate members of society with a safety net.

Greater equality as a general social goal

These two can run counter to one another. For example, increasing taxes on upper income individuals can reduce their incentive to earn income, resulting in less total tax revenue for the poor.

A bulk of US transfers go to the middle class through social security, which makes sense since the middle class make up the majority of those who vote. Retired Americans are known for being especially active.

Farmers have similar benefit. In urban areas, there are a diverse set of industries, but in rural states, it’s mostly just farmer’s interests. This leads to Congress being ruled by more farmers than it otherwise should be. So their industry gets more benefits from the government than any other.

Stabilization as a Role of the Government

The government can help stabilize the economy through monetary and fiscal policy, especially in the case of a recession.

Government fulfilling its Roles

The government also has to fulfill its roles are stabilizers, redistributors, and protectors of rights. However, its often questionable if it can do it well (in comparison to the market) due to limited info and conflicts in the many goals of the governments (such as the tradeoff in efficiency and equity).

Even if these were nonissues, the government may still fail due to issues with the governmental structure (think how Congress rarely passes anything).

The Holdout Problem

Occurs whenever unanimous approval among members is required for some pareto superior move to occur.

Say there’s a man trying to build a toll road he know he can make 150k off of. He needs to buy properties from 10 owners to build it, each otherwise willing to sell for 10k. Well, if he sells to 9 owners, the last can demand 60k. However, since that’s the case, no owner wants to sell first so they can eventually be able to demand the 60k.

Solutions: Assemble the property from fewer individuals or present alternative areas to buyers (landowners may wanna hold out, but if the man can go elsewhere, they’d be incentivized to sell sooner).

Disney did this by buying using a number of different real estate companies to buy land, so none of the landowners realized they were selling to one entity.

When the government runs into this problem, it uses eminent domain (where landowners are forced to sell at a fair market value).