Exam 2 SMC Policy Economics in one lesson

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

The art of economics

Consists in looking not merely at the immediate but at the longer effects of any act or policy.

The broken glass dilemma

A scenario illustrating the fallacy that destruction can benefit the economy by creating work.

Opportunity cost

The lost benefit that could have been gained from the next best alternative when a choice is made.

Public Works = Public Taxes

The concept that government spending must come from tax revenue, not from other sources.

Inflation

A more vicious form of taxation that decreases the purchasing power of money.

Economic fallacies

Misconceptions that arise from abstraction and overlook the impact on individual members of a community.

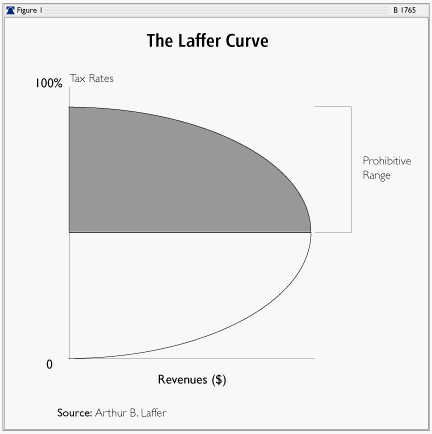

Laffer Curve

Illustrates a theoretical relationship between tax rates and tax revenue.

Net benefit

The overall gain or advantage after considering all effects and alternatives.

Manufacturing displacement

The shift in production focus due to external factors, such as war.

Government spending for employment

Often seen as wasteful when it does not result in net economic benefits.

T/F: Every dollar the government spends is taken away from tax payers.

True

T/F: Every job the government creates destroys a private sector job.

True

The Laffer Curve

The Laffer curve is a curve depicting the relationship between tax rates and revenue, based on a theory by economist Arthur Laffer.