Macro Economics Final Exam Study Guide (College)

1/199

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

200 Terms

________ are generally the result of price ceilings.

Shortages

The main reason price ceilings are set is so that consumer prices

will be lower.

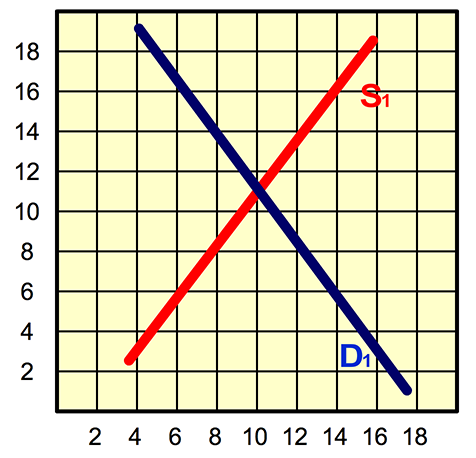

Refer to the figure below. If the government sets a price ceiling of $8,

consumers would demand 12 units.

A price floor attempts to keep prices ________.

higher than the equilibrium price.

What is a the typical result of a price floor?

excess supply.

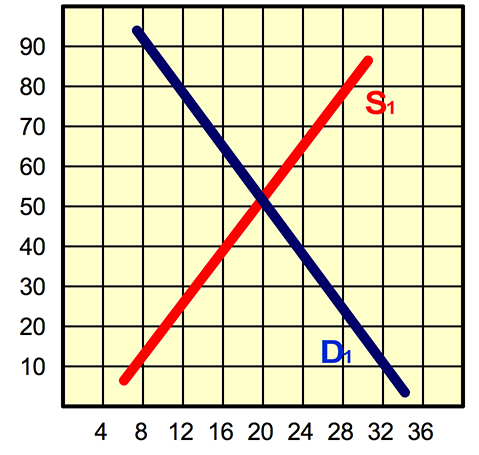

If the government set a price ceiling of $40, there would be:

Isabel experiences diminishing marginal utility when

the value to her of each additional hat she purchases start falling.

Consumer surplus is best described as the extra benefit consumers receive when they ________.

pay less than they would have been willing to pay

Refer to the figure below. Consumer surplus is:

$30

The sum of consumer surplus and producer surplus is know as ________.

social surplus

Making an economically rational decision requires

considering the prospective benefits and costs to oneself.

The theory of rational behavior

is an assumption that economists make to have a useful model for how decisions are made

Which of the following statements reflects marginal decision-making?

Booking this condo in a better location is worth the extra $100.

A positive statement is

can be shown to be correct or incorrect.

Normative statements are based upon

value judgments.

Which of the following statements is positive?

Social security benefits are not taxed.

Which of the following statements is normative?

Congress gives too many tax breaks to corporations.

The slope of a budget constraint line is influenced by

how much one product costs compared to the other.

A budget constraint model differs from production possibilities model in that, typically

only the production possibilities model demonstrates diminishing returns.

If an economy was in a recession and the government decided to use a supply side policy to address it, the government would most likely

institute cutting taxes rather than increasing spending by the government.

According to the Keynesian approach to fiscal policy

The crowding out effect is quite limited as the demand for private loans is low in times of recessions.

Which of the following is likely to lead to economic growth in the long term?

new highways to serve new neighborhoods and business parks

An argument to promote capital deepening is that it will

increase productivity and economic growth in the long run.

If an economy moves into an inflationary period, causing that country to produce more than potential GDP, then

automatic stabilizers will cause tax revenue to increase and government spending to decrease.

If an economy moves into a recessionary period, examples of fiscal policies that act as automatic stabilizers include

an increase in transfer payments or social spending, such as unemployment benefits.

If the economy is producing less than its potential GDP, ________ will show a smaller deficit than the actual deficit.

the standardized employment deficit

If the economy is producing more than its potential GDP, ________ will be larger than the actual budget deficit.

the standardized employment deficit

Expansionary fiscal policy might include which of the following?

Reduction of taxes or increased government spending.

An expansionary fiscal policy can increase the level of aggregate demand by all of the following EXCEPT

decreasing government purchases.

If a government reduces tax rates in order to increase the level of aggregate demand, what type of fiscal policy is being used?

discretionary and expansionary

Which of the following is NOT an example of an expansionary, discretionary fiscal policy?

an increase in tax rates.

When inflation begins to climb to unacceptable levels in the economy, the government should

use contractionary fiscal policy to shift aggregate demand to the left.

Fiscal policy is concerned with which of the following?

Government expenditure changes.

A major concern of fiscal policy is

how federal government taxing and spending affects aggregate demand.

When the government increases its spending, it is conducting

fiscal policy.

When does a budget surplus occur?

When government tax revenues exceed government spending.

What do goods like gasoline, tobacco, and alcohol typically have in common?

They are all subject to government excise taxes.

Which of the following examples describe a progressive tax?

Income tax with a 10% tax rate on low income households and 20-30% tax rates on higher income households.

Which of the following example(s) describe a regressive tax?

Social Security tax rate of 6.2% on earned income below $117,000 and 0% on income earned above $117,000.

A tax that is a flat percentage of all wages earned is a

proportional tax.

Property taxes are

imposed based on ownership of assets such as real estate.

Sales taxes are

imposed as a percentage of the value of the purchase.

A ________ is created each time the federal government spends more than it collects in taxes in a given year.

budget deficit

A ________ means that government spending and tax revenues are equal.

balanced budget

The U.S. produces strawberries in Oregon, but also imports strawberries from Chile. The production costs are lower for strawberries from Chile. Instead of a free trade environment in the U.S., the U.S. government has imposed a value quota. What will the quota on strawberries from Chile do to the U.S. market?

Lower the price of strawberries in the U.S., and increase the quantity of strawberries sold in the U.S.

An example of a tariff would be ________.

a tax on an imported good

The World Trade Organization (WTO) was established in ________.

1995

A common complaint with trade policies is the act of ________.

dumping

Since the change in GDP is a greater change than in the expenditure model the multiplier has a value ________.

greater than one

Why does the multiplier effect exist?

Because a change in expenditures leads to changes in income, which generates further spending.

If government spending increases by $4 billion and real GDP increases by $8 billion, the expenditure multiplier must be ________.

2.0

If the MPC is 75%, what is the spending multiplier?

4

If the expenditure multiplier is 2.5 and the government spending increases by $4 billion, what would be the increase in the real GDP?

$10 billion

When the economy experiences an inflationary boom, the GDP gap is:

negative.

Keynesian economists believe that the economy needs to be influenced in order to correct itself from the effects of unemployment and inflation. This can be done through ________ policies.

fiscal

Keynesians believe the economy is characterized by recessions and inflationary booms which can cause unemployment and inflationary concerns. The solutions to a recession causing unemployment is expansionary fiscal policy in the form of ________.

tax cuts and increased government spending

The Keynesian approach focuses on aggregate demand and sticky prices has proven useful in understanding how the economy fluctuates in the ________-run and why recessions and cyclical unemployment occur.

short

Keynes believed that economies are ________ driven in the ________ .

demand; short-run.

Keynes understood that in the short-run wages and prices are ________ and therefore encourage the use of ________ to return an economy to equilibrium.

rigid; fiscal policy

What is the best explanation for the slope of the neoclassical zone of the aggregate supply curve?

A small an increase in aggregate demand when the economy is operating at potential output causes the price level to rise, with little or no effect on real output.

Neoclassical economists argue that

the long run aggregate supply curve is vertical.

A rightwards shift of the AD curve along the Neoclassical portion of the aggregate supply curve will result in

an increase in the price level.

Aggregate demand is more likely than aggregate supply to ________ in the short run.

shift substantially

If you are explaining the theory of rational expectations to a friend, you would say that the change in an agents’ expectations is ________ and therefore ________ the effectiveness of monetary or fiscal policy.

immediate; precludes

Which of the following scenarios would most likely be viewed from a neoclassical perspective as an undermining element of the long-run productivity growth in an economy?

business capital investment tax cuts

Keynes argued that the ________ was unable to keep the economy at full employment. As a result, the ________ should take an active role in managing the economy.

private sector; government

Which one of the following statements best represents the Keynesian Perspective?

People’s demand determines what is built

What are the components included in aggregate demand?

Consumption, investment, government spending, and net exports.

According to the Keynesian perspective, reasons for an increase in aggregate demand include

increase in foreign demand for net exports.

If U.S. goods are relatively cheaper compared with goods of foreign places, then U.S. exports are likely to rise. This would make the aggregate demand curve ________.

shift to the right

According to macroeconomic theory, evidence that high unemployment may be accompanied by low inflation, and low unemployment may be accompanied by high inflation is illustrated by the

Keynesian Phillips curve tradeoff.

The Keynesian economic framework is based on an assumption that

prices and wages are sticky and do not adjust rapidly to changes in aggregate demand.

During recessionary times it can be hard to coordinate lower wages for workers because of the ________.

coordination argument

If inflation occurs in a given year,

the change in the real measurement (GDP) would be smaller than the change in the nominal one.

Which of the following best defines real GDP?

Real GDP is defined as the total dollar value of final goods and services produced within a country in one year after adjustment for inflation.

With a Real GDP of $100 billion in 2016 and of $140 billion in 2017, the real growth would be

40%

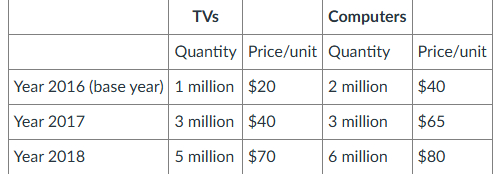

The fictional small country of Dansbert has had a robust GDP the last few years. Dansbert produces just two products: TVs and Computers. The following chart shows product quantities and prices from 2016 to 2018. With 2016 as the base year calculate the real GDP using 2018 prices. What is the real yearly growth in 2017 & 2018?

80% for 2017 : 89% for 2018

Which of the following describes the macroeconomy?

The US inflation rate has been under 2% annually over the last 7 years.

A macroeconomist would study

economic policies designed to stimulate the country’s economy out of a recession

The macroeconomy

regroups the activity of all households, firms and government in a country.

An economic indicator is:

a statistic that helps us understand how the economy is doing.

Gross Domestic Product (GDP) is designed to measure:

a nation’s total production of final goods and services.

GDP includes

only final goods to avoid double counting when including intermediate goods.

Which of the following would fall in the Investment component of GDP?

The amount spent on new factories.

Investment, when calculating GDP, refers to the:

purchase of new capital goods like real estate, equipment, and inventories.

In calculating GDP, which component of spending must be subtracted from total spending?

import

Economic growth is supported by

laws that build trust between parties.

Fluctuations in real GDP are called ________?

business cycles

An economy is considered to be in a recession if

it is moving from the peak toward the trough of the business cycle.

Which of the following best describes a business cycle?

Periods of increasing and decreasing real GDP.

If a country’s Gross Domestic Product increased slower than its population increase, the country’s GDP per capita would

fall.

Gross Domestic Product is a ________measurement of standard of living because ________.

imperfect; not all important determinants of standard of living are incorporated

What factors are left out of the Gross Domestic Product calculation but are still necessary in determining and reflecting our standard of living?

The value of leisure, the quality of our environment, improvements in products quality.

Labor productivity is

the production or output per worker per hour.

Which of the following is unlikely to affect labor productivity?

The frequency of business cycles.

Which is a factor that drives economic growth?

Increased human capital.

Which factors contribute to economic growth?

An increase in university graduates.

If the total number of hours worked per year increases, then automatically

the value of the production will increase.

Compound growth in an economy can increase people’s standard of living for country Z. If the economy for country Z starts with a GDP of 150 and a growth rate of 2% per year, what will its GDP be after 15 years?

202

The country of Wachovia has an economy that will double in 144 years. From what you’ve learned of the power of compound growth what does this mean for Wachovia?

Wachovia has a slow growing economy at a growth rate of .5% per year.