HASS Semester 2 Exam Y10

1/98

Earn XP

Description and Tags

this is probably best for writing notes with ngl

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

99 Terms

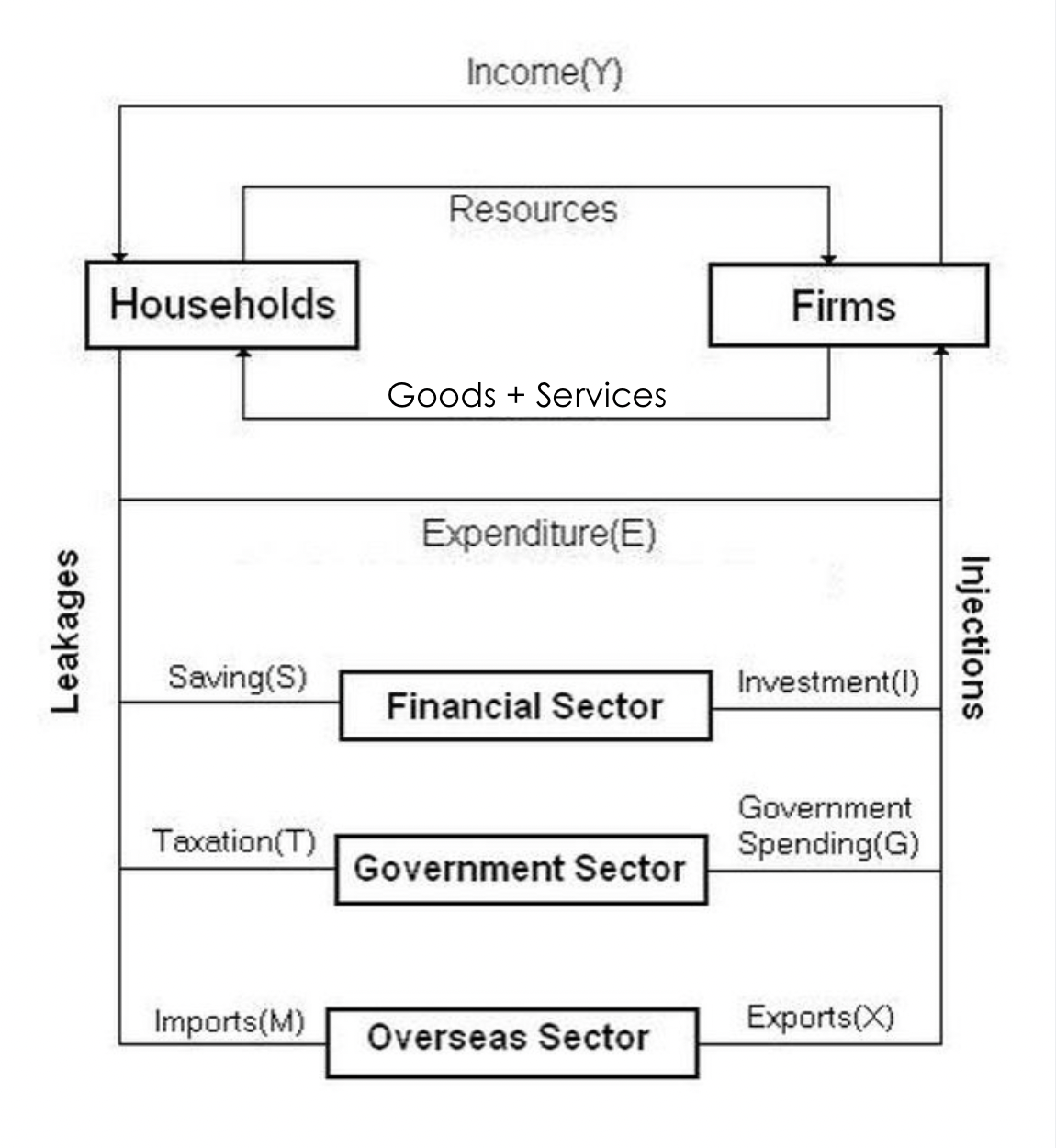

Circular Flow of Income Diagram

Role and Relationships for Households

They have the role of owning the four factors of production (land, labour, capital, enterprise), and exchanging them for income

Their relationship with the firm sector is that they spend money on goods and services to create demand in the economy

Role and Relationships for Firms

They have the role of using the factors of production (land, labour, capital, enterprise) provided by the household sector to create goods and services.

Their relationship with others is that they pay incomes to households and receive revenue when households (+ other sectors) purchase goods and services

Role and Relationship of the Financial Sector

They have the role of facilitating savings (of the household sector), and making investments (for the firm sector)

Their relationship with others is that they channel funds from savers to borrowers to fund consumption, investment, and production

Role and Relationships of the Government Sector

They have the role of collecting taxes from households and firms, and use this revenue to provide public goods and services (healthcare, education, etc.)

Their relationship with others is that they redistribute income, and influence economic activity through policies (social welfare, public investment)

Role and Relationship of Overseas Sector

They have the role of representing the goods and services being exported to/imported from other countries.

Their relationship with others is that they affect the domestic economy through exports (which inject money into the econ.) and imports (which leak money out of the econ.)

Income

A regular flow of money, which may include wages, salaries, rent, interest, etc.

Wealth

The accumulation of the value of all assets, including property, savings, etc.

Types of Commonwealth Taxes

Income Tax

GST (goods and service tax)

Company tax

Income Tax

The tax placed on the yearly income of a worker, and in Australia is a percentage that increases as a person makes more money

How to Calculate Income Tax

If your income is bigger than the highest number in the bracket:

(highest number in bracket - lower number in bracket) x tax rate, then continue until income is between the smallest and biggest number in the bracket, then:

(income - smallest number in bracket) x tax rate

once this is done, add all together to find final tax

GST

Goods and service tax, the tax of 10% added onto the price of most goods and services.

Can be calculated by dividing the price of a good/service by 11, or can be added onto a base price by multiplying it by 1.1

Company Tax

A tax placed on the profits made by a company

Producer

One who provides goods and/or services to consumers

Consumer

One who consumes goods and services purchased from producers

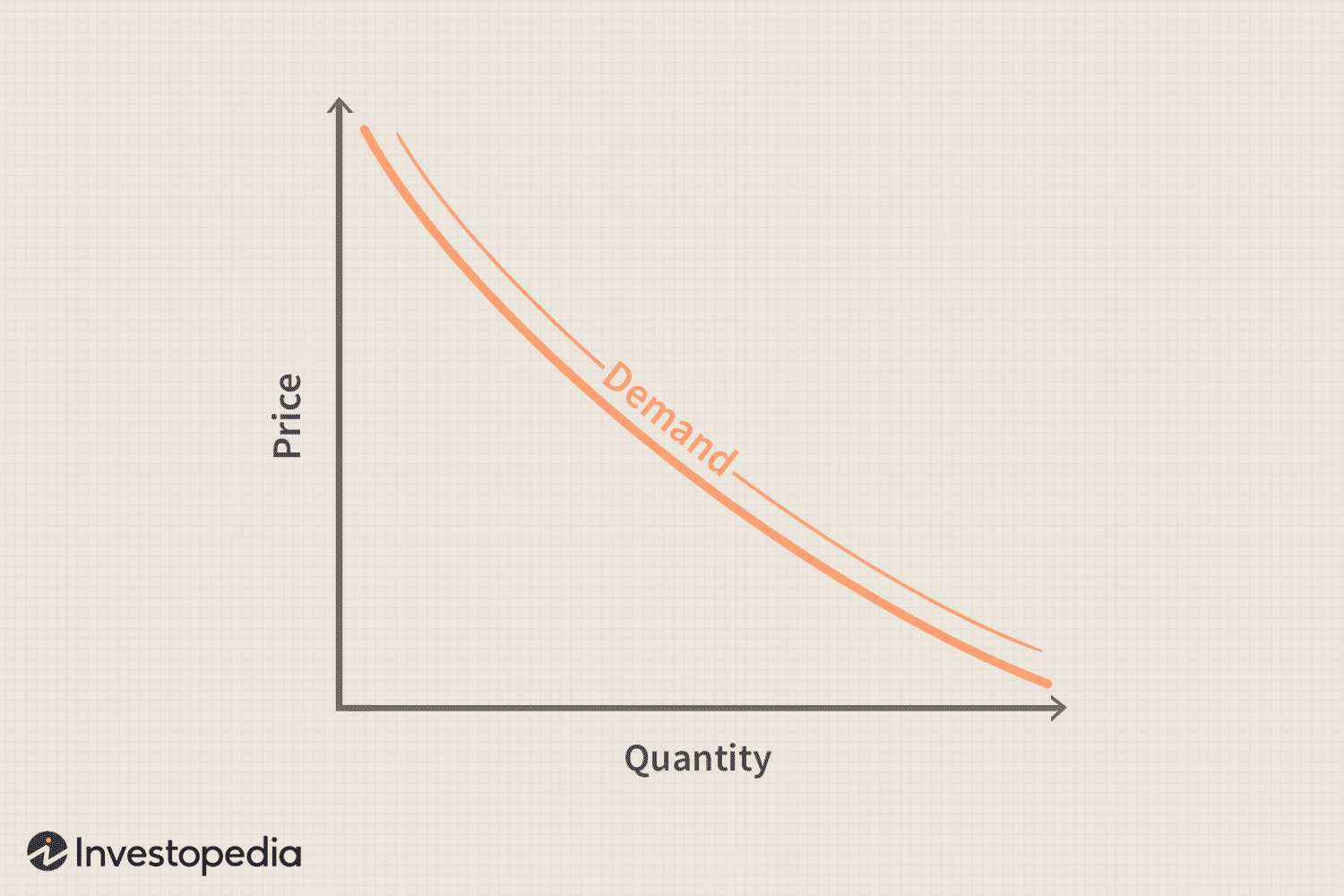

Law of Demand

If everything stays the same, when the price of a product rises, the demand of a product falls. If the price falls, demand rises. Occurs as the lower the price is, consumers believe they are getting more value for a product or can actually afford it

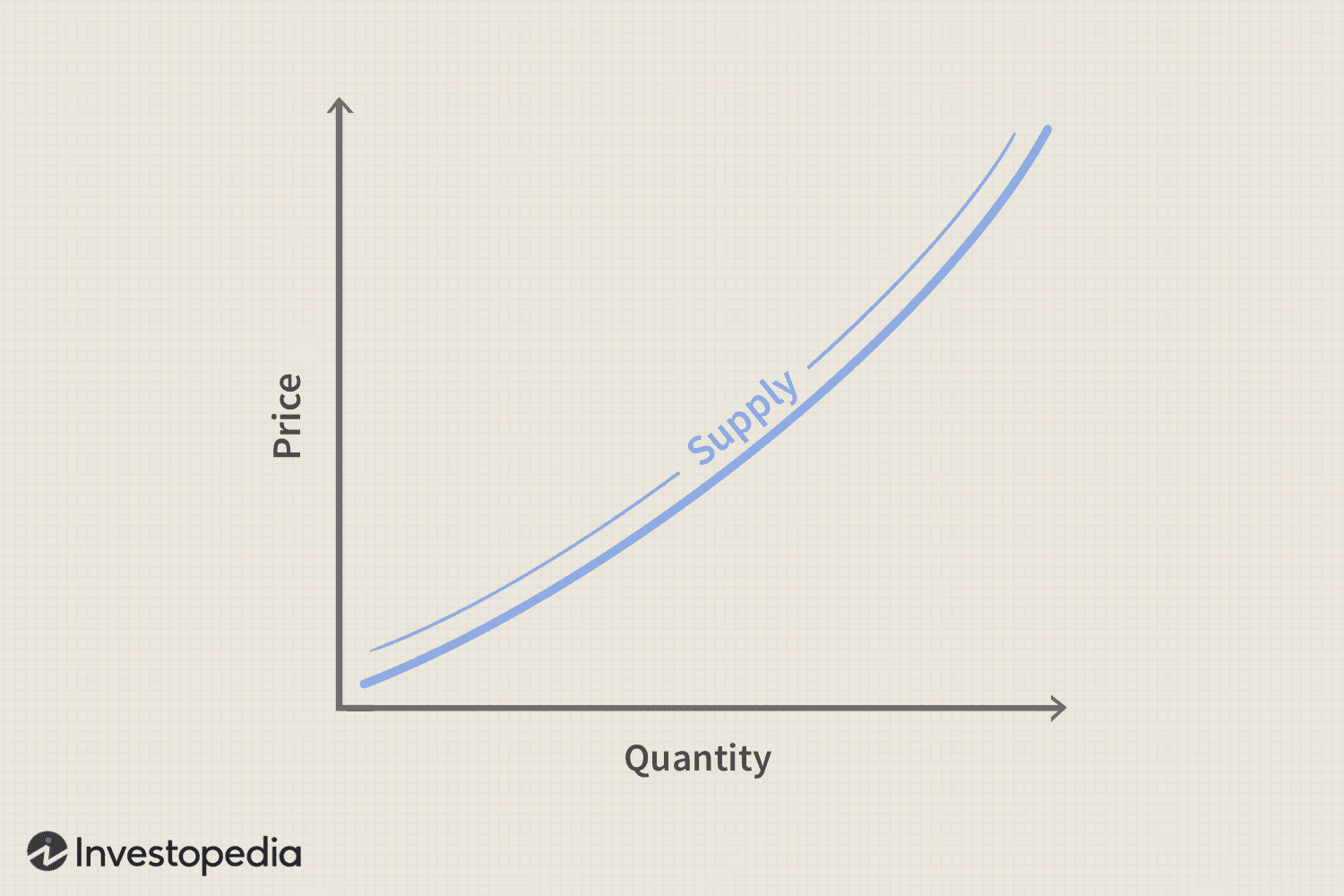

Law of Supply

If everything stays the same, when the price of a product rise, the supply of a product rises. If the price falls, supply falls. Occurs as suppliers become more willing to supply products if they make more money

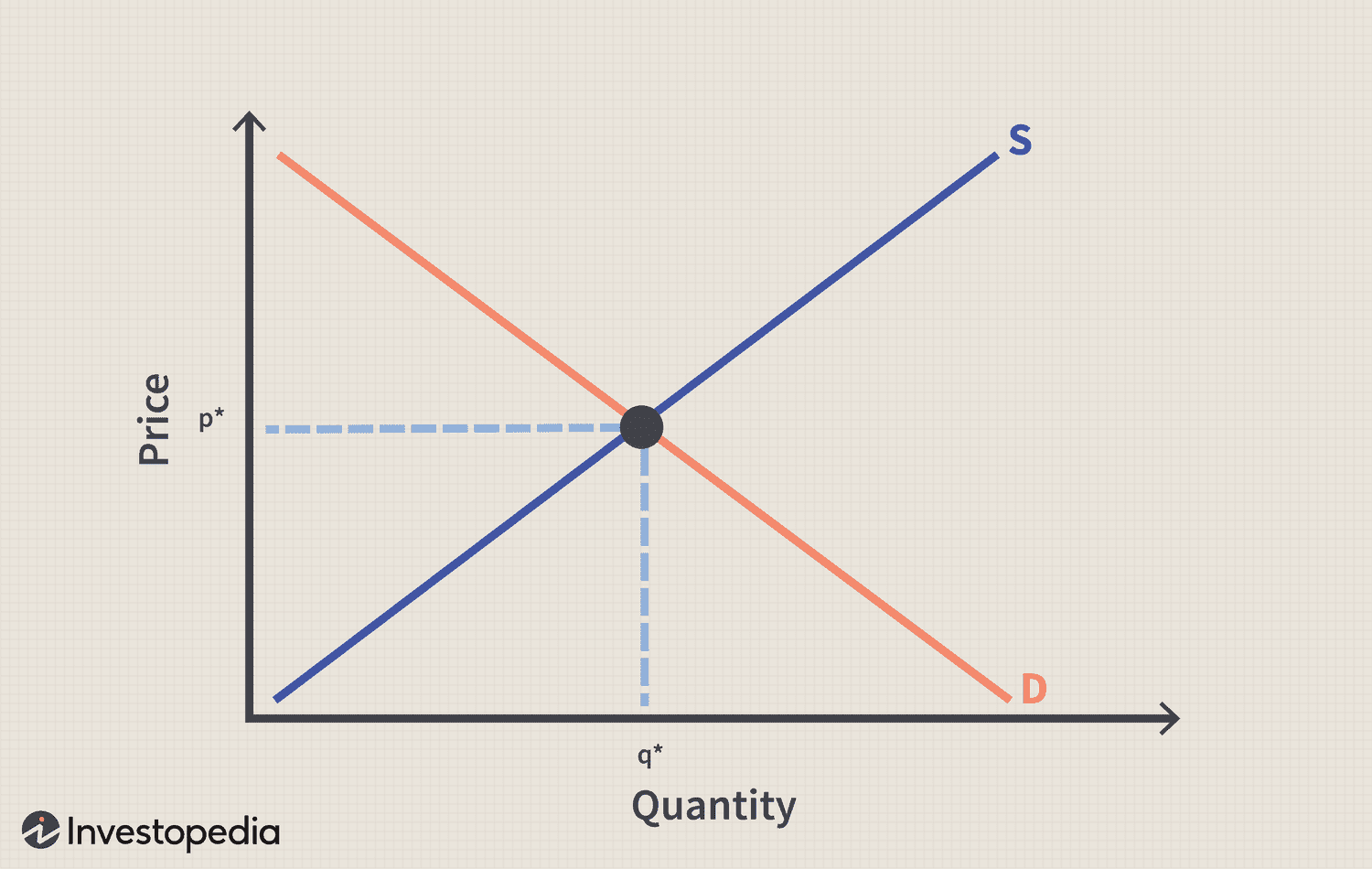

Equilibrium

The point where supply and demand are equal, where the two graphs intersect

Surplus

The points where the supply of a product surpasses it’s demand, meaning that there is not enough demand for a product to match it’s stock (the space above the equilibrium)

Shortage

The points when the demand of a product exceeds it’s supply, meaning that there is too little stock to match the demand for a product (the space below the equilibrium)

Factors that may influence a consumer’s decision to buy

Price (too low could make consumer suspicious, too high could make someone think it’s premium)

Availability of credit (how easy it is to borrow money)

Marketing (how well a product is marketed to the consumer)

Age + Gender (products may be marketed to specific age groups or genders)

Convenience (items that save time may be liked more)

Ethical and Environmental Considerations (items that are bad for environment or workers may be liked less)

Labour Productivity

The amount of goods and services a worker/workers produce in a given amount of time

Capital Productivity

The amount of goods and services that can be produced using a fixed amount of capital in a given amount of time

Ways Capital Productivity can be Increased

Improving tech (using most advanced equipment to save time and cost)

Improving processes (improving production to be more efficient and taking less time, though still being effective. At best, these should organise time, resources, and storage to lower costs)

Ways Labour Productivity can be Increased

Improved Management Practices

Training

Workplace Culture and Flexibility

Appraisal and Feedback

Incentives

Improved Management Practices

A method of improving labour productivity, by making sure managers have the right attributes to lead. Managers should know much about the business, be able to relate well with their employees, and be positive and effective leaders

Training

A method of improving labour productivity, in which new employees effectively have their skills and knowledge developed. Generally involves educational training in things like schools, and extra training at the workplace

Workplace Culture and Flexibility

A method of improving of labour productivity, where the culture of the workplace should be positive, giving the employees stronger work ethics. Having flexible hours and work locations can improve work ethic as well

Appraisal and Feedback

A method of improving work productivity, in which positive and constructive feedback is given to workers. This results higher productivity in workers. This can be done regularly, or in a more formal way through appraisals

Incentives

A method of increasing labour productivity, where something is used to encourage worker productivity, like extra money, holidays/paid leave, shares, etc.

Productivity

The measure of what can be produced (output) with a given amount of resources (input)

Economic Growth

The increasing ability of a nation to satisfy the needs and wants of its people over time, which reflects the size and health of the economy. Is best when at 3-4% per year

How Economic Growth is Measured

Can be measured through analysing the GDP (and it’s changes over time) in a country

GDP

Stands for Gross Domestic Product, and is the value of all of the goods and services produced in a country in a given period of time

Benefits of Economic Growth

Level of Income: Higher growth usually means higher income

Consumption: Increased growth usually means more spending/buying

Ability to Satisfy Needs and Wants: Increased growth usually means better living standards and overall well being, plus having more money to spend on products

Quality of Life: income levels increase the quality of day-to-day products

Living Standards: By being able to satisfy needs and wants, quality of life is enhanced

Costs of Economic Growth

If too high, can have:

Inflationary pressures: high inflation can occur, due to higher demand than supply, lowering value of money

Resource Depletion and Environmental Damage: natural resources can be overused with rapid growth, causing damage to biodiversity and the environment, + pollution

Increased Inequality: economic growth may be focused on one group, not on all of society, increasing inequality between the two groups

Strain on Infrastructure and Institutions: the capacity of infrastructure (houses, roads, etc.), and institutions (legal and regulatory frameworks, etc.) can struggle, causing inefficiencies, shortages, and systemic breakdowns

Inflation

The general increase of the prices of goods and services over a certain period of time

How Inflation is Measured

By calculating the Consumer Price Index (CPI), created by surveying the price of many goods/services across Australia and weighting the goods/services based on how often they are bought (e.g., milk vs buses). Then, this formula is used:

CPI (year 2) - CPI (year 1), which is then divided by CPI (year 1)

Effects of Inflation

Output Effects (Effects on the output of products)

Redistribution Effects (Effects on different groups of society)

Output Effects

Inflation diminishes potential output, where uncertainty over price can cause businesses to focus resources more on speculative activities than productive ones

Prices rises reduce purchasing power, where the rise of income may not keep up with inflation

Uncertainty, where investments become riskier as costs are unpredictable, meaning profits are unpredictable

Capital for Labour Substitution, where workers may be replaced by machinery as wages increase

International Competitiveness, where inflation results in competition between exporters as different countries face different levels of inflation

Redistribution Effects

Where inflation effects different groups differently, including:

Workers, and Welfare Recipients, who may lose as the increases to money they make may not match inflation, meaning they have decreased purchasing power

Savers, who would lose as the value of the money they are saving is decreasing

Borrowers, who would win as the value of the money they owe is decreasing

Lenders, who may lose as they receive the owed money back at a decreased value, unless the interest is equal to/over the rate of inflation

Unemployment

The issue where people able to and willing to have an occupation, lose their job and/or are unable to find one

How Unemployment Rate is Measured

Number of Unemployed People / Labour Force

Labour Force

The total number of all people who are able to and are willing to have a job. Is calculated by adding the number of unemployed people and the number of employed people

Who Counts as Unemployed

People 15 or above without a job, though are able and willing to work

Participation Rate

The proportion of the population in the labour force. Is calculated by: (Labour force) / (Population 15 or over)

Types of Unemployment

Structural Unemployment, where there are less jobs available than there are people with the skills to do the job (can be caused by advances in technology)

Seasonal Unemployment, where certain jobs are only in demand during certain times of year

Cyclical Unemployment, where unemployment rises and falls with changes in economic activity

Hardcore Unemployment, where a person is unemployed long term due to lack of skills, age, or personal problems

Frictional Unemployment, where a person is unemployed short term and voluntarily as they change jobs

Economic Effects of Unemployment

Deteriorating Living Standards, where unemployment may cause consumers to spend less money, families to face more stress, feelings of personal failure and a loss of skills

Decreased National Production, where resources (including labour) are underused, meaning the GDP will fall lower than it’s potential as there is less production

Changed Government Budget Position, where tax revenue decreases, while welfare spending increases, lowering available money for other sectors

GDP per Capita

The GDP divided by the population, which represents the average standard of living and wealth each person should have. The higher this is, typically the higher standard of living

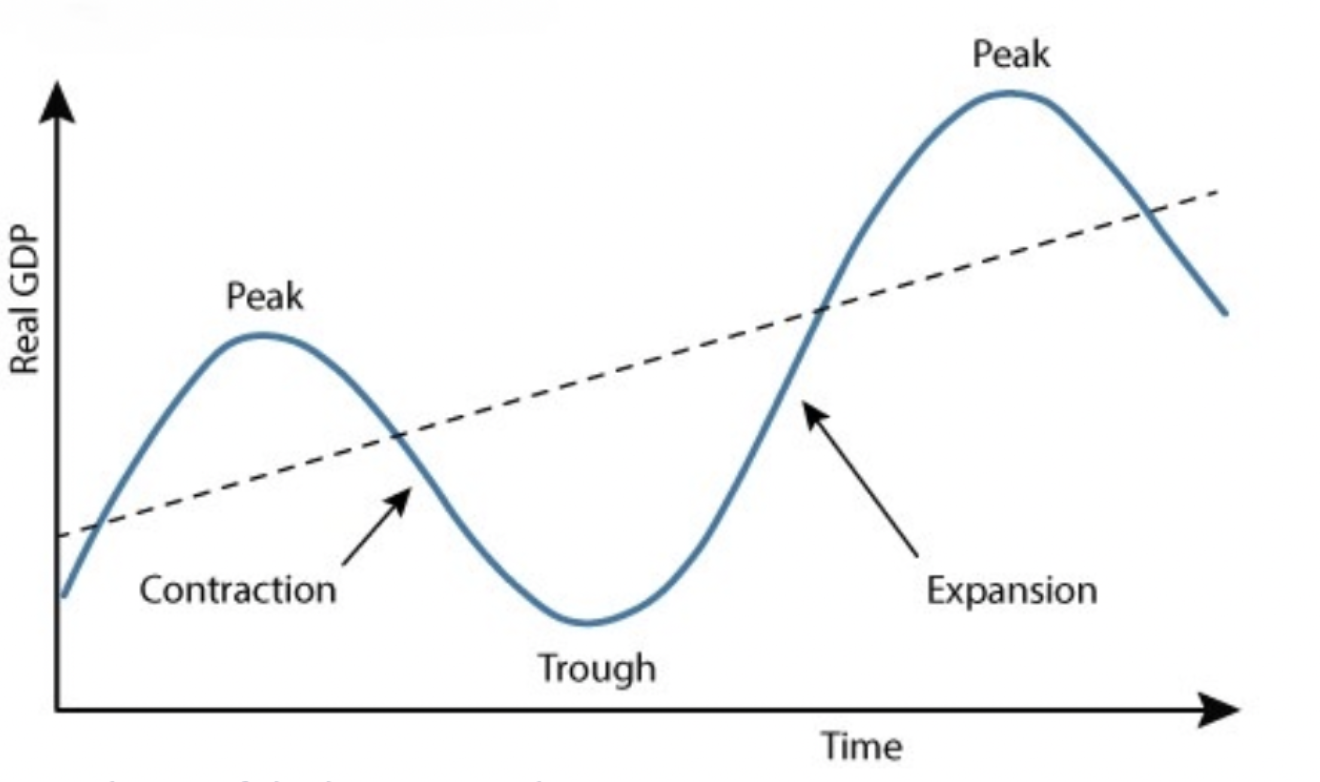

Business Cycle

The cycle that depicts the rise and fall in the output of goods and services over time

Features of the Business Cycle

Expansion: the phase where GDP is growing, moving toward a peak. This means businesses are expanding, producing more goods, hiring more, and morale is generally higher

Peak: the highest point that comes from expansion

Contraction: the phase where GDP falls and moves toward a trough. This means production goes down, hiring goes down, and morale is generally lower

Trough: the lowest point that comes from a contraction, and is the transition from declining economic activity to expansion

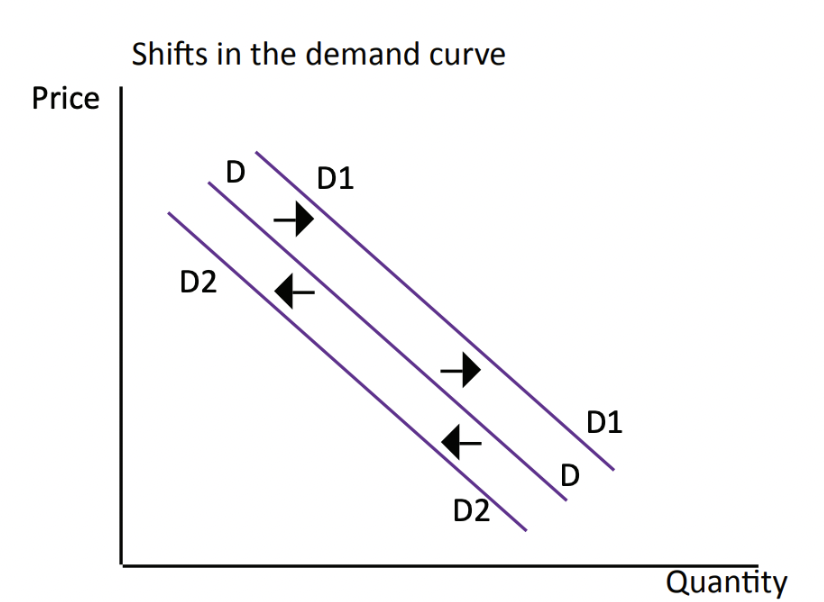

Shifts in Demand

Occur when non-price factors affect the demand of the product, causing the demand graph to shift to the left when it decreases demand, or shift to the right when it increases demand. Occurs as non-price factors change how willing consumers are to buy products at a certain price

Non-Price Factors for Demand

Changes to disposable income (if people have more money to spend, they become more willing to buy and vise versa)

Changes to peoples tastes and interests (products or hobbies may go in or out of fashion)

Changes to interest rates (the more interest people are charged on credit, the less willing they may be to buy and vise versa)

Advertising/marketing campaigns (good advertisements/positive media increase demand, and vise versa)

Changes to the makeup of the population (e.g., if more of the population are elderly, things like walkers may increase in demand, while nappies may decrease)

Price of related goods (e.g., if light bulbs become more expensive, demand for lamps may decrease. e.g., 2, if price of coffee increases, demand for tea may increase)

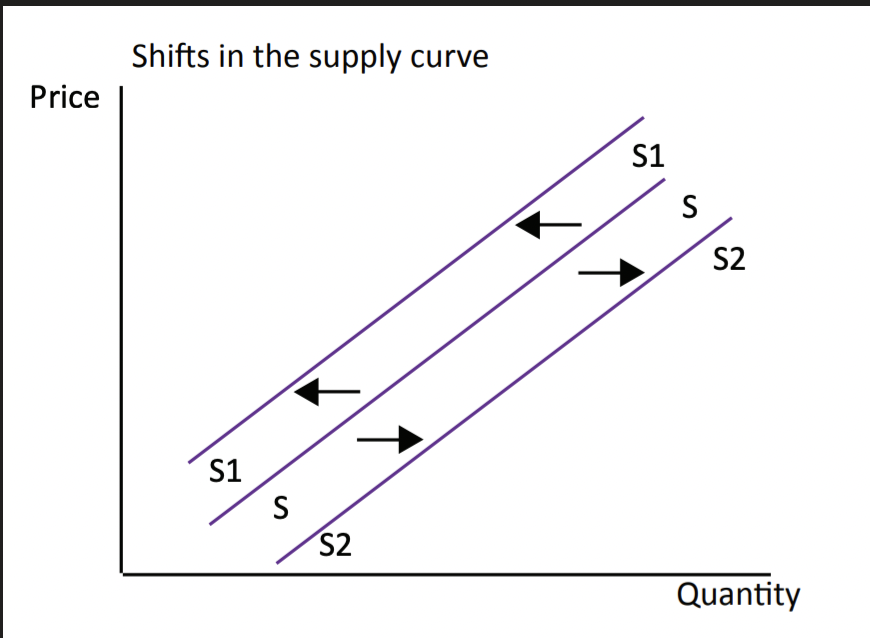

Shifts in Supply

Occur when non-price factors affect the supply of the product, causing the supply graph to shift to the left when it decreases the supply of a product, or shift to the right when it increases the supply of a product. Occurs as non-price factors change how willing producers are to stock products at a certain price

Non-Price Factors for Supply

The price of resources (if the price of resources increase, the price of products may increase, meaning less are produced [and vise versa])

Technology (new/imported technology may make production more efficient, lowering production costs, meaning more are made)

Reduced Legislation (laws and regulations may affect how products are produced, possibly introducing new restrictions that make the process have higher costs)

Weather/Seasonal (the time of year or weather may affect production processes, such as droughts, or good growing seasons for farming, or fishing in winter)

Cost of Production (if the costs involved in making a product increase, less will sold at the same price, and vise versa)

Price of other goods (more profitable goods may have more resources diverted to producing them, increasing their supply, while less profitable ones may be given less resources, meaning less supply)

Expectations of Producers (if producers expect prices to rise, they may hold stock back until it can be sold for more and vise versa)

Areas where the Government spends Taxation Revenue

Health

Social Security/Welfare

School

Aged Care

Environmental Protection

Defense

Macroeconomic Policies that can Impact on Living Standards

Budgetary/Fiscal Policy - the policies placed on the federal budget, increasing or decreasing tax rates and expenditure

Monetary Policy - the policies placed by the RBA that affect money supply and interest rates

Why Income Earners are paid at Different Rates

Education and Skills, where more education and skills often lead to higher paying jobs

Experience, where doing a job for longer may allow you to be paid better

Occupation, where some jobs pay better than others

Industry, where some industries pay better than others

Location, where your geographical location affects your income

Democracy

A system of government where people have the power to determine how they will be governed or managed

Justice

A broad term, that in Australia, refers to how all people should be treated by everyone equally and in a fair + balanced matter

Westminster System

A form of parliamentary government based of the UK’s system, in which parliament has a bicameral system and a sovereign who signs off on laws

Participation

An important concept in democracy, in which everyone should participate in democracy, through voting in elections + referendums, serving on a jury, or paying taxes

Rights and Responsibilities

The entitlements and duties people are granted as citizens of a country

Roles of the Australian Government

ensuring our society is united, safe, and peaceful, done through courts

making laws that reflect the prevailing values and moral standards of the people

ensuring all people have access to basic services and utilities (food, healthcare, internet, etc.)

supporting everyone to have a reasonable standard of living (including unemployed people, or people unable to work)

Key Features of the Australian Government

The Government has various roles to perform in service to citizens

Laws being made through parliaments that perform a variety of tasks (making/changing laws, having discussions, examining issues, reviewing injustices in law)

The Government is based on the federal system

Federal System

The system in which Australia is divided into six states and three territories (ACT, NT, Norfolk Island), which each have their own parliament to make laws, while the nation has it’s own federal parliament

The 1st Principle the Government is Based On

Our government should protect the rights and freedoms of the individuals, while minimising government control and interference. There are also lawmakers that should support us, though should not limit on our basic human rights and freedoms. These laws should be fair, not discriminatory.

The 2nd Principle the Government is Based On

The parliament should make laws that reflect the values, beliefs, and moral standards of the population. The representative democracy has free and fair elections, meaning that if laws are made that goes against our values, beliefs, and moral standards, the candidate risks not being elected again. These laws should reflect those of everyone, not just the voters

The 3rd Principle the Government is Based On

Governments should be able to justify their actions and decisions to voted (AKA being accountable/answerable/a responsible government). One way this is enforced is in parliamentary question time, where the opposition are given the opportunity to debate and question the decisions made by the government. This can also be kept by contacting local MPs to question decisions. If a politician is discovered dishonest or acting irresponsibly, they have the duty to resign

The 4th Principle the Government is Based On

The government should not make laws that are beyond their powers, which is enforced through the separation of powers. This means no one has the power over all three branches, which are the:

executive branch, which has the power to administer laws, headed by the Gov. General and Prime Minister, and includes the government departments.

Legislative Branch, which has the power to make laws, and includes the House of Reps and the Senate.

the Judiciary, which has the power to apply and interpret the law, includes all courts, and determines guiltiness and punishments of suspects

Three Levels of Government

Federal

State

Local

Responsibilities of the Federal Government

Medicare

Defense

Immigration

Foreign Policy

Currency

Responsibilities of the State Government

Public Transport

Primary + Secondary Education

Electricity

Water

Health Services

Responsibilities of the Local Government

Local infrastructure (roads, drainage, waste)

Recreational facilities (libraries, pools, parks)

Aged-care facilities

Childcare facilities

Roles in the House of Reps [don’t know if we need to know]

PM - the leader of the party with majority, sits nexts to speaker

Speaker - An experienced politician responsible for maintaining order in the hearing

Ministers - Politicians allocated to portfolios (specific areas)

Shadow Ministers - Politicians that monitor the ministers

Leader of the Opposition - Leader of the party with the 2nd largest amount of seats

Deputy PM - either the deputy leader of the Labor Party when Labor leads, or the leader of the National Party when Liberal leads

Hansard - Government workers that record the proceedings

Independents - politicians that do to belong to a specific party

Function of the House of Reps

The lower house, which has the role of introducing and discussing on bills, then voting on if they should be passed to Senate. Is meant to represent the needs of the People, and has 151 members for each electorate

Function of the Senate

The upper house, which has the role of reviewing and discussing bills voted on by the House of Reps, and either sending them to the Governor General to be passed, or sending them back to the House of Reps to make changes. Is meant to represent the needs of the States, and has 76 members (12 for each state, 2 for each territory)

Function of the Governor General

Is meant to represent the British Monarch to Australia, and has the power to oversee Prime Ministers, having the ability to dismiss them, and signs off bills in Royal Assent to turn them into laws

Compare and Contrast Australia and Indonesia’s Structure and Levels of Government

Both Australia and Indonesia are representative democracies that have three different levels, led by one figure.

They differ in that Australia is a Constitutional Monarchy which has a PM and headed by a Gov. General, while Indonesia is a Republic, having a president. Australia is also split into federal, state, and local, while Indonesia has national, provincial, and district.

Compare and Contrast Australia and Indonesia’s Separation of Powers

Australia and Indonesia both have a system of separation of powers, in which the power to make, administer, and interpret the law. The power to make is given to parliaments, the power to administer is given to the head of state, and the power to interpret is given to the courts and judges.

They differ though, in that Australia and Indonesia have different levels of parliaments (federal, state, local vs. national, provincial, district), and the president in Indonesia is the executive branch instead of the PM.

Compare and Contrast Indonesia and Australia’s Parliaments

Australian and Indonesian parliaments both are made up of two houses, in which one house creates the laws.

They differ in that Australia’s parliament is bicameral as it has a lower and upper house, a House of Reps and the Senate. Laws must be drafted in the House of Reps, and then must be passed through both houses. Indonesia’s parliament is split between the People’s Representative Council (560 seats) and the Regional Representatives Council (132 seats), and is not bicameral as there is no lower or upper house. The PRC has full power to draft and create laws, and the RRC can only give advice.

Compare and Contrast Australia and Indonesia’s Elections and Voting

Australian and Indonesian elections are similar as they have different elections for candidates trying for different levels of government. They also have different parties trying to fill the houses of parliament.

Australia has state and federal elections on different days once every roughly 3 years, while Indonesia has state and federal elections on the same day every 5 years. As well as this, Australia has two main political parties, while Indonesia has a large mix of big and small political parties, with the PRC changing with each election

Coastal Management

The measures and strategies used by professionals in order to try and control the impact of natural processes and human activities. Is greatly important as it helps mitigate the consequences of human activity, like global warming and erosion

Climate Change Impacts on Coastal Regions

Temperatures Increase

Higher levels of Carbon Dioxide

Changing rainfall patterns

Impact of Temperature Increases on Coastal Regions

Rising of Sea Levels

Saltwater invades into freshwater ecosystems

Increased erosion

Increase of sea surface temperature

More algal blooms

Coral reef bleaching

Marine life dying

Natural Disasters more intense

Melting of Ice caps and Permafrost, exposing coastlines in polar region

Impact of Increasing Levels of CO2

Oceans become more acidic

More marine life dies

Coral bleaching

Impact of Changing Rainfall Patterns

Sediment supply for different ecosystems change

Increased erosion

Changing of environments

Population Growth Impacts on Australian Coasts

Marine Engineering structures harden the coast and change natural processes (erosion, etc.)

Changing the natural flow of water through dams, dredging, etc. alters freshwater levels and sediment, and affects ecosystems and landforms

Sewage and run off of pollutants causes pollution in the ocean

Overfishing in areas with rapid growth

Ports become entry points of invasive species

People can destroy natural environments, through litter, trampling, animal abuse, etc.

Hard Engineering

A form of engineering in coastal management that involves building structures in order to protect coastlines from erosion or waves, making it a more obvious form of management. These are also quite expensive, and often have detrimental impacts on the environment.

Have many examples, such as groynes, gabions, rock armour, offshore breakwater, etc.

Soft Engineering

A form of engineering in coastal management that involves utilising the natural processes of the coast to protect it. It also tends to be more sustainable to the environment and cheaper, though takes longer to get results.

The two main types are sand nourishment and managed retreat

Other Issues that Impact Coasts

Loss of coastal biodiversity - where human activities have starting driving mass extinction, causing key damage on mangroves, seagrass beds, salt marshes, and coral reefs

Marine pollution - where pollutants, including fertilisers, plastic, sewage, etc., and can cause dead zones (areas in the ocean of too little oxygen to support life)

Examples of Coastal Management Engineering

Rock armour

Sea walls

Gabions

Offshore breakwater

Groyne

Beach Nourishment

Managed Retreat

Rock armour

Boulders placed on a beach that absorb the energy of waves.

Good as they’re long lasting and prevent erosion, bad as they can trap litter and limit beaches

Sea Walls

Walls built parallel to shore to absorb wave energy.

Good as they prevent erosion effectively and can double as other infrastructure (walkways, etc.), bad as they can be hazardous for floods and damage ecosystems

Gabions

Cheaper sea walls made from rocks placed in a metal frame.

Good as they’re very cheap and easy to construct, though bad as they can only go on sandy coasts, high maintenance, and dangerous if broken

Offshore Breakwater

Structure built offshore parallel to coast designed to break waves early, before they hit land.

Good as they can make safer waters for boats and prevent erosion, bad as they can be high maintenance, don’t work well with tall waves, and can have impacts on environment

Groyne

Structure built perpendicular to shore that traps sediment.

Good as they expand beaches and are effective at minimising erosion, though bad as they can be very expensive to build and maintain

Beach Nourishment

A process of soft engineering in which sand is placed onto or near a beach, allowing the beach to replenish it’s sand.

Good as it is cost-effective and lowers risks of floods, though bad as they can be costly overtime, disturb the ecosystem, and be harmful if sand is extracted from bad places

Managed Retreat

A process of soft engineering in which human settlements and hard engineering structures are moved further inland, allowing natural coastal activities to occur without interference.

Good as they can lead to the creation of waterbodies that create a natural defense against erosion, though bad as they require the consent of people who have to move, possibly driving up costs in negotiation