Moral Hazard

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

ex post moral hazard

increase in medical care consumption when covered by insurance

ex ante moral hazard

people engaging in riskier behaviors (skipping exercise/smoking more) because they are insured

does moral hazard cause welfare loss

Yes. The induced demand created by health insurance coverage generates a welfare loss.

Example of welfare loss

If medical test cost $100 (marginal cost) but you only value it at $30 (marginal value), without insurance you wouldn’t buy it

With insurance paying 80%, you only pay $20, so you do buy it

The loss: the system spent $100 to give you something you only value at $30

The $70 gap is “welfare loss” money spent that wasn’t really worth in terms of value generated

why does moral hazard cause welfare loss

Under insurance, people utilize care where the marginal value is less than its marginal cost

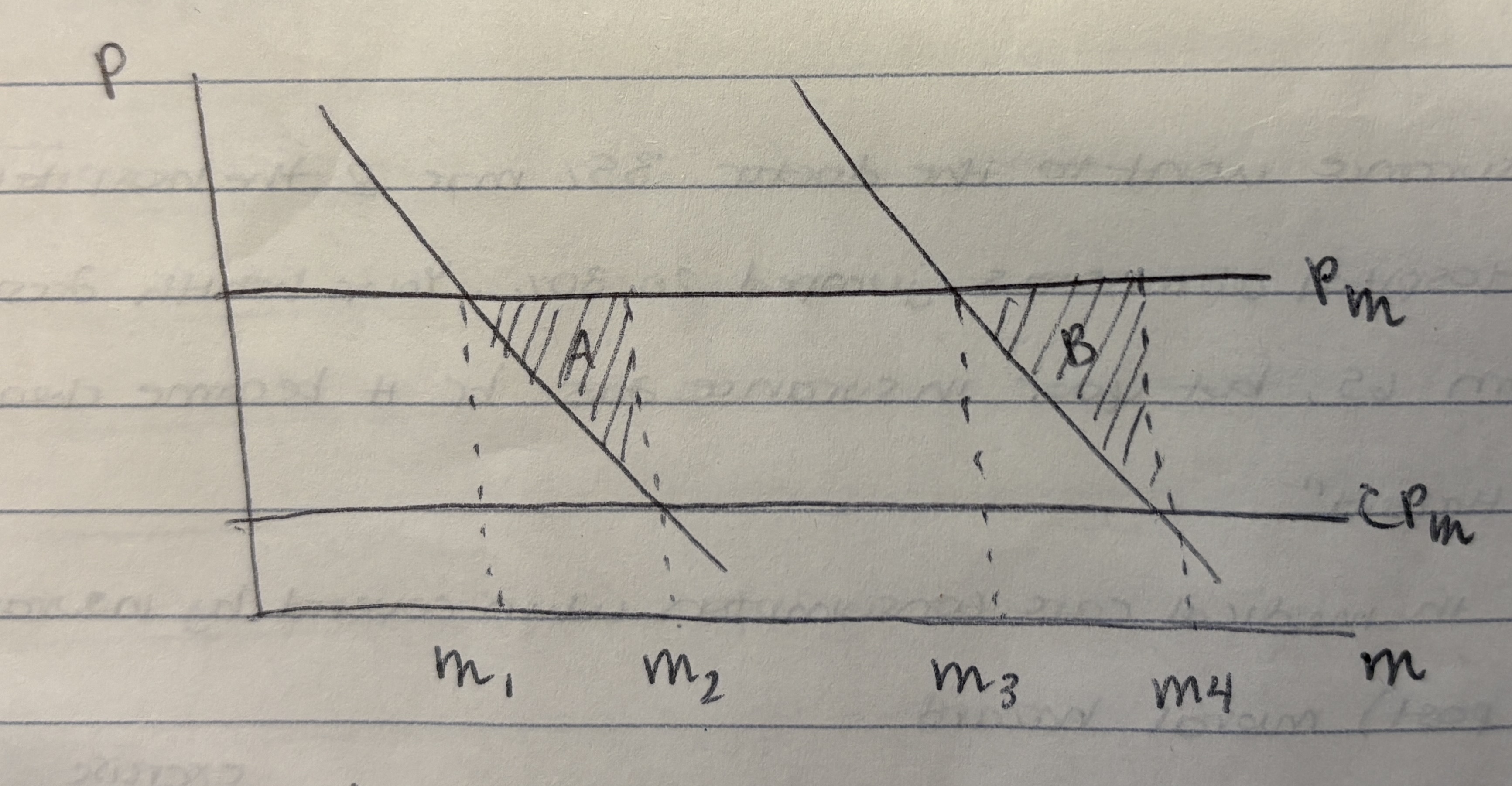

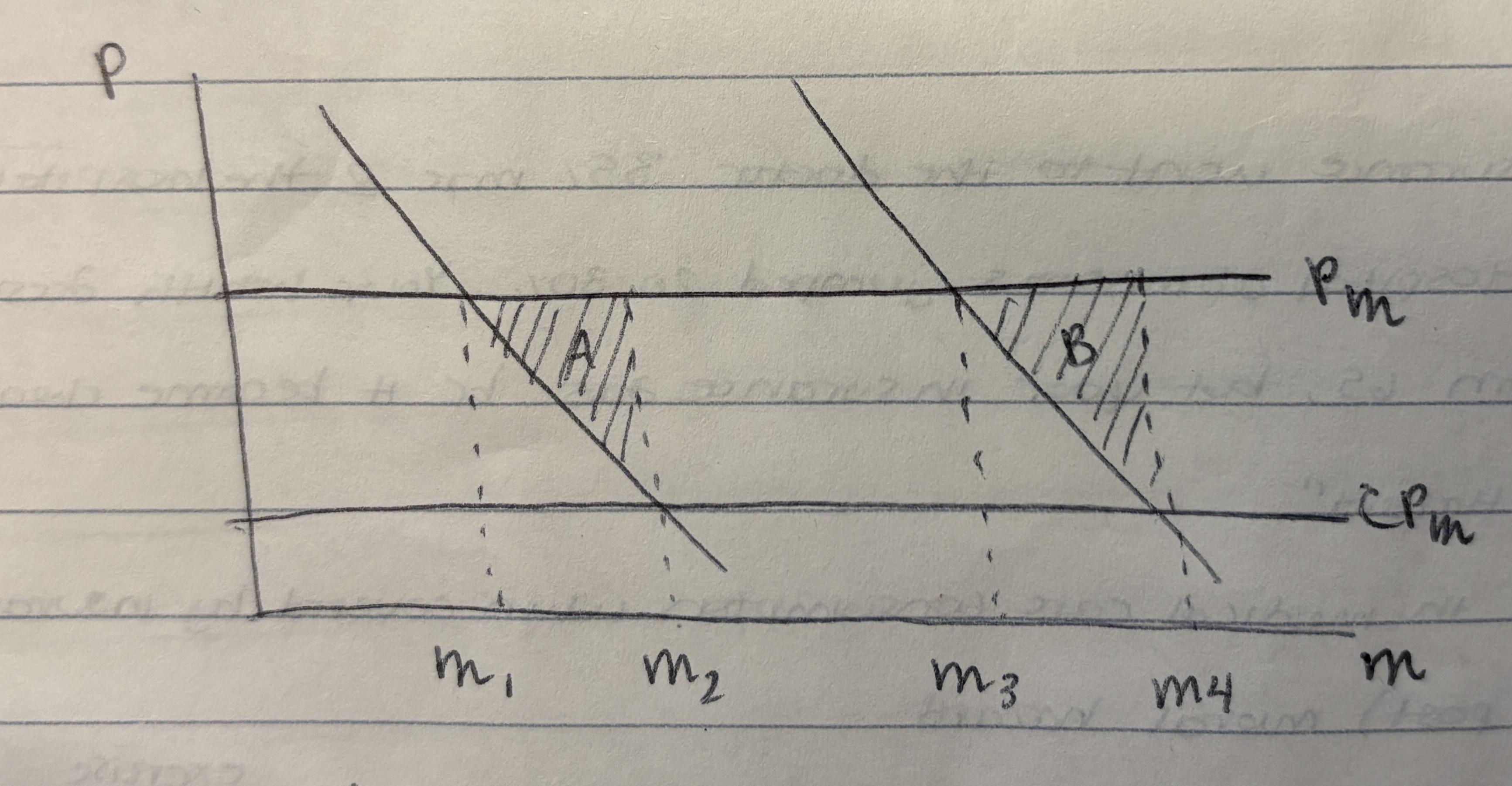

welfare loss as a triangle A or B

the value of consumption between the insured amount and uninsured amount is smaller than the actual cost of that care

Suppose only two illnesses can occur with different probabilities, f1 for mild illness and f2 for severe illness; probability of not getting sick is 1 - f1 - f2; assume consumer chose an insurance policy with C = 0.2; if illness 1 occurs the demand curve is D1 and it is D2 for illness 2. What is the welfare loss for illness 1?

the insurance plan induces the consumer to buy m2, but an uninsured consumer would buy m1

the welfare loss generated by induced demand is triangle A

welfare loss occurs bc medical care consumption between m1 and m2 creates marginal value (downward demand curve) smaller than its actual cost (price)

what is the welfare loss for illness 2?

if illness 2 occurs demand is m4 and the welfare loss is shown as triangle B

How does the optimal choice of insurance coverage (the optimal coinsurance rate, C*) balance the welfare loss from moral hazard and the welfare gain from insuring against financial risk?

the optimal coinsurance rate C* is the one that balances the welfare loss from moral hazard (A or B) with the welfare gain from insuring against financial risk associated with illness

the goal is to maximize social welfare

what are the two mechanisms balanced to maximize social welfare

When C is high (high effective price), the welfare loss from moral hazard is small, but the welfare gain from insuring against financial risk is also small

When C is low (low effective price), the welfare loss from moral hazard is large (large areas A and B), but the welfare gain from insuring against financial risk is high

why do we “hate” the triangle

the size of the triangle depends on your coinsurance

the heigh of the triangle is the difference between the true cost and what you paid

we want to make the triangle small (because it’s a waste) by making you pay more (high coinsurance)

why do we hate risk

We want to protect you from bankruptcy by making you pay less (low coinsurance)

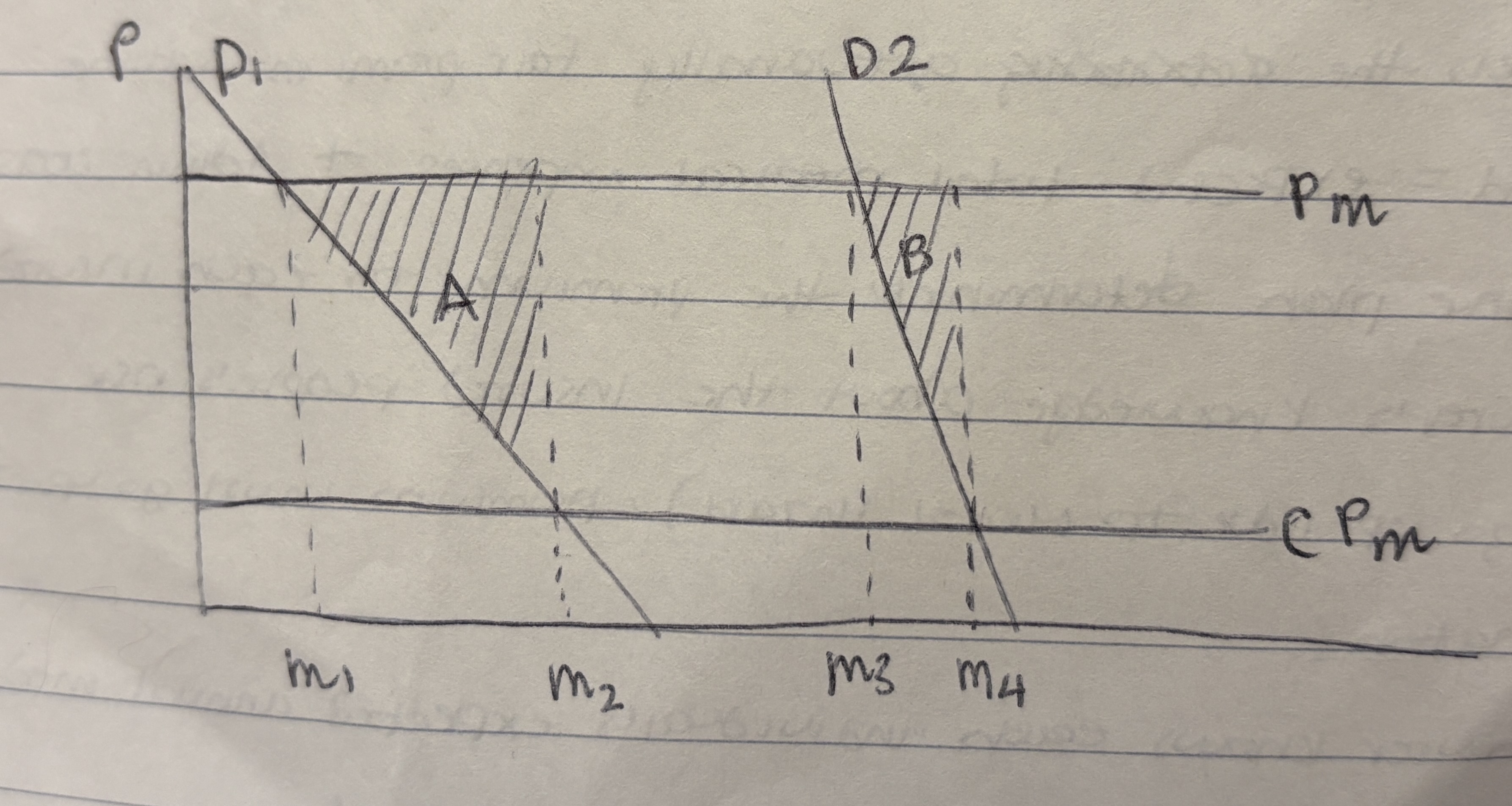

How does the welfare loss due to moral hazard vary with the elasticity of demand for medical care?

If demand is more price-inelastic (steeper demand curve), the moral hazard loss is smaller.

If demand is more price-elastic (flatter demand curve), the moral hazard loss is large

What happens to the demand curve if it is more price-inelastic

demand curve is D2 and is less price responsive

as a result, acquiring an insurance policy with coinsurance rate C only increases medical care consumption from m3 to m4

What happens to the demand curve if it is more price-elastic

demand curve is D1 and is more price responsive

acquiring an insurance policy with coinsurance rate C increases medical care consumption by a larger margin (from m1 to m2)

choice of optimal coinsurance rate C* also depends on price elasticity of demand

How does the optimal choice of insurance coverage depend on the elasticity of demand for medical care?

for inelastic demand, more complete insurance coverage (C close to 0) can be optimal since the resulting moral hazard loss is relatively small

for elastic demand, less complete insurance coverage (C close to 1) is preferred to reduce moral hazard loss that is relatively large