International Finance - Foreign exchange risk and currency derivatives

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

what is a call option

is a financial contract that gives the buyer the right, but not the obligation, to purchase an underlying asset (like a stock, bond, or commodity) at a predetermined price (the strike price) by a specific date (the expiration date).

The call will be exercised as soon as ST ≥ Strike

what is a put option

is a derivative contract that grants the holder the right, but not the obligation, to sell an underlying asset (like a stock) at a specified price (the strike price) by a certain date (the expiration date).

The put will be exercised as soon as ST ≤ Strike

what is the strike price

the exchange rate at which the foreign currency can be purchased (call) or sold (put)

what is the premium

the cost, price, or value of the option itself

what is the underlying

actual spot exchange rate in the market

what is the specificity of an American option

gives the buyer the right to exercise the option at any time between the date of writing and the expiration or maturity date.

what is the specificity of an European option

option can be exercised only on its expiration date, not before.

what does it mean at-the-money (ATM).

An option whose exercise price is the same as the spot price of the underlying currency

what does it mean in-the-money (ITM).

An option that would be profitable, excluding the cost of the premium, if exercised immediately

what does it mean out-of-the money (OTM).

An option that would not be profitable, excluding the cost of the premium, if exercised immediately

hedging : If you receive foreign currency

hedge for the risk of an appreciation (depreciation) of the domestic (foreign) currency

hedging : If you pay foreign currency

hedge for the risk of a depreciation (appreciation) of the domestic (foreign) currency

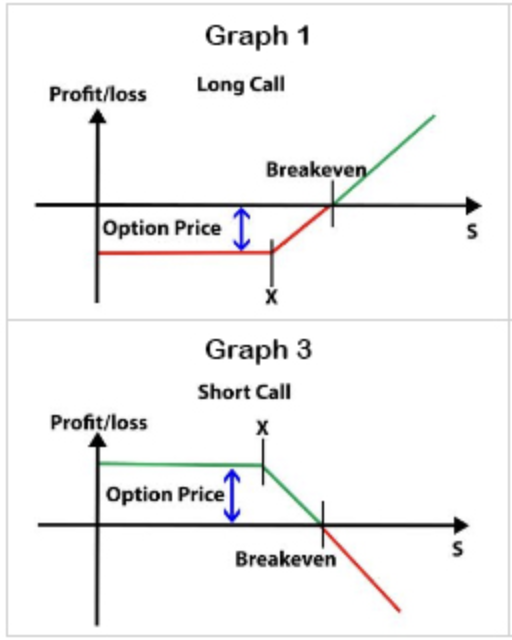

long / short call graphs

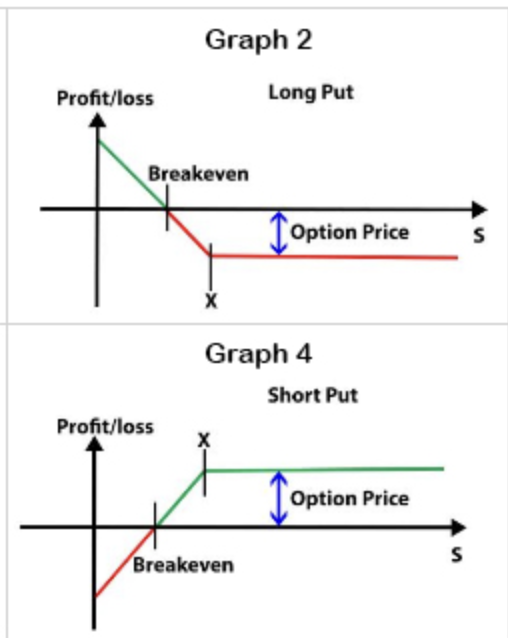

long / short put graphs

If future forex rate > K

the holder will not exercise the put, so you will have to buy in spot market and that is more expensive, although you still get the revenue from selling the put option

If future forex rate < K

the holder will exercise the put and you will be forced to buy at K. As long as the strike price is not too high relative to the spot rate, your revenue from selling the option should cover the additional cost

Increasing the exercise price of a call option →

Reduces the probability that the option will be exercised so it decreases the option’s value

Increasing the exercise price of a put option →

Increases the probability that the option will be exercised so it increases the option’s value

what are currency swap

is an agreement between two parties to exchange the cash flows of two long-term obligations denominated in different currencies.

change the currency denomination of debt, by exchanging streams of interest payments in different currencies for an agreed period of time.

what are interest rate swaps

allows a company to change the nature of its debts from a fixed interest rate to a floating interest rate.