Managerial Final Exam Tips

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

33 Terms

Special or Custom Order

Selling Price-Variable Costs=Contribution Margin

If CM p/u is positive, accept the order. If CM p/u is negative, decline the order.

Keeping or Dropping a Product Line

Selling Price-Variable Costs=Contribution Margin

If CM p/u is positive, keep the product line. If CM p/u is negative, drop the product line.

Product Mix Decisions

Calculate CM per hour. Focus on product line that has higher CM p/h. Use remaining hours on the other product lines.

Making or Buying a Product

Make: (VC x units)+FC

Buy: (Outsource Cost x units)+FC

Choose the option with the lowest answer.

Sell or Process Further

Keep at Split-Off or Process Further=New Revenue-New Costs. Choose the highest yielding products and subtract joint costs from the total of those choices.

Regular Pricing Decisions

Use the Sales-COGS=GP formula. Sales will always equal 100% so use algebra to solve for whatever the problem is asking for.

Annuity

"next X years"

"yearly payments"

"per year"

"a year"

Single Sum

"one-time cost"

"invest a certain amount today"

"fixed amount today"

selling an asset since you only sell the item one time

Semi-Annual

Multiply payments times 2 and divide interest by 2

Sales Budget

Unit Sales

x Selling Price

=Total Sales

Cash Receipts or Collections Budget

Total Sales

x % Cash Collections

x % Credit Collections

Total Credit Sales

X% this month

+X% previous month

=Total Credit Receipts

+Cash Collections from Above

=Total Cash Collections

Production or Purchases Budget

Expected Unit Sales

+Desired Ending Units

-Beginning Inventory

=Total Required Units

x Cost per Unit

=Total Production Cost

Cash Disbursements Budget

Total Production Cost

X% this month

+X% previous month

=Total Cash Payments for Purchases

Cost Center

Manager only responsible for managing their departments costs (expenses).

Ex. Accounting, H/R, Legal

Revenue Center

Manager focused on increasing department revenue and managing their expenses.

Ex. Salesperson

Profit Center

Manager responsible for revenue and expenses within their center.

Ex. Store manager, restaurant manager

Investment Center

Manager accountable for investments, revenues, and costs

Ex. Finance

Static or Master Budget

Budget based on the level of output (units) planned at the start of the budget period

Flexible Budget

A budget prepared for various levels of sales volume. Variable costs change in proportion to sales volume but fixed costs stay the same.

Sales Volume Variance

=Flexible Budget - Static Budget

Variance due to difference in actual units sold vs budgeted.

Flexible Budget Variance

=Flexible Budget - Actual Results

Variance due to company earning more or less than expected for the ACTUAL level of output.

Both Variances Together

=Static Budget Variance

Return on Investment (ROI)

Calculates how much income is generated in proportion to its assets.

=Operating Income/Total Assets

Residual Income (RI)

= Income - (Target Rate of Return x Total Assets)

Positive # means managements expectation were exceeded.

Negative # means target rate of return was not met.

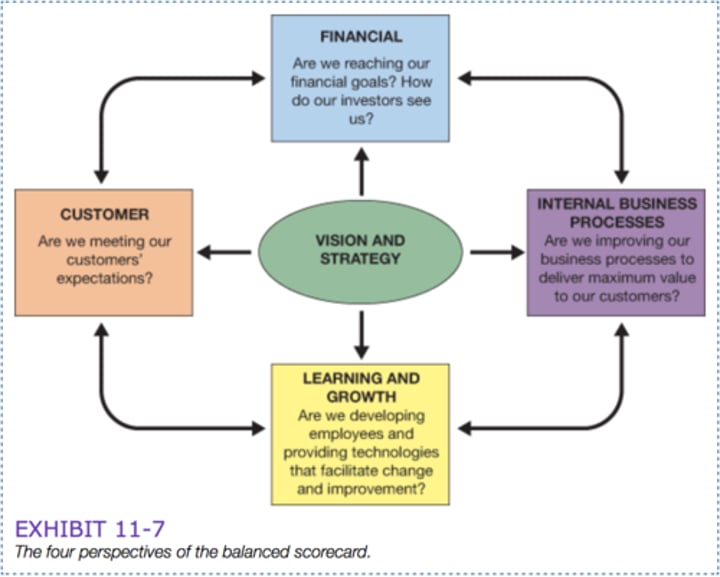

Balanced Scorecard

4 aspects:

Employee Learning and Growth

Operational Efficiency/ Internal Business

Customer Satisfaction

Financial Profitability

Direct Materials Price Variance

(actual price - standard price) x purchased quantity

Direct Materials Quantity Variance

(actual quantity - standard quantity) x standard price

Direct Labor Rate Variance

(actual rate - standard rate) x actual hours

Direct Labor Efficiency Variance

(actual hours - standard hours) x standard rate

Variable Overhead Efficiency Variance

(actual hours - standard hours) x standard rate

Variable Overhead Rate Variance

(actual rate - standard rate) x actual hours

Fixed Overhead Budget

Actual $ - Budgeted $

Fixed Overhead Volume Variance

budgeted fixed overhead - applied fixed overhead (based on predetermined OH rate)