AP Micro unit 3

1/114

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

115 Terms

production function

the relationship between the available amount of inputs producing a quantity of outputs

short run

[changes over a short term of time] At least one input is fixed

Long run

[changes over a long term of time]

All inputs are variable [can change]

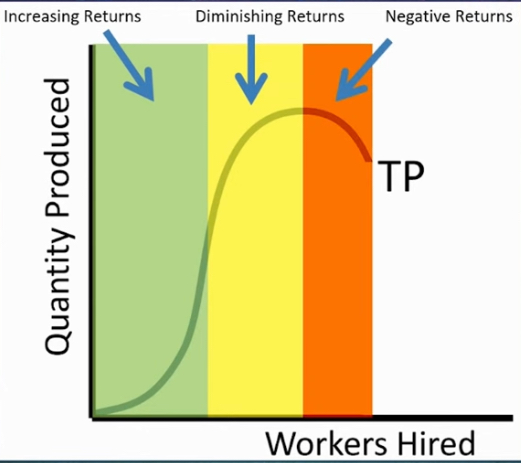

Total Production

amount of output as there are more inputs [workers hired]

![<p>amount of output as there are more inputs [workers hired]</p>](https://knowt-user-attachments.s3.amazonaws.com/b827fc53-1004-42c7-9187-8b947e3929db.jpg)

Total production stages

increasing returns

diminishing returns

Negative returns

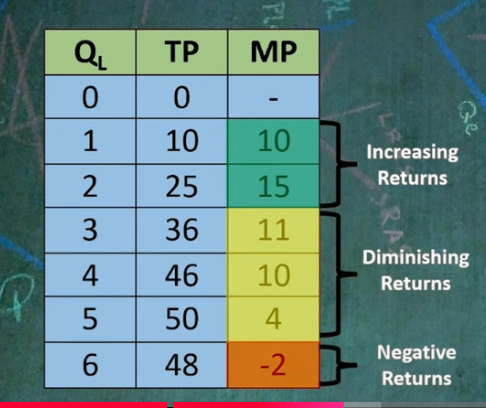

Marginal Product

formula

TP new - old / Quantity of labor

→ note that Q is usually one

Law of Diminishing Marginal returns

“ON which worker does diminishing return set in?”

pick the # of workers it takes to start to see a decrease

Law of Diminishing Marginal returns

“AFTER which worker does diminishing return set in?”

choose the # of workers it takes before the marginal product starts to decrease

Total Product Max

Amount of production reaches its maximum when MP hits the x-axis

Marginal Product

What’s the reason for MP to increase

due to specialization

→ each worker is assigned one specific task to get good at, increasing effective output

Marginal Product

What’s the reason for MP to Diminish

due to more workers spread between a fixed amount of capital

→ multiple people performing the same tasks crowds the effectiveness of the work

Marginal Product

What’s the reason for MP to reach negative returns

More workers get in the way of each other and reduce production

Average Product [AP]

Total production [TP] / Quantity of Labor

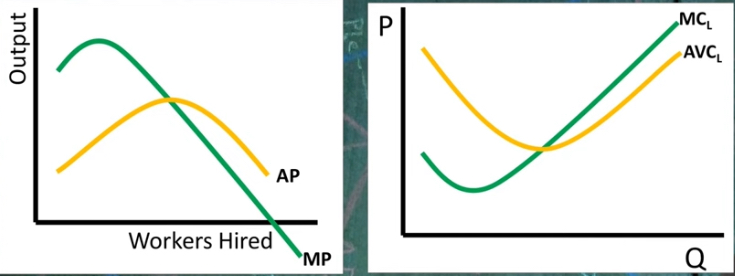

MP and AP relationships

when MP> AP = AP is rising

when MP < AP = AP is falling

AP reaches vertex = highest AP

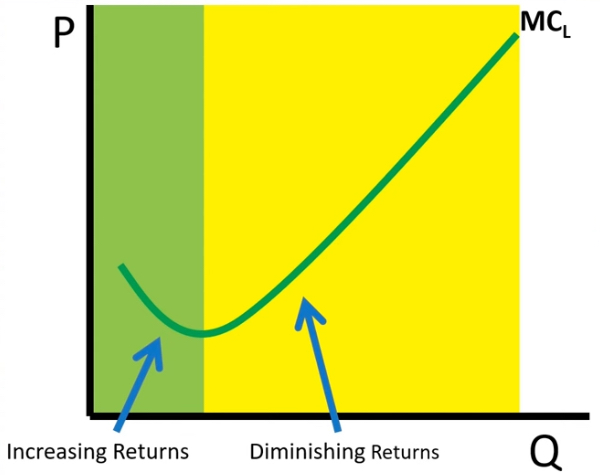

Marginal Cost of Labor [ MCL ]

Wage / MP

→ does not exist at negative return of MP

Marginal Cost of Labor

Graph

Diminishing return sets in at Minimum of function

increasing returns are found when MC decreases

Diminishing returns are found when MC increases

AVG variable cost of labor [AVCL]

# of workers x wage / TP

MCL vs AVC

look at graph

MP and AP vs MCL and AVC

→ When MP rises? When MP falls?

rise = MCL falls

falls = MCL rises

→ are just opposites of each other

MP and AP vs MCL and AVC

→ When AP rises? when AP falls?

rises = AVC falls

falls = AVC rises

→ are just opposites of each other

Fixed Cost [FC]

price doesnt change w amount of output

fixed cost example

Even if the bakery produces 0 loaves of bread, it still has to pay $2,000 for rent and equipment.

If it produces 1,000 loaves, the rent is still $2,000.

Variable Cost [VC]

price changes with amount of output

variable cost example

Each worker is paid $15 per hour.

If the bakery produces 0 cookies, it hires no workers, so labor cost = $0.

If it produces 1,000 cookies, it might need 5 workers for 8 hours each, costing $600.

FC and VC Graph

also known as TFC and TVC

Total cost [TC]

Fixed cost + Variable Cost

TC graph

is the same as TVC but shifted upwards

shifts upward as much as TFC shifts upward

Marginal Cost

change in TC over change in Quantity

VC from MC

VC is the sum of each units MC

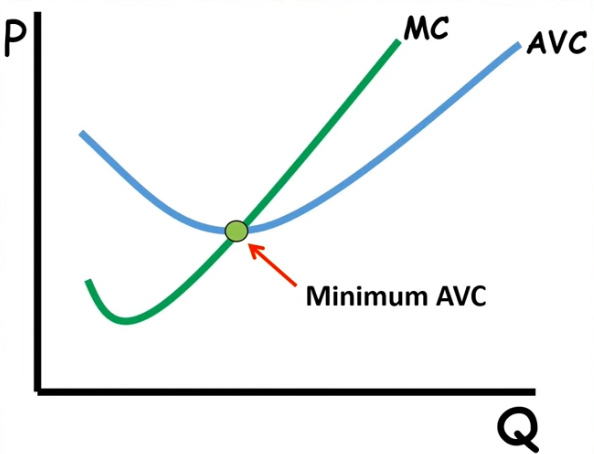

Average Variable cost [AVC]

VC/Quantity

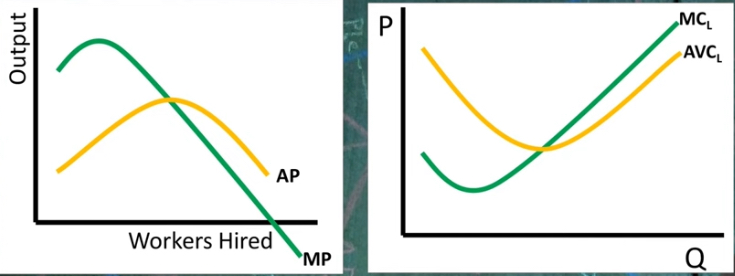

MC and AVC

Graph

AVC will intersect MC at its minimum

AVC drags down when MC drags down

AVC drags up as MC drags up

Average Total Cost [ATC]

TC/Q

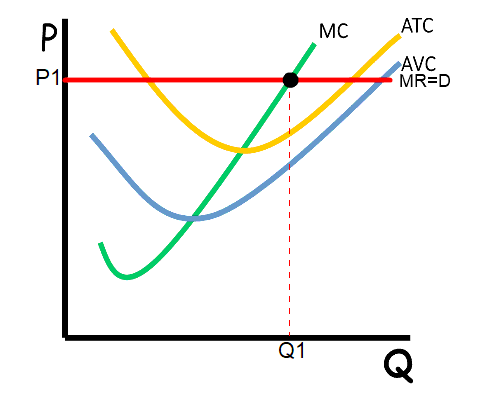

ATC and MC

Graph

ATC’s minimum intersects MC

when mc is below ATC → ATC falls

when mc is above ATC→ ATC rises

Productive efficient Q is found at ATC’s minimum [producing at the lowest AVC]

MC = ATC at minimum

![<ol><li><p>ATC’s minimum intersects MC</p></li><li><p>when mc is below ATC → ATC falls</p></li><li><p>when mc is above ATC→ ATC rises</p></li><li><p>Productive efficient Q is found at ATC’s minimum [producing at the lowest AVC]</p></li><li><p>MC = ATC at minimum</p></li></ol><p></p>](https://knowt-user-attachments.s3.amazonaws.com/62a28cd7-1f7b-4bcd-a6e4-4c20fd11caba.jpg)

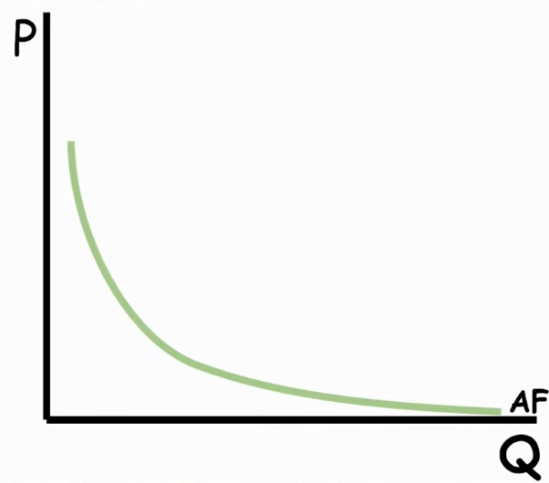

Average fixed cost [AFC]

TFC [total fixed cost]/ Q

AFC GRAPH

FC decreases as Q increases

has an asymptote

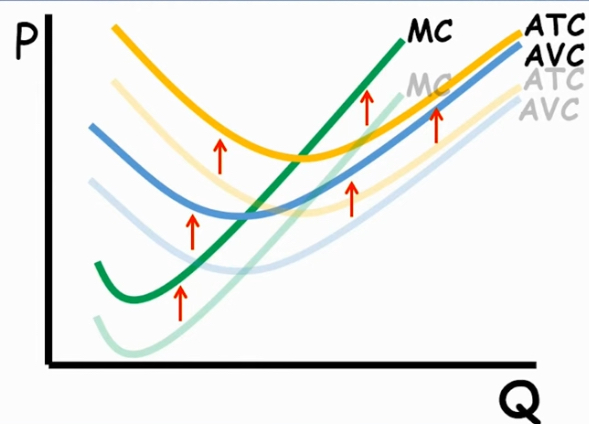

ATC, MC and AVC Graph

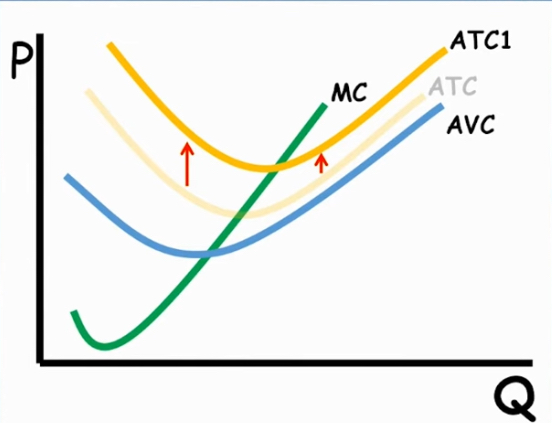

A change in the fixed cost

shifts ONLY the ATC upwards

the average fixed cost is the gap between AVC and ATC

ATC, MC and AVC Graph

Change in Variable cost

all functions shift upwards

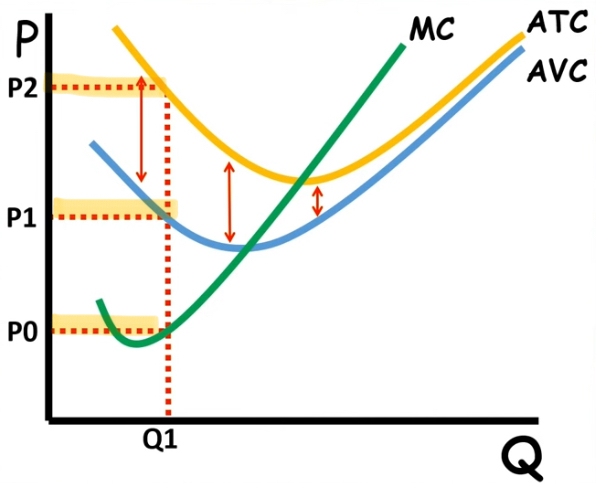

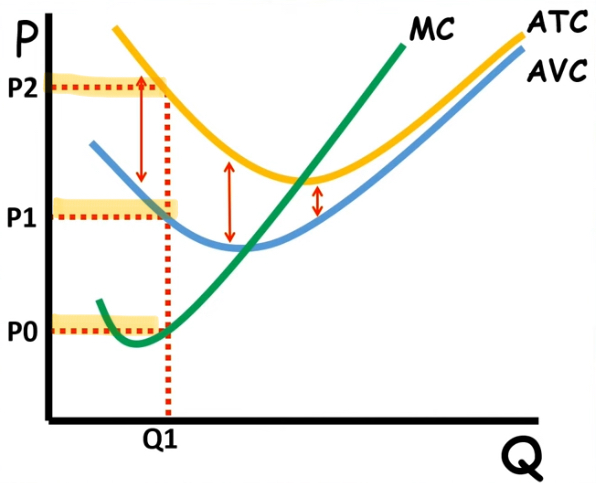

ATC, MC and AVC Graph

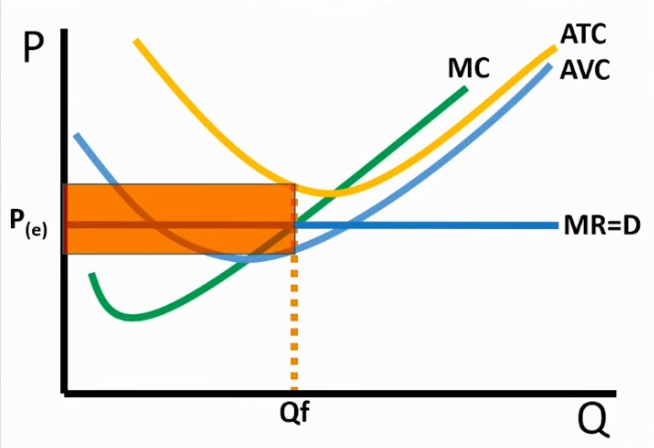

Finding TC via graph

Find production price of either ATC, AVC by finding its y axis point

Multiply it by the quantity [x-axis point]

itll be a rectangle

![<ol><li><p>Find production price of either ATC, AVC by finding its y axis point </p></li><li><p>Multiply it by the quantity [x-axis point]</p></li><li><p>itll be a rectangle</p></li></ol><p></p>](https://knowt-user-attachments.s3.amazonaws.com/28841c14-22ce-4422-96d9-0c924cf552d4.jpg)

ATC, MC and AVC Graph

Finding the cost of production

from the function head down to the quantity and across to the price

ATC, MC and AVC Graph

finding the average fixed cost

by finding the price of production for ATC and AVC

you subtract the two production costs to find the gap between = AFC

ATC, MC and AVC Graph

finding the TOTAL fixed cost

finding the higher production [p2] multiplying it by Q

then subtract the area of p1 times Q

![<ol><li><p>finding the higher production [p2] multiplying it by Q</p></li><li><p>then subtract<strong> the area </strong>of p1 times Q</p></li></ol><p></p>](https://knowt-user-attachments.s3.amazonaws.com/e43aeec3-d0f4-4ea2-b1d9-06f37cfcd90c.jpg)

Why do ATC and AVC get closer?

bc AFC is always decreasing

why is ATC U-shaped?

as AFC falls it drags down ATC with, but will begin to increase again bc of the rising AVC due to diminishing returns

→ rising AVC outweighs the dragging AFC

When a question is reffering to input/output

its just talking about Quantity itself

AFC, ATC, AVC and MC relation

Graph

what creates Long run ATC

different capacities of production

ATC long run curve

consists of all the minimum short run firms’ ATC’s of different capacities

ATC long run curve

phases

Economies of scale

Constant return of scale

Diseconomies of scale

ATC long run curve

Economies of scale

cost falls as capacity increases

occurs bc of…

Bulk purchase of resources

better capital

better tech

management is efficient

ATC long run curve

Constant Returns to Scale

cost stays the same as capacity increases

operating at an efficient scale

ATC long run curve

minimum efficient scale

is the lowest quantity that minimizes average cost

increasing output has no effect

→ found at constant returns to scale

ATC long run curve

diseconomies of scale

cost rises as capacity increases

occurs when..

communication is having a breakdown

bureaucracy inefficiency [too large for management to continue efficiency]

Returns to scale

comparing change in all inputs vs. change in outputs

Returns to scale

increasing [economies]

if you double all inputs [labor/capital] =

more than double in output

→found in economies of scale

Returns to scale

constant returns

double all inputs =

exactly double the outputs

→ found in constant returns to scale

Returns to scale

decreasing

double all inputs =

less than double the output

→ found in upwards slope [diseconomies scale]

Minimum efficient scale [MES] vs. market size

mes is small compared to market size

many small firms can operate with perfect competition

Minimum efficient scale [MES] vs. market size

mes is large compared to market

only a few large firms can operate efficiently

Explicit cost

the regular cost of materials or ingredients needed to produce a product

→ fixed + variable cost = explicit

Implicit cost

[Opportunity cost]

The loss of money/time to make other amounts of money → left old job that paid 2k to start a buisiness

Accounting profit

regular profit

total revenue - explicit cost = profit

Economic Profit

total revenue - [implicit + explicit cost] = profit

accounting profit - opportunity cost

Normal profit "breaking even”

economic profit is 0

accounting profit is equal to implicit cost

no entry or exit of market

accounting profit doesnt include

opportunity costs

Why is economic profit important

Accounting profit may look good, but a firm could still be underperforming economically if opportunity costs are high.

Economic profit provides a more accurate picture of whether a firm should continue operating or consider alternative uses of its resources.

In the long run, competitive markets force firms toward normal profit (economic profit = 0).

economic profit >0

positive

earning more than o.p.c

attracts new firms to enter the market

economic profit < 0

cant cover cost of o.p.c

firm might exit market in the long run

finding marginal product in a table

do not take the output as the amount of MP, rather find the change in output

Profit maximization

TR vs TC

TR > TC = economic profit

TR < TC = economic loss

TR = TR = breaking even [normal profit]

for a firm its not MB

its MR → revenue for producing one product

Marginal revenue

change in TR/ change in Q

when is profit maximization found

MR = MC

MR and MC graph

point of intersection is profit max

MR and MC graph

relations

MR > MC → production increases

MR < MC → production decreases

Profit maximization

when should a firm continue to produce

as long as MR > MC but stop production at MR < MC

MR and MC table FRQ

bc 7$ MR > 6$ MC, but at 5 units 5$ MR < 6$ MC

“revenue from producing one more unit”

referring to MR

MR = MC

graph

the line equals MC = MR = D = P = AR

Notes:-

avc

fixed cost

remember cost and what an item is being sold for are two different things

still has to be paid when facing economic loss

Shut down vs. exit the market

→ temporarily closed in the short run [less hrs ina day]

→ permanently closed

A firm operates when

if not = shutdown

Loss < fixed costs

TR > VC

P > AVC

AR > AVC

If a firm shuts down

Loss = fixed cost

If a firm operates

formula

Loss = TR - (VC + FC)

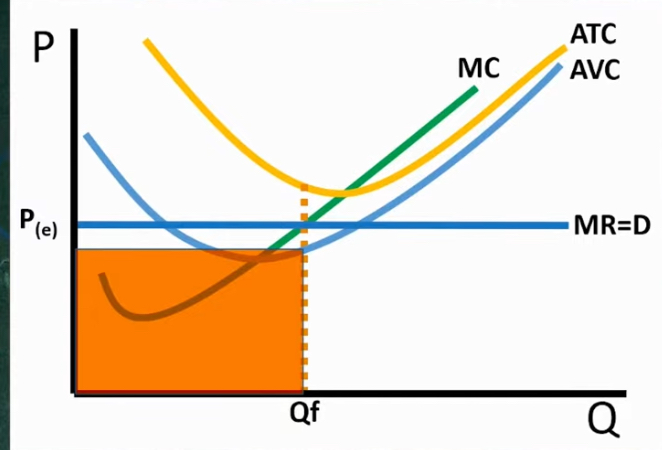

Finding Economic loss

Graph

From the space between ATC and price

Finding the FC

Graph

The rectangle below the price

→ starts from AVC at Qf till price

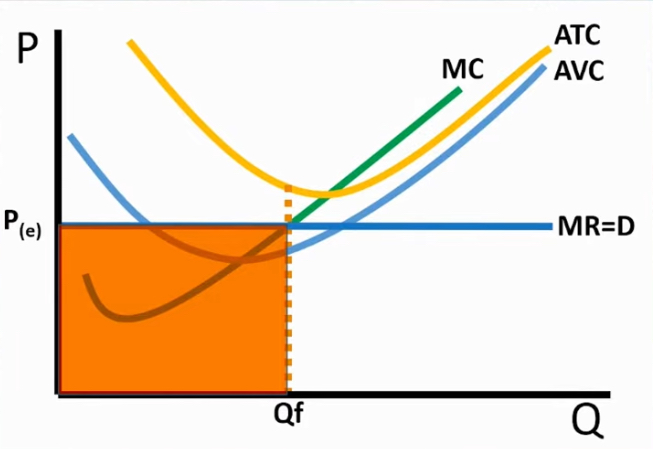

P > ATC

Short run firm

Loss is less than fixed cost

TVC

Graph

From AVC at Qf and make a square out of it

(Note that it doesn’t line up with price)

Total rev

Graph

Square from price and Q max

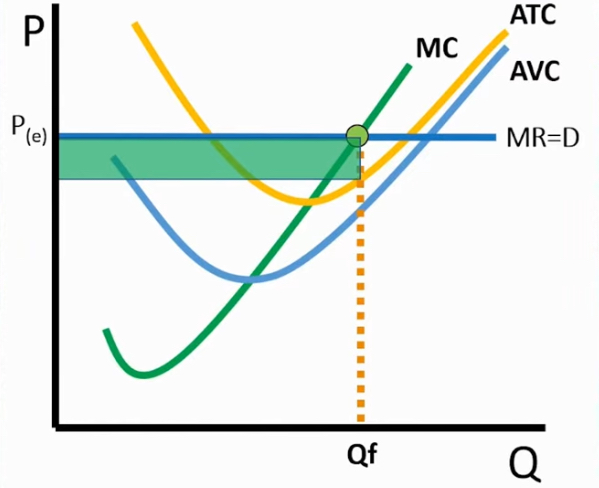

If Price over ATC at the profit-maximizing

Earning a profit with no loss for the firm

→ found by (Price - ATC) x Qf

ATC meets MC and P

A firm breaks even

→ if they choose to shut down = loss is found between AVC and ATC till price

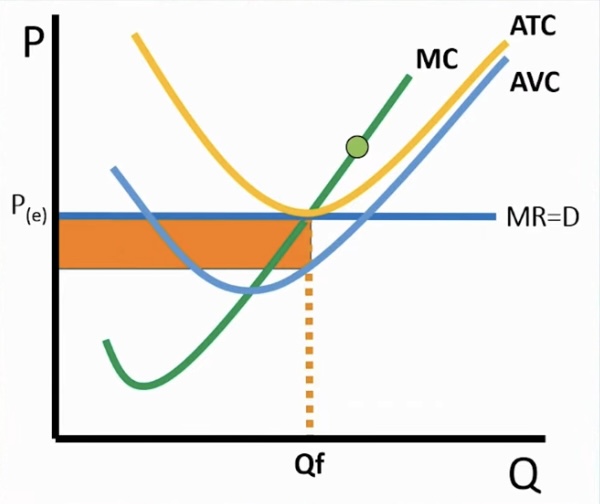

Price is under than ATC for a firm but above AVC

Graph

The firm is undergoing economic loss

Economic loss is found between price and ATC

but shutdown is bigger and between ATC and AVC [fixed cost]

economic loss < fixed cost

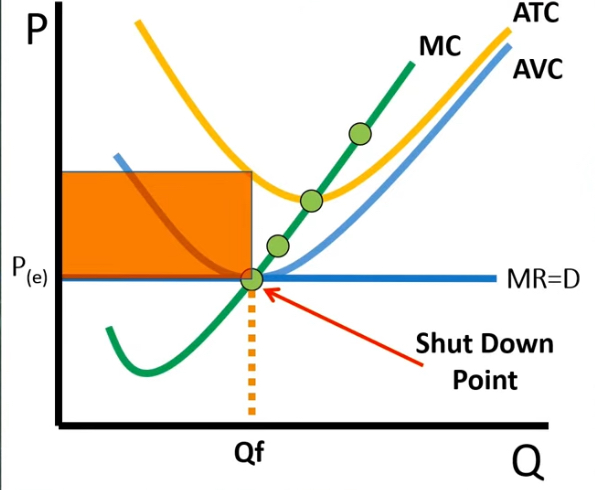

Price meets AVC in a firm

Shut down point is met

→ shutting down is cheaper than not

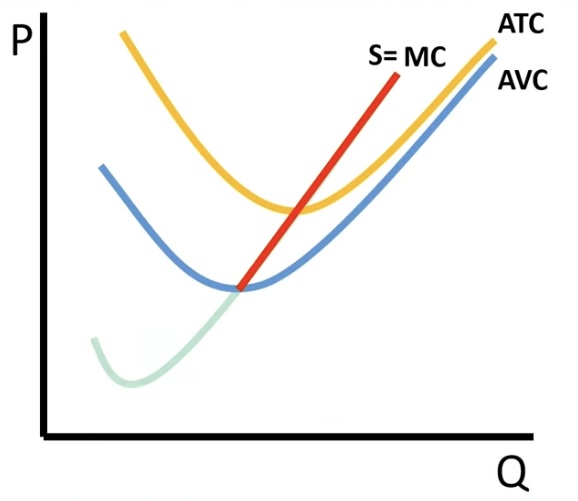

Firms supply curve

MC curve above minimum of the minimum of the AVC curve

Long run Decisions for firms

Short run PROFITS AND barriers to entry are low

Firm will enter the market → Market supply shifts to the right, Price falls → until zero economic profit

Long run Decisions for firms

Short run LOSSES AND barriers to entry are low

Firms exit the market → Market supply shifts left, Price rises → until zero economic profit

A firm exiting the market as it experiences short run losses in low barrier entry

Permanently shuts down

In the long run

Costs

Are all variable, fixed and variable are all adjustable due to time

Perfect competition

Many buyers and sellers

identical products,

3. a lot of competition,

no barriers to entry

price takers

Perfect competition

long run low barriers

a firm will always experience zero economic profit

Profit maximization

where price meets MC = MR to determine Qf