ACC 111

0.0(0)

Card Sorting

1/172

There's no tags or description

Looks like no tags are added yet.

Last updated 3:12 AM on 9/14/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

173 Terms

1

New cards

2

New cards

Finance

the system that includes:

* the circulation of money

* the granting of credit

* the making of investments, and

* the provision of banking facilities

\

3

New cards

Finance

management of money

4

New cards

Financial Management

also known as **Corporate Finance**

5

New cards

Financial Management

3 Functions:

* Investing

* Financing

* Dividend Policy Making

* Investing

* Financing

* Dividend Policy Making

6

New cards

Financial Management

focuses on decisions relating to how much and what types of assets, how to raise the capital needed to purchase assets, and how to run the firm so as to maximize its value.

7

New cards

Money Market

**short-term** capital market

8

New cards

Money Market

examples: treasury bills, time deposits, foreign exchange, overnight markets/borrowings

9

New cards

Treasury Bills

issued by the government **to raise money** to support the operations of the government

10

New cards

Reserve Requirement

the portion of the deposit kept by the BSP

11

New cards

Capital/Financial Market

**long-term** capital market

12

New cards

Primary Market

stocks or bonds **issued for the** __**first time**__

13

New cards

Secondary Market

stocks or bonds **sold by the** __**investors of the primary market**__

14

New cards

Investments

it concerns **decisions about stocks and bonds** and includes a number of activities.

15

New cards

Security Analysis

through the use of fundamental analysis and technical analysis in **finding the true values of the security**

16

New cards

Fundamental Analysis

looking at the **Financial Statements and the Financial Ratio**s

17

New cards

Technical Analysis

looking at the **trend or pattern** of the investment

18

New cards

Chartist

they look at the trend, pattern, and movement of the stock

19

New cards

Portfolio Theory

deals with the best structure or combination of stocks and bonds with the lowest risk;

20

New cards

Portfolio Theory

to get the best combination of the capital structure to maximize the price of the stock of the company (which maximizes profits)

21

New cards

Market Analysis

that deals with the issues of stocks and bonds are overvalued or undervalued at any given time.

22

New cards

Cost of Capital

minimum required rate of return by the company

23

New cards

overvalued stock

when the actual market price is higher than the intrinsic value. You don’t buy but you sell if you have stocks

24

New cards

undervalued stock

when the actual market price is below the intrinsic value, you buy stocks

25

New cards

Behavioral Finance

the psychology of investing is being examined as the behavior of the investors, when it comes to buying and selling, have impact on the financial instrument

26

New cards

Firm’s Goal

To maximize a stockholder's wealth is through the value of their ordinary share. We want to maximize the price of the stock of the company

27

New cards

Intrinsic Value

the true value of the stock

28

New cards

\\Market Price

prevailing price of the stock in the market

29

New cards

Market Equilibrium

intrinsic value = market price

30

New cards

Investments

the **most important function** of the finance manager in the corporation

31

New cards

Investments

it entails an outflow of resources with the expectations of a benefit in the form of cash inflows in the near future.

32

New cards

Investment Decision

the most important of the three distinct types of decisions when it comes to value creation.

33

New cards

Investments

the firm’s life support in continuing its existence.

34

New cards

Financing Decision

It considers the best possible financing mix or capital structure of the company.

35

New cards

Financing Decision

to look for resources that will give the company the lowest weighted average cost of capital (WACC)

36

New cards

Financing

the one that supports the investing activities

37

New cards

Dividends

the retained earnings distributed to stockholders.

38

New cards

Vice President - Finance

also known as the Chief Finance Officer (CFO)

39

New cards

Treasurer

the true function of the financial management

40

New cards

Controller

the true work of the accounting

41

New cards

Risk Return Trade-Off

an increase in return is coupled by a corresponding increase of risk.

42

New cards

Risk Return Trade-Off

the higher the risk the higher the return

43

New cards

Sole Proprietorship

among the three forms of business organizations, this is the easiest to organize

44

New cards

Partnership

the partners contributed something to the partnership in return for the profits to be divided among the partners

45

New cards

Limited Liability Company

It is a hybrid between a partnership and a corporation.

46

New cards

Limited Liability Company

A form of business organization with the liability-shield advantages of a corporation and the flexibility and tax pass-through advantages of a partnership.

47

New cards

General Partnership

subject to tax similar to a corporation

48

New cards

General Professional Partnership (GPP)

a type of partnership which is not subject to tax

49

New cards

Limited Liability Partnership

It is used for professional firms in the fields of accounting, law, engineering, architecture, and others.

50

New cards

Corporation

It is an artificial being created by operation of law having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence.

51

New cards

Agency Theory

it poses a potential conflict of interest between the stockholders and managers.

52

New cards

Managers

naturally inclined to act in their own best interests (which are not always the same as the interest of stockholders)

53

New cards

Stockholders

more likely to prefer riskier projects, because they receive more of the upside if the project succeeds.

54

New cards

Bondholders

receive fixed payments and are more interested in limiting risk. They are particularly concerned about the use of additional debt.

55

New cards

Creditors

does not want stockholders (corporation) to owe more debt as there are more chances that the first creditors would not be paid

56

New cards

Financial Statements

provides the financial position and financial performance of a company as of a particular period of time so that it would help the firm and the stakeholders to make decisions

57

New cards

Financial Statements Analysis

the process of analyzing the financial statements for the purpose of making business decision.

58

New cards

Financial Statements Analysis

an evaluation of the past and current performance of the firm and its perception in the future.

59

New cards

Predictive Value

based on the record you can predict what is most likely to happen in the future

60

New cards

Horizontal Analysis

used to evaluate the trend in the accounts over the years. It is usually shown in comparative financial statements.

61

New cards

Comparative Statements

Compares two comparative years and show the increases or decreases in the account balances with their corresponding percentages.

62

New cards

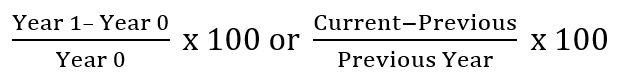

Comparative Statements

Formula:

63

New cards

Trend Ratio

A firm’s present ratio is compared with its past and expected future ratios to determine whether the company’s financial condition is improving or deteriorating over time.

64

New cards

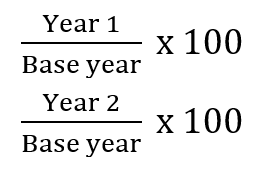

Trend Ratio

If we want to see the more essential analysis

65

New cards

Trend Ratio

Formula:

66

New cards

Base Year

the farthest year used to compare the present ratio, it is to determine the increase or decrease

67

New cards

Common Size Statement

A significant item in a financial statement is used as a base value.

68

New cards

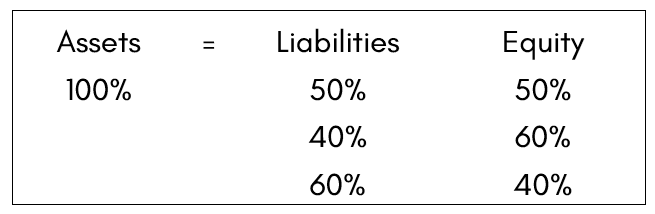

Base Values

* Statement of Financial Position

* Total Assets

* Liabilities + Equity

* Comprehensive Income Statement

* Net Sales

* Total Assets

* Liabilities + Equity

* Comprehensive Income Statement

* Net Sales

69

New cards

Financial Ratios

analysis from one statement to another statement or the same statement

70

New cards

Combination of Accounts

a kind of Financial Ratio where one account is coming from one statement and the other is coming from another. The denominator is always average.

71

New cards

Industry Comparison

financial ratios are computed and compared with the industry average.

72

New cards

Trend Analysis

the firm’s financial ratios are computed and compared with their past performance.

73

New cards

Liquidity Ratio

A financial ratio where it is the **company’s ability to meet its maturing short-term obligations**.

74

New cards

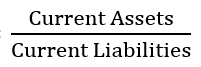

Current Ratio

A __liquidity ratio__ where it is used **to measure the ability of the firm to meet its current liabilities** as paid by its current assets.

75

New cards

Current Ratio

Formula:

76

New cards

Acid-test Ratio / Quick Ratio

A stringent test of a firm’s liquidity; test of **ability to meet current liabilities from a more liquid assets**.

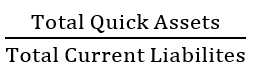

77

New cards

Acid-test Ratio / Quick Ratio

Formula:

78

New cards

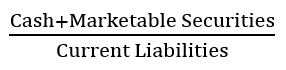

Cash Position Ratio

It determines how much **cash and marketable securities** can pay for every peso of current liabilities.

79

New cards

Cash Position Ratio

Formula:

80

New cards

Working Capital

It shows what absolute amount is **the excess or shortage of current assets** to pay-off current liabilities.

81

New cards

Working Capital

Formula: current assets – current liabilities

82

New cards

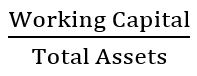

Working Capital to Total Assets

It shows how much portion of the total assets are invested in the working capital.

83

New cards

Working Capital to Total Assets

Formula:

84

New cards

Cash Flow Liquidity Ratio

This measures short-term liquidity by adding cash, marketable securities, cash flow from operating activities.

85

New cards

Cash Flow Liquidity Ratio

Formula:

86

New cards

Activity or Asset Utilization Ratio

A financial ratio where it is used to determine how quick various accounts are converted into sales or cash.

87

New cards

Operating Cycle

It measures the length of time required to convert cash to finished goods to sales to receivable and then back to cash.

88

New cards

Operating Cycle

Formula: Ave. Collection period + Ave. Age of Inventory

89

New cards

Cash Conversion Cycle

It measures the length of time required to convert cash to finished goods to sales to receivable, back to cash to payables.

90

New cards

Cash Conversion Cycle

Formula: age of receivables + age of inventory – age of payables

91

New cards

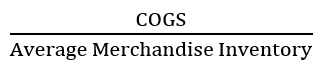

Merchandise Inventory Turnover

It determines efficiency of the firm in managing and selling inventories. Only for **merchandising** company.

92

New cards

Merchandise Inventory Turnover

Formula:

93

New cards

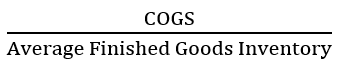

Finished Goods Inventory

It determines efficiency of the firm in managing and selling inventories. Only for **manufacturing** company.

94

New cards

Finished Goods Inventory

Formula:

95

New cards

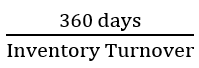

Average Age of Inventory

It determines the average number of days to **sell or consume the average inventory**.

96

New cards

Average Age of Inventory

Formula:

97

New cards

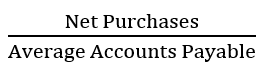

Accounts Payable Turnover

It measures the efficiency of the company in **meeting trade payable.**

98

New cards

Accounts Payable Turnover

Formula:

99

New cards

Average Age of Payable

Formula:

100

New cards

Working Capital Turnover

It determines the **adequacy & activity of working capital**.