IMC Unit 2: Macro Economics

1/57

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

58 Terms

What are the Key Economics Indicators in the US

Average weekly hours of production workers

Initial claims for unemployment insurance

New orders in manufacturing

New private housing permits

Yield curve slope shifts

Money supply

Consumer sentiment

Personal income

Data releases, e.g. non-farm employment (payroll

What are Economic and Financial Cycles

Economy-wide fluctuations in economic activity observed via

• GDP/Income/Employment/Industrial production

• Boom and contraction

How long do Business Cycles tent to last

3-5 Years

What do Keynesisan Ideas suggest are the causes of Business Cycles

• Fluctuations in demand

• The cycle of net credit creation suggests easy credit leads to

speculative bubbles

What is the circular flow of money thoey

Economy comprised of ‘households’ and ‘firms’

‘Government’ and ‘foreign factors’ are IGNORED temporarily

National income accounting is a way to measure GDP (Y)

In the Circular flow theory are households and firms inputs and outputs equal?

Yes

What are Leakages and Injections in the Circular Flow

Leakages: savings, tax, imports

• Injections: investment, government spending, exports

If Households either save or consume what does Y equal

Y = C + S

In the Circular flow theory are savings and investments equal?

Yes

Deposits are lent to businesses and used to invest

How is GDP(Y) equal

Y= C+I+G+(X-M)

What is GDP

The value of output produced by factors of production which are

located within the domestic economy

Ignoring foreign factors

What is GNP

This is GDP plus the net income from abroad

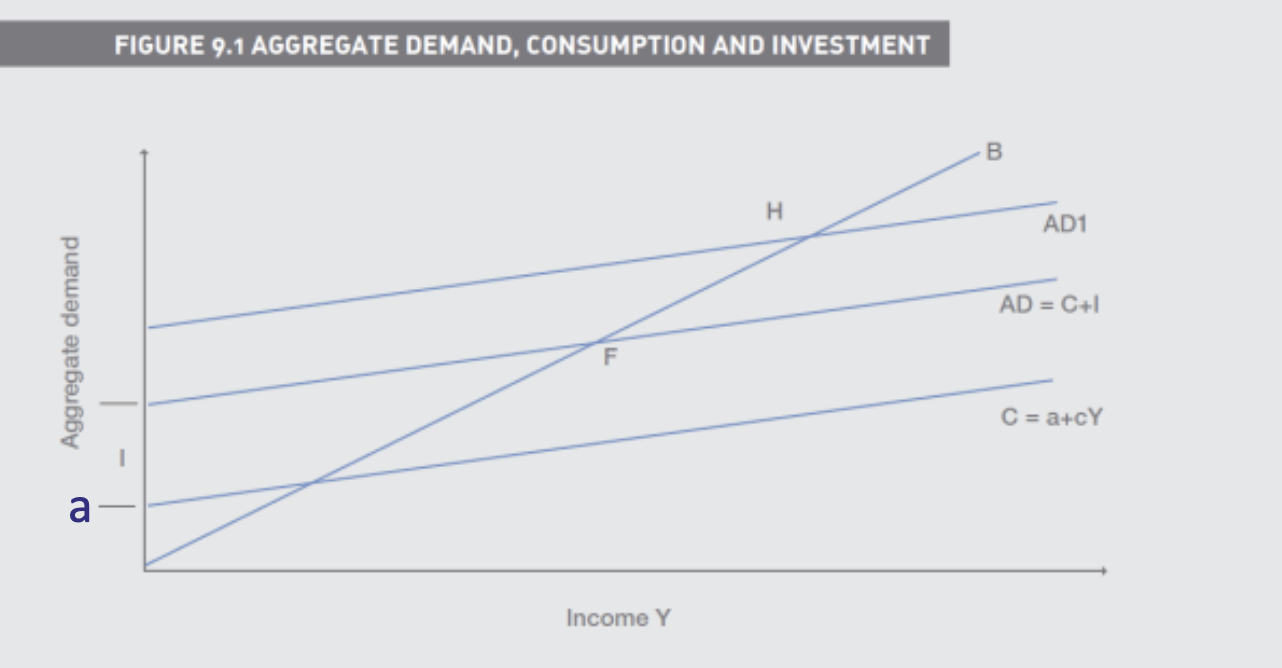

What is the consumption function

C= a +cYD

a is autonomous spending

c is the ‘marginal propensity to consume’ (MPC)

YD is disposable income

What is the Multiplier

1/(1-c)

(1-c) = the marginal propensity to save (MPS

What is the Multiplier when the Government is factored in

Tax reduces our ability to consume:

• C = a + c(1-t)YD

Hence adjusted for tax the multiplier becomes:

• 1/(1 - c(1-t))

What is the Multiplier when Foreign Trade is factored in

The multiplier adjusted for the marginal propensity to import ‘e’ is:

• 1/1 – (c-e)

What is Fiscal Policy

The totality of the government’s decisions about spending and

taxation

What is the Budget Surplus

The difference between government revenue (t) and spending (G

What is stabilisation policy

Adjusting ‘G’ or ‘t’ to boost or slow down the economy is know a

How does fiscal policy slow down a boom

Increasing taxation (t) decreases consumption by decreasing

disposable income (YD)

Decreasing government spending (G) delivers less stimulus

How does fiscal policy stimulate growth

Decrease taxation (t) increases consumption by increasing

disposable income (YD)

Increasing government spending (G) delivers more stimulu

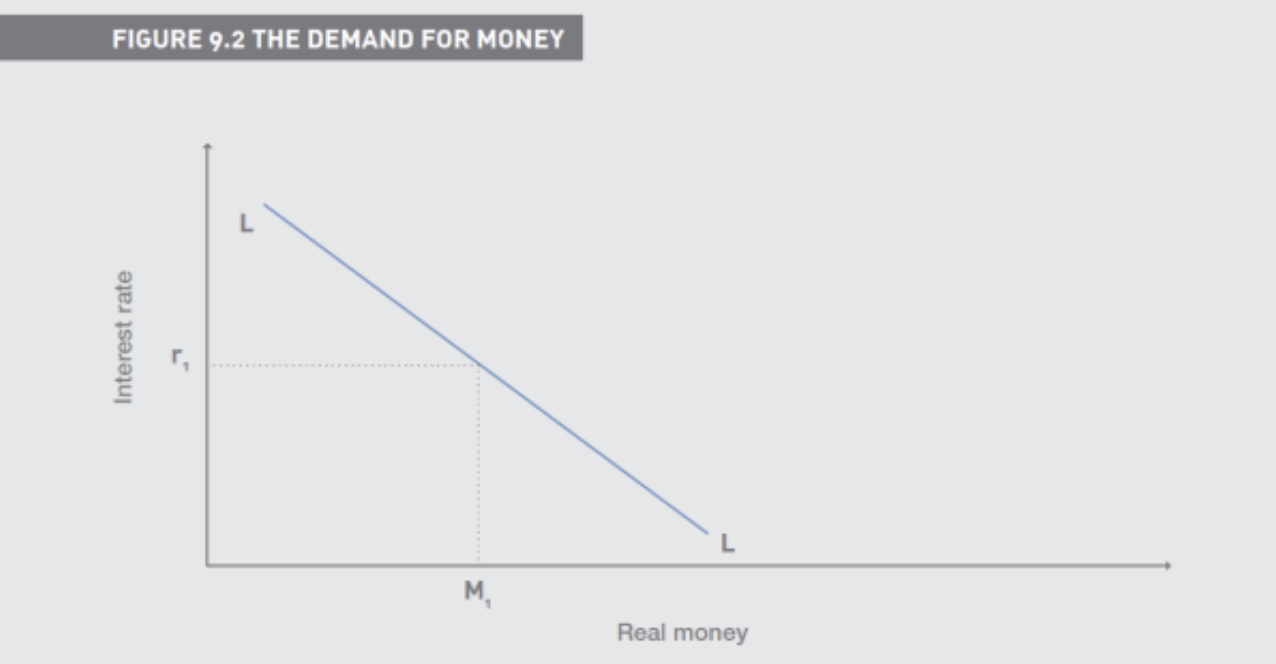

What is monetary policy

When Central Bank’s influence the price and quantity of money and credit available in the economy

What is the M0 Measure of the money supply

Publication ceased in 2006. Replaced by publication of

‘reserve balances’ (bank and building society deposits at the Bank

of England)

What is the M1 Measure of the money supply

Notes and coins outside of banks, together with private sector non-interest bearing sight deposit

What is the M3 Measure of the money supply

M1 plus private sector interest bearing sight and time

deposits (excluding Building Societies)

What is the M4 Measure of the money supply

M3 plus CDs, repos and securities with a maturity of less than

five years

What is the M4ex Measure of the money supply

M4 excluding the deposits of international offshore

financial centres

What is the system of fractional reserve banking

A small proportion of deposits are held by the bank (the majority

is used to create credit)

What is the monetary base (the stock of high-powered money)

The quantity of notes and coins in private hands and held by the banking system

What is the Money multiplier

The relationship between the different definitions of money and changes in the monetary base

What does the Quantity Theory of Money relate to

The supply of money to inflation

What is the equation for the Quantity Theory of Money

MV = PT

• M is money

• V is velocity

• P is the price level

• T is the level of transactio

What are the 3 typical assumptions of the Quantity Theory of Money

V and T are fixed with respect to the money supply

Supply of money is exogenous

Causation runs from left (MV) to right (PT

What do the assumptions of the Quantity Theory of Money mean

An increase in the supply of money will lead to an exactly

proportionate increase in the price level

Thus money supply expansions only cause price inflatio

How do Central Banks control money supply

By changing interest rates

What are the different types of Uneployment

Frictional

Structural

Classical

Keynesian

What is Inflation

Sustained price rise

Measured by the year-on-year change in the consumer price index (CPI)

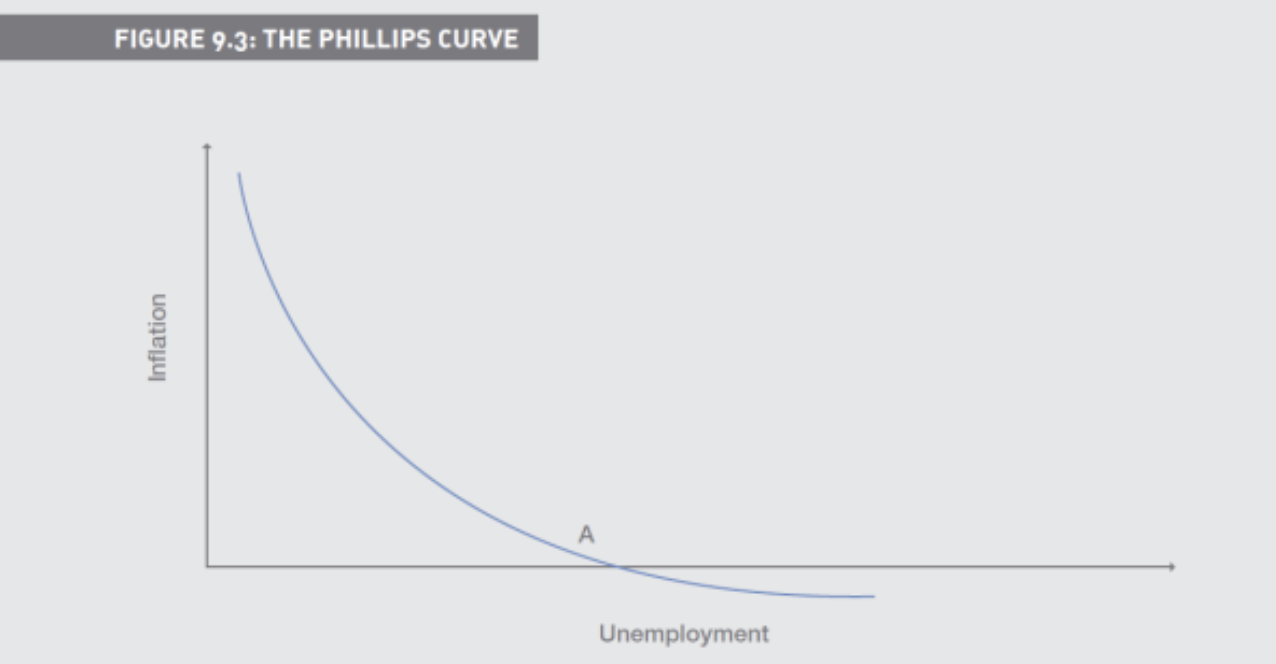

What is the Phillips Curve

Shows the relationship between inflation and unemployment

More inflation Less unemployment

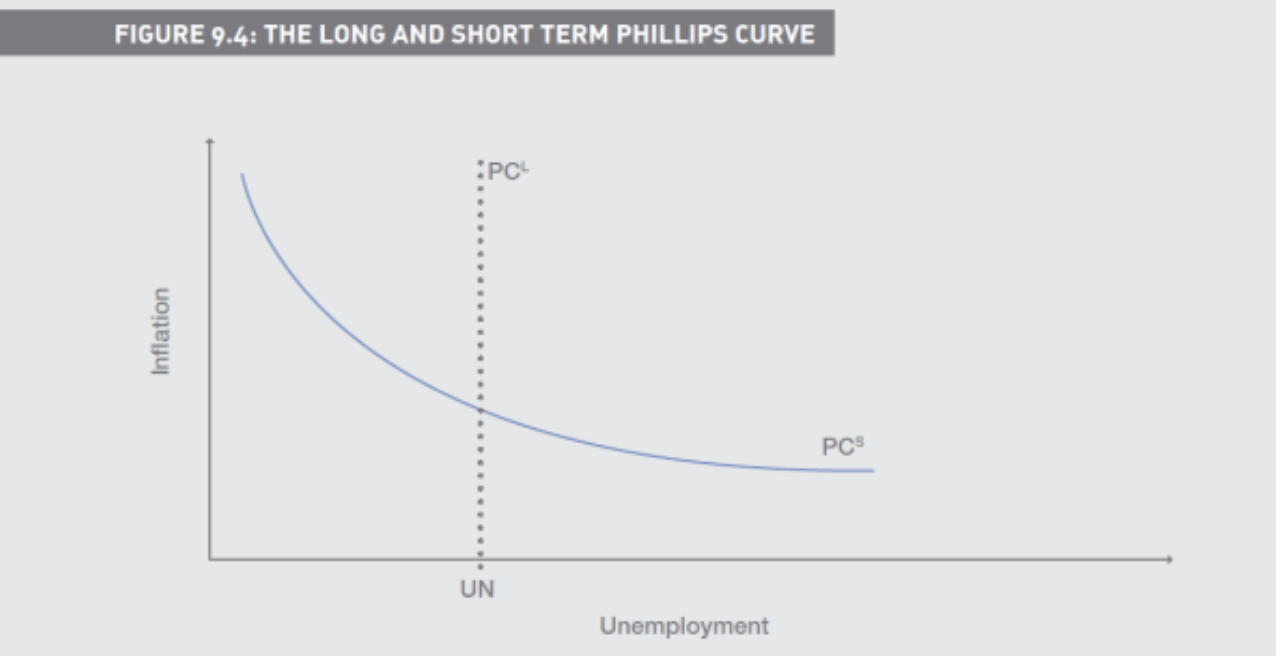

How is the Phillips Curve in the Long Run

Trade-off between unemployment and inflation was found to be

temporary, rather than permanent

Over the long-term when the economy is expanding in equilibrium there was found to be a natural rate of unemployment, full employment

What are the other Central Bank Tools for managing the Economy

Open market operations

• Quantitative easing

Reserve ratio

Forward guidance

How does the MPC set interest rates

to influence aggregate demand to keep inflation within ±1% of the CPI target level of 2%

What are the Bank liquidity requirements

Banks must hold a percentage of their risk-adjusted assets in high quality assets (cash, government bonds)

Securitising assets lowers this requirement

What are the features of the FOREX Market

No physical market place

Major players: international banks and brokerage house

What are the features of the Spot Market

Transactions for ‘immediate delivery’

Normal settlement: T+2

Market makers quote rates as bid-offer spread

What is a Bid Price

Price at which a market maker or dealer is willing to buy an asset from you.

What is a Offer (Ask) Price

Price at which a market maker or dealer is willing to sell an asset to you.

A market maker is quoting a price for GB pounds in US dollars GBP/USD 1.5244-1.5284. How many dollars will you receive if you sell £500,000 to the market maker?

500,000 × 1.5244 = 762,200

What are the Features of the Forward Market

Transactions to trade currencies at a future date at a fixed price

agreed now

Forward quotes are at a premium or discount to spot

Question on premiums on discount

xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz xyz

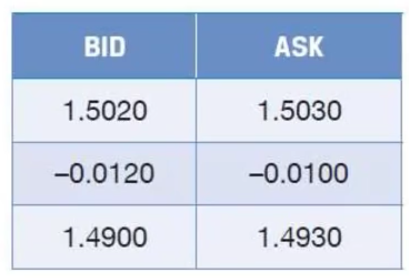

Sterling spot against the dollar is GBP|USD 1.5020-1.5030, and the three- month rate is quoted as a premium of 1.2c-1.0c

How much sterling will you receive if you sell $500,000 forward

Since you are selling, you’re looking for the Ask Price

You must subtract the premium

Therefore, the answer is 500,000 / 1.4930

= 344,896

What is Purchasing power parity (PPP)

The ‘law of one price’

• Explains the relationship between spot rates and forward rates

• Relies on the principle of zero arbitrage

What is the rationale of PPP

an exchange rate will change by a proportion that

reflects the inflation differential between two countries

What is the Formula for PPP

A good costing £1 in the UK currently costs $1.4471 in the US. Inflation is 2.0%pa in the UK and 2.5%pa in the US.

Calculate the expected 12 month forward rate

1.4471 * ((1+ 0.025) / (1+ 0.02))

= 1.454

What is Interest rate parity (IRP)

Starting from a point where exchange rates are at their

equilibrium, an increase/(decrease) in domestic interest rates will

cause that country’s currency to appreciate/(depreciate

What is the rationale of IRP

1. Converting a £ sum to $s today (at the spot rate), depositing in the US (at the US interest rate) and re-converting at the forward rate

should generate the same sterling value as;

2. Depositing the same £ sum in the UK for the same period

What is the Formula for IRP

The £/$ exchange rate is £1/$1.4471 in the US. Interest rates are 2.0%pa in the UK and 2.5%pa in the US.

Calculate the three-month forward rate

3 months = 0.25 years

1.4471 * ((1+ 0.025 ×0.25) / (1+0.02×0.25))

1.4471 * (1+ 0.00625) / (1+ 0.005)

= 1.4489