TAXATION_VAT

1/54

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

55 Terms

1. Which of the following is not subject to business tax?

a. Sale of goods, services and lease of property in the ordinary course of trade or business.

b. Importation of goods into the Philippines, whether for personal or business use

c. Gratuitous transfer

d. All of the above

Answer: C

•Onerous transfer (sale/barter/exchange) = business taxes and income tax

•Gratuitous transfer (donations) = donor's tax or estate tax

2. Which is correct?

a. Without a business pursued in the Philippines (except importation) by the taxpayer, value added tax cannot be imposed.

b. "In the course of trade or business" means the regular conduct or pursuit of a commercial or an economic activity, including transactions incidental thereto, by any of whether or not the person engaged therein is a non-stock, nonprofit private organization or government entity.

c. Services rendered in the Philippines by a non-resident foreign person shall be considered as being rendered in the course of trade or business even if the performance is not regular.

d. All of the above

Answer: D

• Generally, isolated transaction is not subject to vat. It is assumed to have been made not in the ordinary course of trade or business. However, isolated services rendered by a nonresident foreign person is considered a transaction in the ordinary course of trade or business, therefore subject to vat.

Philippine Catering Corporation (PCC) is a vat registered company which has been engaged in the catering business for the past 10 years. It has invested a substantial portion of its capital on flat wares, table linens, plates, chairs, catering equipment, and delivery vans. PCC sold its first delivery van, already 10 years old and idle to Northern Gravel and Sand Corporation (NGSC), a corporation engaged in the business of buying and selling gravel and sand. The selling price of the delivery van was way below its acquisition cost. The sale of delivery van by PCC to NGSC is:

a. unrelated transaction to PCC, hence, not subject to vat

b. An isolated transaction which is not subject to vat.

c. The sale is subject to vat being a transaction incidental to the catering business which is a vat registered activity of PCC.

d. None of the above

Answer: C

•Transactions which that are undertaken incidental to the pursuit of a commercial or economic activity are considered as entered into in the course of trade or business (Section 105, NIRC). A sale of a fully depreciated vehicle that has been used in business is subject to vat as an incidental transaction, although No. 194637, such March sale may 11, 2013)be considered isolated (Mindanao II Geothermal Partnership vs. CIR, G.R.

Which statement is wrong? Transactions considered "in the course of trade or business". and therefore subject to the business taxes include:

a. conduct or pursuit of a commercial or an economic activity by a stock private organization.

b. Regular conduct or pursuit of a commercial or an economic activity by a non-stock, non-profit private organization.

c. Isolated services in the Philippines by non-resident foreign persons.

d. Isolated sale of goods or services.

Answer: d. Isolated sale of goods or services

Statement 1: Nonstock and nonprofit private organizations which sell exclusively to their members in the regular conduct or pursuit of commercial or economic activity are exempt from value-added tax. Statement 2: Government entities engaged in commercial or economic activity are generally exempt from value-added tax

a. Both statements are correct.

b. Both statements are incorrect.

c. Only the first statement is incorrect

d. Only the second state statement is correct

Answer: B As long as the transaction is not exempt under the law, vat shall be imposed regardless of the classification of the seller or the buyer (government, non-stock non-profit organization, private entities, etc.). Refer also to letter "c" of the next question.

The term "in the course of trade or business" does not include

a. conduct or pursuit of a commercial or economic activity.

b. Incidental business transactions.

c. Transactions by any person, regardless of whether or not the person engaged therein is a non-stock, non-profit private organization (irrespective of the disposition of its net income and whether or not it sells exclusively to members) or government entity.

d. None of the above

Answer: D Under the vat law, incidental transactions (i.e ., sale of asset used in business) is subject to value added tax.

Commonwealth Management and Services Corporation (Comaserco) is a corporation duly organized and existing under the laws of the Philippines. It is an affiliate of Philippine American Life Insurance Company (Philamlife), organized by the latter to perform collection, consultative and other technical services, including functioning as an internal auditor of Philamlife and its other affiliates. These services were performed on a "nonprofit, reimbursement-of-cost only" by Comersco. The services performed by Comersco to Philamlife and other affiliates were subjected to vat by the BIR. Which of the following contentions of Comersco is correct?

I. Which vat because the service was not considered "in the ordinary course of trade or business".

II. Exempt from vat because Comersco was established only to ensure operational orderliness and administrative efficiency of Philamlife and its affiliates, and not in the sale of services.

a. I only

b. Il only

c. Either I or Il

d. Neither I nor Il

Answer: D

The Supreme Court ruled that contrary to Comaserco's contention, Section 105 (persons liable to vat) clarifies that even a non-stock, nonprofit organization or government entity is liable to pay Vat on the sale of goods or services. Vat is a tax on transaction’s, imposed at every stage of the distribution process on the sale, barter or exchange of goods or property, and on the performance of services, even in the absence of profit attributable thereto. It is immaterial whether the primary purpose of a corporation indicates that it receives payments for services rendered to its affiliates on a reimbursement-of-cost basis only, without realizing profit, for purposes of determining liability for Vat on services rendered. As long as the entity provides service for a fee, remuneration or consideration, then the services rendered is subject to vat. Statues that allow exemption are construed strictly against the grantee and liberally in favor of the government.

Statement 1: For a person to be subjected to any business tax, it is necessary that he is regularly engaged in the conduct or pursuit of an economic activity.

Statement 2: A non-resident foreign person performing isolated transaction in the Philippines shall be liable to VAT.

a. Statement 1: TRUE; Statement 2: TRUE

b. Statement 1: TRUE; Statement 2: FALSE

c. Statement 1: FALSE; Statement 2: TRUE

d. Statement 1: FALSE; Statement 2: FALSE

Answer: a. Statement 1: TRUE; Statement 2: TRUE

Value added tax

a. Is an indirect national tax levied on the value added in the production of a good (or service) as it moves through the various stages of production.

b. Is an ad valorem tax.

c. Is preferred in place of a personal income tax by many economists because income taxes are a disincentive to work, whereas vat discourages unnecessary consumption.

d. All of the above.

Answer: d. All of the above

Value added tax

a. Is a form of sales tax

b. Is likewise imposed on barters or exchanges.

c. It is collected through the tax credit method or invoice method

d. All of the above

Answer: d. All of the above

The main object of the value added tax is the transaction. A transaction subject to vat could either be:

a. sale, barter, or exchange of goods or properties in the ordinary course if trade or business.

b. A sale of service in the course of trade or business,

c. An importation of goods, whether or not made in the ordinary course of business.

d. All of the above

Answer: d. All of the above

Who is the one statutorily liable for the payment of VAT?

a. consumer

b. buyer

c. seller

d. buyer or seller

Answer: C

Vat is an indirect tax that may be shifted or passed on the buyer, transferee, or lessee of the goods, properties or services. It should be understood, however, that only the "burden" of paying the vat is shifted to the buyer, transferee or lessee, not the "liability" to pay. The seller is one primarily, directly, and legally liable for its payment. The impact of taxation is on the seller upon whom the tax has been imposed, while the incidence of tax is on the final consumer, the place at which the tax comes to rest.

. Which of the following taxes describes the value added tax?

a. Income tax

b. Sales tax

c. Indirect tax

d. Personal tax

Answer: c. Indirect Tax

Which of the following is incorrect?

a. An article exempt from vat may also be exempt from percentage tax

b. An article subjected to excise tax may be subjected to vat

c. A taxpayer may be subjected both to vat and percentage tax

d. None of the above

Answer: D

If an article is exempt from vat and at the same time not in the list of transactions subject to Percentage Taxes (Sections 116-127), such article is exempt from business tax, such as but not limited to:

❖ sale of agricultural marine food products at its original state sale of fertilizers, poultry feeds sale of books

❖ Excise tax is in addition to vat or Percentage Tax

❖ An article may be subjected to either vat or percentage tax, but same article cannot be subjected to both vat and percentage tax. A taxpayer (individual or corporation), however, may be engaged in transactions that are subject to vat and transactions subject to percentage taxes (mixed transactions). What is prohibited is "same transaction or article" is subjected to vat and percentage tax.

Which of the following is incorrect?

a. A vat-taxable article may be exempt from vat

b. vat-taxable article may be subject to vat

c. A taxpayer may have two businesses where one is subject to vat and the other is subject to percentage tax

d. Manufacturers and importers of goods are subject to excise tax

Answer: D

“A” is correct. Sale of an article not exempt from vat is not subject to vat if the seller is not vat registered and the amount of annual sale or receipts than the vat threshold.

“B” is correct. Sale of an article not exempt from vat is subject to vat if the seller is vat registered or the annual gross sales or receipts exceeded the vat threshold.

“C” is correct. The taxpayer or seller is engaged in mixed transactions.

“D” is incorrect. To be subjected to excise tax, the product manufactured or imported shall pertain to sin products or non-essential goods, or non-essential services

Which is correct?

a. An excise tax which imposes a tax based on weight or volume capacity or any other physical unit of measurement is called specific tax.

b. An excise tax which imposes a tax based on selling price or other specified value of the article is called ad valorem tax.

c. A percentage tax which is imposed whether the transaction resulted in a gain or loss is called transaction tax.

d. All of the above.

Answer: d. All of the above

Which of the following is not a business tax?

a. Excise Tax

b. Value-added tax

c. Other percentage tax

d. Income tax

Answer: d. Income Tax

Which is incorrect?

a. A taxpayer whose annual gross receipts or sales exceeds P3,000,000 shall pay vat even if not vat registered.

b. A taxpayer whose annual receipts or sales do not exceed P3,000,000 but who is vat registered shall pay vat.

c. A non-resident lessor or foreign licensor who is not vat-registered is subject to vat.

d. None of the above

Answer: d. None of the above

. Registration of taxpayers under the vat system may be classified as, except

a. Mandatory vat registration

b. Optional vat registration

c. Mixed vat registration

d. None of the above

Answer: c. Mixed vat registration

NOTE:

MANDATORY VAT REGISTRATION

Gross sales or receipts preceding > P3,000,000 and not exempted under the law

Gross receipts preceding year > P10,000,000 and the taxpayer is a radio and/or television broadcasting company.

OPTIONAL VAT REGISTRATION

Gross sales or receipts SP3,000,000 and not exempted under the law.

Gross receipts preceding year SP10,000,000 and the taxpayer is a radio and/or television broadcasting company.

Which of the following has an option to register under the VAT system?

I. Common carriers by land transporting passengers, the gross receipts of which do not exceed P3,000,000.

II. Radio and/or television broadcasting companies whose annual gross receipts of the preceding year exceeds P10,000,000.

III. Operator of cockpit, the receipts of which do not exceed P3,000,000 during the year.

IV. Seller of vat-subject services the gross receipts of which do not exceed P3,000,000.

a. IV only

b. I and III only

c. I and IV only

d. All of the above

Answer: A

The taxpayer under item "I" cannot avail the "optional" vat registration because it is subject to Common Carrier's Tax (Percentage Tax) under Section 116 of the Tax Code, as amended, instead of value added tax.

The taxpayer under item "Il" is required to register under the vat system, hence, it shall fall under the "mandatory" vat registration instead of "optional" vat registration.

The taxpayer under item "Ill" cannot avail the "optional" vat registration because it is subject to Amusement Taxes (Percentage Tax) under Section 125 of the Tax Code, as amended, instead of value added tax.

The following data were provided by spouses Pedro and Ana. In 2021, Pedro's gross receipts from his practice of profession was P2,850,000 while her wife, Ana, has gross sales of P2,200,000 derived from her trading business. Assuming they are not vat registered, will they be subject to vat?

a. Yes, because their aggregate gross receipts/sales exceeded the vat threshold of

b. No, because for purposes of vat threshold, husband and wife shall be considered as separate taxpayers.

c. Yes, because their gross receipts/sales are not specifically exempt from vat as provided in the Tax Code.

d. None of the above

Answer: B

For purposes of determining whether or not the gross sales or receipts exceeded the vat threshold of P3M, husband and wife shall be treated as separate taxpayers.

POI is a certified public accountant. He applied for work and was hired by a Firm which is engage in Business Process Outsourcing, handling accounting work for US entities. He was paid for his services. How should POI treat such payment for business tax purposes?

a. Subject to 12% VAT

b. Subject to Percentage Tax

c. Exempt from VAT and Percentage Tax

d. is a zero-rated transaction

Answer C

The payment he is receiving is classified as salaries or compensation income due to the presence of employer-employee relationship. Pol is an employee of the Firm, hence, not subject to business tax.

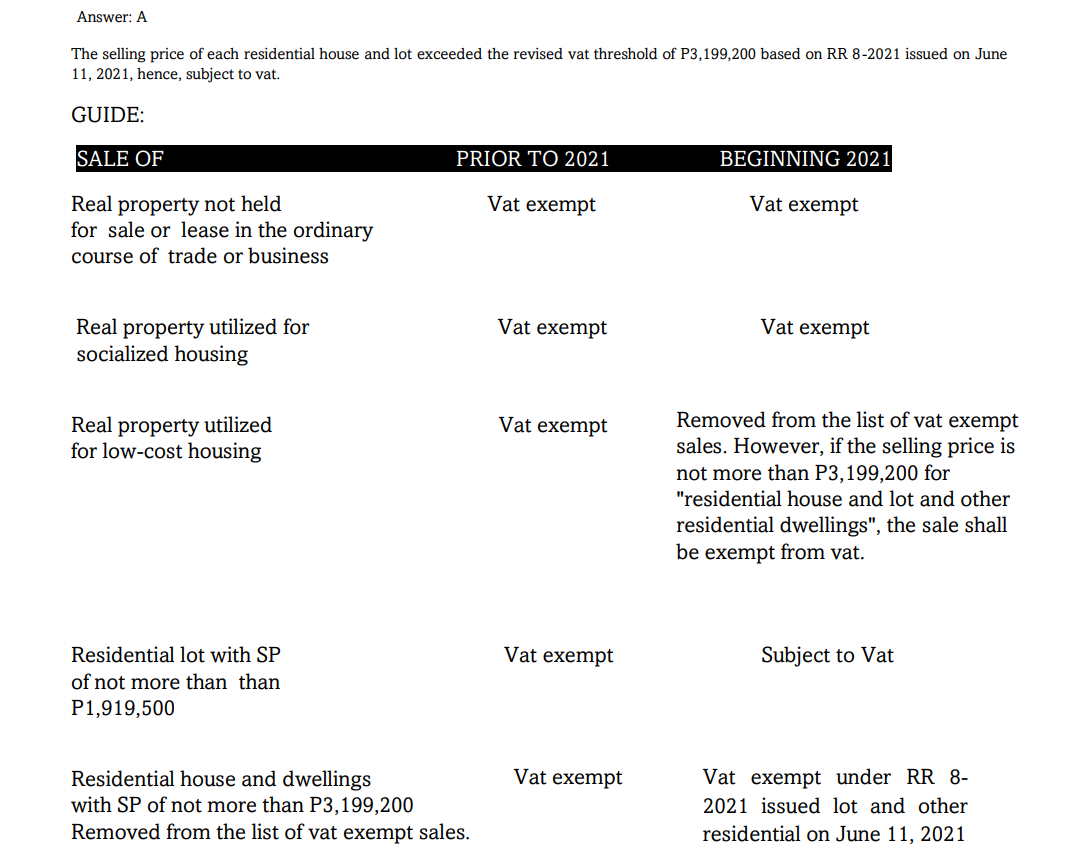

Where even if there is a business, there is no vat to be imposed beginning January 1, 2021 in the following cases:

I. Sale of real properties not primarily held for sale to customers or held for lease in the ordinary course of trade or business.

II. Sale of real properties for socialized housing

III. Sale of residential house and lot and other residential dwellings valued at P3,199,200 and below.

a. only

b. II only

c. I and II only

d. All of the above

Answer: d. All of the above

Where even if there is no business, vat is imposable on:

I. Importations of goods for personal use

II. Services rendered in the Philippines by nonresident foreign persons, even isolated, shall be considered as being rendered in the course of trade or business.

a. I only

b. Il only

c. I and II

d. None of the above

Answer: c. I and II

One of the following is not an activity subject to VAT:

a. Sale in retail of goods by a dealer

b. Sale of Bamboo poles by a dealer

c. Sublease of real property in the course of business

d. Importation of ordinary feeds for poultry chicken

Answer: d. Importation of ordinary feeds for poultry chicken

The following are exempt from vat, except

a. Sale of 1 sack of rice

b. Sale of lechon manok

c. Sale of pet food

d. Sale of newspaper

Answer c. Sale of pet food

The following are exempt from vat, except

a. Sale of marinated fish

b. Sale of gold to the Bangko Sentral ng Pilipinas

c. Association dues, membership fees, and other assessments and charges collected by home owners associations and condominium corporations.

d. None of the above

Answer: A

Revenue Ruling 348-11 dated Sept 28, 2011 provides that sale of marinated fish is not exempt from vat. Laws granting exemption from tax are construed strictly against the taxpayer. Exemption from payment of tax must be clearly stated in the language of the law.

"B" is exempt from vat beginning Jan. 1, 2018 (previously subject to 0% vat)

"C" is exempt from vat beginning Jan. 1, 2018

Which of the following shall be exempt from vat?

a. Services of banks.

b. Services of money changers and pawnshops.

c. Services of credit cooperatives

d. All of the above

Answer: D

"A" and "B" are subject to gross receipts tax, a percentage tax under Sections 121 and 122 of the Tax Code.

"C" is exempt from vat and percentage tax.

Which of the following is exempt from VAT?

a. Common carriers transporting passengers by air within the Philippines

b. Common carriers transporting passengers by sea within the Philippines

c. Common carriers transporting passengers by land within the Philippines

d. Common carriers transporting cargoes by air within the Philippines

Answer: c. Common carriers transporting passengers by land within the Philippines

Which of the following carrier shall be subject to value-added tax?

a. Sea carrier classified as Resident Foreign Corporation, with annual gross receipts of P2,000,000.

b. Air carrier classified as Resident Foreign Corporation, with annual gross receipts of P3,000,000.

c. Sea carrier classified as Domestic Corporation, voyage is from Philippines to Japan, with annual gross receipts of P5,000,000.

d. None of the choices

Answer: C

"A" and "B" are subject to common carriers tax on international carriers under Section 118 of the Tax of Code, the with amount respect of gross to their receipts. transport As of to goods, their passenger cargoes or operations, mails originating they are in the exempt Philippines both from vat and percentage fax.

“C" is subject to 0% vat

A dealer in securities sold unlisted shares of stocks of a domestic corporation and derived a gain of P100,000 therefrom. The sale is:

a. Subject to capital gains tax

b. to percentage tax of 6/10 of 1% of gross selling price.

c. Subject to 12% vat

d. Exempt from business tax

Answer: C

"A" and "B" are applicable only if the seller is a shareholder or investor

Determine the business taxes of the following:

I. Lease of residential units with a monthly rental per unit not exceeding P15,000 (regardless of the amount of aggregate annual gross rentals).

II. Lease of residential units with a monthly rental per unit exceeding P15,000 but the aggregate of such rentals during the year do not exceed P3,000,000.

III. Lease of commercial units regardless of monthly rental per unit.

A. None, OPT, VAT

B. None, OPT, OPT

C. None, VAT, VAT

D. VAT, VAT, VAT

Answer: C

GUIDE:

Lease of commercial units = generally subject to vat, regardless of the amount of monthly rental per unit.

Lease of residential units:

•Monthly rental per unit s P15,000 = exempt from business tax

•Monthly rental per unit > P15,000 but the annual gross receipts from these units S P3,000,000 = exempt from vat but subject to 3% percentage tax under Section 116 of the Tax Code, as amended.

•Monthly rental per unit > P15,000 and the annual gross receipts from this units > P3,000,000 = subject to 12% vat.

•If the lessor is engaged in renting out residential units with monthly rental per unit of < P15,000 as well as residential units with monthly rental per unit of > P15,000 = treat both activities separately. The residential units with monthly rental per unit of < P15,000 is exempt from business taxes while the residential units with monthly rental per unit of > P15,000 is either subject to Section 116 or vat.

Determine the correct statement from the following: In cases where a lessor has several residential units for lease, some are leased out for a monthly rental per unit of not exceeding P15,000 while others are leased out for more than P15,000 per unit, his tax liability will be:

a. The gross receipts from rentals not exceeding P15,000 per month per unit shall be exempt from vat regardless of the aggregate annual gross receipts.

b. The gross receipts from rentals exceeding P15,000 per month per unit shall be subject to vat if the annual gross receipts from said units including the gross receipts from units leased out for not more than P15,000 exceed P3,000,000.

c. Both statements are correct.

d. Both statements are incorrect

Answer: A

“B” is incorrect. The gross receipts from units with monthly rental of not more than P15,000 shall not be added to the gross receipts from units with monthly rental of more than P15,000.

To be subject to vat, the lease of residential units shall have

I. Monthly rental per unit exceeding P15,000

II. Gross annual rental exceeding P3,000,000

a. Both I and II are necessary

b. Both I and II are not necessary

c. Only I is necessary

d. Only Il is necessary

Answer: a. Both I and II are necessary

To be subject to vat, the lease of commercial units shall have

I.Monthly rental per unit exceeding P15,000

II.Gross annual rental exceeding P3,000,000

a. Both I and II are necessary

b. I and II are not necessary

c. Only I is necessary

d. Il is necessary

Answer: D

The threshold of P15,000 monthly rental is not applicable to commercial units. Only the annual threshold of P3,000,000 gross receipts shall apply

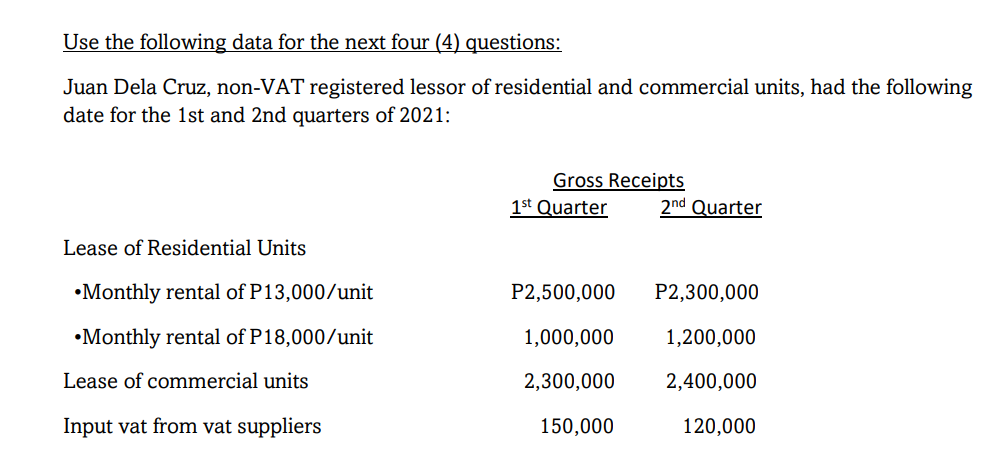

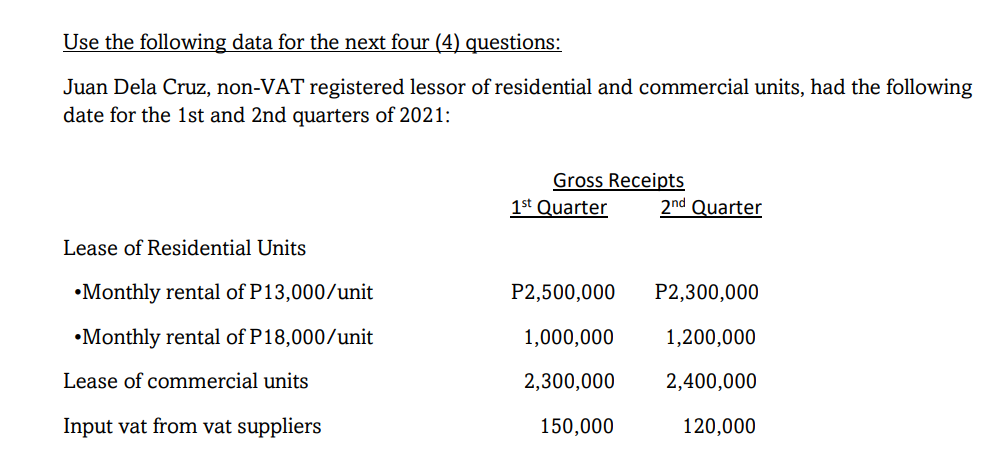

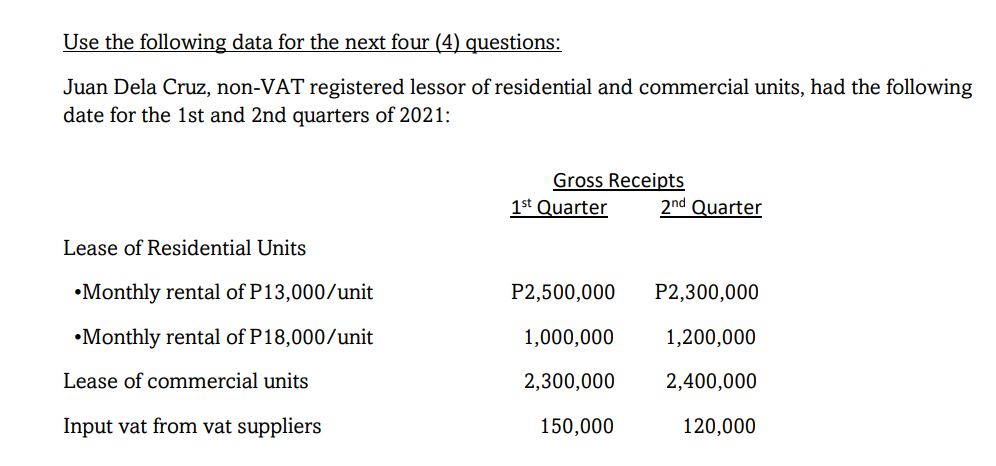

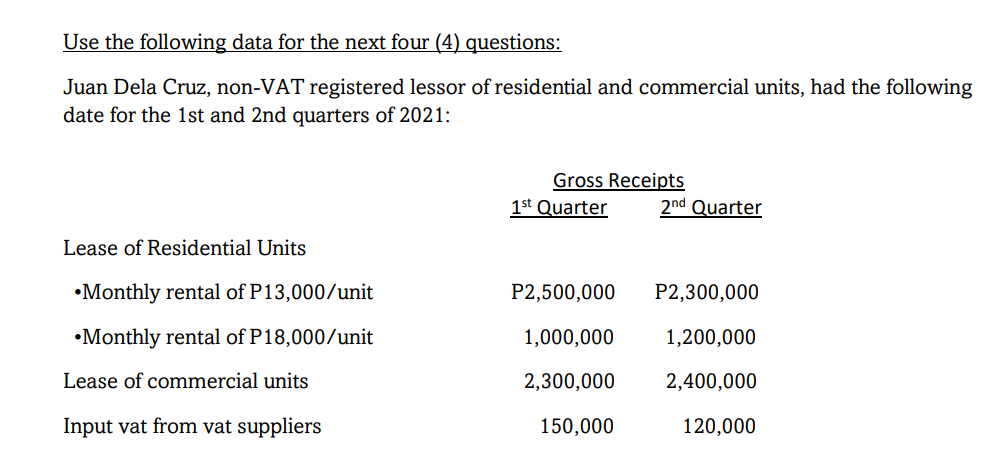

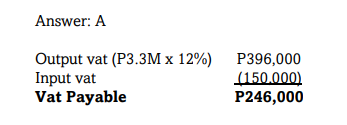

How much is the business tax due for the 1st quarter of Mr. Dela Cruz?

a. P99,000

b. P174,000

c. P396,000

d. P246,000

Answer: C

Business tax (vat) = P3,300,000 x 12% = P396,000

The lease of residential units with monthly rental of P13,000 per unit shall be exempt from business tax.

The gross receipts from lease of residential units with monthly rental of P18,000 per unit and the lease of commercial units exceeded the vat threshold of P3M for the first quarter, hence, shall be subject to vat.

Input vat credit is not allowed as a consequence of being a non-vat registered entity.

How much is the business tax due for the 2nd quarter of Mr. Dela Cruz?

a. P432,000

b. P312,000

c. P708,000

d. P108,000

Answer: A ; Business tax (vat) = P3,600,000 x 12% = P432,000

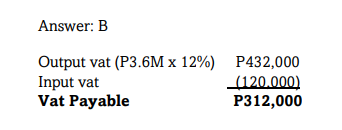

How much is the business tax due for the 2nd quarter of Mr. Dela Cruz assuming he registered as a VAT taxpayer at the start of the 2nd Quarter?

a. P432,000

b. P312,000

c. P708,000

d. P108,000

Assuming Mr. Dela Cruz is vat registered taxpayer instead of non-vat registered, how much is his business tax due for the 1st Quarter?

a. P246,000

b. P546,000

c. P696,000

d. P396,000

Which of the following is exempt from vat?

a. Services rendered by Pedro Construction Company, a contractor to the World Health Organization (WHO) in the renovation of its offices in Manila. WHO is an entity exempt from tax under international agreements to which the Philippines is a signatory.

b. Sale of tractors and other agricultural implements by Magsasaka Corporation to local farmers.

c. Sale of RTW by Ana's boutique, a Filipina dress designer, in her dress shop and other outlets.

d. Fees for lodging paid by students to Bahay-bahayan dormitory, a private entity operating a student dormitory (monthly fee, P2,500).

Answer: D

"A" is subject to 0% vat

"B" and "C" are subject to 12% vat

"D" is vat exempt. The monthly fee paid by each student falls under the lease of residential units with a monthly rental not exceeding P.15,000 per month per unit. The term "unit" shall mean per person in the case of dormitories, boarding houses and bed spaces.

Sale of the following real properties beginning January 1, 2021 are subject to vat, except:

a. Residential lot held for sale in the ordinary course of business.

b. Residential house and lot held for sale in the ordinary course of trade, sold for P3,199,200.

c. Sale of real property used in the ordinary course of business.

d. All of the above

Answer: B

"A" is subject to vat. Beginning 2021, the sale of residential lot in the ordinary course of trade or business is no longer exempt from vat.

"B" is exempt from vat. The revised threshold of residential house and lot and other residential dwellings beginning January 1, 2021, adjusted using the 2010 Consumer Price Index using the formula as provided in RR 8-2021 is P3,199,200. Since the property was sold at an amount not exceeding the threshold, the sale is exempt from vat.

Sale of real property used in business is subject to vat (incidental transaction).

On February 2021, Ana bought one (1) parcel of residential lot for P1,850,000 from XYZ Realty, a vat registered real estate developer, in one of the latter's subdivision projects located in Bulacan. A month after the purchase, she learned that the owner of the adjacent residential house and lot, Fe, is about to relocate in Batangas. She bought the property for P3,500,000. Based on the information provided, which of the following statements is correct?

a. The purchase of residential lot from XYZ Realty as well as the residential house and lot from Fe are subject to vat.

b. Only the sale of residential house and lot by XYZ Realty is subject to vat because it was made in the course of trade or business and the seller is a vat registered.

c. Both acquisitions are exempt from vat, however, the sale of residential house and lot by Fe to Ana shall be subject to 6% capital gains tax.

d. None of the above

Answer: B

"A" is incorrect. Beginning 2021, the sale of residential lot in the ordinary course of trade or business is no longer exempt from vat. The sale of residential house and lot by Fe, a non-real estate dealer, is a sale of real property not primarily held for sale in the ordinary course of trade or business, hence, not subject to vat.

"C" is incorrect. As discussed in the preceding bulleted item, the sale by Fe was not made in the ordinary course of trade. The asset sold by Fe is classified as capital asset subject only to capital gains tax, not business tax.

Statement 1: The sale of real property not primarily held for sale in the ordinary course of business is exempt from vat. Statement 2: The sale of parking lot as an adjunct of a condominium unit in the course of trade or business at a gross selling price of P500,000 is exempt from vat as long as its price, together with the unit, does not exceed the vat threshold.

A. True, True

B. True, False

C. False, True

D. False, False

Answer: B

The sale of parking lot as an adjunct of a condominium unit is subject to vat regardless of the amount of selling price because it is not classified as house and lot nor other residential dwellings.

In 2020, a vat registered real estate dealer sold a residential lot for P1,919,500 to a vendee who intends to erect his residential house thereon. The sale shall be:

a. Subject to 12% vat

b. Subject to 0% vat

c. Vat exempt

d. None of the foregoing

Answer: C

Prior to 2021, sale of residential lot by a real estate dealer valued at not more than P1,919,500 is exempt from vat.

In 2021, a vat registered real estate dealer sold a residential lot for P1,919,500 to a vendee who intends to erect his residential house thereon. The sale shall be:

a. Subject to 12% vat

b. Subject to 0% vat

c. exempt

d. of the foregoing

Answer: A

Beginning 2021, sale of residential lot in the ordinary course of trade or business is already generally subject to vat.

.In 2020, Clifford purchase a condominium unit from his friend, Ronald (condo unit owner), for P3,000,000 and a parking lot from the subdivision developer for P800,000. The correct amount of vat is:

a. P456,000

b. P360,000

c. P96,000

d. PO

Answer: C

The sale of the condominium by Clifford's friend is subject to 6% capital gains tax because the unit sold is classified as capital asset located in the Philippines. It is a sale of real property not ordinary held for sale or lease in the ordinary course of trade or business.

The sale of parking lot by the subdivision developer (ordinary asset of the developer) is subject to vat. The output vat shall be computed as follows: Output vat = P800,000 ? 12% = P96,000

.In 2021, Clifford purchase a condominium unit from Central Realty Corporation for P2,500,000 including a parking space for P800,000. The correct amount of vat is:

a. P456,000

b. P360,000

c. P96,000

d. PO

Answer: C

The condominium unit is classified as "other residential dwelling" for vat purposes. Since the selling price did not exceed the revised vat threshold of P3,199,200 (adjusted using the 2010 consumer price index) beginning January 1, 2021, the sale shall be exempt from vat.

The sale of parking lot by Central Realty (ordinary asset of the developer) is subject to vat. The output vat shall be computed as follows :

Output vat = P800,000 x 12% = P96,000.

The sale of parking lot as an adjunct of a condominium unit is subject to vat regardless of the amount of selling price because it is NOT classified as house and lot nor other residential dwellings. The sale shall be treated separately for purposes of determining the value added tax.

2021 taxable year, a subdivision developer sold five (5) residential house and lots, each to different vendees, for P4,000,000 per lot, or a total sales of P20,000,000 for the taxable period. These sales shall be classified as:

a. 12% VAT transactions

b. 0% VAT transactions

c. VAT exempt transactions

d. None of the foregoing