Lecture 6(1) - Momentum & Volume Indicators

1/55

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

56 Terms

Volume

Amount of shares/contracts traded over a specified period and is portrayed as a vertical bar below the price bar

High volume _____in the direction of the trend

should go

Volume not going with the trend is a ________

warning of impending trend reversal

Exceptionally high volume is a signal of an ________ _________

important change

When prices are rising/declining:

Volume increasing in confirming

Volume decreasing is questionable

When a price advance halts with high volume, it is a potential ____

top

When a price decline halts with high volume, it is a potential _______

bottom

Volume displays the _____ of a move in price

intensity

Methods for Analyzing Volume confirmation

Volume indexes

On Balance Volume

AD - Accumulation/Distribution Index

Volume Related Oscillators

Volume Oscillator

Chaikin Money Flow

Volume Spikes

Volume Indexes

Comprised of cumulative sums of data measuring supply and demand over time, rather than a specific period

Do not have an upper/lower bound

Compare price with the index looking for divergences between highs and lows in each

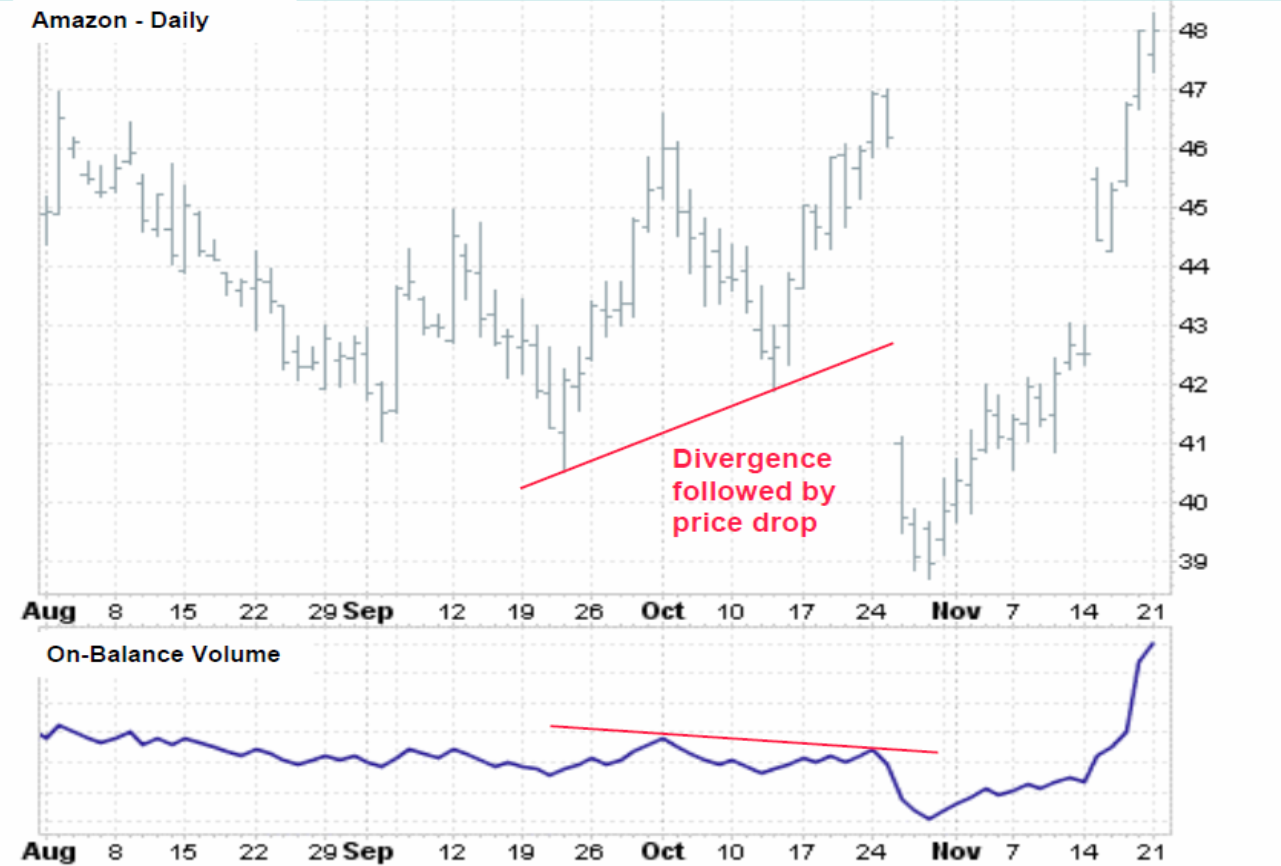

On Balance Volume

Cumulative index of plus or minus volume days based on change of closing prices

Volume based indicator that tracks buying and selling pressure, maintaining cumulative totals, goes up on up days, and down on down days

High Volume should confirm price trend, therefore compare price to OBV

Negative divergence between price and OBV ________

warns of a potential price reversal

Negative Divergence Graph

Accumulation/Distribution Index formula

Volume x [(close - low) - (High - close)]

(High/low)

A/D Index

Uses a more specific calculation to calculate the midpoint for the day’s volume

If close occurs above the midpoint for the day, the result is positive

This one has an adjustment factor

Volume Related Oscillators

Oscillates between an upper and lower bound

A move to high upper bound level creates an “overbought” condition

A move to a lower bound level produces an “oversold” condition

Bounded

Used for divergence analysis, trend lines, sometimes pattern analysis → more useful for trading range markets

Volume Oscillator

Ratio between 2 moving averages of volume and is used to determine when volume is expanding or contracting

Expanding volume implies strength in the trend, contracting volume implies weakness in trend

Useful for confirming trend and for giving advanced warning in a trading range of direction for next breakout

Chaikin Money Flow

Uses A/D calculation for each day

Calculated by summing ADs over the past 21 days and dividing that sum by the total volume over the past 21 days

This produces an oscillator that rises above zero when upward trend (buying pressure) begins and declines below zero (selling pressure) when the trend turns downward

Volume-related oscillator

Volume Spikes

Usually a test of a significant support/resistance level

Sign of a sudden change in information (gap) or other pattern breakout

Most common at the beginning and end of a trend

Volume Spike graph

Momentum

Measure of the velocity of price movements, rather than price movements themselves

Rate of change of price measures how quickly prices are rising or how steeply the trend line is sloping

Types of momentum indicators

Rate of Change (ROC)

Moving Average Convergence Divergence (MACD)

Stochastic

Relative Strength Index (RSI)

Momentum oscillators work in these ways:

Oscillate between an upper and lower bound so a move to high upper bound level creates an “overbought” condition, and a move to a lower bound level produces an “oversold” condition

To indicate divergences between momentum and price trend and as a result gives indication to price trend change

Crossing of 0 or midpoint line can give you signals of trend change

Negative Divergence

Price hits a higher high, momentum oscillator hits a lower high

Positive Divergence

Price hits a lower low, but momentum oscillator hits a higher low

Overbought

When prices are noticeably above the central trend, and hit the upper boundary level of a momentum oscillator

Oversold

When prices are noticeably below the central trend, and hit the lower boundary level of a momentum oscillator

MACD - Moving Average Convergence Divergence

Uses 2 lines: MACD and signal line

Uses the 9, 12, 26 period EMAs

MACD line is calculated by finding the difference between two exponential moving averages (EMAs) of closing prices: the last 26 and 12 periods

Signal line is the 9 period EMA of MACD line

When MACD is above 0 line, (short term EMA > long term EMA), it suggests an upward trend

How is the MACD line calculated?

By finding the difference between two exponential moving averages (EMAs) of closing prices - the last 26 and 12 periods

How is the signal line (in MACD) calculated?

Find the 9 period EMA of the MACD line

Histogram is the difference between:

the MACD and its signal line

MACD is useful in trending markets because it is

unbounded

MACD Buy Signal

When the MACD line crosses the signal line from below and both lines are below the 0 zone. Best buy signals occur below the 0 zone

MACD Sell Signal

When the MACD line crosses the signal line from above and above the 0 zone

Overbought indicator in MACD

When lines are far above the 0 line

Oversold indicator in MACD

When lines are far below the 0 line

ROC - Rate of Change

Measures the amount a stock price has changed over a given number (N) of past periods

Price today - Price N periods ago x 100

Price N periods ago

Buy signal in ROC

When ROC crosses the 0 line from below

Sell signal in ROC

When ROC goes lower from above overbought level

RSI - Relative Strength Index

Measures a security’s price strength relative to its own past price history

Bounded by the range of 0-100

RSI = 100 - 100

1 + RS

where RS = Average of x day’s up closes

Average of x day’s down closes

Overbought RSI indicator

Above 70

Oversold RSI indicator

Below 30

RSI in bear and bull markets

Bull Market: above 50, ranges from 55-85

Bear Market: 25-60

Top Failure Swing

When a peak in RSI over 70 fails to exceed a previous peak in an uptrend (may signal a top) - RSI forms an “M” with the second peak a lower high

Bottom Failure Swing - RSI

When RSI is in a down trend (under 30), fails to set a new low and when proceeds to exceed a previous peak (may signal a bottom) - RSI forms a “W” with the second trough a higher low

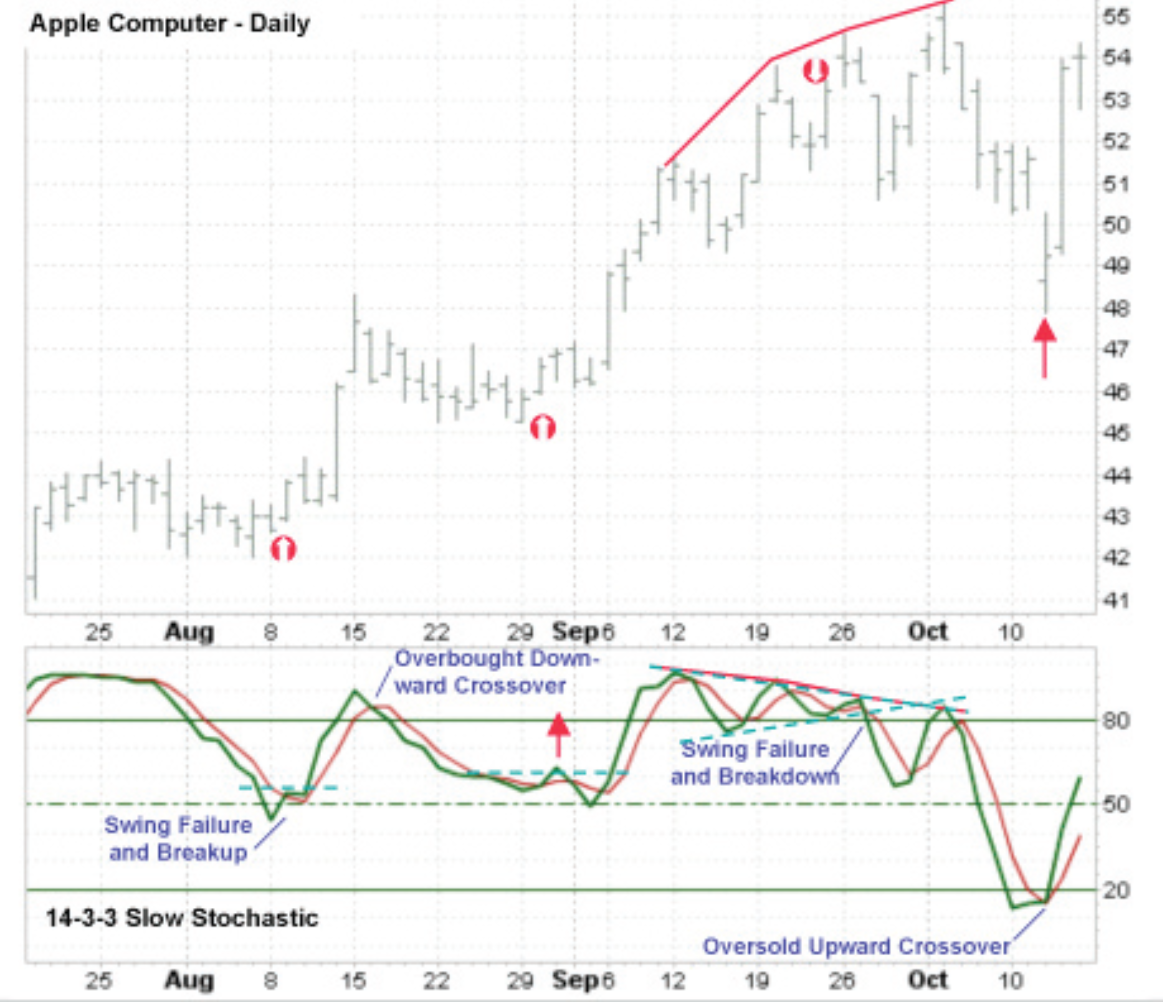

RSI divergence graph

Stochastic Oscillator

As prices increase, prices tend to be at the upper end of the price range, and in down trends, price tends to be near the lower end of the range

Measures current closing price versus defined past findow of prices

Stochastic Oscillator Equation

%K = 100 x (Close - Low)

(High - Low)

Fast %D - Fast Stochastics

3 period SMA of the %K line

Slow %D - Slow Stochastics

3 period SMA of the %D line

Using Stochastics in the Overbought/Oversold

Bounded from 0-100

Overbought: Above 80

Oversold: Below 20

Using Stochastics in the trending markets

Divergences

Pattern recognition - trend line breaks, triangles

Failure swings

Using Stochastics in the Trading range markets

Crossovers

Failure swings

Overbought/oversold

Using Stochastics in the Failure Swings: Top Failure Swing

When a peak in stochastic over 80 fails to exceed a previous peak in an uptrend

Using Stochastics in the Failure Swings: Bottom Failure Swing

When stochastic is in a down trend (under 20) fails to set a new low and then proceeds to exceed a previous peak

Stochastic graph