🟩ACCT 2301 | CH 1-3 Exam #1

1/20

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

21 Terms

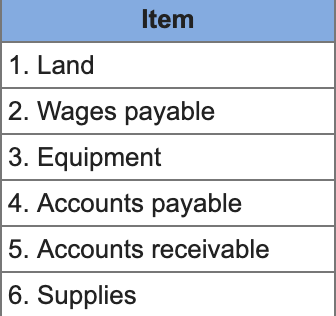

Classify each of the following items as assets, liabilities, or equity from the drop down provided.

Land = Assets

Wages payable = Liabilities

Equipment = Assets

Accounts payable = Liabilities

Accounts receivable = Assets

Supplies = Assets

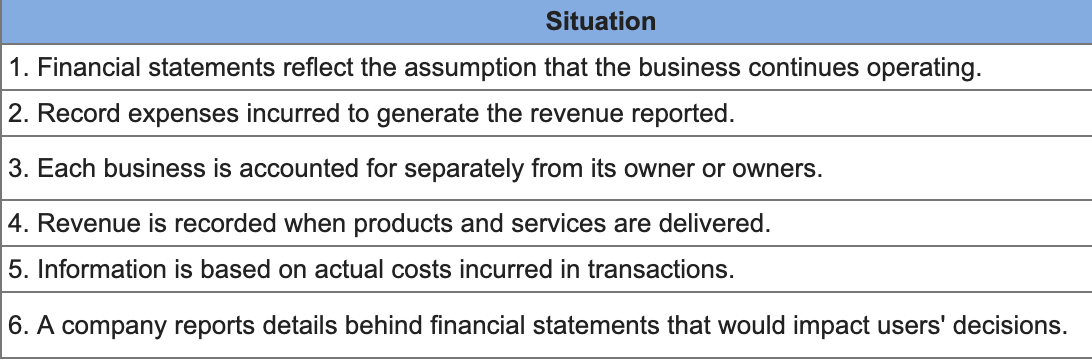

Identify the accounting principle or assumption that best reflects each situation.

Financial statements reflect the assumption that the business continues operating.

Going-concern assumption

Identify the accounting principle or assumption that best reflects each situation.

Record expenses incurred to generate the revenue reported.

Expense recognition (matching) principle

Identify the accounting principle or assumption that best reflects each situation.

Each business is accounted for separately from its owner or owners.

Business entity assumption

Identify the accounting principle or assumption that best reflects each situation.

Revenue is recorded when products and services are delivered.

Revenue recognition principle

Identify the accounting principle or assumption that best reflects each situation.

Information is based on actual costs incurred in transactions.

Measurement (cost) principle

Identify the accounting principle or assumption that best reflects each situation.

A company reports details behind financial statements that would impact users' decisions.

Full disclosure principle

Using the above information prepare a December income statement for the business.

First cell is “For Month Ended December 31”. Then next cell is Revenues and then all Expenses listed. The very last cell is Net income where you subtract Total revenues from Total expenses to calculate it.

When a Equity value is missing…

Assets - Liabilities

When an Assets value is missing…

Liabilities + Equity

When a Liabilities value is missing…

Assets - Equity

When preparing a statement of retained earnings what goes first?

“For Month Ended December 31”

When preparing a statement of retained earnings what goes first?

“As of December 31”

When preparing a statement of retained earnings what goes next?

“Add: Net income”

When preparing a statement of retained earnings, what goes after “Add: Net income?”

“Less: Dividends”

When preparing a statement of retained earnings what goes after “Less Dividends”

Retained earnings, December 31

When preparing a statement of retained earnings what goes after “Less Dividends”

Retained earnings, December 1