Chapter 16: Working Capital Management - AR & AP

1/29

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

30 Terms

Accounts Receivable: Selling on Credit

Common in certain industries where ‘buy now, pay later’ is expected.

Creates a receivable asset on the financial statement.

Business wants to sell to customers and receive cash to earn profits/stay liquid but not offering credit may lead to customers choosing competitors.

Businesses must wait for cash from credit sales.

Optimum Credit Policy

Essential for managing liquidity.

Helps determine T&C’s and internal procedures for offering credit to customers.

Optimum level of trade credit extended to customers represents a balance between:

Profit improvements from sales obtained by allowing credit

Cost of credit allowed

Why have a credit policy?

Firms ideally want cash with each order but may offer substantial discounts to achieve this.

Credit terms are part of the firm’s marketing strategy.

Aligning with common industry practices is advisable.

Lenient credit policy can attract more customers but may lead to a disproportionate increase in costs.

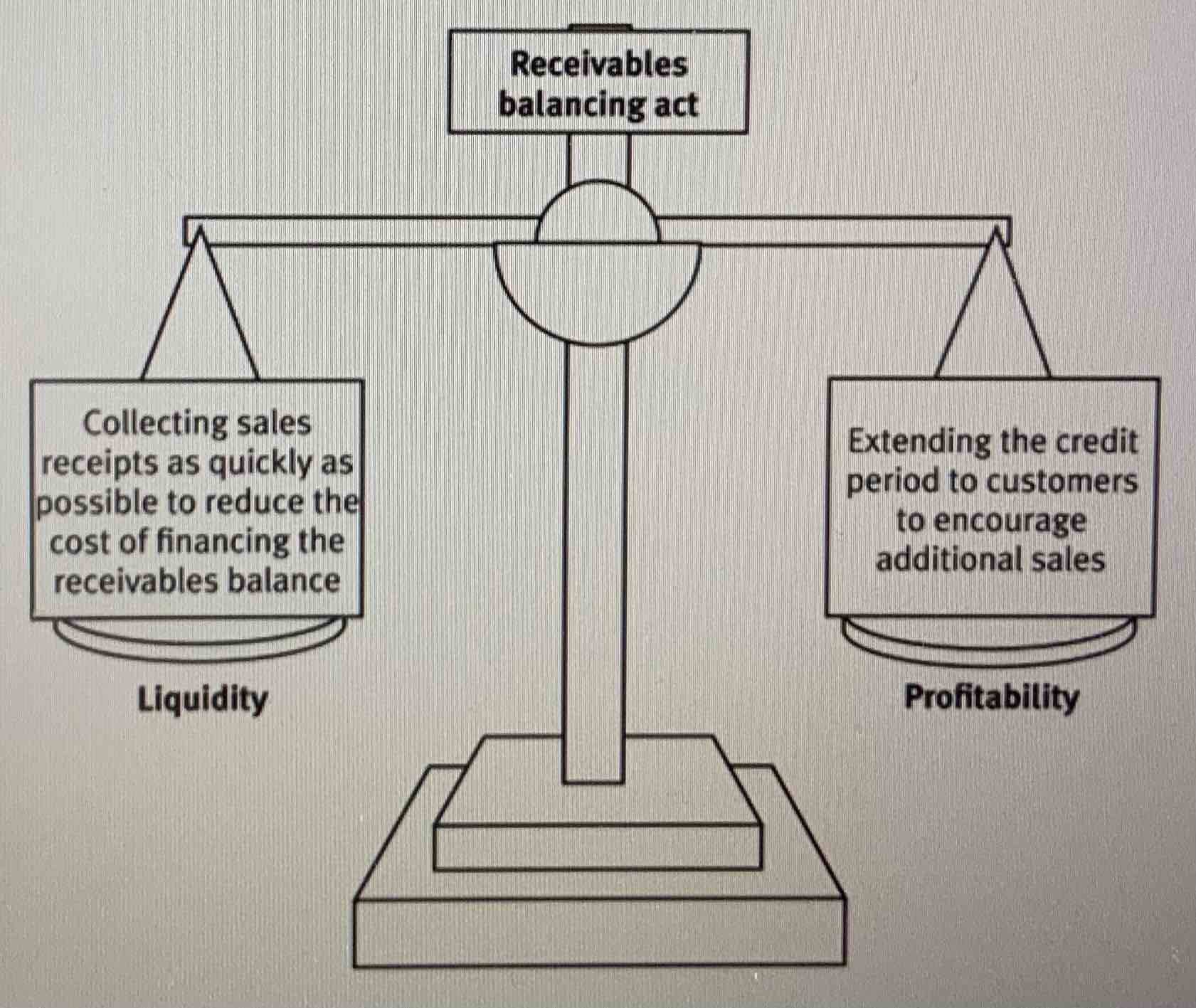

Receivables Balancing Act

This trade-off is a key factor in determining the entity’s working capital investment.

Payment Terms

Need to consider the period of credit granted and how payment will be made.

Need to specify the price, the delivery date, the payment date(s) and any early settlement discounts allowed.

Examples of Payment Terms

Payment within a specified period (30 days)

Payment within a specified period with discount (2% discount in 10 days or no discount in 30 days)

Weekly credit which requires supplies in a week to be paid by specific day in following week

Related to delivery of goods (cash on delivery COD)

Methods of Payment

Cash, BACS, cheques, banker’s draft, standing orders, direct debit, credit cards, debit cards, CHAPS.

Factors impacting credit policy

Demand for products

Competitors’ terms

Risk of irrecoverable debts

Financing costs (using overdrafts incurs interest, using savings losses interest)

Costs of credit control

4 Aspects of Receivables Management

Assessing customer’s creditworthiness

Must perform checks on new customers before offering credit. Existing customers must also be monitored.

Setting credit limits

The amount of credit and length of time credit is offered is determined.

Invoicing promptly and collecting overdue debts

Monitoring the credit system

Monitoring of ageing and receivable days ratios.

Creditworthiness Information

Bank/trade references, visit to customer premises, competitors, published information, credit reference agencies, legal sources of credit information, entity’s own sales records, credit scoring, credit rating.

Assessing Creditworthiness

To minimise the risk of irrecoverable debts occurring, an entity should investigate the creditworthiness of all new customers (credit risk), and should review that of existing customers from time-to-time, especially if they request that their credit limit is raised.

Setting Credit Limits

When setting credit limits there are two limits that need to be set:

The amount of credit available

The length of time allowed before payment is due

Both of these limits might be adjusted in accordance to the risk profile of the customer.

Customer’s Credit Status Risk

The customer’s payment record and history of prompt or late payments

Any new information that is obtained about the customer (financial statements, press reports)

The level of credit available and length of settlement period offered to a customer (if across-the-board standard terms are not used) should then be based on the assessment of this risk.

Invoicing & Collecting Overdue Debts: Process of Debt Collection

A credit period only begins once an invoice is received so prompt invoicing is essential. If debts go overdue, the risk of default increases so a system of follow-up procedures is required:

Reminder letter

Telephone calls

Withholding supplies

Debt collectors

Legal action

Collection Targets

A target set for credit control staff for the amount of payments to collect for trade receivables within a given period of time. The target will not be a motivator however, unless performance is assessed and individuals are rewarded (with a bonus) on the basis of meeting or exceeding standards.

Monitoring Receivables

Age analysis of outstanding debts

Working capital ratios

Statistical data

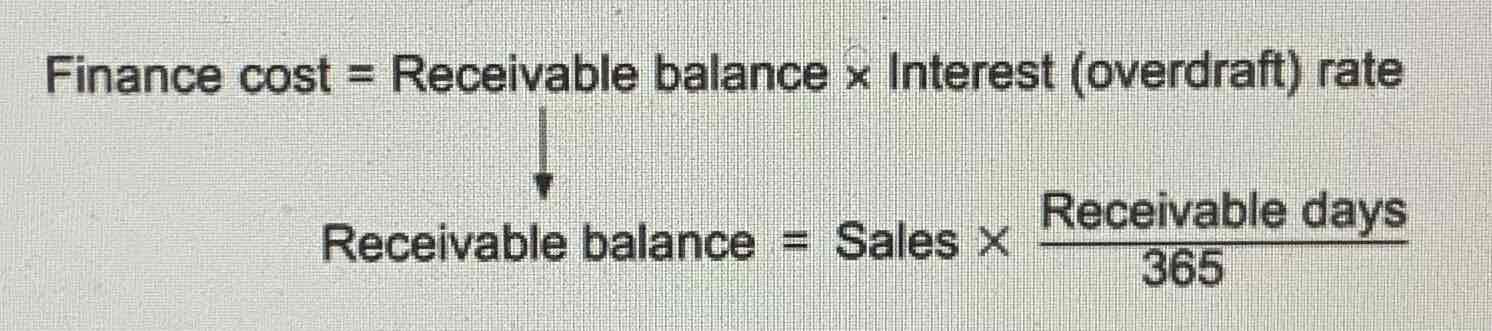

Cost of Financing Receivables

As part of determining the credit policy assessments of the costs of extending credit will be required.

The entity should determine the costs of overdraft interest incurred by not receiving the cash from the customer immediately.

Early Settlement Discounts

Cash discounts are given to encourage early payment by customers. The cost of the discount is balance against the savings the entities receives from its lower receivables balance.

If the discount’s cost exceeds the overdraft interest rate, then the discount should not be offered.

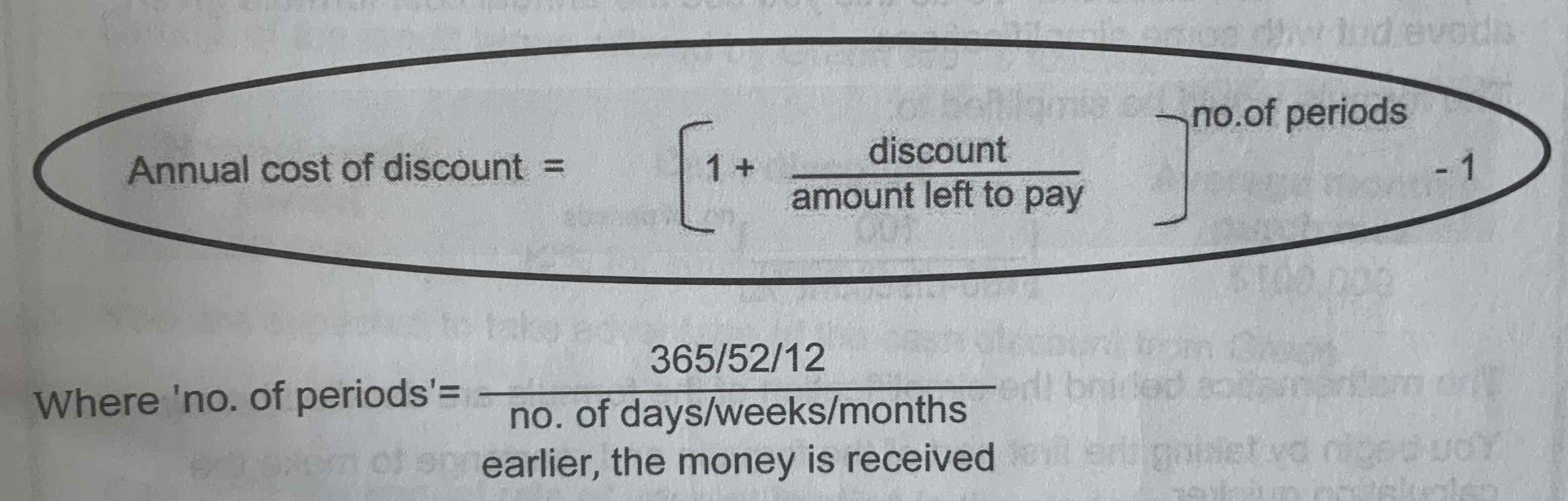

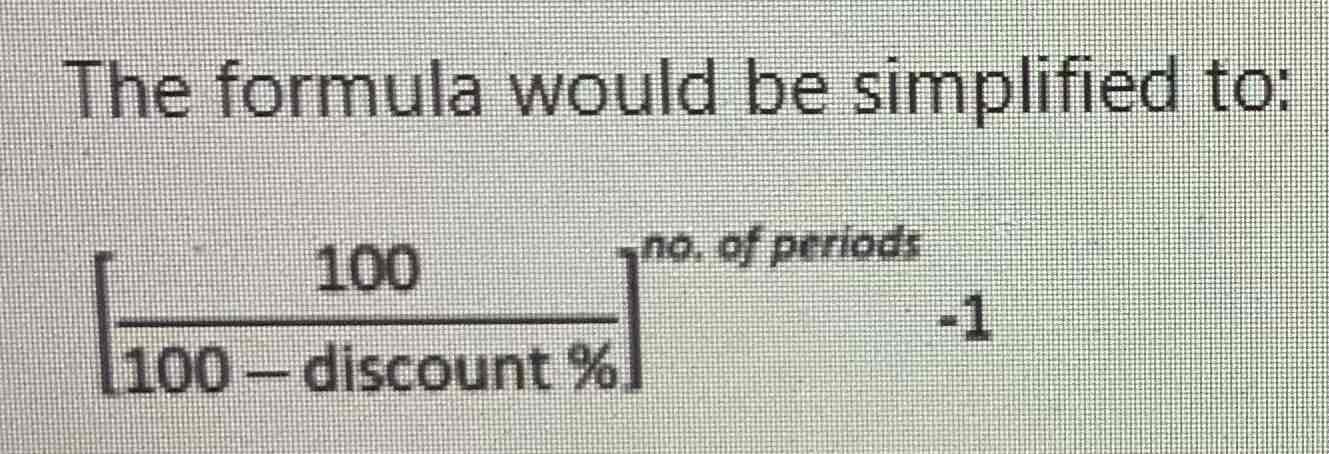

Effective Annual Cost of a Discount

May be asked to calculate the annual rate of interest implied in a cash discount.

To do this you use the annual cost formula for early settlement discounts with some simplifications.

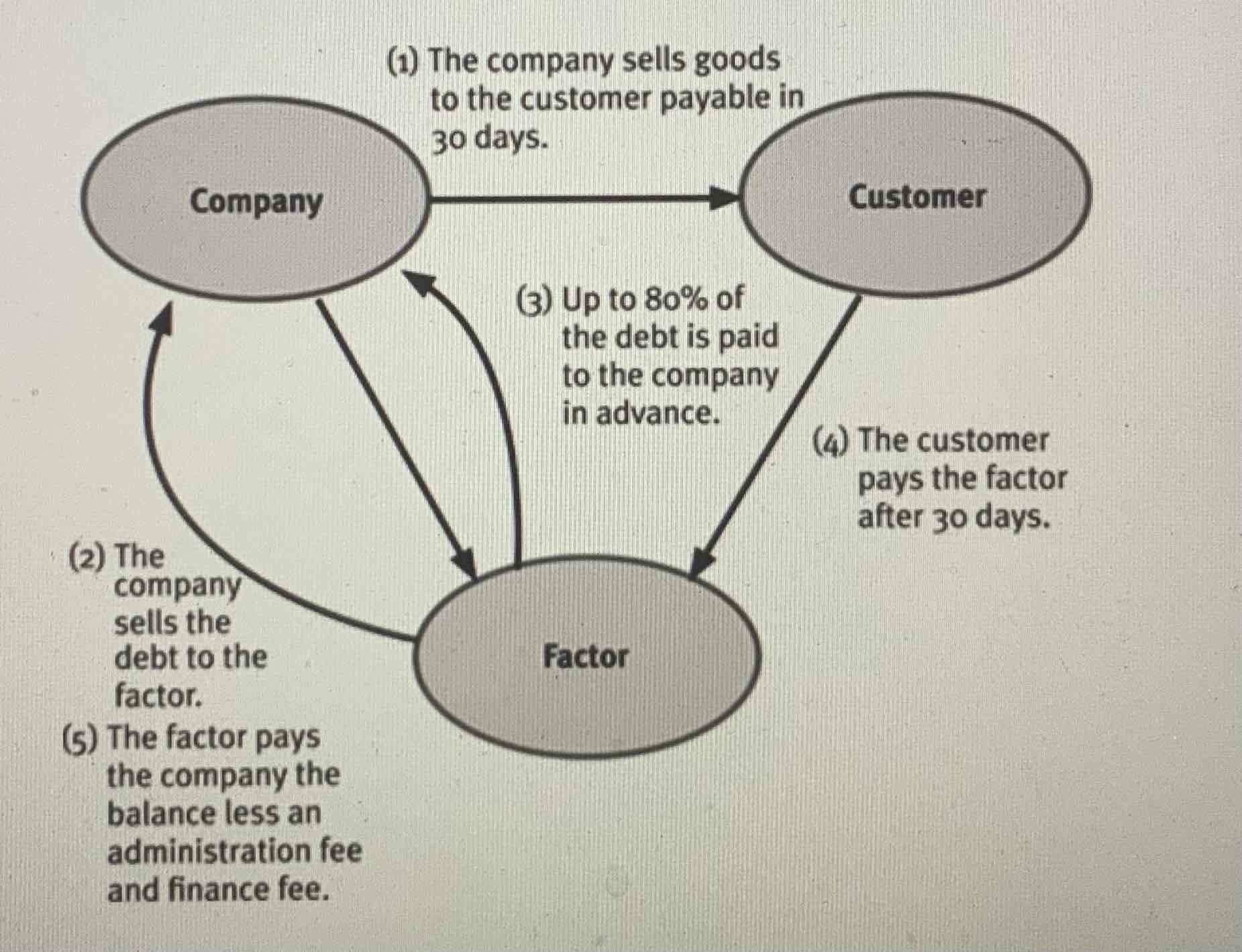

AR - Factoring

Factoring is the sale of debts to a third party (the factor) at a discount in return for prompt cash.

Debts of an entity are effectively sold to a factor. The factor takes on the responsibility of collecting the debt for a fee. The entity can choose one or both of the following services by the factor:

Debt collection and administration: recourse or non-recourse

Credit insurance

These are particular value to smaller firms and fast growing firms.

Non-recourse factoring is more expensive as the factor bears the costs of any irrecoverable debts.

Advantages to AR Factoring

Saving in administration costs.

Reduction in the need for management control.

Particularly useful for small & fast growing businesses where the credit control department may not be able to keep pace with volume growth.

Disadvantages of AR Factoring

Likely to be more costly than an efficiently run internal credit control department.

Factoring has a bad reputation associated with failing companies; using a factor may suggest your company has money worries.

Customers may not wish to deal with a factor.

Once you start factoring it is difficult to revert easily to an internal credit control system.

The company may give up on the opportunity to decide to whom credit may be given (non-recourse factoring).

Benefits of AR Factoring

Business improves it’s cash flow as factor provides finance for up to 80% or more of debts within 24 hours of the invoices being issues while a bank overdraft will normally only lend up to 50% of an invoices value.

A factor can save entity administration costs of keeping the sales leader up-to-date and the costs of debt collection.

If the business were to allow the factor to administer the sales ledger, it can use the factor’s credit control system to assess the creditworthiness of both new and existing customers.

Non-recourse factoring is a convenient way of obtaining insurance against irrecoverable debts.

Problems with AR Factoring

Intervention of the factor between factor’s client and the credit customer could endanger trading relationships and damage goodwill as customers may prefer to deal with the business not the factor.

When a non-recourse factoring service is used, the client loses control over decisions about granting credit to its customers.

Some clients prefer to retain the risk of irrecoverable debts and opt for a ‘with recourse’ factoring service where the client and not the factor decides whether legal action should be taken against the non payer.

Suppliers/customers of the client using a factor to collect debts may fear the entity is beset with cash flow problems raising concerns about its viability. Suppliers may impose more stringent payment terms negating the benefits provided by the factor.

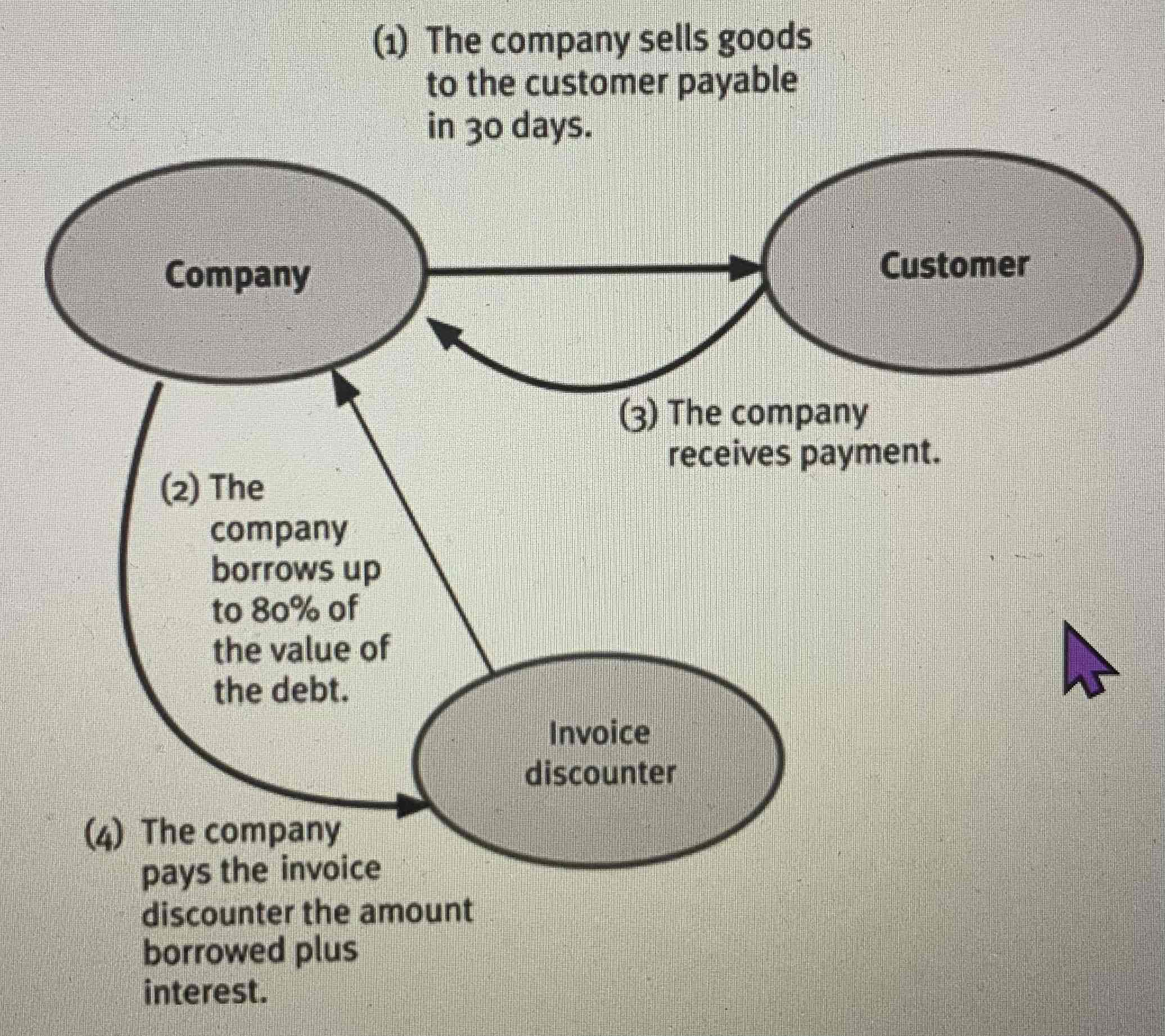

AR Invoice Discounting

Raising finance against the security of receivables without using the sales ledger administration services of a factor.

Specific invoice discounting entities exist but service often provided by factoring entities.

Selected invoices are used as security against which the entity may borrow funds as a temporary source of finance which is repayable when the debt is cleared.

Similar to the financing part of the factoring service without control of credit passing to the factor.

Advantages of AR Invoice Discounting

Short term cash boost

Customer is unaware

Disadvantages of AR Invoice Discounting

Expensive long term

Extra administration costs

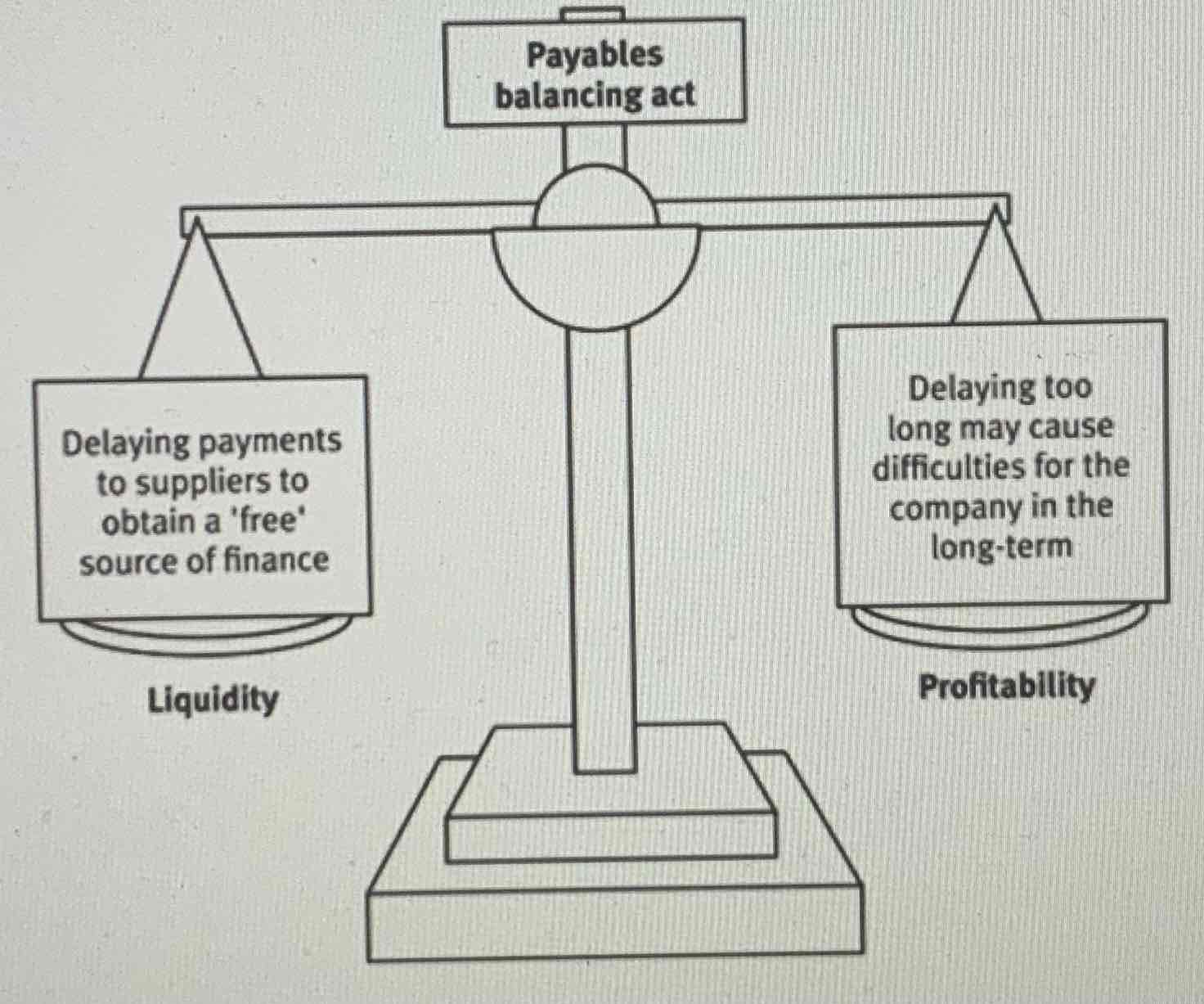

AP - Managing Trade Credit

Simplest and most important source of short-term finance for many entities.

It is a balancing act between liquidity and profitability.

Trade credit is normally seen as a ‘free’ source of finance but it may be that the supplier offers a discount for early payment so delaying payment here is no longer free, since the cost will be the lost discount.

Impact of Delaying Payment to Supplier

Suppliers may refuse to supply in future

Supplier may only supply on a cash basis

There may be loss of reputation

Suppliers may increase price in future

Age Analysis of Payables

The value of an age analysis of trade payables is less obvious than the value of an age analysis of trade receivables.

However, the management need to be aware of:

The total amount payable to suppliers

When the money will be payable

The amounts payable to each individual supplier and how close this is to the credit limit available from the supplier

Whether the entity is failing to pay its trade supplier on time